Best Credit Cards for Defence Personnel

Last Updated : Oct. 15, 2024, 12:15 p.m.

Credit cards for defence personnel are specially curated to cater to the needs of defence servicemen and women. Those who serve in the Indian army, air force, navy, government defence services, and paramilitary forces should think about getting one. Most of these defence credit cards offer benefits and reward points across various categories like lifestyle, entertainment, groceries, household, travel, priority services, etc., thus fulfilling the various needs arising for defence personnel. These specialized credit cards come with low annual fees, affordable interest rates, high credit limits, attractive reward programs, and comprehensive insurance coverage. Let us now look at some of the best credit cards for defence personnel in India for 2025.

Dive deeper into this article to know more about the Best Credit Cards for Defence Personnel.

Top 12 Credit Cards for Defence Personnel 2025

Credit Card | Joining fees | Annual/Renewal fees |

|---|---|---|

Indian Army Yoddha BoB Credit Card | NIL | NIL |

| Assam Rifles The Sentinel BoB Credit Card | NIL | NIL |

Bank of Baroda Varunah Credit Card | NIL | NIL |

| Bank of Baroda Vikram Credit Card | NIL | NIL |

| ICICI Bank Parakram Select Credit Card | NIL | NIL |

| Axis Bank Pride Signature Credit Card | NIL | 500 (Waived off on spending Rs. 40,000 in the previous year) |

| Axis Bank Pride Platinum Credit Card | NIL | Rs. 250 from the second year onwards waived off on spending Rs. 20,000 in the previous year |

| SBI Shaurya Credit Card | Rs. 250 | Rs. 250 from the second year onwards |

| Shaurya Select SBI Card | NIL | INR 1499 |

| PNB Rakshak Credit Cards (Platinum and Select variants) | NIL | NIL |

| Veer Select Credit Card - Kotak Mahindra Bank | NA | Rs. 599 |

| Kisan Gold Card Loan for Defence Personnel | NA | NA |

Best Credit Cards for Defence Personnel - Key Features

Indian Army Yoddha BoB Credit Card

This card is an exclusive credit card for our Indian army personnel. It offers exclusive complimentary memberships, travel perks, and shopping rewards. Here are some of the key highlights.

Key Highlights:

- Get a complimentary 6 month FITPASS Pro membership worth Rs. 15,000 on activating the card.

- Earn 500 reward points on spending Rs. 5,000 within 60 days of card issuance.

- Get a 12 month Amazon Prime membership on spending Rs. 1 lakh within the first 90 days.

- Get 5x rewards, subject to a maximum of 1,000 reward points per month on spending across departmental stores and movies.

- Get 2 reward points per Rs. 100 spent across other categories. Here 1 reward point = Rs. 0.25.Personal accidental death (air/non-air) insurance cover worth Rs. 20 lakh.

- Enjoy 8 complimentary domestic airport lounge visits each year with 2 per quarter.

- Get a personal accidental death insurance cover (For air or non air) worth Rs. 20 lakhs.

- Get a fuel surcharge waiver of 1%, subject to a maximum of Rs. 250 per month on fuel spends in the range of 400 to 5000.

Assam Rifles The Sentinel BoB Credit Card

The Bank of Baroda Sentinel Credit Card is curated for Assam Rifles personnel, providing many benefits for lifestyle and shopping. This card is lifetime free and offers a rewarding experience on using it. Upgrade your shopping and lifestyle with this exclusive card that understands your unique needs. Here are some of the key features.

Key Highlights:

- Get a complimentary 6 months FitPass Pro membership with your Assam Rifles the Sentinel BoB Credit Card.

- Enjoy a six month FitPass Pro membership and an Amazon Prime subscription for a year upon meeting the spending criteria.

- Gain 10 reward points per Rs. 100 spent on movies, shopping, and departmental stores.

- Enjoy the privilege of additional features like complimentary airport lounge access , golf games, and insurance benefits making it a versatile card.

- Enjoy the pleasure of getting 5x rewards i.e 10 reward points per Rs. 100 on departmental stores and movies. Also enjoy the additional thrill of getting attractive discounts across leading brands.

