ICICI Credit Card PIN Generation

Last Updated : April 26, 2025, 3:08 p.m.

As you start using your ICICI credit card more often, it's important to keep your transactions secure. This means having a strong credit card PIN. If you're new to ICICI credit card, it's advisable to know about the different ways to generate a credit card PIN. ICICI Bank offers different user-friendly options to make things easier for its customers. So, let's discuss all the methods by which you can generate your credit card PIN in a simple and easy-to-understand way.

Which Online Methods to Use to Generate ICICI Bank Credit Card PIN?

You use the internet for all your online transactions, so why not use it to generate your credit card PIN too? Here we will discuss the online methods via which you can get a new PIN for your ICICI credit card . Take a look.

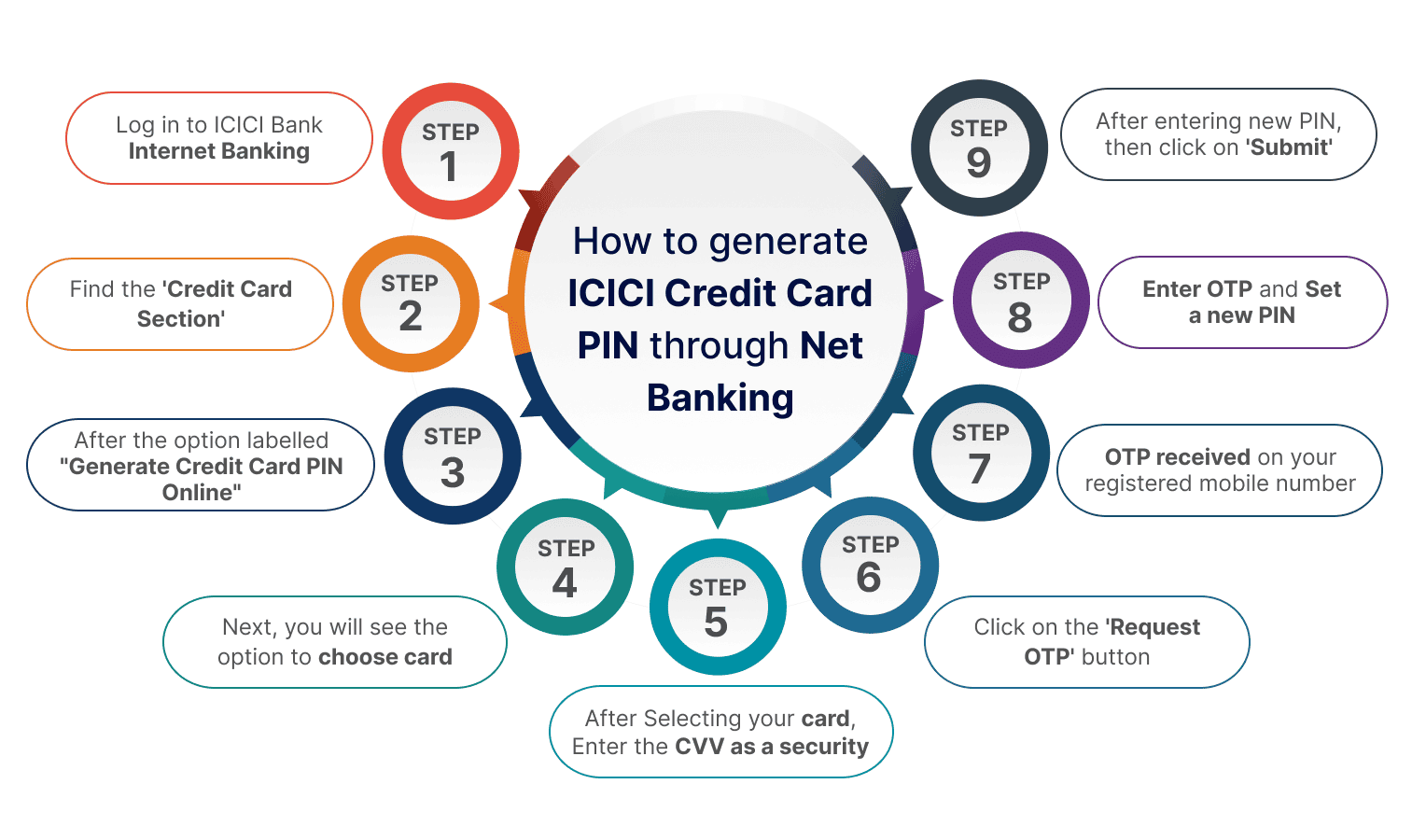

How to Generate the ICICI credit card PIN through Net Banking?

To set up your ICICI Bank credit card PIN online through netbanking, follow these simple steps:

- Log in to ICICI Bank internet banking, to do the same use your respective username and password.

- Once you’re logged in, find the ‘Credit Card Section’, and click on the same.

- Now, within the Credit Card section, locate and click on the option labelled "Generate Credit Card PIN Online" from the menu on the left-hand side.

- Next, you will see an option to choose the credit card for which you want to generate the PIN.

- After selecting your card, enter the CVV (Card Verification Value) as a security measure.

- Click on the ‘Request OTP’ button.

- An OTP will be sent to your registered mobile number linked to your ICICI Bank account.

- Enter OTP and set a new PIN.

- After entering and confirming your new PIN, click on ‘Submit’ to complete the process.

