What is the difference between IFSC and RTGS?

Last Updated : July 29, 2024, 3:33 p.m.

IFSC and RTGS are both important terms used in banking, but they serve very different purposes.

IFSC is a unique code assigned to each bank branch, which helps identify where money needs to go during electronic transfers. RTGS, on the other hand, is a type of money transfer system that allows large amounts of money to be moved instantly between banks.

In this article, we will examine the roles of IFSC and RTGS and their key differences to better understand them. Let’s begin!

What is IFSC and RTGS?

IFSC stands for the Indian Financial System Code. It is like a postal code but for bank branches. It’s an 11-digit code that uniquely identifies each bank branch in India. This helps ensure your money ends up in the right place when you transfer funds electronically. This code is used for banking services like NEFT, RTGS, or IMPS.

RTGS stands for Real Time Gross Settlement. It is a type of money transfer system used by banks. It’s used to transfer large amounts of money from one bank to another in real-time and on an individual basis. This means the transactions are completed instantly without any delay, and once done, they can’t be reversed.

Difference Between IFSC and RTGS

IFSC and RTGS are both crucial to the banking sector but serve different purposes:

IFSC (Indian Financial System Code)

What is it?

It is an 11-digit code consisting of alphabets and numerals. It is designed to uniquely identify each bank branch that is part of India's electronic funds transfer system.

Format of IFSC code

- The first four characters are alphabetic and denote the bank’s name.

- The fifth character is always zero and serves as a control character.

- The last six characters can be alphabetic or numeric and represent the specific branch.

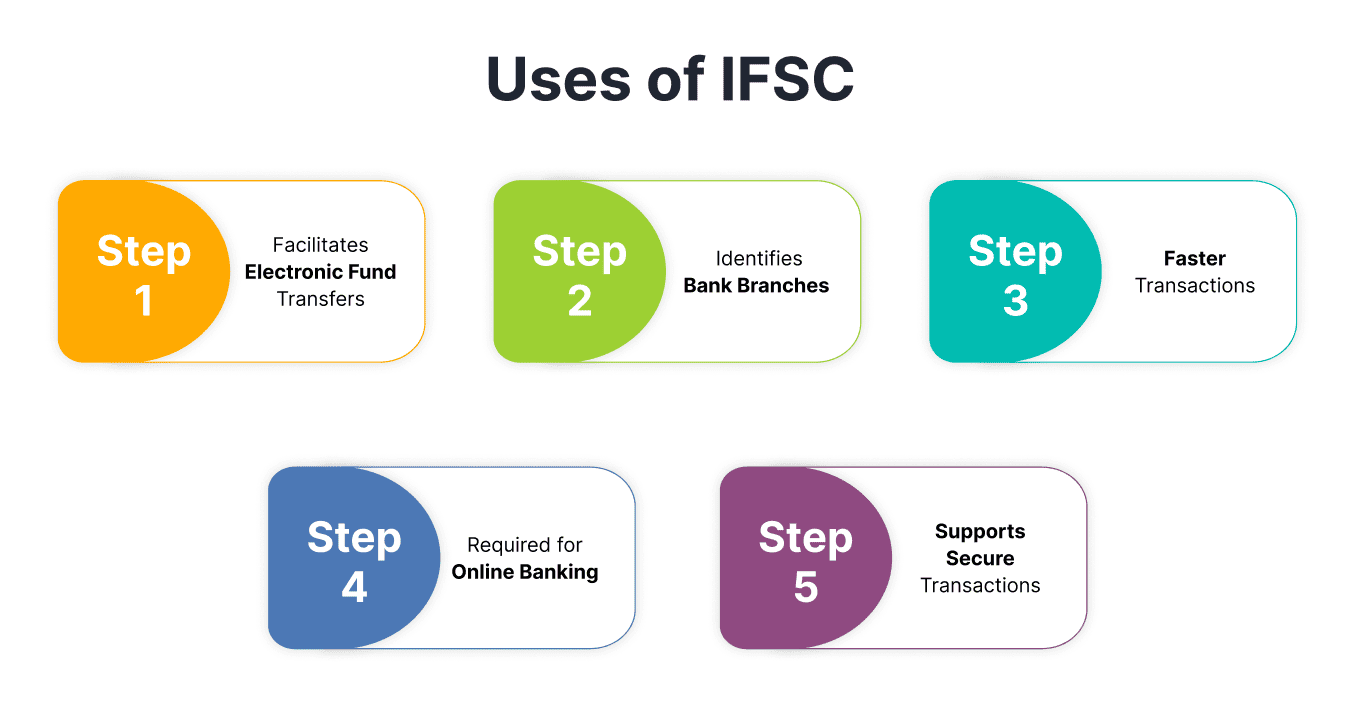

Main uses of IFSC code

The IFSC code plays a major role in online money transfers in India and serves various purposes in banking transactions. Here are the main uses of the IFSC code:

- Facilitates electronic fund transfers: These codes are used to facilitate various types of electronic payments, including NEFT (National Electronic Funds Transfer), RTGS (Real Time Gross Settlement), and IMPS (Immediate Payment Service).

- Identifies bank branches: Each IFSC code is unique to a particular bank branch, making it possible to identify the branch involved in a transaction accurately. This is essential to correctly routing funds to the intended recipient’s bank.