- Enjoy the privilege of getting an Amazon Prime membership for a year on spending Rs. 1 lakh within 90 days of card issuance.

- Get the benefit of 8 complimentary lounge access.

- Experience complimentary FitPass Pro membership worth Rs. 15,000 for 6 months.

Bank of Baroda Varunah Credit Card

This card offers a sea of rewards and benefits for the Indian Navy Personnel across travel, dining, international spends, lounge access, and so on. Here are some of the key features.

Key Highlights:

- Get a 12 month Amazon Prime membership

- Enjoy an exciting welcome with a complimentary 6 month FitPass Pro membership worth Rs. 15,000.

- Earn 5x rewards i.e. 15 reward points per Rs. 100 on travel, dining, and international spends.

- Enhance your travel experiences with unlimited complimentary access at domestic airport lounges.

- Save more with a reduced forex markup fee of 2% on international spends.

- Pleasure yourself with mouth watering cuisines and delight in 5x rewards or 15 reward points per Rs. 100 on your dining spends.

- Get a fuel surcharge waiver of 1% at all fuel stations across India on transactions between Rs. 400 and Rs. 5000.

- Get 3 reward points per Rs. 100 spent on other categories.

- Reward points can be redeemed as cash back @ 1 reward point = Rs. 0.25

Bank of Baroda Vikram Credit Card

The Bank of Baroda Vikram Credit Card is a credit card that offers an exciting and robust rewards programme. Card holders can earn reward points on almost all their spends with accelerated reward points on movies, grocery, and departmental stores.

Key Highlights:

- Get a complimentary 3 month Disney Hotstar membership on doing the first transaction within 30 days of issuing the card.

- Get 500 reward points on spends of Rs. 5,000 within 60 days of card issuance.

- Accrue 5x rewards on movie and departmental store spends.

- Gain 1 reward point per Rs. 100 spent on other categories, @1 reward point = Rs. 0.25

- Get a personal accident death cover worth Rs. 20 lakhs (Air/Non Air).

- Enjoy a fuel surcharge waiver of 1%, subject to a maximum of Rs. 250 per month on fuel spends between Rs. 400 to Rs. 5,000.

ICICI Bank Parakram Select Credit Card

ICICI Bank Parakram Credit Card offers exclusive reward points for the Indian defence and paramilitary personnel. It provides benefits across categories such as canteen stores department, groceries, departmental stores, airport lounges, golf etc.

Key Highlights:

- Get 5x reward points on grocery, departmental stores, and canteen stores department spends, subject to a maximum of 1000 points per month.

- Get 2 reward points for each Rs. 100 spent on other categories.

- Delight in 2 complimentary domestic airport lounge visits and 1 complimentary international airport lounge visit per year.

- On spending Rs. 50,000, you will get 1 complimentary golf round, subject to a maximum of 4 rounds per month.

- Get a personal accident insurance cover of Rs. 2 lakhs and an air accident insurance cover worth Rs. 20 lakhs.

- Obtain a fuel surcharge waiver of up to Rs. 250 each month on fuel spends in the range of Rs. 400 to Rs. 4,000.

Axis Bank Pride Signature Credit Card

This credit card offers decent rewards on each spend. The earned rewards can later be redeemed. The card also offers benefits across categories such as lifestyle and dining. You can also avail lounge access upon reaching milestone spends.

Key Highlights:

- Get 8 EDGE rewards for each Rs. 200 spent.

- Rewards points can be redeemed against the EDGE rewards catalog

- Get up to 2 complimentary domestic airport lounge visits per quarter. You can avail the lounge access only on spending Rs. 50,000 in the previous 3 months.

- Delight in a discount of minimum 15% on dining through the Axis Bank Dining Delights program.

- Get a fuel surcharge waiver of 1%, subject to a maximum of Rs. 400 per month on fuel spends in the range of Rs. 400 to Rs. 4000.

Axis Bank Pride Platinum Credit Card

This card is exclusively curated for the defence personnel who serve tirelessly in the Indian defence forces and the Government of India. The card offers rewards on daily spends, surcharge waivers on fuel, and discounts on dining at partnered restaurants.

