Best Co-Branded Credit Cards in India

Last Updated : Nov. 26, 2024, 1:35 p.m.

Co-branded credit cards are those that are launched by banks in collaboration with well-known brands. These brands could be travel, fuel, shopping, lifestyle, dining or food delivery apps, airlines, hotel chains, etc. Co-branded cards are best for brand loyalists who can earn accelerated rewards on these brands and save more on their spends. At present, there are many co-branded credit cards in the market. Let us now read about some of the best co-branded credit cards in India.

Top Co-branded Credit Cards in India

The top co-branded credit cards can be divided broadly into the following categories

- Travel

- Business

- Shopping

- Fuel

- Airlines

- Entertainment -Dining, movies, etc.

Here is a list of some of the best co-branded credit cards in India for 2025.

Credit card | Category | Co-branded partners | Joining fee | Annual fee or renewal fee |

|---|---|---|---|---|

Standard Chartered EaseMyTrip Credit Card | Travel | Standard Chartered Bank and EaseMy Trip | Rs. 350 (For the first year) | Rs. 350 (from 2nd year onwards |

Travel | SBI and Yatra | Rs. 499 | Rs. 499 | |

Travel | ICICI Bank and MakeMyTrip | Rs. 2500 | Nil | |

Travel | SBI and IRCTC | Rs. 1499 | Rs. 1499 | |

Travel | SBI and IRCTC | Rs. 500 | Rs. 300 | |

Marriott Bonvoy HDFC Credit Card | Travel | Marriott Bonvoy and HDFC Bank | Rs. 3000 | Rs. 3000 |

Shopping | ICICI Bank and Amazon | Lifetime free | Lifetime free | |

Shopping | Axis Bank and Flipkart | Rs. 500 | Rs. 500 from second year onwards | |

Myntra Kotak Credit Card | Shopping | Kotak Bank and Myntra | Rs. 500 | Rs. 500 |

Shopping | HDFC Bank and Tata Neu | Rs. 1499 | Rs. 1499 | |

Fuel | SBI and BPCL | Rs. 1499 | Rs. 1499 | |

Fuel | Axis Bank and IndianOil | Rs. 500 | Rs. 500 from the 2nd year onwards | |

Fuel | IDFC First Bank and HPCL | Rs. 199 | Rs. 199 | |

Swiggy HDFC Bank Credit Card | Dining | HDFC Bank and Swiggy | Rs. 500 | Rs. 500 |

EazyDiner IndusInd Bank Credit Card | Dining | IndusInd Bank and EazyDiner | INR 1999 | INR 1999 |

PVR INOX Kotak Credit Card | Movies | Kotak Bank and PVR Inox | Nil | Rs. 499 |

RBL Bank Play Credit Card | Movies | RBL Bank and BookMyShow | INR 500 | INR 500 |

Airlines | Axis Bank and Vistara | Rs. 3000 | Rs. 3000 (From 2nd year onwards) | |

Club Vistara IDFC First Credit Card | Airlines | IDFC First Bank and Air Vistara. | Rs. 4,999 | 4,999 (From the 2nd year onwards) |

Airlines | SBI and Air India | 1,499 | 1,499 | |

Airlines | Axis Bank and Vistara Airlines | 10,000 | 10,000 |

Let us now look at the key features of some of the best co-branded credit cards in India in 2025 under each of these categories.

Travel Co-branded Credit Cards

Standard Chartered EaseMyTrip Credit Card

This card comes with exclusive travel benefits such as accelerated reward points on hotel and airline purchases, complimentary lounge access both international and domestic, and great discounts. This card in your wallet ensures an awesome and comfortable travel experience.

Key Features and Benefits:

- Earn 10x rewards on spends of Rs. 100 at hotels and airline websites/outlets/apps.

- Get an instant discount of 10% and 20% on hotel and flight bookings respectively on the EaseMyTrip website or app.

- Enjoy 2 complimentary domestic lounge access per year.

- Get 2 complimentary international lounge visits per year.

- Get an instant discount of 20% on domestic and international hotel bookings (With a maximum discount of Rs. 5000 and Rs. 10,000 respectively).

- Get 10% off on domestic and international flight bookings (With a maximum discount of Rs. 1000 and Rs. 5000 respectively).

- Get a discount of Rs. 125 on bus ticket bookings (On a minimum ticket booking of Rs. 500).

- Get 2x reward points per Rs. 100 spent on all other categories of retail spends (2 reward points = Rs. 0.50).

