Which is the Best Forex Card in India?

Last Updated : Oct. 1, 2024, 7:01 p.m.

Using a debit card or a credit card on an international trip will attract foreign currency mark up fee which is usually as high as 3.5% of the amount transacted. So, it is ideal to use a forex card. A Forex card is a prepaid card that you can load with a balance in any of the currencies supported by the card. Transacting abroad in a loaded currency does not attract any foreign currency mark up fee. Most forex cards now support multiple currencies. A forex card makes your travel worry free. You do not have to carry cash or worry about currency conversion. Also, these cards shield you against foreign currency price fluctuations, since the exchange rates are locked once the currency is loaded. Let us now read about the best Forex cards in India for 2025.

Top Forex Cards in India 2025

Card | Currencies |

|---|---|

BookMyForex Zero Markup Forex Card | 14 currencies US Dollars (USD), Great Britain Pound (GBP), Euro (EUR), Canadian Dollar (CAD), Australian Dollar (AUD), Singapore Dollar (SGD), Arab Emirates Dirham (AED), Saudi Riyal (SAR), Thai Baht (THB), Swiss Franc (CHF), Hong Kong Dollars (HKD), New Zealand Dollar (NZD), Japanese Yen (JPY), South African Rand (ZAR) |

Axis Bank Multi Currency Forex Card | 14 currencies United States Dollar (USD), EURO (EUR), GBP (Great Britain Pounds), SGD (Singapore Dollars), AUD (Australian Dollars), CAD (Canadian Dollars), JPY (Japanese Yen), SEK (Swedish Krona), THB (Thai Baht), AED (UAE Dirham), HKD (Hong Kong Dollars), NZD (New Zealand Dollars), DKK (Danish Kroner), ZAR (South African Rand) |

IDFC Bank Multi Currency Forex Card | 14 currencies United States Dollar (USD), Great Britain Pound (GBP), Euro (EUR), Singapore Dollar (SGD), Japanese Yen (JPY), Swiss Franc (CHF), Hong Kong Dollar (HKD), New Zealand Dollar (NZD), Dubai Dirhams (AED), Norwegian Kroner (NOK), Australian Dollar (AUD), Canadian Dollar (CAD), South African Rand (ZAR) & Swedish Krona (SEK). |

HDFC Bank Multi-Currency ForexPlus Card | 23 currencies Australian Dollar (AUD), AED (Dirhams), Canadian Dollar, Euro, Hong Kong Dollar, Japanese Yen, Singapore Dollar, Sterling Pound, Swiss Franc, Swedish Krona, Thailand Baht, South African Rand, Omani Rial, New Zealand Dollar, Norwegian Krone, Danish Krone, Saudi Riyal, Korean Won, Bahrain Dinar, Qatari Riyal, Kuwaiti Dinar, Malaysian Ringgit, and US Dollar |

IndusInd Bank Multi currency Forex card | 14 currencies United States Dollar (USD), Euro (EUR), Great Britain Pound (GBP), Canadian Dollar (CAD), Arab Emirates Dirham (AED), Swiss Franc (CHF), Hong Kong Dollar (HKD), Japanese Yen, Australian Dollar (AUD), (JPY), New Zealand Dollar (NZD), Saudi Riyal (SAR), Singapore Dollar (SGD), South African Rand (ZAR), Thai Bhat (THB) |

Standard Chartered Forex Card | 20 currencies United States Dollar (USD), Euro (EUR), Great Britain Pound (GBP), Australian Dollar (AUD), Canadian Dollar (CAD), Arab Emirates Dirham (AED), Hong Kong Dollar (HKD), Swiss Franc (CHF), Japanese Yen (JPY), New Zealand Dollar (NZD), Saudi Riyal (SAR), Singapore Dollar (SGD), South African Rand (ZAR), Thai Bhat (THB), DKK (Danish Krone), SEK (Swedish Krona), EUR (Euro), HKD (Hong Kong Dollar), QAR (Qatari Rial), JPY (Japanese Yen), KWD (Kuwaiti Dinar), OMR (Omani Rial), NOK (Norwegian Krone), and NZD (New Zealand Dollar) |

SBI Bank Multi Currency foreign travel card | US Dollar (USD), Pound Sterling (GBP), Euro (EUR), Canadian Dollar (CAD), Australian Dollar (AUD), Japanese Yen (JPY), Saudi Riyal (SAR), Singapore Dollar (SGD), United Arab Emirates Dirham (AED). |

Bank of Baroda Multi Currency Forex Card | 3 currencies USD, GBP & EURO. |

Kotak Mahindra Bank Forex Travel Card | 13 currencies. US Dollar (USD), European Euro, Sterling Pound, Australian Dollar (AUD), Singapore Dollar (SGD), Swiss Franc, Hong Kong Dollar (HKD), Canadian Dollar, Japanese Yen, Swedish Krona, South African Rand, United Arab Emirates Dirham, and Saudi Riyal. |

Features and benefits of Forex Cards

- It is a safer and easier alternative to carrying cash.