Key Highlights:

- Enjoy a dining discount of at least 15% when you use your credit card at partner restaurants.

- Get 4 reward points for each Rs. 200 spent on the card.

- Get an additional 100 reward points every month on spending Rs. 50,000 or more in the previous month.

- Enjoy a fuel surcharge waiver of 1%, up to a maximum of Rs. 250 every month on spends between Rs. 400 to Rs. 4000.

SBI Shaurya Credit Card

Cardholders can enjoy earning bonus reward points on dining, movies, grocery, departmental stores, and canteen stores department. Also, the card can be embossed with emblems of Air force, Army, Navy, and Paramilitary.

Key Highlights:

- Get 1000 reward points on paying the first year annual fee of Rs. 250.

- Earn 5 reward points per Rs. 100 spent on dining, movies, departmental stores, grocery stores, and CSD.

- Accrue 1 reward point for each Rs. 100 spent on other categories.

- Reward points can be used to pay the credit card bill @ 1 reward point = Re 0.25.

- You can redeem the reward points against the rewards catalogue.

- Get a waiver on your renewal fee on spending Rs. 50,000 or more in the previous year.

- Get a fuel surcharge waiver of 1% up to Rs. 250 per statement cycle on fuel purchases made in the range of Rs. 500 to Rs. 3000.

- Get a complimentary personal accidental insurance cover of up to Rs. 2 lakhs. The service is provided by RuPay.

Shaurya Select SBI Card

The Shaurya Select SBI Card serves those who serve the nation. The card is curated to meet the specialized needs of the defence personnel and provides you with a truly rewarding experience. This card provides milestone benefits, insurance coverage, and a strong rewards program.

Key Highlights:

- Earn 10 reward points per Rs. 100 spent on dining, movies, grocery (CSD canteen spends), and departmental stores.

- Earn 2 reward points per Rs. 100 spent on other categories. Reward points are not accrued on categories of fuel, cash, & S2S transactions.

- Reward points can be used to purchase items, vouchers, etc. from the SBI rewards catalogue.

- Enjoy a credit of 1500 reward points on paying the renewal fee.

- The following milestone benefits can be availed:

- Get a Pizza hut voucher worth Rs. 500 on spends of Rs. 50,000 or more in a quarter.

- Get a voucher worth Rs. 7000 from Yatra or Pantaloons on spending Rs. 5 lakhs or more.

- Get a waiver on next year’s annual fee on spends of Rs. 1.50 lakhs.

- Voucher codes will be shared through SMS to the registered mobile number within 10 days of reaching milestone spends.

- Avail complimentary personal accidental insurance cover worth Rs. 10 lakhs offered by RuPay.

- Avail complimentary fraud liability cover worth Rs. 1 lakh.

- Get a fuel surcharge waiver of 1%, subject to a maximum discount of Rs. 250 per statement cycle, on fuel transactions of value Rs. 500 to Rs. 4,000.

- Avail concierge services to make travel arrangements like dining reservations and hotel bookings. It can be used for consultancy services also.

PNB Rakshak RuPay Credit Cards

The 2 variants of PNB Rakshak RuPay credit cards - RuPay Platinum and RuPay Select are issued under the PNB Rakshak Plus Scheme to all serving defence personnel, pension, defence veteran pensioners, and trainees. Both the card variants are lifetime free.

Key Highlights:

- No annual fee has to be paid if the card is used at least once every quarter.

- Get 300 welcome reward points on making the first transaction using the credit card.

- Earn exclusive cashback on dining at restaurants and eateries and utility bill payments.

- Get offers on over 300 merchants under the RuPay program.

- Get a comprehensive accidental death insurance cover and permanent disability cover of Rs. 2 lakhs and Rs. 10 lakhs respectively.

- Get complimentary domestic airport lounge access every quarter and 4 international airport lounge access every year.

- The limit of the card is marked by double the monthly income or pension, which can be changed at the discretion of the bank.