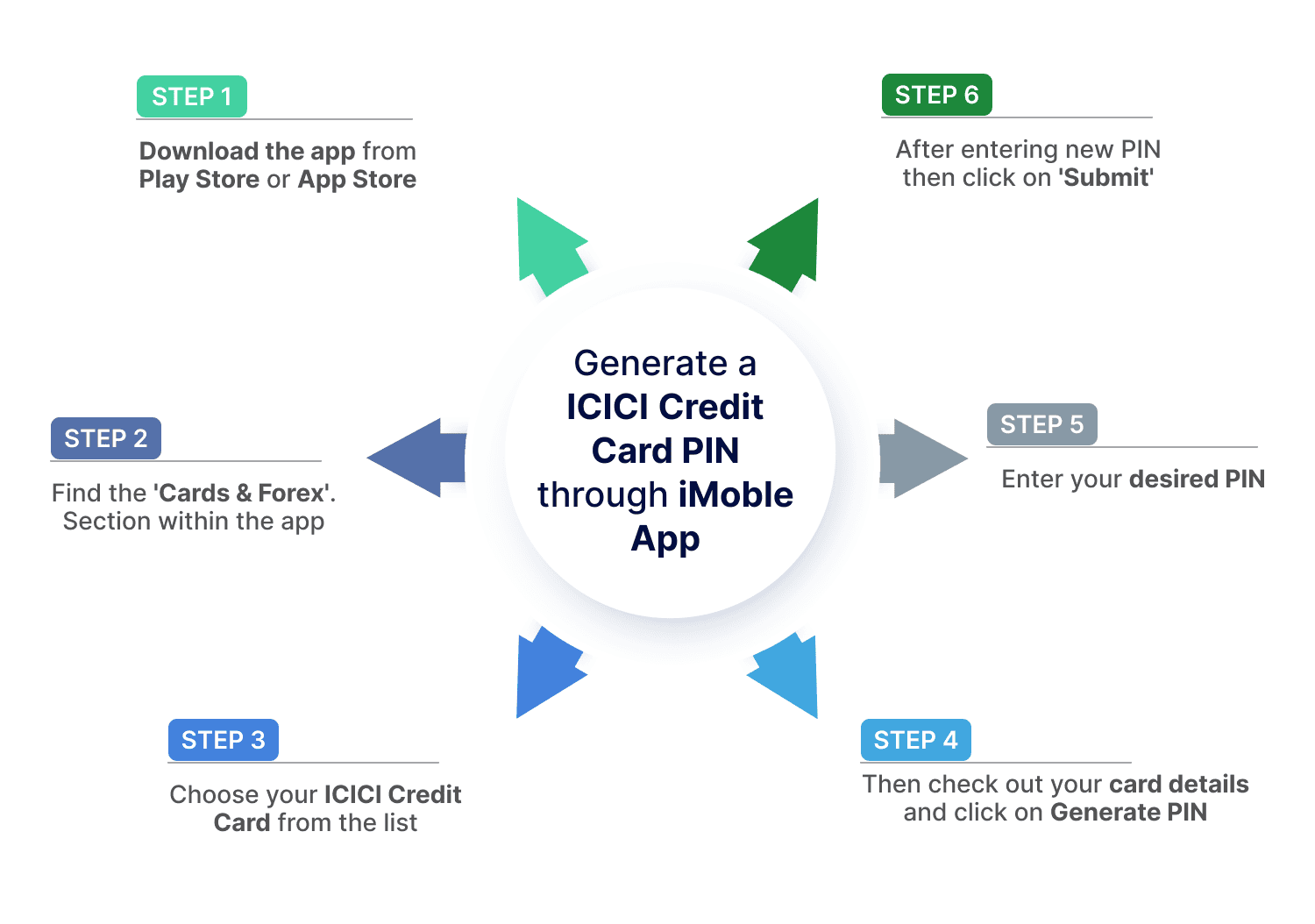

Which Steps to take to Generate a Credit Card PIN through the iMobile App?

If you prefer using iMobile Pay to manage your ICICI Bank credit card, follow these steps to generate your PIN:

- Download the app from the Play Store or app store, open the iMobile Pay app on your mobile device and log in using your credentials.

- Find the "Cards & Forex" section within the app.

- Choose your ICICI Bank credit card from the list of cards displayed.

- Now check out your card details, look for the option "Generate PIN" and click on it.

- Next, enter your desired PIN in the designated field.

- After entering your new PIN, review it for accuracy, and then click on "Submit"

By following these steps, you can easily generate a new PIN for your ICICI Bank credit card through iMobile Pay, offering you a convenient and secure way to manage your card settings on the go.

Which Offline Method to Use to Get ICICI Bank Credit Card PIN?

If you are not tech-friendly and prefer to manage your banking and credit card details offline, ICICI do have options for you too. You can check out the below-mentioned steps and generate a new PIN for your ICICI credit card.

How to Generate Credit Card PIN at ICICI’s Bank Branch?

If you prefer to set up your ICICI credit card PIN in person, you can visit any ICICI Bank branch. Here's how:

- Find the nearest ICICI Bank branch to your location using the bank's website or mobile app.

- Before heading to the branch, make sure you have your ICICI credit card, address proof (like an Aadhaar card or utility bill), and photo identity proof (like an Aadhaar card or PAN card) with you.

- Go to the nearest ICICI Bank branch during their working hours.

- Once inside the branch, approach the customer service desk or a banking representative.

- Inform the bank representative that you want to set up your credit card PIN.

- Hand over your ICICI credit card along with your address and identity proofs to the bank representative.

- You may need to fill out a form for PIN generation. Complete the form with accurate information.

- The bank representative may verify your identity and the documents provided.

- After verification, you'll be asked to choose a 4-digit PIN number for your credit card.

- Once your PIN is successfully set, the bank representative will confirm the process is complete.

- If there are any documents or receipts provided, make sure to collect them before leaving the branch.

By following these steps and visiting an ICICI Bank branch, you can set up your credit card PIN in person with the assistance of a bank representative