- Get an annual fee waiver on spends of Rs. 50,000 or more.

Yatra SBI Card

The Yatra SBI card provides a host of benefits on traveling such as welcome vouchers, complimentary lounge access, air accident cover, and discounts on hotel bookings. Enjoy your travels with perks from this card.

Key Features and Benefits:

- Get vouchers worth Rs. 8,250 as welcome benefit

- Get Rs. 1,000 off on domestic flight bookings by making a transaction of Rs. 5,000 at Yatra

- Get Rs. 4,000 off on international flight bookings by making a minimum transaction of Rs. 40,000 at Yatra.

- Get 20% off on domestic hotel bookings on making a minimum transaction of Rs. 3000 at Yatra.

- Get 6 reward points per Rs. 100 spent on departmental stores, grocery, dining, entertainment, international spends, and movies.

- Air accident cover worth Rs. 50 lakhs.

- Get 1 reward point per Rs. 100 spent on other categories.

MakeMyTrip ICICI Bank Signature Credit Card

Enjoy your dream holiday with the MakeMyTrip ICICI Bank Signature Credit Card. This card unveils a world of travel privileges such as special discounts, rewards, holiday welcome vouchers, and others.

Key Features and Benefits:

- Get an MMT holiday voucher worth Rs. 2,500

- Get up to 4 My Cash per Rs. 200 spent on Make My Trip flight bookings

- Get up to 4,000 My Cash every year as milestone benefit

- Get 2 complimentary domestic lounge access every quarter

- Get 1 complimentary railway lounge access every quarter

- Get 25% off up to Rs. 150, twice a month on booking at least 2 movie tickets via BookMyShow and INOX.

IRCTC SBI Card Premier

This is one of the few co-branded credit cards that offers benefits on railway travel. You can enjoy complimentary railway lounge access , complimentary insurance coverage, and greater reward points on your IRCTC bookings. All these benefits make it one of the best co-branded credit cards in India for railway travel. Have pleasurable railway travel experiences with this card in your wallet.

Key Features and Benefits:

- Get a valueback of 10% on AC1, 2 & 3, ECC, and CC bookings via IRCTC

- You can redeem the rewards on IRCTC in the ratio of 1:1

- Accrue 2,500 and 5,000 reward points on annual travel spends of Rs. 50,000 and 1 lakh respectively.

- Get fraud liability cover of Rs. 1 lakh, rail accident insurance of Rs. 10 lakhs, and air accident cover of Rs. 50 lakhs.

- Get a 1% waiver of transaction charge on IRCTC railway tickets and 1.8% waiver on IRCTC airline tickets.

- Get 8 complimentary visits to railway lounges in a year (With a maximum of 2 per quarter).

- Get 3 reward points per Rs. 125 spent on dining and utilities and 1 reward point per non fuel retail spends.

IRCTC SBI Platinum Card

This card offers a variety of benefits such as railway lounge access, savings on transaction charges, value back on railway ticket bookings etc. Get a fruitful travel experience with this card in your wallet.

Key Features and Benefits:

- Get 350 activation bonus reward points on making a single transaction of Rs. 500 or exceeding that within 45 days of card issuance.

- Get a value back of 10% on booking tickets through IRCTC.Co.in and the IRCTC mobile app for AC1, AC2, AC3, executive chair car, and chair car.

- Save transaction charges of 1% on railway ticket bookings done on www.irctc.co.in.

- Enjoy 4 complimentary lounge access annually to participating lounges in India with a maximum of 1 per quarter.

Marriott Bonvoy HDFC Credit Card

Enjoy free nights, complimentary Silver Elite Status, Bonvoy reward points across categories such as dining, entertainment, travel, golf etc. Get a wholesome experience with this delightful card. The all round experience that the card gives makes it one of the best Co-branded credit cards in india.

Key features and benefits:

- Get 1 free night award and 10 elite night credits on the first eligible spend transaction or fee levy on the card.

- Get a complimentary Marriott Bonvoy Silver Elite Status

- Earn 8 Marriott Bonvoy points per Rs. 150 spent at hotels participating in Marriott Bonvoy

- Earn 4 Marriott Bonvoy points per Rs. 150 spent on travel, dining, and entertainment.

- Earn 2 Marriott Bonvoy points per Rs. 150 spent on all other applicable purchases.

- Get 2 complimentary golf access per quarter across the world (Green fee waiver).

