Best Credit Cards for Railway Ticket Booking

Last Updated : Dec. 18, 2024, 3:49 p.m.

Most people in India travel a lot. They choose various modes of transport like flights, trains, cars, etc. When it comes to railway travel, there are credit cards which help you to cut down on expenses, because they may earn you discounts or reward points when you book railway tickets. There are multiple credit cards given by different banks. So, before deciding on which one to use for booking railway tickets, you must explore the features, benefits, and fees of all these cards. Let us now read about some of the best credit cards for railway ticket booking in India in 2025.

Top Credit Cards for Railway Ticket Booking in India in 2025

You can go through the list of best credit cards that can be a savings instrument when you book your train tickets. IRCTC is the official website for booking train tickets and you need to register on it.

| Credit Cards | Railway ticket booking Benefits | Key Features | Key Features |

|---|---|---|---|

| IRCTC SBI Card Premier |

|

| Annual fee: Rs. 1,499 Renewal fee: Rs. 1,499 Add on fee: Nil |

| IRCTC SBI Platinum Card |

|

| Annual fee (One-time): Rs. 500 + GST Renewal Fee- Rs. 300 + GST |

| Air India SBI Signature Credit Card |

|

| Annual fee (One-time): Rs. 4,999 plus taxes. Renewal fee (Per annum): Rs. 4,999 |

| HDFC Bharat Cashback Credit Card |

|

| Joining fee: Rs. 500 + GST Annual fee: Rs. 500 + GST |

| Kotak Bank Royale Signature Credit Card |

|

| Joining Fee- NIL - Annual Fee- ₹999 + GST |

| Kotak Aqua Gold Credit Card |

|

| Joining fee: Nil Annual fee: Nil |

| IRCTC BOB RuPay Credit Card |

|

| Joining fee: Rs. 500 Renewal fee: Rs. 350 |

|

| Joining Fee: Rs. 500 Renewal fee: Rs. 500 |

Best Credit Cards for Railway Ticket Booking - Other Features

You must take a look at other features of these cards that enable savings for you and you can apply for the credit card online .

IRCTC SBI Premier Card

This co-branded credit card offers great benefits on railways such as 10% cashback on booking tickets via IRCTC.Co.in, free railway lounge visits, rail accident insurance. Besides these, the card offers all round benefits on other categories like fuel, air travel, loss of card, etc. Overall, it is one of the best credit cards for railway ticket booking.

Features:

Enjoy 8 complimentary visits to railway lounges annually.

Get a maximum of 2 railway lounge visits through the IRCTC SBI Card Premier.

Get a Fuel Surcharge Waiver of 1% with a maximum of up to Rs. 250 per month at all the refilling stations.

Enjoy a waiver of 1.8% on Air IRCTC at the time of booking Air Tickets.

Enjoy a complimentary rail accident insurance cover of Rs. 10 lacs

Enjoy a complimentary air Accident Insurance cover of Rs. 50 lakhs.

Get a complimentary fraud liability cover of INR 1 lakh.

IRCTC SBI Platinum Card

The IRCTC SBI Platinum card offers you exclusive benefits on railway ticket booking such as a transaction charge waiver, high valueback, complimentary lounge access. Other benefits include welcome bonus, fuel surcharge waiver, reward points on every spend, etc. Apply for this card, which is one of the best IRCTC credit cards and one of the best credit cards for railway ticket booking and enjoy the magnificent perks.

Features:

Earn 350 activation bonus reward points on doing transactions for Rs. 500 or over within 45 days of issuing the card. Fuel and cash spends are not included.

Earn 1 reward point per Rs. 125 spent on non fuel retail purchases on www.irctc.co.in.

- Enjoy a fuel surcharge waiver of 1% across all petrol pumps in India on transactions between Rs. 500 to Rs. 3,000.

Air India SBI Signature Credit Card

Enhance your travel experience with the Air India SBI Signature Credit Card. This card offers great benefits across Air travel with Air India. Benefits include reward points on air tickets booked through the Air India website, visits to domestic and international lounges. However, this credit card can be used to book railway tickets too. Overall, this card offers other benefits like fuel surcharge waiver, balance transfer, lost card liability cover, etc.

Features:

Enjoy the privilege of getting complimentary membership to the Air India frequent flyer program.

Get a fuel surcharge waiver of 1% across all fuel stations in India on transactions in the range of Rs. 500 to Rs. 4000 (With a maximum of up to Rs. 250 per statement cycle).

Enjoy lost card liability cover of Rs. 1 lakh.

Enjoy cash withdrawal facilities from 1 million Visa ATMs globally with 18,000 Visa ATMs in India.

You can obtain add on cards for your spouse, parents, children, or siblings over the age of 18

Purchases worth Rs. 2500 or more can be converted into easy EMIs with Flexipay.