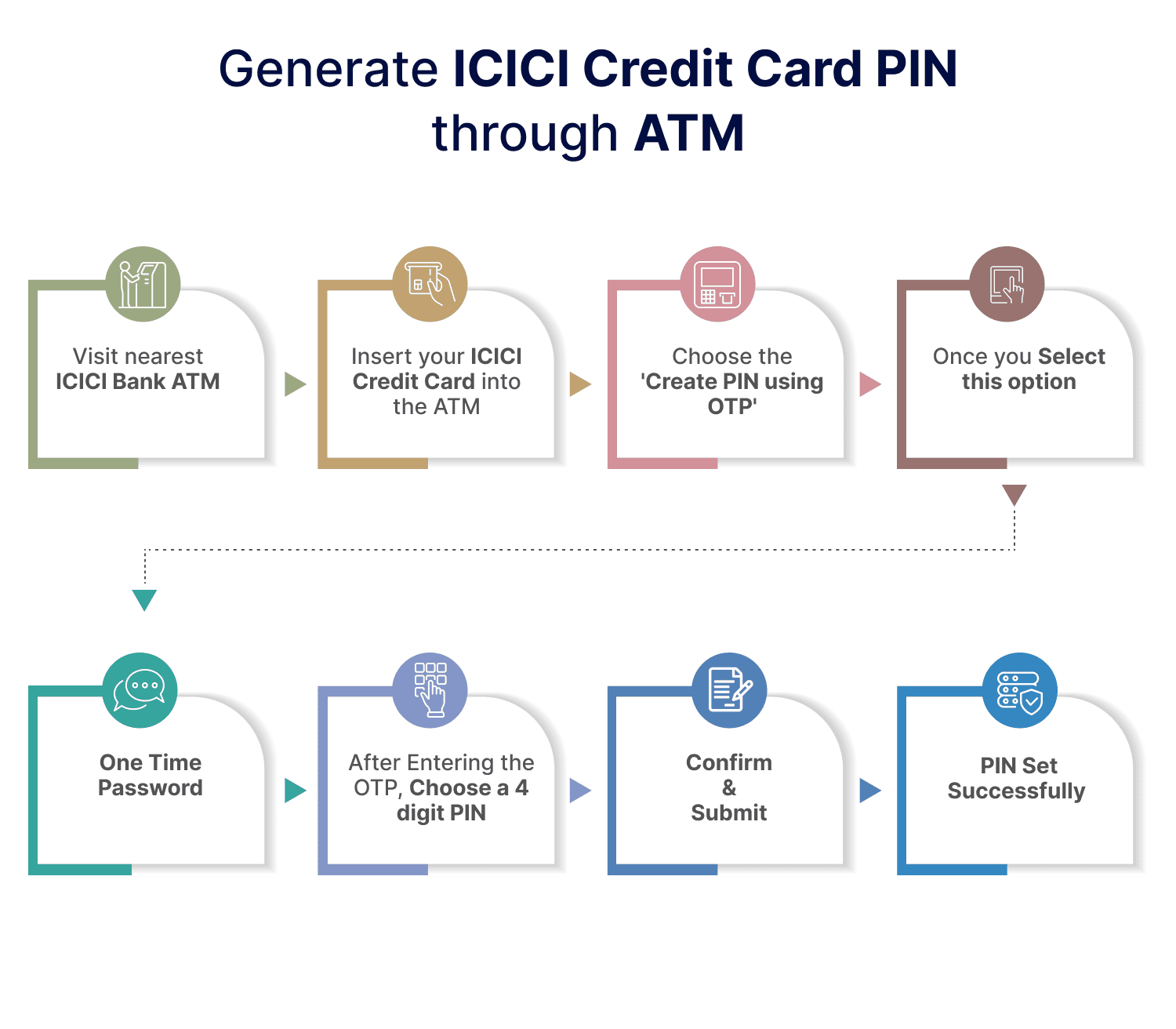

How does an ICICI Bank ATM Generate Your Credit Card PIN?

When setting up your ICICI credit card PIN for the first time, you can do it easily at any ICICI Bank ATM. Here's how:

- Visit an ICICI Bank ATM , we suggest you go to any nearby ICICI Bank ATM.

- Insert your ICICI credit card into the ATM and select the language you prefer.

- Choose the 'Create PIN using OTP' option from the options displayed on the screen.

- Once you select this option, a One Time Password (OTP) will be sent to your mobile phone. Enter this OTP into the ATM when prompted.