- You will not get Marriott Bonvoy points on the following non core product categories

- Fuel

- Smart EMI/Dial an EMI transaction

- Payment of outstanding balances

- Cash advances

- Payment of card fees and other charges

- Wallet loads/gift or prepaid card load/voucher purchase

- You will get a foreign currency markup of 3.5% on all your foreign currency spends

- Get 12 complimentary access within India (At both domestic and international terminals)

- Get 12 complimentary access within India using this co-branded credit card each year.

- Get 1 free night award and 10 elite night credits on the first eligible transaction or fee levy on the card.

- Get 1 free night award on eligible spends of INR 6 lakhs in an anniversary year.

- Get 1 free night award on eligible spends of INR 9 lakhs in an anniversary year

- Get 1 free night award on eligible spends of INR 15 lakhs in an anniversary year.

Shopping Credit Cards

Amazon Pay ICICI Credit Card

This card is the best co-branded credit card in India for Amazon purchases. With this card, you will be able to earn cashback on every purchase made on Amazon whether you are an Amazon Prime member or non member. Also, enjoy other benefits such as fuel surcharge waiver and cashback on other purchases as well. Thus enjoy enormous savings with this credit card especially designed for you to save.

Key Features and Benefits:

- Get up to 5% cashback on Amazon purchases.

- Get a cashback of 1% across all offline spends.

- Get a cashback of 5% on Amazon spends for Prime members

- Get a cashback of 3% on Amazon spends for non prime members

- Get a cashback of 2% on spends at Amazon Pay partner merchants

- Get a cashback of 1% on other spends.

- Get a fuel surcharge waiver of 1% across all fuel stations in India.

Flipkart Axis Bank Credit Card

Enjoy immense benefits with this card which is one of the best co-branded credit cards in India for Flipkart purchases. Avail cashback on e-commerce giants like Swiggy, Uber, PVR, Flipkart, and Cleartrip. Also get to enjoy complimentary domestic airport lounge access, fuel surcharge waiver, and welcome perks.

Key Features and Benefits:

- Get a cashback of 5% on transactions made on Flipkart and Cleartrip

- Get a cashback of 4% on partner merchants like Swiggy, Uber, PVR, etc.

- Get a cashback of 1% across other spends.

- Get 4 complimentary domestic airport lounge access annually on spends of at least Rs. 50,000 in a year.

- Get activation benefits worth Rs. 600 from Flipkart and Swiggy.

- Get a fuel surcharge waiver of 1% on transactions between Rs. 400 and Rs. 4,000.

Myntra Kotak Credit Card

If you are a frequent online shopper preferring Myntra over other ecommerce shopping portals, then this card is a must have for you. It is one of the best co-branded credit cards in India for Myntra shopping. Experience a world of cashback, instant discounts, free shipping, advanced access to exclusive sales, etc. airport lounge access, and welcome e-vouchers. Bring out the fashionista in you and decorate your wardrobe with the latest fashion trends available with the Myntra co-branded credit card.

Key Features and Benefits:

- Get an instant discount of 7.5% on all spends using the Myntra app and website, subject to a maximum discount of Rs. 750 per transaction.

- Get unlimited cashback of 1.25% on all your spends on any other platform except Myntra. This Myntra cashback offer does not apply to spends on categories such as rent, EMIs, fuel, and recharges.

- Get a cashback of 5% on spending at preferred partners like Swiggy, Cleartrip, PVR, and Urban Company, subject to a maximum of Rs. 1000 per month.

- Get complimentary access to the Myntra insider program in addition to the Myntra payment offers. The program can be activated, subject to the terms and conditions set by Myntra. You can find out the details of the Myntra insider program membership in the link .

- Get a welcome e-voucher worth Rs. 500 on activating the card.

- Get 4 free airport lounge access annually, with 1 complimentary domestic lounge access per calendar quarter. You can enjoy gourmet meals, comfortable seating, newspaper, magazines, widescreen TVs, and free Wi-Fi.

- Apart from the best offers for online shopping, get 2 free PVR movie tickets worth Rs. 250 each on spends of Rs. 50,000 every quarter.

- Get the annual fee of Rs. 500 waived on spending more than Rs. 2 lakhs annually.

- Get a fuel surcharge waiver of 1%, equal to Rs. 3,500 every anniversary year.

Tata Neu Infinity HDFC Credit Card

This credit card offers innumerable benefits such as airport lounge access, fuel surcharge waiver, savings on e-commerce, bill payments, insurance, and UPI transactions. Pack your wallet with this card and enjoy enormous perks.