Dues on your other banks’ credit cards can be transferred to your Air India SBI Signature Credit Card. Then you can continue to pay the EMIs at lower interest rates.

HDFC Bharat Cashback Credit Card

Enjoy huge cashback on railway ticket booking with this credit card which is a great one to have in your wallet. Other benefits include cashback on grocery, fuel, bill payments, etc. Enjoy transacting with this card, which is one of the best credit cards for railway ticket booking.

Features:

Obtain an interest-free credit period of up to 50 days

Experience a zero liability to indemnify you from the losses caused by the unauthorized or fraudulent usage of the lost card.

The Interest on the revolving Credit is 3.49% per month

The age of the applicant must be 21 to 65 years

Enjoy the privilege of getting a renewal fee waiver on reaching milestone spends of Rs. 50,000 in a year.

Customers can use the cashback obtained in the form of reward points to pay credit card bills. This cashback is reflected in the next statement.

You can redeem up to a maximum of 3,000 reward points.

Kotak Bank Royale Signature Credit Card

The Kotak Royale Signature Credit Card offers rewards across various categories like dining, shopping, travel, etc. With its multiple benefits, this card is a great choice for railway ticket booking.

Features:

Get 2 free visits every quarter to select Dream Folks lounges in India.

Enjoy amenities such as high end TVs, luxury seating, gourmet meals, newspaper, magazines, and free WiFi.

Enjoy a fuel surcharge waiver (Up to Rs. 3500 per year) on transactions between Rs. 500 to Rs. 3000.

Get a cover of Rs. 2.5 lakhs if the card is stolen and used for any fraudulent activity.

The Interest on this card is 3.5% per month.

Get an annual fee reversal on reaching milestone spends of Rs. 1,00,000.

The age of the primary cardholder must be between 21 and 65 years.

Kotak Aqua Gold Credit Card

The Kotak Mahindra Bank Aqua Gold Card is a secured credit card and it offers multiple perks. From offering a higher credit limit to enabling interest-free cash withdrawals, the Aqua card promises an enjoyable shopping experience. So, what are you waiting for? Apply for this card instantly and enjoy the advantages.

Features:

The maximum credit limit available is Rs. 12 lakhs.

Enjoy an interest free cash withdrawal facility up to 48 days each year.

The cash limit is 90% of the sanctioned credit limit.

You can easily do a balance transfer using this card with a simple call to the bank.

You can share the perks of the card with your family members like parents, spouse, kids, and siblings by getting them free add on cards.

Enjoy 4 free PVR tickets or cashback up to Rs. 750 on reaching milestone spends of Rs. 1.50 lakhs in a year.

IRCTC BOB RuPay Credit Card

This card offers huge reward points and savings on railway tickets booking through the IRCTC website and mobile app. This card has a great rewards program and benefits you on departmental store shopping and various other categories. Complimentary railway lounge perks are another highlight. With multiple benefits on railways, it is one of the best credit cards for railway ticket booking. Experience the pleasure of using this IRCTC credit card with its many privileges.

Features:

Get 500 reward points as welcome bonus on spends of Rs. 5,000 or more within 60 days card issuance.

Get a surcharge waiver of 1% on all fuel transactions in the range of Rs. 500 to Rs. 3000 (With a maximum waiver of Rs. 100 per statement).

Enjoy zero liability on lost cards.

Purchases greater than Rs. 2500 can be changed into EMIs in the range of 6 to 36 months.

Get up to 3 lifetime free add on cards for your spouse, kids, parents, or siblings (Above the age of 18).

Accrued reward points can be redeemed as cashback @ 1 reward point = Rs. 0.25.

IRCTC HDFC Bank Credit Card

This card offers benefits to those who travel frequently by railways. Attractive joining bonus, lounge access, discounts on railway ticket bookings, visits to executive railway lounges are some of the awesome benefits. Pocket this card and reap the advantages of using one of the best credit cards for railway ticket booking.

Features:

Get a fuel surcharge waiver of 1% at all fuel pumps across India on transactions between INR 400 to INR 5,000.

Receive a welcome gift voucher worth Rs. 500 by doing the first transaction within 37 days of card issuance.

Get a milestone gift voucher of INR 500 on reaching quarterly spends of INR 30,000 or more.

Enjoy a renewal fee waiver on reaching anniversary milestone spends of INR 1,50,000 or more.

