Best Credit Cards for Zomato

Last Updated : Oct. 10, 2024, 11:36 a.m.

Food cravings always make you pick up your mobile phone and order food from the Zomato App. Why go outside when you get the food delivered home? The app is widely used in India and you get the best deals on it. But if you want to save some more money, then you should use credit cards to pay for food ordered online. These cards provide complimentary Zomato membership and discounts on food delivery. You can enjoy huge rewards and cashback for online food ordering.So, let’s now move on to read about some of the best credit cards for food ordered from Zomato in India in 2025. These credit cards will help you save some extra bucks.

Top Credit Cards for Zomato Food Order

Before making any order from Zomato, you must see which credit card can provide you with the best deals. We have gathered the top credit cards that will give you many benefits on Zomato App.

Credit Cards | Zomato offers | Joining fee |

|---|---|---|

IDFC First SWYP Credit Card |

| Rs. 199 |

4% cashback | Rs. 499 | |

5% cashback | Rs. 1000 | |

HDFC Diners Club Privilege Credit Card | 5x reward points on Zomato Earn 20 reward points on every Rs 150 spent on Swiggy and Zomato. | Rs. 2500 plus GST |

American Express SmartEarn™ Credit Card | 10X membership reward points on Zomato. | 495 plus applicable taxes |

Get 40% off on Zomato on a minimum transaction of Rs. 200 | Rs. 250 | |

The card offers 10% cashback on purchases made on Zomato | Rs. 500 |

IDFC FIRST SWYP Credit Card

The IDFC FIRST SWYP Credit Card caters to young adults and those who are new to credit with its attractive features and emphasis on digital payments. Here’s a quick overview:

Key Highlights:

- Easy on the Wallet: The card boasts a low joining fee (around ₹199 + GST) and a reasonable annual fee (₹199 + GST after the first year).

- Rewards for EMI: Earn 1,000 reward points on your first EMI conversion.

- UPI Integration: Link your SWYP Card to your UPI app for seamless and convenient digital payments, even rewarding you with points for UPI transactions (excluding rent and fuel).

- Flexible Payment Options: Unlike traditional cards, SWYP offers you the option to convert your monthly credit card bill into EMIs (equated monthly installments) for easier management.

- Lifestyle Benefits: Enjoy additional perks like complimentary Time Prime membership upon spending Rs. 30,000 within the first 90 days of getting the card.

Axis Bank Ace Credit Card

The Axis Bank Ace Credit Card is a compelling option for those who value cashback on everyday purchases. Here’s a breakdown of its key features:

Key Highlights:

- Everyday Cashback: Earn a flat 2% cashback on all your online and offline spending, making it a versatile card for various purchases.

- Boosted Cashback Categories: Get additional cashback on specific spending categories like:

- 5% cashback on bill payments (electricity, internet, gas, etc.) & DTH and mobile recharges done via Google Pay.

- 4% cashback on popular online spending platforms like Swiggy, Zomato & Ola.

- Joining Fee Reversal & Annual Fee Waiver: Spend ₹10,000 within 45 days of card issuance to get the joining fee reversed. Additionally, an annual spend of ₹2 lakhs or more waives the annual fee for the following year.

- Complimentary Lounge Access: Enjoy 4 complimentary domestic lounge visits per year, making travel more comfortable.

- Fuel Surcharge Waiver: Get a 1% waiver on fuel surcharge (maximum ₹500 per month) on transactions between ₹400 and ₹4,000 at all fuel stations in India.

HDFC Millennia Credit Card

HDFC Millennia Credit Card caters to millennials who enjoy shopping and online entertainment. Here’s a glimpse into what it offers:

Key Highlights:

- Millennial-Focused Rewards: Earn a generous 5% cashback on popular spending categories like Amazon, Flipkart, Myntra, Zomato, Swiggy, and more. This makes it a great card for online shopping and food deliveries.

- 1% Cashback on Other Spends: Even outside the bonus categories, you’ll still earn a decent 1% cashback on most purchases (excluding fuel).

- Milestone Spender Benefits: Reach spending milestones of ₹1,00,000 in a quarter and be rewarded with gift vouchers worth ₹1,000.

- Fuel Surcharge Waiver: Get a waiver on fuel surcharge on transactions between ₹200 and ₹500 at petrol pumps across India.

- Easy EMI Conversion: Large purchases can easily be converted into EMIs (Equated monthly installments) for manageable repayment.

HDFC Diners Club Privilege Credit Card

The HDFC Diners Club Privilege Credit Card provides magnificent benefits across travel, entertainment, and dining. Additionally, you can also enjoy many other benefits including complimentary memberships to several other services like Amazon Prime, Times Prime, Dineout, and MMT Black.

Key Highlights:

- Enjoy a Great Welcome: Get complimentary annual memberships of Swiggy One and Times Prime on spending Rs. 75,000 within 90 days of issuing the card.