Key Features and Benefits:

- Get 5% NeuCoins on all non EMI spends at Tata Neu and its partner brands.

- Get 8 domestic and 4 international priority pass lounge access per year.

- Get 1,499 NeuCoins after making the first spend within 30 days of issuing the card.

- Get 1.5% NeuCoins on non-Tata brand and merchant EMI spends and UPI.

- Get additional 5% NeuCoins on select spends at the Tata Neu app or website.

- Enjoy a low forex markup fee of 2%

- Renewal fee waiver on reaching milestone spends Rs. 3,00,000 or more in a year.

Credit Cards for Fuel

BPCL SBI Card Octane

Enjoy unlimited privileges on dining, movies, departmental stores, and groceries with this credit card . It is most suitable for frequent fuel users and travelers. Fuel up your savings with the BPCL SBI Card Octane.

Key Features and Benefits:

- Enjoy 6000 bonus reward points equivalent to INR 1500 on paying the annual fees

- Within 30 days of paying the annual fee, reward points will be credited to the cardholder’s account.

- Enjoy a valueback of 7.25%. Get 25x reward points on fuel spends at BPCL petrol pumps. Get up to 2500 reward points per billing cycle.

- Get a fuel surcharge waiver of 6.25% plus 1% on every transaction up to Rs. 4000 made at BPCL (Exclusive of GST and other charges).

- Enjoy a maximum fuel surcharge waiver of Rs. 100 per statement cycle per credit card account, which sums up to an annual savings of Rs. 1200.

- Get 4 complimentary visits per year to domestic VISA lounges in India (Maximum of 1 visit per quarter).

- Get e-gift vouchers of value Rs. 2000 from Yatra, Bata/Hush Puppies, and Aditya Birla Fashion on annual spends of INR 3 lakhs.

- Get complimentary fraud liability cover of Rs. 1 lakh

- Enjoy an annual fee waiver on yearly spends of Rs. 2 lakhs

- Instantly redeem reward points at select BPCL petrol pumps.

- You can also redeem reward points at the shop and smile rewards catalog.

ICICI HPCL Super Saver Credit Card

This card enables you to save immensely on fuel, utility, departmental store spends, and grocery bills. Get welcome benefits, complimentary lounge access, and instant discounts on movie tickets booked on Inox Movies and BookMyShow.

Key Features and Benefits:

- Enjoy 1 complimentary domestic airport lounge access per quarter on reaching spends of Rs. 35,000 in the previous quarter

- Get savings of up to 6.5% on HPCL fuel spends

- Enjoy a cashback of 5% on departmental, grocery, and utility purchases.

- Enjoy a cashback of 4%, with a maximum of Rs. 200 per month on HPCL spends and 1% on fuel surcharge.

- Complimentary road side assistance is available 24/7

- Get an additional cashback of 1.5% or save 6 reward points on fuel transactions made using the HP pay app at various HPCL outlets.

- Get a discount of up to 25% on movie tickets booked in Inox Movies and BookMyShow with a maximum of Rs. 100 on each booking (Offer valid twice a month).

- Get a welcome benefit of Rs. 2000 on activating the card and paying the fee.

IndianOil Axis Bank Credit Card

You can save limitlessly on fuel with this credit card. The card also offers valueback to the users in the form of accelerated reward points at IndianOil outlets. Besides this, the card also enables you to save well on online shopping, dining, etc.

Key Fatures and Benefits:

- Accrue up to 1250 EDGE Reward points on fuel transactions done within 30 days of issuing the card.

- Accelerated reward points at any IOCL fuel outlet: Enjoy a value back of 4% on fuel transactions between INR 400 to INR 4000 by accruing 20 reward points per spends of 100 at any IOCL fuel outlet in India.

- Accelerated reward points on online shopping: Get a value back of 1% on online shopping by earning 5 reward points per INR 100 spent on transactions between Rs. 100 to Rs. 5000.

- Fuel surcharge waiver: Get a fuel surcharge waiver of 1% on fuel spends between INR 400 to INR 4000.

- Get an annual fee waiver on spending more than INR 3,50000. Transactions excluded from waiver will be rent transactions, wallet load transactions, cash withdrawals, fees, charges, GST, and insurance spends.

- Get an instant discount of up to 10% on your movie ticket booked via the Bookmyshow app or website.

- Rewards on other spends: Earn 1 EDGE reward point on spends of INR 100 with your credit card. These points can be redeemed against the spends on insurance, gold/jewelry, wallet, rent, utilities, government institutions, and education.