- They protect you from foreign currency price fluctuations as rates are locked when the currency is loaded in the card.

- They help you to carry multiple currencies in a single card, so you can transact in the currency of your choice using the same.

- The card comes with chip and PIN technology for elevated security.

- You will get SMS alerts and emails as well for every load and purchase.

- If the card is stolen or lost, you can block it by alerting the card issuer. Then, access to performing activities with the card will be temporarily suspended. There are no extra charges or fines for non use.

- With the help of statements, you can easily keep track of the expenditure done using the card.

- Forex cards are less expensive compared to credit or debit cards. This is because the card discharges payments in Indian rupees, which will be converted into the currency of the country in which the card is used. So, a currency conversion fee will be charged each time the payment is made. This fee is known as cross currency mark up and it is typically in the range of 2 to 5% based on the type of card and the issuing bank.

- Forex cards come with excellent customer support, which make them quite user friendly.

- They come with attractive facilities. Some forex cards offer international lounge access and thus enable comfortable travel. There are others which help in.

- Some other cards offer services that help in referring you to hotels, car rentals, or medical service providers and help you out when you lose your passport, luggage, etc.

- A number of card issuers also offer deals and discounts when the forex card is used, thus making their use rewarding. Some cards such as the Axis Bank World Traveller Forex Card & Axis Bank Club Vistara Forex Card reward their customers for every spend.

- The funds in your forex card will be valid for 5 years once loaded. You do not convert the remaining funds in your card to another currency. You can use the leftover money in any other country you wish. When the amount is over, you can reload the card again.

Types of Forex Cards

There are two types of Forex cards as given in the table below:

Single Currency Forex card | Multi-currency Forex card |

|---|---|

It can be loaded only with a single currency | The card can be preloaded with many currencies |

These are more suitable for people who travel to one country for some time. They can be reloaded when needed. | They can be used in several countries without incurring any additional charges due to the multi currency support. You can travel and transact all across the globe with a single forex card. |

Nowadays most card issuers provide multi currency forex cards due to their benefits.