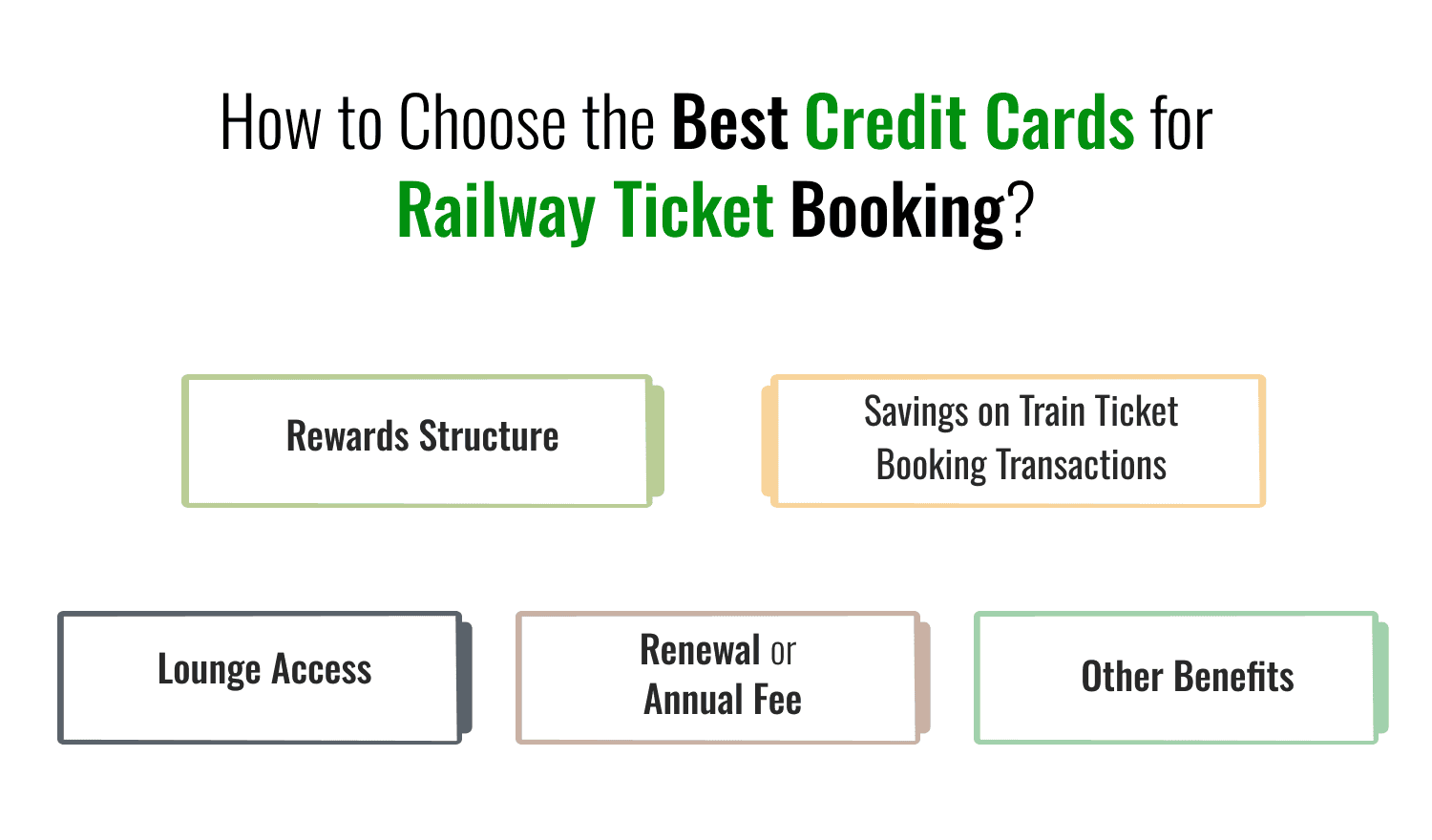

How to Choose the Best Credit Cards for Railway Ticket Booking?

Here are some tips to choose the right credit card for railway ticket booking:

Rewards structure: Analyze the rewards structure of the card. Understand how many points you can get on railway ticket booking in the form of cashback, reward points, valueback, etc. There are credit cards which give you a huge value back, as high as 10% on train tickets. So, compare and zero in for cards which offer you great rewards on railway ticketing.

Savings on train ticket booking transactions: Cards offer transaction charge waivers on train ticket booking. For instance, IRCTC co-branded credit cards with SBI, RBL Bank, and HDFC offer a waiver of 1% on transaction charges. Choose cards which have this facility.

Lounge Access: Analyze the lounge access benefits of the card. Some cards may have a great lounge access program in addition to offering huge rewards and savings on railway ticket booking. You can then compare between the various cards and choose which offers a superb combination on all 3 parameters.

Renewal or annual fee: Evaluate if you can afford to pay the card fees. Finally, the fees should not outweigh the benefits offered by the card.

Other benefits: Credit cards which provide excellent offers on railway ticket booking may also offer benefits across various other categories like shopping, air ticket.

Frequently Asked Questions (FAQs)