- Faster transactions: With the use of IFSC codes, electronic fund transfers are quicker and faster as compared to traditional methods. This efficiency is of utmost importance in this quick-paced financial environment.

- Required for online banking: IFSC codes are essential to execute transactions such as setting up automatic payments, paying online bills, or transferring money through Internet banking.

- Supports secure transactions: The specificity of IFSC codes adds an additional layer of security to transactions. It helps in verifying that the funds are sent to and from legitimate bank branches.

RTGS (Real Time Gross Settlement)

What is it?

It is a type of electronic payment system in which money or securities are transferred from one bank to another on a "real-time" and "gross" basis. This means that transactions are not subjected to any waiting period and are settled as soon as they are processed.

Key features of RTGS

Here are the main features of RTGS:

- Real-time processing: RTGS is the payment method that processes and settles payments instantaneously, without any delay. Once a transaction is initiated, it is completed within seconds or minutes, ensuring that funds are transferred quickly.

- Gross Settlement: Each transaction is settled individually on a one-to-one basis without netting or bundling with other transactions. This means that payments are processed and settled one at a time, ensuring clarity and reducing transaction complexity.

- Minimum/maximum transaction limit: The minimum amount usually required for an RTGS transaction is Rs. 2 lakh in India. There is no upper limit on the amount that can be transferred via RTGS.

- 24*7 availability: This payment system is available round the clock, 24 hours a day, seven days a week, including weekends and holidays. This continuous availability allows users to perform transactions at any time, providing flexibility and convenience.

- Widely accessible: RTGS services are available through various channels, including internet banking and physical bank branches. This wide accessibility makes it easy for individuals and businesses to execute transactions efficiently.

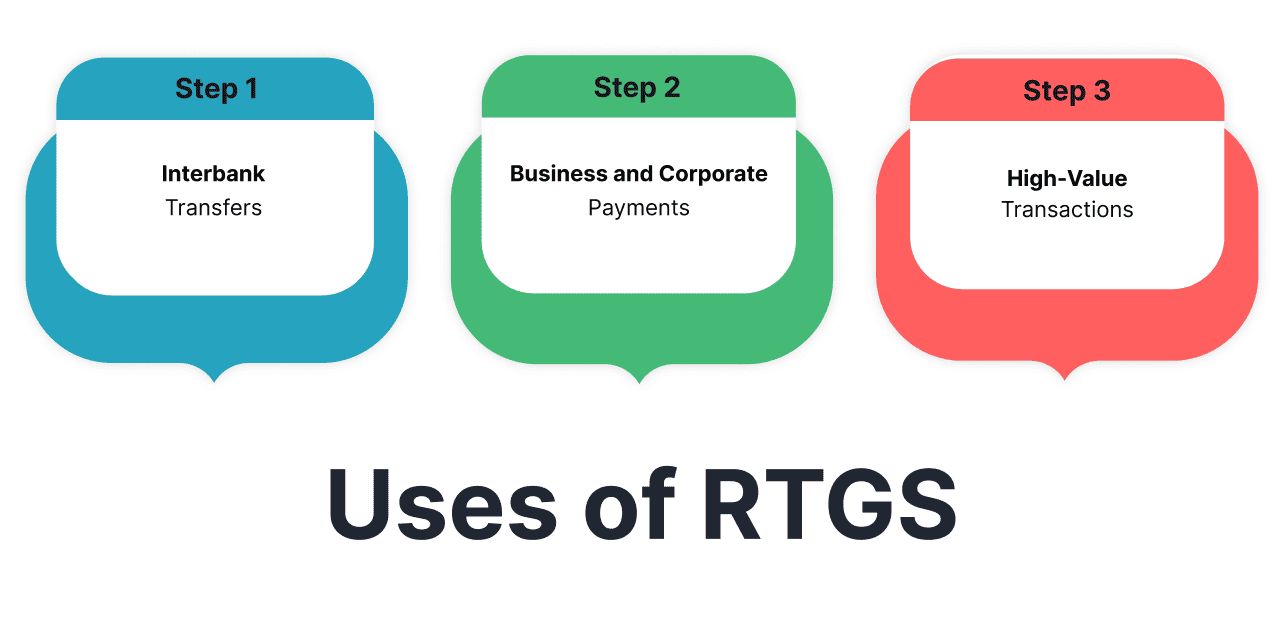

Main uses of RTGS

RTGS is a vital financial service used in banking to transfer money between banks. Here are the main uses of RTGS:

- Interbank transfers: RTGS is extensively used for interbank transfers where immediate settlement is crucial, such as for balancing books, managing liquidity, or meeting regulatory requirements.

- Business and corporate payments : Businesses often use RTGS for making payments that are time-sensitive, such as payments for raw materials, high-value supplies, or contractual obligations where immediate fund receipt is crucial.

- High-value transactions: This payment system is typically used for large transactions. It usually has a minimum limit (often around 2 lakh INR), making it ideal for high-value transfers that need immediate clearing.

Conclusion

In summary, IFSC and RTGS are important for managing money transfers in India, but they serve different purposes. The IFSC code helps make sure money is sent to the right bank branch. On the other hand, RTGS is a system used to transfer large amounts of money quickly and safely between banks.

Frequently Asked Questions (FAQs)