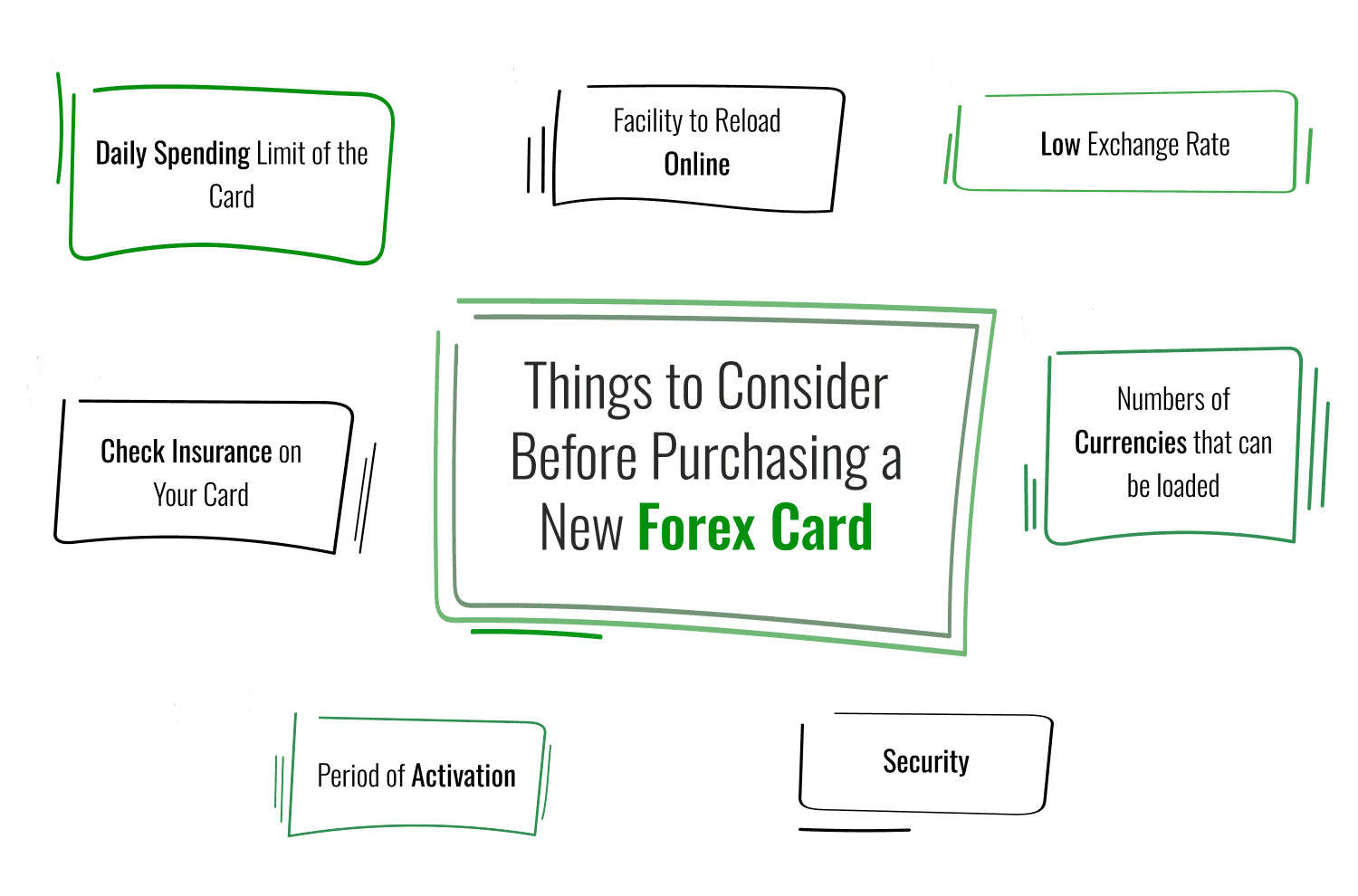

Things to Consider Before Purchasing a New Forex Card

- Daily spending limit of the card: Every forex card will come with a daily spending limit. Once this limit is reached, you cannot spend more than that.

- Facility to reload online: To enable instant transfer of funds from your account, your card should have an online reload facility.

- Low exchange rate: Before buying a card, check the exchange rates offered by the card and choose the most cost effective one.

- Number of currencies that can be loaded: It is ideal to have a single card that can hold multiple currencies rather than having many cards for each currency. If you plan to visit multiple countries during your trip, this will come in handy. So, make sure your card supports the maximum number of currencies.

- Check Insurance on Your Card: Forex cards provide insurance coverage against personal injury, baggage loss, card loss,etc. Before you purchase the card, enquire your card issuer about the insurance coverage facilities.

- Period of activation: Check with your card provider how long the card will take to get activated from the date of purchase. Also be aware of the card reloading time, the time taken to deliver etc.

- Security: Ensure that your card has the EMV chip enabled in order to prevent card skimming, cloning, etc. This provides high security.

Forex Cards in India 2025 - Key highlights

BookMyForex Zero Markup Forex Card

This multi currency card functions just like a credit card. The card’s unique USP is that it can be loaded with a foreign currency at zero markup interbank linked rates. Other features include fixed exchange rates, chip and PIN security, exchange rates, same day doorstep delivery and minimal ATM fees.

Key Features

- It is easy to apply for this card as the option is available 24/7 online.

- The delivery is super fast. It gets delivered on the same day at your doorstep.

- You can reload your card instantly through the BookMyForex app, enabling access to funds whenever required.

- The issuance fee, maintenance fee, and reload or unload fee are zero.

- The replacement fee is INR 250 and the ATM withdrawal fee is USD 2 or equivalent.

- The card provides exact interbank rates with zero added margin providing users with competitive rates

- The withdrawal limit is USD 7500 or equivalent for POS/Ecommerce/Cash Advance, and USD 1000 or equivalent for ATM Cash withdrawals.

- The card offers the benefit of zero TCS for transactions below Rs. 7 lakhs.

- Get a discount of 1500 off on booking your card via the BookMyForex app. Also, get a free international SIM along with your Forex card order.

- Win a gift hamper worth Rs. 3000 by making a card unboxing video.

- Grab a BookMyForex personalized forex card for free and enjoy amazing Visa offers on travel, dining, shopping, and more.

