Best Credit Cards for Insurance Premium Payment

Last Updated : Sept. 23, 2024, 4:26 p.m.

Many people opt for various types of insurance - Life insurance, home insurance, vehicle insurance, etc. While most credit cards do not reward payments made towards insurance, some still offer good rewards for these. Here, we will read about such cards.

Top Credit Cards for insurance Payments in India 2025

Making insurance payments using a credit card will fetch you reward points and it will also help you manage your finances better. The table below lists some of the top credit cards for insurance payments in india 2025.

Card | Joining fees | Renewal fees | Quantum of rewards on insurance |

|---|---|---|---|

Amex Platinum Travel Credit Card | Rs. 1499 plus GST | This card does not give membership reward points for insurance. But, it credits 15,000 MR points on spends of Rs. 1.90 lakhs, provides a voucher worth Rs. 10,000 for Taj, and 25,000 MR points on spends of Rs. 4 lakhs in a year. | |

Rs. 1,499 plus applicable taxes | Rs. 1,499 plus applicable taxes | NeuCoins for insurance spends will be capped at 2,000 NeuCoins per day. NeuCoins will be credited 2 days post the settlement of the transaction. | |

Lifetime free | Lifetime free | Earn 1% cashback on insurance payments | |

2500 plus applicable taxes | 2500 plus applicable taxes | 4 reward points per Rs. 150 on insurance spends | |

Rs. 499 plus applicable taxes | Rs. 499 plus applicable taxes | 1% cashback credited as NeuCoins, Subject to a maximum of 2000 per day. | |

HDFC Bank BizBlack Metal Edition | Rs. 10,000 plus GST | Rs. 10,000 plus GST | 5 reward points per Rs. 150, subject to a maximum of 5000 reward points each day |

HDFC Bank BizPower | Rs. 2,500 plus GST | Rs. 2,500 plus GST | 4 reward points per Rs. 150 subject to a maximum of 2000 reward points each day |

HDFC Bank Diners Club Black Metal | Rs. 10,000 Plus GST | Rs. 10,000 Plus GST | 5 reward points per Rs. 150 |

Yes Bank Marquee Card | Rs. 9,999 Plus GST | Rs. 4,999 Plus GST | 10 reward points per Rs. 200 |

Rs. 1,499 Plus GST | Rs. 1,499 Plus GST | 3 CV points per Rs. 200. Milestone benefits of 1000 CV points on spending Rs. 50,000 within 90 days of card issuance. | |

HDFC Bank INFINIA Metal | Rs. 10,000 Plus GST | Rs. 10,000 Plus GST | 5 reward points per Rs. 150, up to 5,000 reward points per day |

Rs. 500 | Rs. 500 | 1 reward point per Rs. 100 spent on insurance |

Top Credit Cards for insurance Payments in India 2025 - Other Key highlights

Amex Platinum Travel Credit Card

Get a luxurious and enjoyable travel experience with this card. Apply for it and earn air miles, discounts, cashback, and rewards when you shop, dine, or travel.

- Milestone benefits: Get a Flipkart voucher on spends of Rs. 1.90 lakhs in a year.

- Free airport lounge access: Enjoy 8 free domestic airport lounge visits per year (Up to 2 complimentary visits per quarter) across India.

- E-gift card: Get a Taj experiences E-gift card worth Rs. 10,000 from the Taj, SeleQtions, and Vivanta hotels.

- Additional travel vouchers: Get an additional Flipkart voucher or travel benefits on American Express Travel.com worth Rs. 7,500 on reaching milestone spends of Rs. 4 lakhs in a year.

HDFC Tata Neu Infinity Credit Card

Make the most out of your savings with this co-branded credit card . Enjoy 10% savings on e-commerce, bill payments, insurance, UPI transactions, and lounge access.

- Welcome offer: Get 1,499 Neucoins as a welcome benefit for the first transaction made within 30 days of issuing the card.

- Rewards: 5% cashback as Neucoins on Tata brand spends and 1.5% cashback on other spends.

- Fuel surcharge waiver: Get a fuel surcharge waiver of up to 1% on fuel spends between Rs. 400 and Rs. 5,000 across all fuel stations in India (Up to a maximum of Rs. 500 per statement cycle).

- Lost card liability cover: Up to Rs. 9 lakhs if the card is lost.

- Emergency overseas hospitalization: Up to Rs. 15 lakhs in case of emergency overseas hospitalization.

- Renewal fee waiver: Get a renewal fee waiver on reaching milestone spends of Rs. 3 lakhs or more before the renewal date.

Amazon Pay ICICI Credit Card

This lifetime free credit card provides you with considerable cashback on purchasing from Amazon.

- Rewards: Unlimited rewards

- Benefits on Amazon as cashback:

- Amazon Prime members can earn a cashback of 5% on transactions made at www.Amazon.in

- Non Prime members can earn a cashback of 3% on transactions made at www.Amazon.in.