- Offers on dining: Enjoy a discount of 15% on delicious cuisines partner restaurants in India via EazyDiner.

HPCL IDFC FIRST Power+ Credit Card

If you are a HPCL brand loyalist, then this card is for you. You can save on your HPCL fuel expenses with a huge value-back using this card. This card also comes with enormous welcome benefits, which exceed its annual fee.

Key Features and Benefits:

- Get savings of 5% on your HPCL fuel expenses.

- Get savings of 2.5% as rewards on grocery and utility expenses

- Get savings of 2.5% as rewards on IDFC First FASTag recharge

- Get 2x rewards on other retail transactions.

- Get a cashback of Rs. 250 on the first HPCL fuel transaction of Rs. 250 or above within the first 30 days of card issuance.

- Get a 5% cashback (Up to Rs. 1000) on the transaction value of the 1st EMI conversion.

- Get a discount of up to 50% on domestic and international rental cars with Eco rent A car and Europcar.

- Get a discount of Rs. 1000 on Zoomcar rentals.

- Get complimentary roadside assistance worth Rs. 1,399

- Get a personal accident cover of Rs. 2,00,000 and lost card liability cover of Rs. 25,000

- You can convert your purchases and balances into EMIs and pay conveniently.

Entertainment -Dining, Movies, etc

Swiggy HDFC Bank Credit Card

Unlock exclusive cashback and offers on Swiggy with the Swiggy HDFC Bank credit card. Also avail milestone benefits, complimentary Swiggy One membership on card activation, and cashback on other spends. With these exclusive benefits, this is a great card to have and it is amongst the best co-branded credit cards in India for Swiggy orders.

Key Features and Benefits:

- Get a cashback of 10% on orders from Swiggy, Instamart, Dineout, and Genie

- Get a cashback of 5% on online spends.

- Get a cashback of 1% on other spends

- Get a cashback of up to Rs. 3,500 in a month

- Get a 3 month Swiggy One membership of value Rs. 1,199 on activating the card.

- Get a renewal fee waiver on reaching annual spends of Rs. 2 lakhs.

EazyDiner IndusInd Bank Credit Card

Enjoy exciting reward points on purchases made on the EazyDiner app. Not just this, unlock a whole new world of other benefits like welcome bonus, complimentary domestic lounge access, complimentary alcoholic beverages, etc.

Key Features and Benefits:

- Get a complimentary 12 month EazyDiner Prime membership.

- Get 10 reward points per Rs. 100 spent on dining, entertainment, and shopping.

- Get 2,000 EazyPoints and a postcard hotel voucher worth Rs. 5,000 as welcome bonus.

- Accrue 3X EazyPoints on every spend and get an extra 25% off on payments made for dining or take-away via PayEazy on the EazyDiner app.

- Get complimentary alcoholic beverages for every diner at select restaurants.

- Enjoy up to 8 complimentary domestic lounge visits in a year.

- Get 2 complimentary movie tickets, each worth Rs. 200 on BookMyShow every month.

PVR INOX Kotak Credit Card

This card is the most suitable for frequent movie goers and movie lovers. Save on food, beverages, movie tickets, etc. with this card and enjoy access to premium PVR Inox lounges.

Key Features and Benefits:

- Get 1 PVR INOX movie ticket on every spend of Rs. 10,000 in a monthly billing cycle.

- Earn tickets worth Rs. 300 each on reaching milestone spends of Rs. 10,000

- Get a 20% discount on food and beverages at PVR Inox theater, app, and website.

- Get a flat 5% discount on movie tickets every time you book either on the app, theater, or website.

- Enjoy visits to premium PVR INOX lounges.

- The card comes with zero joining fees.

RBL Bank Play Credit Card

This card is curated to give the owner an all round and wholesome experience. You can enjoy the privilege of getting discounts across all purchases on the BookMyShow app like food, beverages, movies, streams, sports, events etc.

Key Features and Benefits:

- Enjoy a monthly benefit of INR 500 on BookMyShow on reaching monthly spends of Rs. 5,000.

- Delight in delectable food and beverages worth Rs. 100 on purchasing a movie ticket with this card.

- Benefit from a discount of INR 500 on streams, movies, sports activities, events, and plays on the BookMyShow app or website.

- Get a fuel surcharge waiver up to INR 100 once a month, on transactions between Rs. 500 to Rs. 4000.