Veer Select Credit Card - Kotak Mahindra Bank

The Veer Select credit card enables the brave defence personnel to manage their daily spends while earning exciting rewards and other benefits.

Key H ighlights :

- Get 9 reward points per Rs. 200 spent across other categories of dining, movies, departmental stores, and grocery.

- Earn 3 reward points per Rs. 200 spent on other categories.

- Get complimentary IHO membership worth Rs. 8,500 on spending Rs. 500 within the initial 30 days of issuing the card.

- Get 8 complimentary airport lounge access every year with 2 lounge access per quarter within India.

- Get a fuel surcharge waiver of 1% across fuel stations.

- Get a railway surcharge waiver of 1.8% for transactions done on www.IRCTC.Co.in and 2.5% for transactions done on Indian Railways booking counters.

- The card’s embedded EMV chip gives an additional level of security.

- Get a 6 digit PIN authentication for the higher security of your transactions.

- Get an annual fee waiver on spends of Rs. 100,000 annually.

Kisan Gold Card Loan for Defence Personnel

This loan can be availed by all the defence personnel with minimum one year of service. Eligible individuals include Personnel of Army, Air Force, Navy, Military services like ITBP/BSF/CRPF/Coastal Guards/CISF and Assam/J&K rifles. The loan can be taken for various purposes like crop production, repair and maintenance, farm development, and domestic requirements.

Key Highlights:

- Get free personal accidental insurance cover of up to Rs.10,00,000/-

- Get an exclusively designed Rupay farmer Platinum premium debit card for conducting hassle free transactions.