Axis Bank Multi Currency Forex Card

The Axis Bank multi currency forex card enables you to buy, sell, and handle foreign currency of different denominations at the best possible rates through easy, quick, and safe banking transactions.

Key Features

- You can apply online or visit any Axis Bank branch. The documentation process may be slightly lengthy.

- The card will be dispatched within 3 to 4 working days.

- Reloading can be done by logging into the Axis Bank mobile banking app or internet banking. The reload fee is Rs. 100.00 plus GST.

- The issuance fee is 300 plus GST and the annual or inactivity fee is USD 5 or equivalent to that. The reload or unload fee is 100 plus GST, replacement fee is USD 3 or equivalent to that. The ATM withdrawal fee is 0.5% of the transaction amount.

- The exchange rate comes with a 2.50% markup over base rates.

- The withdrawal limit is USD 10,000 or equivalent for POS/Ecommerce/Cash advance, and USD 1000 or equivalent for ATM cash withdrawals.

- Get 24/7 help through Trip assist in case you lose your card or money.

- You can make the payment at the rate of loading or reloading your card.

- Get attractive and lowered rates on Southeast Asian currencies.

- If you are a Priority or Burgundy customer, you can avail an issuance fee waiver of Rs. 300.

- Benefit from bookings on dining, sight-seeing, and tours with this card.

IDFC Bank Multi Currency Forex Card

Make your travel seamless and easy with multi currency forex cards. With upto 14 currencies that you can load in this card, you can transaction in any of the countries with just this one card. This card is accepted at millions of Visa merchants all across the world (Excluding India, Nepal, and Bhutan)

Key Features:

- You can apply for the card either online or via the IDFC Bank branch.

- The card will be delivered within 4 to 6 working days.

- Reloading and unloading of the card can be done through the mobile banking app of IDFC, internet banking, or the authorized branch.

- The issuance fee and the reload or unload fee are zero.

- The replacement fee is Rs. 200 plus GST and the ATM withdrawal fee is Rs. 1.5 USD.

- The exchange rate comes at a mark up of 3.25% over the base rate.

- The daily applicable withdrawal limit is 5000 USD or equivalent to that.

- You can accrue 1000 reward points with your forex card.

- Get an international SIM card free along with your card.

- Get the best in class travel insurance coverage with this card.

HDFC Bank Multi-Currency ForexPlus Card

Make your international travel exciting yet safe with this forex card which can hold up to 22 currencies. Transact with enhanced security using this card which is designed with a built-in PayWave technology to make contactless payments at retail outlets. You can just wave the card at a distance of 4 cms or less from the payment machine and pay with utmost safety.

Key Features:

- You can apply both online and offline.

- The card is delivered within 3 working days for an HDFC Bank savings account customer. For others, it can take up to a week.

- You can reload the card by using internet banking or visiting the branch of HDFC bank. The reload fee is Rs. 75 plus GST.

- The issuance fee is Rs. 500 plus GST and there is no annual or inactivity fee.

- The reload or unload fee is Rs. 75 plus GST and the replacement fee is Rs. 85 plus GST

- The ATM withdrawal fee is USD 4 or equivalent to it.

- The exchange rate comes with a markup of 2 to 3% over the base rate.

- The daily withdrawal limit is USD 5000 or equivalent for ATM cash withdrawal.

- Get complimentary lounge access to international airports in India.

- Get free comprehensive insurance covers for air accidents, loss of checked in baggage, loss of personal documents, and loss of cash in transit.

IndusInd Bank Multi Currency Forex Card

This chip based technology foreign exchange card provides for trouble free and cashless travel. Benefits are in line with typical forex cards including enabling online transactions at hotels, flights, stores, etc., international ATM withdrawals, easy card replacement, and hotlisting of the card over the phone when lost or stolen.

Key Features:

- You can apply for the card both online and offline.

- Customers do not need an IndusInd account to purchase the card.

- The card will get delivered within 24 to 48 hours after applying for it.

- The card can be reloaded or unloaded by going to the IndusForex portal or an IndusInd bank branch.

- The issuance fee is INR 150 plus GST and the annual or inactivity fee is USD 3 or equivalent.

- The reload of unload fee is INR 100 plus GST and there is no replacement fee.

- The ATM withdrawal fee is USD 2 or equivalent.

- The exchange rate comes with a mark-up fee of 3.5% over base rates.

- The daily limit or POS withdrawal limit is Rs. 7 lakhs.