Airlines

Axis Bank Vistara Signature Credit Card

This card comes with several benefits for Vistara loyalists. Card holders can earn CV points for each and every purchase and later redeem them to avail upgrades or award flights. This card is a great one to have if you are a frequent flyer due to its lounge access, complimentary premium economy ticket vouchers, etc. With its multiple benefits, this is one of the best co-branded credit cards in India for Vistara brand lovers.

Key Features and Benefits:

- Get a complimentary premium economy class ticket voucher as a welcome gift on paying the joining fee.

- Get 3000 bonus CV points on reaching milestone spends of Rs. 75,000 in the first 90 days

- Enjoy the premium privileges of the complimentary Club Vistara Silver membership such as priority check-in, additional baggage allowance on paying the fee, etc.

- Earn 4 CV points per spend of Rs. 200 using the Axis Bank Vistara Signature Credit Card. You can redeem the points accrued for upgrades and award flights.

- Get 4 complimentary premium economy ticket vouchers on reaching milestone spends. Get the 1st, 2nd, 3rd, and 4th premium economy ticket vouchers on reaching milestone spends of Rs. 1,50,000, 3,00,000, 4,50,000, and 9,00,000 respectively.

- Enjoy 2 complimentary lounge visits to select airports within India.

- Get purchase protection cover up to Rs. 1 lakh for the following:

- Loss of travel documents

- Delay of check-in baggage

- Loss of check-in baggage.

- You can convert purchases of 2500 or more into EMIs.

Club Vistara IDFC First Credit Card

With exclusive discounts and offers on travel, this card provides you with a comfortable and seamless travel experience.

Key Features and Benefits:

- Get up to 6000 CV points, with a maximum of 2000 CV points in the 2nd, 3rd, and 4th billing cycles on reaching milestone spends of Rs. 30,000 in each.

- Gain up to 5 complimentary premium economy ticket vouchers each anniversary year.

- Get the first ticket voucher on reaching spends of Rs. 1,50,000 in a year

- Get the second ticket voucher on reaching spends of Rs. 3,00,000 in a year

- Get the third ticket voucher on reaching spends of Rs. 4,50,000 in a year

- Get the 4th ticket voucher on reaching spends of Rs. 9,00,000 in a year

- Get the 5th ticket voucher on reaching spends of Rs. 12,00,000 in a year.

- Enjoy 4 complimentary rounds of green fees annually.

- Get 2 complimentary golf lessons per calendar year

- Get 50% off on the green fee exceeding the complimentary

- Get 2 complimentary visits to airport lounges and spas per quarter on reaching monthly spends of Rs. 20,000.

- Get 1 complimentary visit to an international airport lounge per quarter on reaching monthly spends of Rs. 20,000

- Enjoy an air accident cover of Rs. 1 crore

- Get a personal accident cover of 10,00,000 and lost card liability cover of Rs. 50,000

- Get a reimbursement of USD 500 on loss of checked-in baggage, USD 100 for delay of checked-in baggage, USD 300 for loss of passport and other documents, and USD 300 for delay in flight.

Air India SBI Platinum Credit Card

This card offers exclusive travel privileges like complimentary domestic lounge visits, accelerated rewards on Air India bookings, and seamless booking of railway tickets online on the IRCTC website.

Key Features and Benefits:

- Enjoy a welcome bonus of 5000 reward points on paying the joining fee

- Have the privilege of getting a complimentary Air India frequent flyer membership

- Enjoy 8 complimentary visits per year to domestic Visa lounges in India (With a maximum of 2 visits per quarter).

- Get 2 reward points per Rs. 100 spent

- Get up to 15,000 bonus reward points annually.

- You can redeem your reward points @ 1 reward point = 1 Air India Air mile.

- Earn up to 5 reward points when booked for self and 15 reward points when booked for others per Rs. 100 on Air India tickets purchased via AirIndia.com, AirIndia mobile app, etc.

- Enjoy a 1% fuel surcharge waiver on purchasing petrol and all other products and services across petrol pumps in India.

- Enjoy a complimentary lost card liability cover of Rs. 1 lakh.

- Enjoy easy and seamless booking of railway tickets online and get them delivered at your doorstep.

- Go to IRCTC.Co.in.

- Register yourself on the website free of charge

- Login using your username and password

- Proceed towards making your reservations by following the instructions.

Axis Bank Vistara Infinite Credit Card

This card is highly unique as it offers benefits across the flying business class sector. Further, this card comes with a highly beneficial milestone program and a complimentary Vistara Gold membership. Apply for this card and enjoy the benefits soon. With these unique and highly valuable features, you can easily say that it is one of the best co-branded credit cards in India.