- 2% cashback on transactions done at over 100 Amazon Pay merchant partners on using this card at Amazon Pay

- 1% cash back on all other payments.

HDFC Regalia Gold Credit Card

Apply for this credit card and enjoy the magnificent welcome benefits, rewards on purchases, complimentary lounge access, vouchers, and more. Enjoy your life with this all in one card.

- Complimentary lounge access: The card offers complimentary access to over 1,000 airport lounges globally.

- Rewards: Earn 4 reward points per Rs. 150 spent on retail purchases and 5x reward points at select retailers.

- Vouchers on milestone spends: Get vouchers worth Rs. 1,500 on reaching quarterly spends of Rs. 1.5 lakhs and flight vouchers worth Rs. 5000 on reaching milestone annual spends of Rs. 5 lakhs.

- Savings: Save up to 20% on restaurant bill payments through Swiggy Dine Out across 20,000 restaurants.

- Complimentary club memberships: Get complimentary Club Vistara Silver Tier and MMT Black Elite memberships.

Tata Neu Plus HDFC Bank Credit Card

This card offers extraordinary rewards for Non-EMI spends on Tata brand partners and EMI spends on non Tata brands.

- Welcome benefits: Earn 499 NeuCoins on making the first transaction before 30 days from the date of card issuance. They will be added to the Tata Neu App within 60 days.

- Fuel surcharge waiver: Get a fuel surcharge waiver of 1% at fuel stations across India for transactions between Rs. 500 to Rs. 5000 (Up to a maximum of Rs. 250).

- Complimentary lounge access: Get 4 complimentary domestic lounge access in a year (1 per quarter). Pay an additional charge of Rs. 2 for lounge access.

- Rewards points in the form of NeuCoins:

- Get 2% rewards in the form of NeuCoins on Non-EMI spends on Tata Neu and Tata partner brands.

- Earn 1% rewards as NeuCoins on EMI spends or spends on non Tata partner brands.

- Earn additional reward points of 5% on spending through the Tata Neu website or app.

HDFC Bank BizBlack Metal Edition

This card offers a range of benefits for business travel, complimentary club membership and hotel stay, and savings on income tax or GST bill payments.

- Reward Points: Earn 5x reward points on spending more than Rs. 50,000 per statement cycle, (Up to 7,500 reward points). Reward points are applicable only on specific spends such as income tax payments, GST payments, SmartPay bill payment, GST payments, and PayZapp bill payments.

- Welcome benefits: Get a complimentary annual membership of Club Marriott and Taj Stay Voucher worth Rs. 5000 on reaching milestone spends of Rs. 1.5 lakhs within the first 90 days.

- Milestone benefits: Get flight tickets or Taj Hotels Stay voucher worth up to Rs. 5000 on reaching milestone spends of Rs. 5 lakhs and above.

- Business insurance: The card offers a business insurance package covering fire and burglary, electronic equipment, hospital cash, cash in safe/transit starting at Rs. 3,785 per year.

- Lounge access: Access to more than 1,000 airport lounges world wide.

HDFC Bank BizPower

This card provides exemplary benefits on business expenditure. Right from travel vouchers and complimentary lounge access to business ad spends, enjoy the perks offered by this card by applying for it.

- Business travel benefit: Get simplified business travel benefit on travel voucher worth Rs. 10,000 plus complimentary lounge access.

- Savings: Save up to 8.67% on business ad spends (Google Ad spends/Meta), income tax or GST and bill payments.

- Reward points: Earn five times the reward points on GST, income tax, vendor and bill payments.

- Lounge Access: Access up to 16 domestic and 6 international airport lounges in a year.

- Milestone benefits: Get a gift voucher worth up to Rs. 2,500 from Reliance Digital or MakeMyTrip on reaching milestone spends of Rs. 2.5 lakhs every quarter.

- Renewal fee waiver: Get an annual fee waiver on spending more than Rs. 4 lakhs in the previous year.

- Swiggy Dineout: Get up to 7.5% off on restaurant bill payments at more than 20,000 restaurants.

HDFC Bank Diners Club Black Metal

It is one of the most premium cards in India and offers benefits across multiple categories like shopping, dining, golf, etc. However, it is focused more on benefits across the travel segment.

- Reward points: Get 10,000 bonus reward points per Rs. 4 lakhs spent in a calendar quarter.

- Dining benefits: Get 2x reward points on weekend dining.

- Travel benefits: Get access to more than 1,300 airport lounges worldwide, baggage assistance, and fast track airport check-in.

- Lifestyle benefits: Enjoy complimentary annual memberships to Amazon Prime, Swiggy One, and Club Marriott.

