Best Credit Cards for Utility Bill Payment

Last Updated : Sept. 25, 2024, 3:01 p.m.

There are credit cards that offer benefits like reward points, cashback, or value back on utility bill payments made through the relevant platform. Let us now read about some of the top credit cards for utility bill payments in 2025.

Top Credit Cards for Utility Bill Payments in India for 2025

Credit Card | Joining fee/Annual or renewal fee | Rewards on utility bill payments |

|---|---|---|

Rs. 499 | 5% cashback on utility bill payments and recharges via Google Pay | |

Rs. 500 | Get up to 25% cashback on transactions made on Airtel Thanks app | |

NIL | 1 reward point per INR 100 spent on utility bills. | |

Rs. 1499 | 5% NeuCoins on all non-EMI spends at Tata Neu & its partner brands | |

Rs. 2,500 | 4 reward points for each INR 150 on your utility bill payments | |

Standard Chartered Super Value Titanium Credit Card | Rs. 750 | 5% cashback on utility bills |

American Express Gold Charge Card | Rs. 1000 or Rs. 4500 | 1 membership reward point for each Rs. 50 spent on utilities. |

NIL | 2% cashback on utility bill payments. |

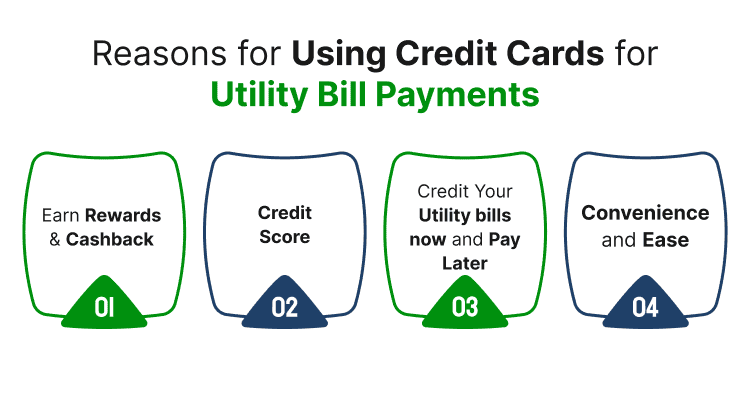

Reasons for Using Credit Cards for Utility Bill Payments

Earn Rewards and Cashback

When you use credit cards to pay utility bills, you can instantly earn cashback and rewards. Before choosing a credit card for paying utility bill payments, you have to understand its terms and conditions. This is because different cards will have varied benefits. For instance, the Axis Bank Ace Credit Card, Airtel Axis Bank Credit Card, and the Tata Neu Infinity HDFC Card provides you with 5%, 10%, and 5% cashback on utility bill payments.

Credit Score

Your credit score will also improve on making utility bill payments with your credit card. If you pay your credit card bills on time, then you will have an impeccable credit history or credit score.

Credit your Utility bills now and Pay Later

You can instantly pay your utility bills and then repay it back once your statement is generated. Every credit card gives an interest free credit period of 50 to 55 Days. So, make use of this feature to pay your bills later.

Convenience and Ease

It is easy and convenient to pay your utility bills using your credit card. You don’t have to use other ways of payment. Several apps provide the facility to save the card information under the RBI guidelines. So, you need not type in the information each time and can make the payment instantly and effortlessly.

Top Credit Cards for Utility Bill Payments 2025 - Key Highlights

Axis Bank Ace Credit Card

This card is a great option if you want to save on your utility bill payments. The card provides 5% cashback on bill payments, DTH, and mobile recharges via Google Pay. The card also offers a 4% cash back on popular dining platforms and unlimited cashback of 1.5% on all other offline and online spends.

Other key features:

- Get 4 domestic lounge access per year on spends of Rs. 50,000 or more in the previous quarter.

