Updating Your Banking Details: The Switch from Old to New IFSC Codes

Last Updated : July 30, 2024, 11:24 a.m.

Updating your banking details might sound like a chore, but when it comes to switching from old to new IFSC codes, it's an essential step to ensure your transactions continue smoothly without a hitch. As banks evolve through mergers or relocations, IFSC codes—those crucial identifiers for electronic transfers—also change.

Stay ahead of these updates to keep your financial dealings seamless and secure. Here’s how you can make the switch effortlessly and why it’s important for your everyday banking needs.

An Overview of IFSC Code

IFSC code is an 11-digit alphanumeric code used to uniquely identify bank branches in India that offer online money transfer services. This code is essential for facilitating electronic fund transfers through systems like NEFT (National Electronic Funds Transfer), IMPS (Immediate Payment Service), or RTGS (Real-time Gross Settlement).

Here’s the structure of IFSC code:

- First four characters: These represent the bank’s name.

- Fifth character: This is always ‘0’ and reserved for future use.

- Last six characters: These are numeric and uniquely identify the specific branch of the bank.

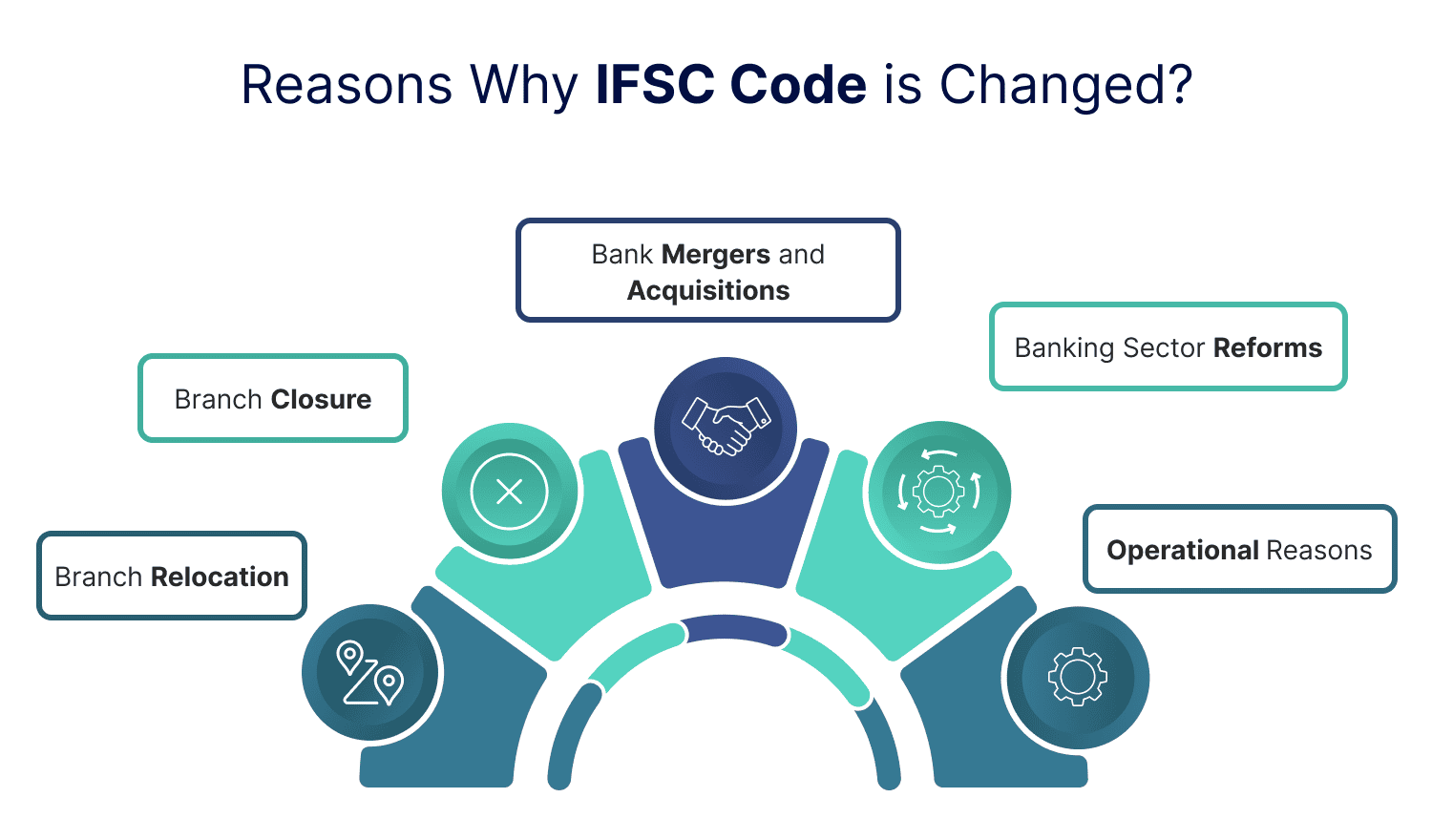

Reasons Why IFSC Code is Changed?

IFSC codes may change due to several reasons. It is often related to adjustments within the banking infrastructure or organizational changes.

Here are some of the common reasons why an IFSC code might be changed:

- Branch Relocation: When a bank branch is relocated to a different location, the IFSC code may change. This is because the last six characters of an IFSC code represent a bank branch, which is likely to be different in the new location.

- Branch Closure: If a bank decides to close a branch permanently, its IFSC code will become inactive. Customers of the closed bank branch will be provided with new IFSC code corresponding to another branch, where their accounts might be transferred.

- Bank Mergers and Acquisitions: In case a merger or acquisition involving banks happens, the IFSC codes of the branches of merging banks might change to reflect the new entity’s banking network. This is one of the common reasons for IFSC code changes, as the banking landscape keeps changing with mergers and acquisitions.

- Banking Sector Reforms: Regulatory changes or reforms in the banking sector initiated by the Reserve Bank of India (RBI) or other banking authorities can also lead to changes in the IFSC codes. These reforms might aim to streamline banking operations, enhance security, or improve customer service.

- Operational Reasons: Banks might also change IFSC codes for internal operational reasons, such as rebranding, restructuring of banking channels, or to correct anomalies in the existing code structure.

How to Find the New IFSC Code?

Below, we have listed a few ways to find the new IFSC code:

- Cheque Book and Passbook: Banks usually issue new cheque books and passbooks that show the updated IFSC code post merger or branch change. You can find the new IFSC code printed on the cheque leaf or the front page of your passbook.

- Bank’s Official Website: Most banks will update the IFSC codes on their official websites. You can use the branch locator tool or IFSC code finder by entering the city and state or the branch name to get updated IFSC code.

- RBI Website: The official website of the RBI maintains a comprehensive list of IFSC codes of all bank branches participating in the NEFT/RTGS system. You can visit the RBI’s official website and go to the ‘IFSC codes’ tab to find the updated ones.

- Customer Care and Branch Visit: If the IFSC code has changed, you can also contact your bank’s customer care or visit the branch. Bank officials can give you the most accurate and updated information regarding IFSC codes.

- Online Banking and Mobile Apps: If you use a mobile banking app or online banking, you can often find the new IFSC code in the account details section or by navigating to the fund transfer options where the IFSC code is required.

Summing Up!

Making the switch to new IFSC codes may require a bit of effort, but it's a small step that can prevent potential headaches like delayed payments or transaction failures. Remember to check your bank’s notifications regularly and update your banking details whenever necessary to keep your financial life running smoothly.

Frequently Asked Questions (FAQs)