- Spas: Enjoy a discount of 20% off at some of India’s premium spas.

Yes Bank Marquee Card

The Yes Bank Marquee credit card comes with appealing benefits like international lounge access, low forex mark-up fee, complimentary guest visits, etc. making it an attractive option for those who undertake international travel frequently.

- Lounge access:

- Primary and add-on card holders get unrestricted complimentary international airport lounge access. They are also eligible for 24 complimentary visits to domestic airport lounges in India per year.

- Guests have 8 complimentary lounge access per year.

- Low Forex markup fee: Low foreign currency exchange mark-up fee of 1% on international transactions.

- Reward Points:

- Earn 36 Yes Rewardz points per Rs.200 spent on online shopping.

- Earn 18 Yes Rewardz points per Rs. 200 spent on offline shopping.

- Earn 10 Yes Rewardz points per Rs. 200 spent on categories like recharge, loading wallet, utility bills,etc.

Club Vistara SBI Card

Accrue Club Vistara points with every swipe of your Club Vistara SBI Card. Have a rewarding and smooth travel experience with this power packed card.

- Reward points: Earn 3 CV points per Rs. 200 spent. CV points can be used to book Vistara Airline tickets at the rate of 1 CV point = Re 1.

- Milestone benefits: Enjoy an economy class ticket with the base fare waived off on reaching milestone spends of Rs. 1.25 lakhs, 2.5 lakhs, or 5.00 lakhs. Also get an hotel e-voucher of value Rs. 5,000 from Yatra on completing spends of Rs. 5 lakhs.

- Travel benefits: Get complimentary air tickets, priority pass membership, and access to airport lounges.

- Welcome benefits: Get an e-gift voucher through e-email within 30 working days after paying the annual fee.

HDFC Bank INFINIA Metal

This is a card meant for the high spenders providing premium lifestyle benefits across various categories like golf, travel, shopping, dining, etc.

- Complimentary nights and buffet: The card offers complimentary nights and buffets at participating ITC hotels.

- Complimentary Club Marriott membership: The card offers a complimentary Club Marriott membership for the first year.

- Unlimited airport lounge access: There is no cap on the airport lounge access across the globe for the primary and add on members.

- Reward points: The card provides 5 reward points per Rs. 150 spent.

- Priority Pass: Cardholders can get complimentary access to more than 1000 airport lounges across India through the priority pass.

- Unlimited free golf games: You can enjoy unrestricted access to free golf games at leading golf courses across India.

- Low Forex markup fee: The card offers a low foreign fee on foreign markup in comparison to other cards.

- No cap on cash reward points: The card does not place any limits on cash reward points.

ICICI Bank Coral Credit Card

This card rewards you on everyday spends. Get payback points and rewards on shopping with ICICI Bank Coral Credit Card.

- Reward points

- Earn 2 reward points per Rs. 100 spent on your card (Excluding fuel)

- Earn 1 reward point per Rs. 100 spent on utilities

- Earn 2000 and 1000 reward points on reaching milestone spends of 2,00,000 and 1,00,000 using your credit card in an anniversary year (Up to a maximum of 10,000 reward points per year).

- Dining privileges: Save a minimum of 15% at over 2,500 restaurants in India.

- Movie ticket offers: Get a discount of 25% (Up to Rs. 100) on buying at least 2 movie tickets (Up to twice a month) on BookmyShow and Inox.

- Complimentary airport and railway lounge access: Get one complimentary domestic airport lounge access per quarter on completing spends of at least Rs. 5000.

Advantages of Paying Insurance Premiums via Cards

- Paying your insurance premiums through your credit card will earn thousands of reward points and enjoy great deals.

- If you have given the standing instructions to the bank to debit the premium amount from your credit card then you will not have to remember the due date every time.

- The higher the premium, the higher the reward points.