Key features and benefits:

- Get a complimentary business class ticket voucher on paying the fee.

- Enjoy the exclusive privileges of complimentary Club Vistara Gold membership such as priority boarding, priority check-in, additional baggage allowance, and priority baggage handling on paying the fee.

- Earn 6 CV points per Rs. 200 of eligible spends done using the Axis Bank Vistara Infinite Credit Card.

- Accrue up to 10x membership reward points on booking flights.

- Get 2 complimentary lounge access at select airports within India.

- Get up to 4 business class ticket vouchers - 1st business class ticket voucher, 2nd business class ticket voucher, 3rd business class ticket voucher, and 4th business class ticket voucher on reaching milestone spends of Rs. 2,50,000, 5,00,000, 7,50,000, and 12,00,000.

Eligibility to Apply for a Co-branded Credit Card

The eligibility criteria for co-branded credit cards are as given below:

- The applicant must be an Indian citizen

- The applicant can either be salaried or self-employed

- The applicant should have a good credit history (Not applicable for first time borrowers)

- The least age of the applicant must be 21 years and the maximum age must be 60 years.

Documents Required for Co-branded Credit Cards

The documents required to apply for a co-branded credit card are specified below:

- Copies of identity proofs such as Aadhaar card, passport, etc.

- Copies of address proofs such as driving license, Aadhaar, Voter’s ID, passport, electricity bill, etc. whichever holds your current address.

- A copy of your Permanent Account Number (PAN).

- Salary slips of two months or Income Tax (IT) returns.

- Duly signed in application.

- One passport size photograph.

How to Apply for a Co-branded Credit Card?

Through the Bank’s website

You can apply for a credit card online through the bank’s portal. Here are the steps to do so

Step 1: Visit the website of the bank.

Step 2: Explore for the co-branded credit card that you want.

Step 3: Click the card to find details about the card.

Step 4: Click on the ‘Apply’ button to complete an online application for the same.

Step 5: On the online application page, enter all the essential details with accuracy. Understand the terms and conditions before accepting. Then, click on ‘Submit’.

An application reference number will be given on successfully submitting the application. The bank will take about three to four days to examine the application. If you have all the eligibility criteria needed, then the bank will connect with you. The credit card application will be processed within seven to ten days from the date of applying. You can then track your application status on the bank’s portal using the application ID.

Through Wishfin

You can apply for the co-branded credit cards, whichever is available through Wishfin. There are no login credentials. All you have to do is navigate to the Wishfin portal and go to the credit card section. When you mention the personal and professional details needed, the quotes of different card offers will be shown on the screen. You can apply in three ways on Wishfin .

Apply via Website

Step 1: Open the online application form available on Wishfin

Step 2: Fill the form with your personal and professional details.

Step 3: Submit the form to process your application.

Apply Through Whatsapp

Step 1: Click ‘Apply with the ease of Whatsapp chat’

Step 2: Input your mobile number and click ‘Continue with Whatsapp

Step 3: After that, you will receive a link. Click this link to join a group having Wishfin as the other member.

Step 4: Answer some questions on personal and professional levels and also on credit history.

Step 5: Submit your application.

Step 6: The bank will inspect the application before approving it.

Apply through Wishfin Chat

Step 1: Click the link ‘Use Wishfin Chat’

Step 2: Click the button ‘Start Wishfin Chat’

Step 3: The chat window pops up.

Step 4: Enter the details asked in the chat and the chatbot will take you through the rest of the application process. Follow the instructions and proceed towards completing the application.