- Free Movie Ticket: Get 1 movie ticket free on booking one through BookMyShow. The offer is applicable for shows on Friday, Saturday, and Sunday. You can get up to 2 free tickets every month.

- Non Movie Ticket Offer: Buy one Get one free non movie weekend ticket via BookMyShow.

- Reward Points on Food Ordering: Get 5x reward points on Swiggy and Zomato. Get bonus 4x reward points with an upper limit of 2500 reward points every month.

- Milestone Benefits: Avail vouchers of value Rs. 1,500 from Marriott Experience, Barbeque Nation, Decathlon, O2 Spa, or Lakme Salon on spending Rs. 1.5 lakhs quarterly.

- Renewal Fee Waiver: Get a renewal fee waiver for the next year on spending Rs. 3 lakhs in the anniversary year.

- Reward points/Cashback redemption and validity:

- Get 4 reward points per Rs. 150 on retail spends

- Get 20 reward points per Rs. 150 spent on Swiggy and Zomato

- Earn up to 10X reward points on spends made through Smartbuy.

American Express SmartEarn™ Credit Card

Rich in rewards, this card gives unique membership reward points on dining, shopping, and travel. For those who are buying a credit card for the first time, this card enables you to earn reward points on every purchase.

Key Highlights:

- Welcome Bonus: Get a welcome bonus of Rs. 500 as cashback on spending Rs. 10,000 within the first 3 months.

- Get Rewarded:

- Get 10x rewards on every Rs. 50 spent on Zomato, Ajio, Nykaa, BookMyShow, Uber, and many more

- Get 5x rewards on purchases made on Paytm, Wallet, Swiggy, and BookMyShow.

- Get 1 reward point per Rs. 50 spent.

- Renewal fee offer: Get a renewal fee waiver on spending Rs. 40,000 and above in the previous year.

- Spend Milestones: Get vouchers worth Rs. 500 upon reaching milestone spends of Rs. 1.20 lakhs, 1.80 lakhs, and 2.40 lakhs respectively in a year.

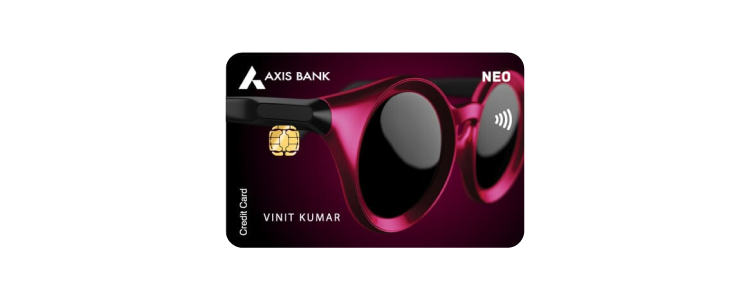

Axis Neo Credit Card

This card provides exciting offers on shopping across various ecommerce platforms like Zomato, Blinkit, Myntra, BookMyShow, etc. However, the card has an average reward structure with just 1 EDGE reward point on spends of Rs. 200 across all categories.

Key Highlights:

- Discount on Utility Bills: Get a 5% discount on utility bill payments via PayTM.

- Blinkit Offer: Get 10% off on spending a minimum of Rs. 750 on Blinkit, subject to a maximum of Rs. 250. This offer can be availed once a month.

- Myntra: Get a bonus discount of Rs. 150 on Myntra on minimum purchases of Rs. 999 on select styles.

- BookMyShow: Get a 10% off on each purchase of a movie ticket on BookMyShow. Get maximum monthly benefits up to Rs. 100.

- Rewards Program: Get 1 EDGE reward point per Rs. 200 spent across all categories.

- First Utility Offer: Get 100% cashback, up to Rs. 300 on the first utility bill payment made within 30 days of card issuance.

Airtel Axis Bank Credit Card

This card helps you earn well on your spends. It is the go to card for cashback . Enjoy up to 25% cashback across several categories such as mobile recharge, traveling, dining, or grocery and also cashback across every spend.

Key Highlights:

- Welcome Voucher: Get an Amazon e-voucher worth Rs. 500 on doing the first transaction within 30 days of issuing the card.

- Cashback: Earn a cashback of 25% on broadband, WiFi, and DTH bill payments through the Airtel Thanks app.

- Complimentary Lounge Access: Enjoy 4 complimentary lounge visits to select airport lounges within India on reaching milestone spends of Rs. 50,000 in the previous 3 months.

- Fuel Surcharge Waiver: Get a fuel surcharge waiver of 1% on all fuel transactions between Rs. 400 to Rs. 4000.

- EazyDiner offer: Enjoy up to 15% off at partner restaurants in India.

Conclusion

Now you have seen the best credit cards for Zomato and you can enjoy great discounts and cashback while ordering food from Zomato. There are many other advantages of these credit cards other than Zomato benefits. These will give you a great experience while you use them on Zomato for ordering food and enjoying Zomato Pro membership.

Frequently Asked Questions (FAQs)