- After entering the OTP, you'll be asked to choose a 4-digit PIN number. Type in the PIN you want, and then type it in again to confirm.

- Confirm and Submit: After you've entered your new PIN twice, press 'Submit' to confirm.

- PIN Set Successfully: If everything is correct, you'll get a message on the ATM screen saying your PIN has been set. You may also receive a confirmation message on your mobile phone.

That's it! Your ICICI credit card PIN is now set, and you can start using it right away.

How to Generate Credit Card PIN via the IVR System?

ICICI Bank offers the convenience of generating your credit card PIN through the Interactive Voice Response (IVR) system. Basically, IVR is an automated telephony system that interacts with callers, gathers information, and routes calls to the appropriate recipient. It uses voice and keypad inputs to provide information or services. Here's how you can generate a PIN with it:

- Call ICICI Bank's IVR number, dial 1800 1800 from your registered mobile number to access ICICI Bank's IVR system.

- Upon connecting to the IVR system, listen carefully to the options provided. For credit card PIN generation, you typically need to select an option related to ATM/Credit Card services. For PIN generation, you have to choose the

- Once you reach the menu for ATM/Credit Card services, press the corresponding number for Option 0. This option is specifically for ATM/Credit Card PIN generation.

- Now, follow IVR Instructions, remember you may need to input your credit card details to verify your identity.

- After following the prompts and providing the necessary information, you'll be prompted to generate a new PIN for your credit card.

- Once you've successfully generated your PIN through the IVR system, you'll receive confirmation either through a recorded message or a notification on the call.

How do make Credit Card more Secure?

By following these tips, you can enhance the security of your ICICI credit card PIN and protect yourself against potential fraud or unauthorised access to your account.

- Memorise Your PIN: Your ICICI credit card PIN is a crucial security feature. Ensure you memorise it and avoid writing it down or sharing it with anyone, including family and friends.

- Keep Your PIN Confidential: Treat your PIN as confidential information. Do not disclose it to anyone, even if they claim to be from the bank or a trusted entity.

- Choose a Strong PIN: Select a PIN that is not easily guessable, such as your birthdate or consecutive numbers. Opt for a combination that is unique to you and difficult for others to guess.

- Change Your PIN Regularly: Consider changing your ICICI credit card PIN regularly to enhance security. This practice reduces the risk of unauthorised access to your card information.

- Shield Your PIN Entry: When entering your PIN at ATMs or point-of-sale terminals, shield the keypad with your hand to prevent others from observing or capturing your PIN.

- Be Wary of PIN Requests: Beware of any requests for your PIN through emails, phone calls, or text messages. ICICI Bank will never ask you to disclose your PIN through these channels. If you receive such requests, it may be a phishing attempt.

- Report Suspicious Activity: If you suspect any unauthorised access to your ICICI credit card or notice unusual transactions, promptly report it to the bank. They can take necessary actions to secure your account and prevent further misuse.

- Monitor Your Account: Regularly monitor your ICICI credit card statements for any unfamiliar transactions. If you notice any discrepancies, investigate them immediately and report them to the bank if necessary.

How long does it take for an ICICI Credit Card to be Delivered?

Upon approval of your Credit Card application, you will receive a 4-digit PIN for your card. The PIN is a security measure to ensure that only you can use your card for transactions.

If you have applied for a standard Credit Card, your 4-digit PIN will be sent separately to your mailing address. You can expect to receive it within 7 working days after receiving your Credit Card. It is important that you keep your PIN confidential and do not share it with anyone.

On the other hand, if you hold the Ferrari Platinum Card, your 4-digit PIN will be sent to you via SMS on your registered mobile number. To ensure that you receive your PIN through SMS, please ensure that your mobile number is registered with us. If your mobile number is not registered, the PIN will be sent separately to your mailing address. If you have any questions or concerns about your PIN, please do not hesitate to contact the ICICI customer service team.

Other Related Topics for Debit Card Pin Generation

Frequently Asked Questions (FAQs)