- Get a 10% cashback, subject to a maximum of Rs. 250 on hotel bookings.

- Get complimentary airport transfers worth up to Rs. 300.

- Enjoy discounts of up to INR 3000 on experiences, sight seeing, and other activities.

- Get a discount of Rs. 500 on processing charges when you send money abroad through wire transfers.

Standard Chartered Forex Card

Enjoy seamless travel with this card which provides amenities for online reload, insurance cover, immediate issuance, duty free shopping, and instant reload.

Key Features:

- You can apply for this card online, and a Standard Chartered bank account may be required.

- You can reload the Forex card at any of the branches locally or via online banking.

- The issuance fee is Rs. 299 and the annual or inactivity fee is USD 5 or equivalent.

- The reload or unload fee is zero and the replacement fee is INR 349. The ATM withdrawal fee is USD 2 or equivalent.

- The exchange rate comes at a markup of 3.5% over the base rate.

- The daily withdrawal limit is USD 2000 or equivalent for ATM cash withdrawal.

- You can use your card at duty free stores at any Indian airport.

SBI Bank Multi Currency Foreign Travel Card

This chip based card is compliant with EMV and helps you store encrypted and private information. Hence it offers elevated security. It is accepted all over the world excluding India, Nepal, and Bhutan.

Key Features:

- You can apply for the card both online and offline. The process is quite lengthy and takes a lot of time.

- The standard time duration for delivery is 7 to 10 working days. However, if express However, an additional fee should be given for express delivery.

- The card can be reloaded at any authorized branch.

- The issuance fee is INR 100 plus GST and the annual or inactivity fee is USD 1.5 or equivalent.

- The reload or unload fee is INR 50 plus GST and the replacement fee is INR 100 plus GST.

- The ATM withdrawal fee is USD 1.75 or equivalent.

- The exchange rate comes with a markup of 3% over base rates.

- The daily cash withdrawal limit for ATMs is USD 10,000 or equivalent and USD 10,000 or equivalent for POS.

- Get an ISIC membership and an international SIM card which is valid for 28 days and has up to 5 GB of data.

Bank of Baroda Multi Currency Forex Card

This card makes your travel memorable and smooth. With more than 150 authorized foreign exchange branches, you can easily access cash whenever required. Have a pleasurable travel experience with this card which eliminates the time wasted in money exchange or encashing your travelers cheque.

Key Features:

- This card can be purchased by both account holders and non account holders. The application process is offline.

- The card can be reloaded only at an authorized branch.

- The issuance fee is INR 150 plus GST and the annual or inactivity fee is USD 5 or equivalent.

- The reload or unload fee is INR 50 plus GST and the replacement fee is USD 5 or equivalent.

- The ATM withdrawal fee is 0.9% of the transaction amount.

- The exchange rate comes with a 3% markup over base rates.

- Get a discount of 6% on domestic and international flights and a flat 5% off on Dubai Visa.

- Get a discount of 20% on MRP across the whole range of grills, accessories, and consumables.

Kotak Mahindra Bank Forex Travel Card

This is a chip based prepaid card that can be loaded with 13 currencies, enabling you to shop anywhere in the world with security, safety, and ease. With this card, the transaction amount is directly deducted from your forex card balance.

Key Features:

- Only those who have a Kotak Bank account can apply for this card. The application process is online.

- You can either have the card delivered at your doorstep or pick it from a branch.

- You can reload the card through Kotak net banking or the mobile banking app. Communicate with the card issuer by mail to unload the funds.

- The issuance fee is 250 plus GST and the annual or inactivity fee is not applicable.

- The reload or unload fee is 275 plus GST and the replacement fee is USD 20 or equivalent.

- The ATM withdrawal fee is USD 2 or equivalent.

- The exchange rate comes with a markup of 3.5% over base rates.

- The daily withdrawal limit for ATM cash withdrawal is USD 2000 or equivalent.

- The card comes with enhanced security, emergency travel assistance, and lost card liability insurance.

How to apply for a Forex Card?

- You can visit the branch or office of the card issuer or apply for it online.

- There are various cards that provide different benefits, and you can choose one that is most suitable for you after comparing between the cards available.

- After choosing the card, you can either go to the branch with the necessary documents to apply or do it online.

Conclusion

It is always ideal to carry a Forex card on foreign trips and use the same for forex transactions. It will help you travel and transact abroad seamlessly. They make paying and shopping overseas convenient and simple.

Frequently Asked Questions (FAQs)