- Get a fuel surcharge waiver of 1% across all fuel stations on transactions between Rs. 400 to Rs. 4,000

Airtel Axis Bank Credit Card

The Airtel Axis Bank Credit Card is best suited for those who have subscribed for Airtel services or regularly use them. The card provides 10% cashback for utility payments made on the Airtel Thanks App and 25% cashback on Airtel Mobile, WiFi, broadband, and DTH bill payments

Other key features:

- Earn cashback of 10% on spends made at Zomato, BigBasket, and Swiggy.

- Get 4 free domestic airport lounge visits annually.

- Enjoy unrestricted cashback of 1% on all other expenses.

ICICI Platinum Chip Credit Card

This card is an entry level card and is best suited for those who want to build their credit score .

Other key features:

- Earn 1 reward point per Rs. 100 spent on insurance and utility bills including government transactions.

- Earn 2 reward points per Rs. 100 spent on retail purchases (Except fuel)

- Enjoy 1% fuel surcharge waiver across HPCL fuel pumps.

- Get movies and travel vouchers, lifestyle products, and other merchandise against your reward points

- Save up to 15% on dining bills at more than 2,500 restaurants across the country.

Tata Neu Infinity HDFC Bank Credit Card

This card is an enhanced version of the Tata Neu HDFC Plus Credit Card. Reward points are credited in the form of Neu Coins. Users can earn 5% NeuCoins on all non-EMI spends at Tata Neu & its partner brands.

Other key features:

- Earn 1,499 NeuCoins post the first spend within 30 days of the card issuance.

- Earn 1.5% NeuCoins for spends made on non-Tata brands and EMI spends made on merchants.

- Get additional rewards of 5% NeuCoins on select spends at the Tata Neu app or website

- Pay a low forex markup fee of 2%

- Get 8 domestic and 4 international lounge visits per year through priority pass.

HDFC Regalia Gold Credit Card

This credit card is a great pick for those who want great rewards and luxury. You can accrue 4 reward points per Rs. 150 spent on this credit card including utility payments. The reward points accumulated can be redeemed against flight or hotel bookings, products, vouchers, Airmiles, or cashback. The reward points earned is restricted at 2,000 per month for utility, cable, and telecom.

Other key features:

- Get a complimentary Club Vistara Silver and MMT Black Elite memberships

- Enjoy a welcome gift voucher of value Rs. 2,500 on paying the joining fee.

- Get access to 6 complimentary international lounges and 12 complimentary domestic airport lounges in a year.

- Get vouchers worth Rs. 1500 from Marks and Spencer, Reliance Digital, Marriott, and Myntra on reaching milestone quarterly spends of Rs. 1.5 lakhs.

- Get flight vouchers worth Rs. 5000 on reaching annual spends of Rs. 5 lakhs

Standard Chartered Super Value Titanium Credit Card

The Standard Chartered Super Value Titanium Credit Card provides benefits across categories such as fuel, telephone bill, and utility bill payments. Users can earn 5% cashback across all these categories.

Other key features:

- Get a 5% cashback on fuel spends up to INR 2000 across all fuel stations in India. You can save up to INR 200 per month with a maximum cashback of INR 100 per transaction.

- Get 1 reward point per Rs. 150 spent on all other expenses.

- Annual fee is not charged for premium banking customers.

- Premium banking clients are eligible for a complimentary priority pass membership

- Premium clients fulfilling the terms and conditions can get 1 free priority pass lounge access per month outside India.

American Express Gold Charge Card

The American Express Gold Charge Card is one of the best credit cards for utility bill payments. It offers rewards on utility bill payments and even fuel spends. One of the most important features of this card is that it comes with no boundaries on the spending limit.

Other key features:

- Get 1 membership reward point per Rs. 50 spent including payments on fuel and utility.

- Every month, earn 1,000 bonus points on 6 transactions of 1,000 each.

- You can shop, dine, and travel with popular brands such as Apple, Flipkart, etc. Earn 5x points on every spend.

- Redeem rewards for vouchers of 18 and 24 Karat Gold collection from Taj, Tanishq, Flipkart, Myntra, Reliance Digital, Shoppers Stop, Reliance Digital, and Amazon.