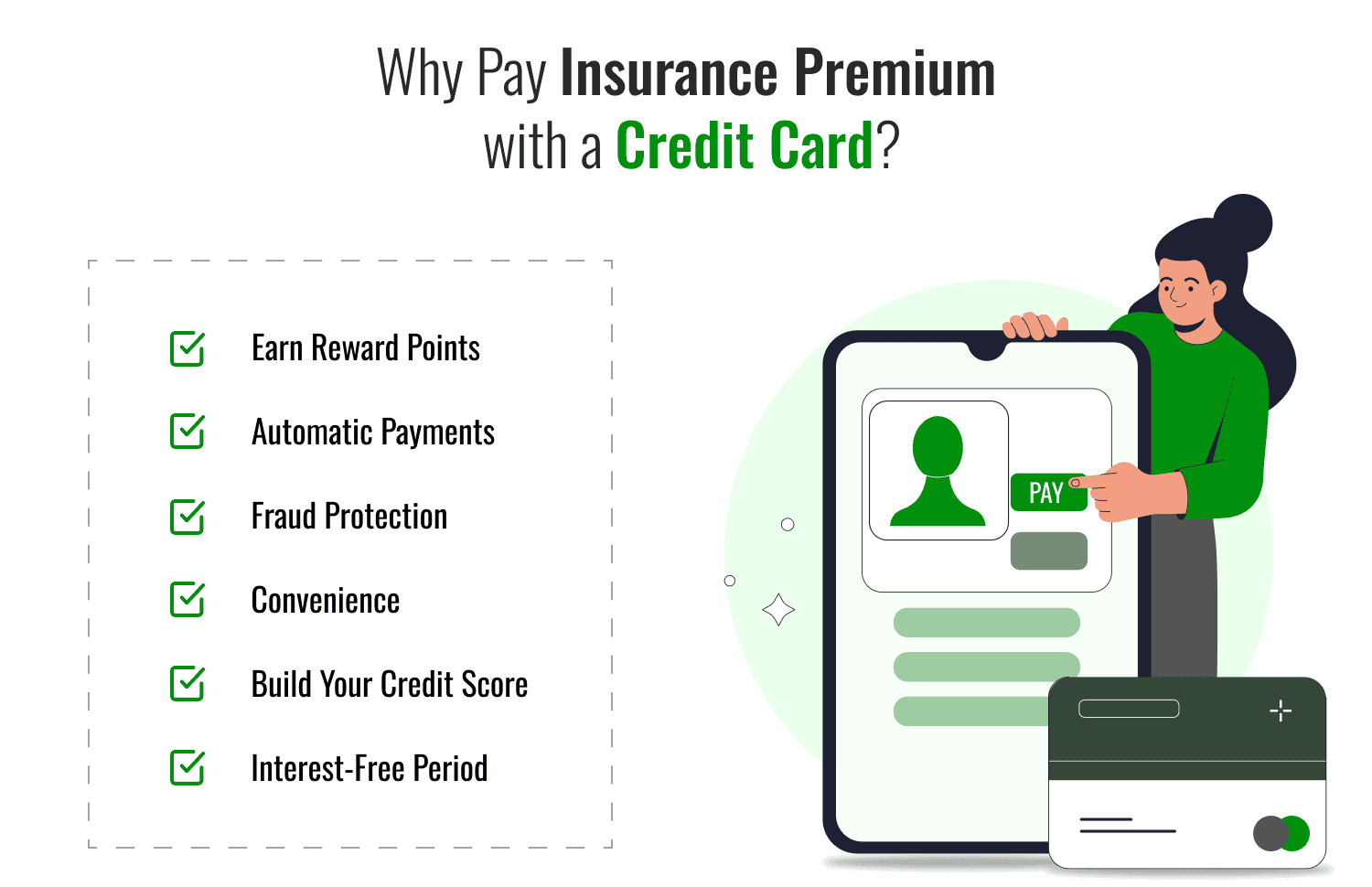

Why Pay Insurance Premium with a Credit Card?

Paying your insurance premiums through your credit card can be a smart move that comes with several benefits. Here are some reasons why you should consider paying your insurance premiums with a credit card:

- Earn Reward Points: One of the most significant benefits of using a credit card for insurance premium payments is that you can earn reward points. Many credit cards offer reward points or cashback offers when you pay your insurance premiums through them. These points can be redeemed for various benefits, such as discounts, vouchers, and other offers.

- Automatic Payments: By using your credit card to pay your insurance premiums, you can set up automatic payments and avoid the hassle of remembering the due date every month. You can simply set up a standing instruction with your bank, and the premium amount will be automatically charged to your credit card on the due date.

- Build Your Credit Score: Paying your insurance premiums regularly and on time using your credit card can help you build a good credit score. A good credit score is essential when applying for loans or credit cards in the future.

- Fraud Protection: Credit cards offer fraud protection, which means that you are not liable for any fraudulent charges made on your card. This can give you peace of mind and protect you from potential financial losses.

- Interest-free period: Many credit cards offer an interest-free period of up to 45 days, which means that you can pay your insurance premiums without any interest charges if you pay your credit card bill in full before the due date .

- Convenience: Paying your insurance premiums through your credit card is a convenient option that saves you time and effort. You can make payments from anywhere, anytime,without visiting the bank or the insurance company.

Conclusion

It is always essential to insure your life, home, and various other products for which insurance is available. In this way, we will be able to cover up to a certain extent for the financial crisis that we face during emergencies. Paying insurance is a recurring responsibility but with so many payments to keep track of, it is difficult to keep a check on these payments. Thankfully, credit cards help us do this. Messages are sent to remind us of our insurance payments. We can even automate our payments. By using the right credit card for insurance premium payments, we can earn cashback or reward points on our payments.

Frequently Asked Questions (FAQs)