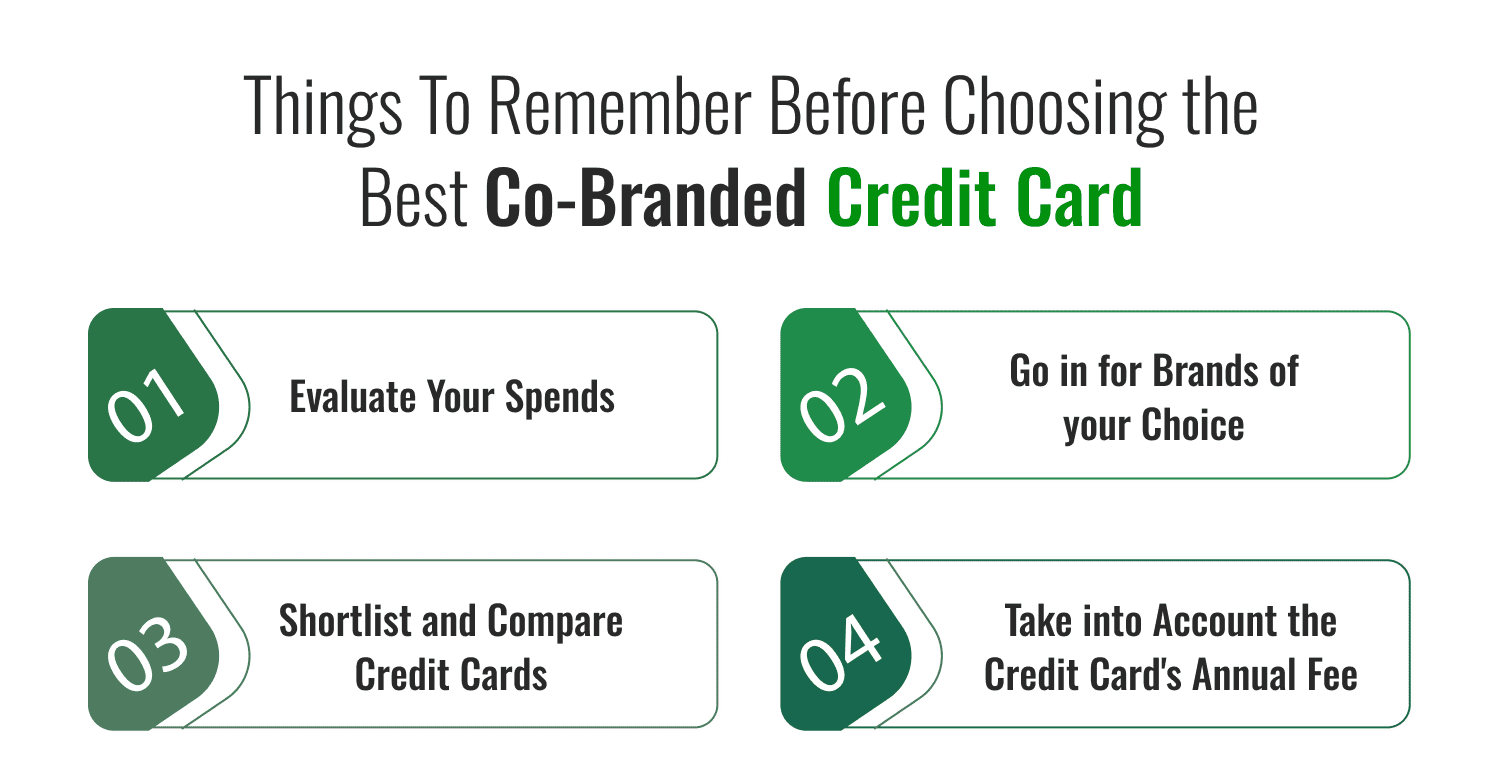

Things to Remember Before Choosing the Best Co-branded Credit Card in India

Here are a few things to keep in mind before selecting the best co-branded credit card in India.

- Evaluate your spends: Before applying for a credit card, it is essential to estimate your income and expenses and make a well thought out decision. Credit cards come with benefits across various categories, such as travel, dining, shopping. Etc. So, it is also important to analyze your spends category. For instance, if you are an avid shopper, you must go in for a card that gives you maximum rewards on shopping.

- Go in for brands of your choice: Identify your preferred and loved brands. If you are a loyalist for some brands, then get the credit card that rewards you maximum for the purchases on that brand. For instance, if you order a lot on Swiggy, then you can go in for the Swiggy HDFC Bank Credit Card.

- Shortlist and compare credit cards : Create a list of credit cards shortlisted after narrowing down on your preferences based on various factors. Compare these credit cards based on different parameters and select the ideal card out of them.

- Take into account the credit card’s annual fee: Most of the credit cards charge a joining or annual fee. First of all understand how much you can or are willing to pay as fees. For the annual fee you pay, the overall benefits given by the card should be greater. Also, some cards offer annual fee waivers on reaching milestone spends. If you do not want to pay annual or joining fees, then you can go in for a lifetime free co-branded credit card.

Conclusion

There are many co-branded cards but you have seen the best co-branded credit cards in India. So, you must compare the fees and features of all the co-branded credit cards and then apply for anyone card as per your needs. All of them have great offers on their respective brand either it is on the HPCL Stations or Amazon or Flipkart. You can save some extra bucks through them on various brands.

Frequently Asked Questions (FAQs)