How to Avoid Credit Card Fraud in India?

Last Updated : Dec. 27, 2024, 4:38 p.m.

Nowadays, with the increased number of credit card transactions, credit card frauds are growing. These credit card frauds can cause extreme havoc, so you must take basic precautions to avoid these. Let us now get some tips on how to avoid credit card fraud in India?

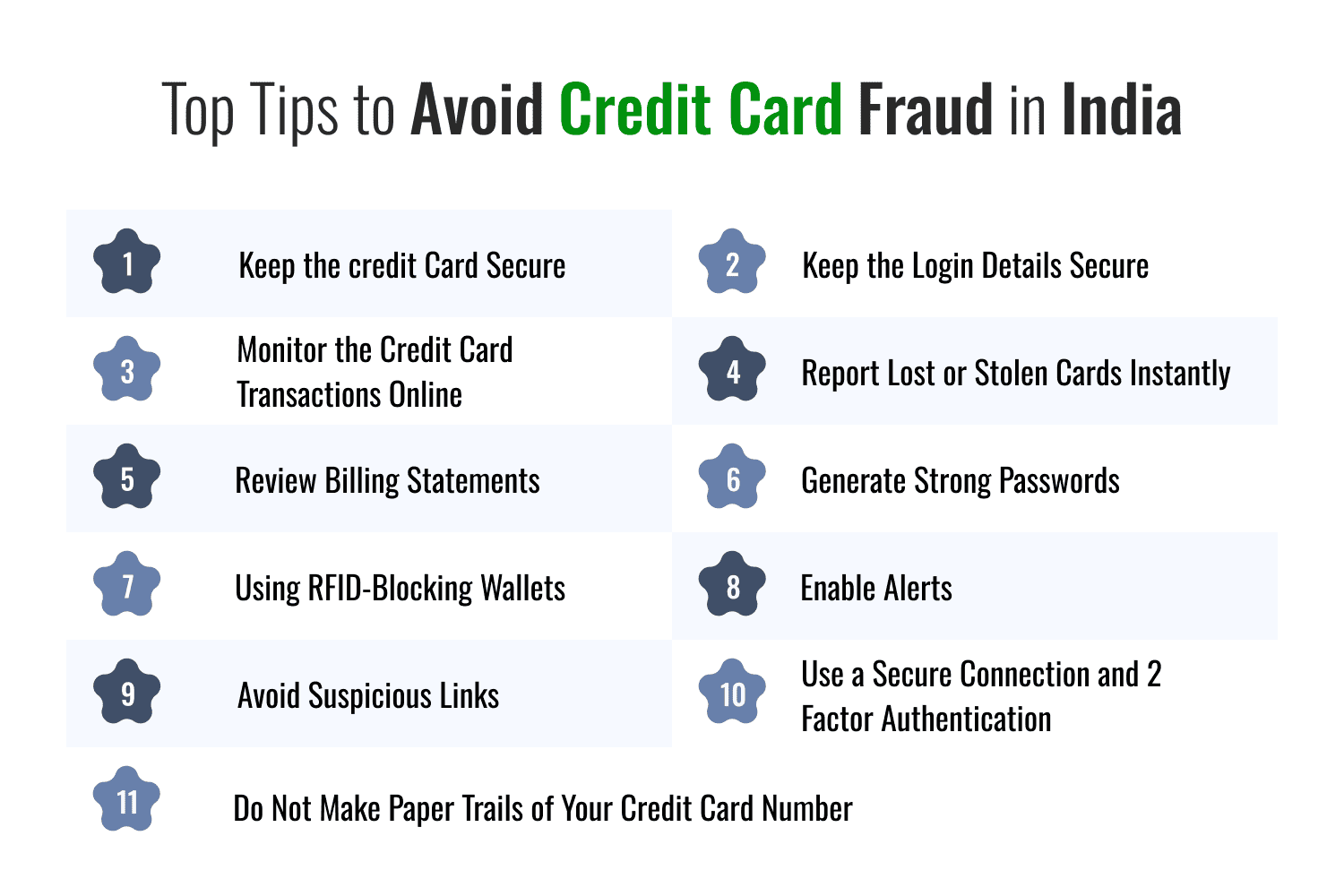

Top Tips to Avoid Credit Card Fraud in India

- Keep the Credit Card Secure: In the first place, it is important to keep the credit card inaccessible to fraudsters. Keep the envelope in which the credit card comes safe and sign on the back of the card as soon as you receive it. Also, keep the credit card secured in a small purse, and this will make it difficult for pickpocketers or snatchers to take it away. After every purchase, do not forget to put the card away as soon as possible because thieves can save a digital imprint of the credit card through snapshots using cellphone cameras.

Are you looking to apply for a new credit card? If so, compare and apply for a credit card most suitable for you at Wishfin here

- Keep the Login Details Secure: Do not reveal your credit card PINs, mobile application passwords, or internet banking passwords to anybody whether it be a friend, a family member, or over an email.

- Monitor the Credit Card Transactions Online: You can monitor your credit card transactions via SMS, email alerts, online banking, or SC mobile.

- Report Lost or Stolen Cards Instantly: Contact your credit card service provider as quickly as possible to inform about the stolen card.

- Review Billing Statements: Give a thorough check of your billing statements and find out if there are any unauthorized or unknown transactions.

- Generate Strong Passwords: Combine letters, numbers, and special characters for your online banking and shopping account passwords. Don’t keep easy passwords such as your birthday or common words. These can be guessed easily.

- Using RFID-Blocking Wallets: When an RFID blocking wallet is embedded in a credit card, it prevents scammers from scanning RFID data while standing next to the other person.

- Enable Alerts: Set up transaction alerts with your credit card issuer or bank. You will then get notifications regarding any transactions made with your card.

- Avoid Suspicious Links: Avoid clicking on suspicious links or downloading attachments from unsolicited emails or messages.

- Use a Secure Connection and 2 Factor Authentication: When you shop online, ensure that the website is secure. Enable 2 factor authentication wherever possible.

- Do Not Make Paper Trails of Your Credit Card Number: Credit card billing statements usually contain the full credit number printed on them. As a credit card user, always remember to shred the statement before throwing it off. You must also shared credit cards which have been cancelled and whose validity has expired.

Frequently Asked Questions (FAQs)