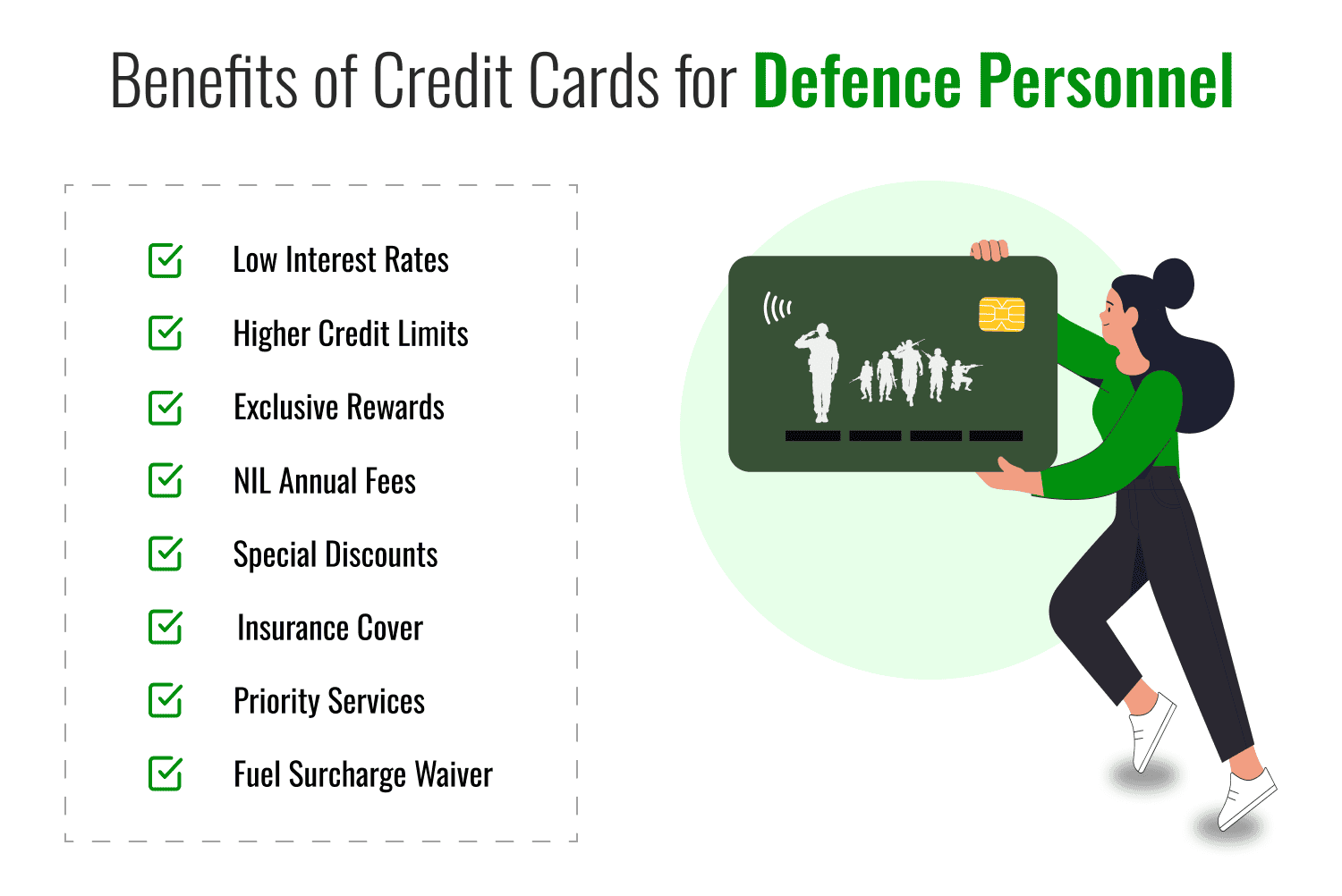

Benefits of Credit Cards for Defence Personnel

Credit cards for defence personnel offer multiple benefits ranging from low interest rates to specially tailored reward programmes. All these programs are aimed at offering financial stability and strength. Here are some major benefits of credit cards for defence personnel.

- Low Interest Rates: Given the unique challenges of a job, defence personnel need financial flexibility. The lower interest rates offered by these cards help these individuals manage sudden expenditures seamlessly without accumulating debt.

- Higher Credit Limits: The higher credit limits help defence personnel manage sudden huge expenditures that come in their way.

- Exclusive Rewards: These cards accumulate rewards on every purchase. The value of rewards in defence cards is usually higher than other normal cards. These rewards can be redeemed across categories like travel, shopping, and other merchandise.

- Nil Annual Fees: Many credit cards meant for defence personnel come without any annual fees. This helps them get complete benefits from discounts, rewards, cashback, etc.

- Fuel Surcharge Waiver: Fuel surcharge waiver contributes considerably to savings. This minimises the overall cost of fuel and travelling.

- Priority Services: Many card issuers provide quick application processing and dedicated customer service lines for these personnel taking into account the importance, time sensitivity, and risky nature of their jobs .

- Insurance Cover: Credit cards for defence personnel often include comprehensive insurance covers for life and accidents.

- Special Discounts: These cards provide exclusive discounts across online shopping, dining, and lifestyle. These help in saving considerably and reducing the overall cost.

How to Choose a Credit Card for Defense Personnel?

Comparing credit cards for defence personnel helps individuals choose the best one. Here are some factors on which you need to judge the cards.

- Interest Rates: It is important to compare the interest rates as reduced interest rates will help in ease the burden of paying credit card bills. These are especially useful for people who carry a balance every month.

- Credit Limits: High credit limits give financial stability, especially beneficial for defence personnel who may have sporadic but large expenses. Always compare how much credit is provided and if it meets your spending patterns.

- Rewards Programs: Each card will offer unique rewards such as cashback, air miles, discounts, and redeemable points. Compare between the cards for reward points and choose one according to your spending habits.

- Annual Fees: There are many cards that come with no annual fee or very low annual charges. Choosing a card with no or low annual fee can help you save significantly. It is always important to note that charges on the card should not outweigh the savings made on the card .

- Simplicity of the Application Process: Consider how easy the application process is including the necessary documentation and the approval time. Easy and quick approval is important when you need a credit card in a short duration of time.

Conclusion

It is especially important for defence personnel to choose the best credit card . The card must be able to support their position and help them get convenience and savings. The credit cards given above are some of the best ones for individuals in defence services. Upon reading the key features and comparing them based on the impacting factors listed above, you can make a decision as to which card is most suitable for you.

Frequently Asked Questions (FAQs)