What happens if I use the wrong IFSC Code?

Last Updated : July 29, 2024, 4:01 p.m.

When transferring money online, it’s essential to enter the correct account information along with the correct IFSC (Indian Financial System Code). Each bank branch has a separate IFSC of its own.

To make online fund transfers using NEFT (National Electronic Funds Transfer), RTGS (Real-time Gross Settlement), or IMPS (Immediate Payment Service), you need to add the person's bank account to your list of payees or beneficiaries. To do this, you'll need to provide details like their name, bank name, account number, and IFSC code.

In this article, we will focus on what happens when you enter the wrong IFSC or IFSC of a different bank or branch. But before that, let’s understand the meaning of IFSC.

What is IFSC?

IFSC is an 11-digit alphanumeric code used to identify each bank branch in India. The first four characters of an IFSC code represent the bank’s name, the fifth character is ‘0’, and the last six characters denote the bank branch.

This code helps in making electronic money transfers between banks, especially for wire transfers and other types of electronic payments within India.

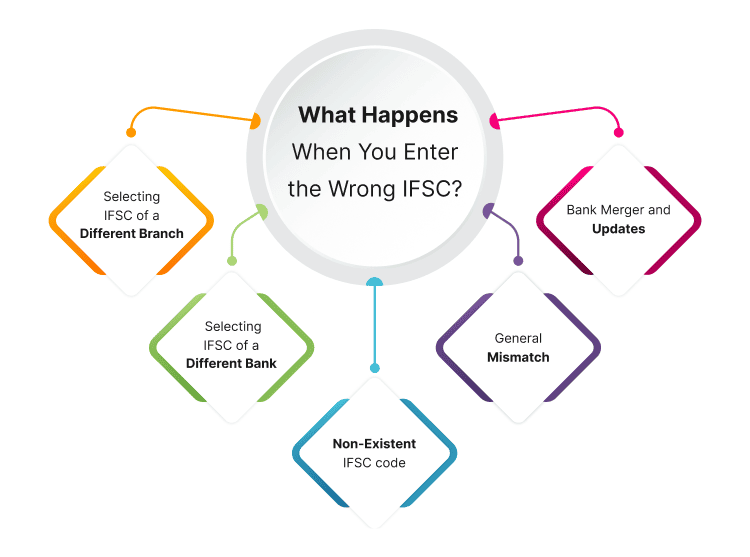

What happens when you enter the wrong IFSC?

The likelihood of IFSC-related errors during the transaction process is minimal as most banks generally ask customers to select the bank’s name and branch from the drop-down menu. However, in some cases, customers may be asked to enter the IFSC code manually, which may increase the chances of entering the wrong code.

So, here’s what can happen in such cases:

- Selecting IFSC of a different branch: If you input the IFSC code of a different branch but other details like the account number and account holder's name are correct, the transaction will likely still go through. This is because the system uses your account number to map back to the correct branch, allowing the transfer to proceed if the account holder's name matches.

Keep in mind, not all banks check the beneficiary's name before transferring funds. So, if the account number is correct, the transaction will likely be processed.

- Selecting the IFSC of a different bank: Suppose you need to transfer money to an SBI bank account, but you chose the IFSC code of ICICI bank. In such a scenario, the transaction will depend on whether the other bank has an account with the same account number. If it does, the funds might be transferred to that account, which could belong to a different person. This scenario is rare but possible.

- Non-existent IFSC code: If the provided IFSC code is for a non-existent bank branch, the transaction is likely to fail. The funds will not be transferred, and you will be notified of the failed transaction.

- General mismatch: In most cases, if there is a mismatch between the IFSC code and the account details, the transaction will be canceled due to a discrepancy. The money will not be debited, or if it is, it will be refunded.

- Bank merger and updates: If the IFSC code has changed due to a bank merger or branch relocation, the old IFSC code will likely result in a failed transaction. It is important to update the IFSC code to the new one provided by the bank.

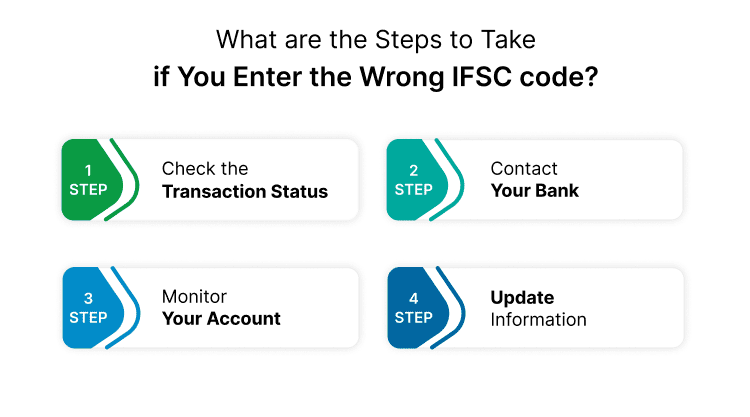

What are the steps to take if you enter the wrong IFSC code?

If you enter the wrong IFSC code during a bank transaction, follow the below steps to address the issue:

- Check the transaction status: Once the transaction is complete, verify whether it has failed or gone through. If it has failed due to the incorrect IFSC code, the amount is generally refunded to your account automatically.

- Contact your bank: If you realize the mistake after initiating the transaction, contact your bank immediately for assistance.

- Monitor your account: Keep an eye on your account statements to confirm that the transaction was cancelled or that a refund was processed.

- Update information: Ensure that you have the most recent IFSC code, especially if your bank has undergone mergers or branch relocations.

Summing up!

Using the correct IFSC code is crucial for ensuring successful bank transactions. Errors in entering the IFSC code can lead to transaction failures or misdirected funds, causing delays and potential complications in retrieving the money. It's important to double-check all details before completing any financial transaction to avoid such issues and ensure your funds reach the intended recipient without delay.

Frequently Asked Questions (FAQs)