Amazon Pay ICICI Credit Card

This card offers great cashback for your purchases and is curated for people who are frequent shoppers on Amazon. It is lifetime free and offers 2% cashback on your monthly utility bills for gas, water, and electricity.

Other key features:

- If you are a member of Amazon Prime, earn 5% cashback on your Amazon India spends.

- For non Prime members, earn 3% cash back on your Amazon India spends.

- Earn 2% cash back on payments made to 100 plus partner merchants on Amazon Pay.

- Earn 1% cashback on other expenses such as shopping, dining, travel, and insurance payments.

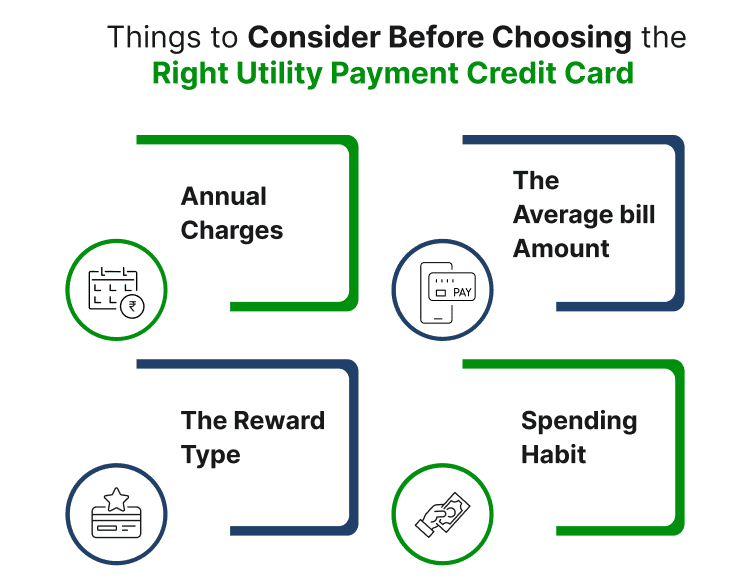

Things to Consider Before Choosing the Right Utility Payment Credit Card

Before choosing the credit card for making the utility bill payments, you must compare the various credit cards for impacting factors.

- Annual charges: Evaluate the benefits in comparison to the annual charges and ensure that you are able to get maximum gains from your card.

- The average bill amount: The utility bill amount is not constant. So, compute the average bill amount in order to be aware of the cashback and rewards you will get every month.

- The Reward type: Determine how you want to get your points, whether in the form of rewards or cashback. Choose a card accordingly.

- Spending habit: Determine where you spend the most. Is it shopping online, travel, dining out, fuel, or what is it? Once you know, you can select the card accordingly. For instance, if you are a frequent flyer, you can choose a card that is most suited for travel and offers maximum benefits on travel.

How to Pay Utility Bills with a Credit Card?

Given below are the ways to pay utility bills with a credit card

Online Banking

Step 1: Log in to the online banking portal of the credit card

Step 2: Navigate to the section on bill payments

Step 3: Choose the utility bill option. Then, key in the details of the utility provider.

Step 4: Enter the amount to be paid and confirm.

Step 5: A confirmation message will be sent as soon as the amount is credited to the card issuer.

Mobile Banking App

Step 1: Open your mobile banking app.

Step 2: Navigate to the bill payment section.

Step 3: Choose the option for utility bill payments

Step 4: Follow the instructions and complete the payment for credit card utility bill payment.

Through the Website or app of the Utility Provider

Step 1: Log into the portal of your utility bill provider and choose the option for payment

Step 2: Choose the method of payment as ‘credit card’

Step 3: Enter your credit card details to complete the transaction

Make Automatic Payments

You can automate your payments for utility bills every month through your bank’s online banking platform or the utility provider’s portal.

Conclusion

Not every individual will have the same requirements. So it is important to compare the various credit cards when choosing one. Credit cards should be evaluated and compared on different parameters such as rewards structure, fees, etc. You can compare and apply for credit cards here at Wishfin. Also, you should pay your bills on time and in full in order to build a good credit score with your credit card.

Frequently Asked Questions (FAQs)