Is IFSC Code 11 Digits?

Last Updated : July 30, 2024, 11:53 a.m.

When you're transferring money online, it's important to use the IFSC Code . This unique code ensures that your money goes exactly where it's supposed to. It's a vital part of electronic payments, guiding each transaction to the correct bank branch. In this article, we'll explore the structure of the IFSC Code and discuss why it's essential for ensuring safe and accurate financial transactions.

Full Form of IFSC

IFSC stands for Indian Financial System Code. It is an 11-digit alphanumeric code used by the Reserve Bank of India to identify each bank branch participating in the country’s electronic payment systems such as NEFT (National Electronic Funds Transfer), IMPS (Immediate Payment Service) and RTGS (Real-time Gross Settlement).

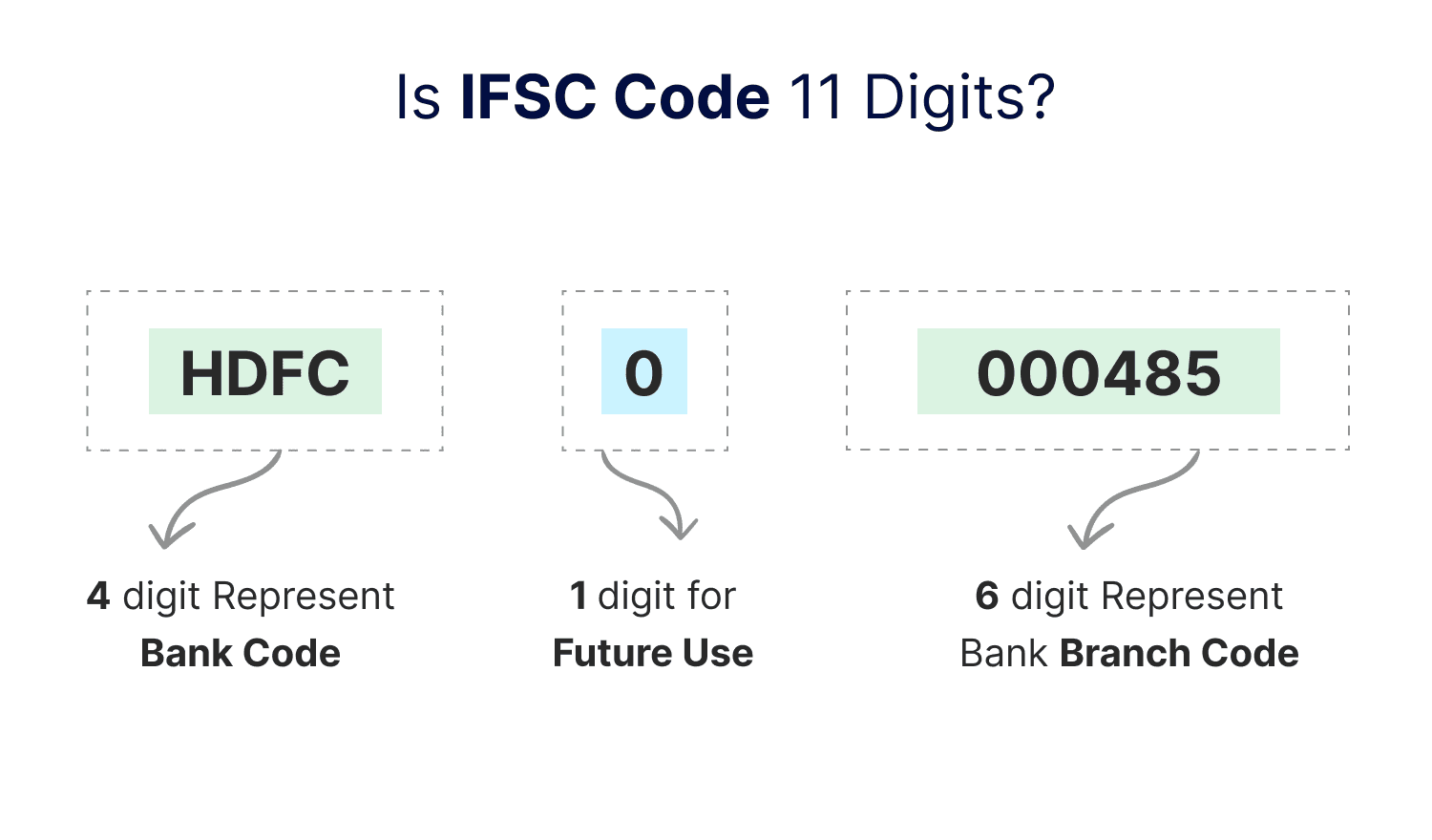

What is the IFSC Code Format?

As already mentioned above, IFSC is an 11-digit identification code dedicated to a particular bank branch.

- The first four alphabetic characters represent the bank name.

- The fifth character is always 0.

- The last six characters (usually numeric, but can be alphabetic) represent the bank branch.

For instance, consider the State Bank of India (SBI). The first four characters of its IFSC code are 'SBIN'. The last six digits specify the branch code. For example, the IFSC code for the SBI branch located at 23, Himalaya House, Kasturba Gandhi Marg, New Delhi 110001, is SBIN0005943. In this code, '005943' identifies the specific branch.

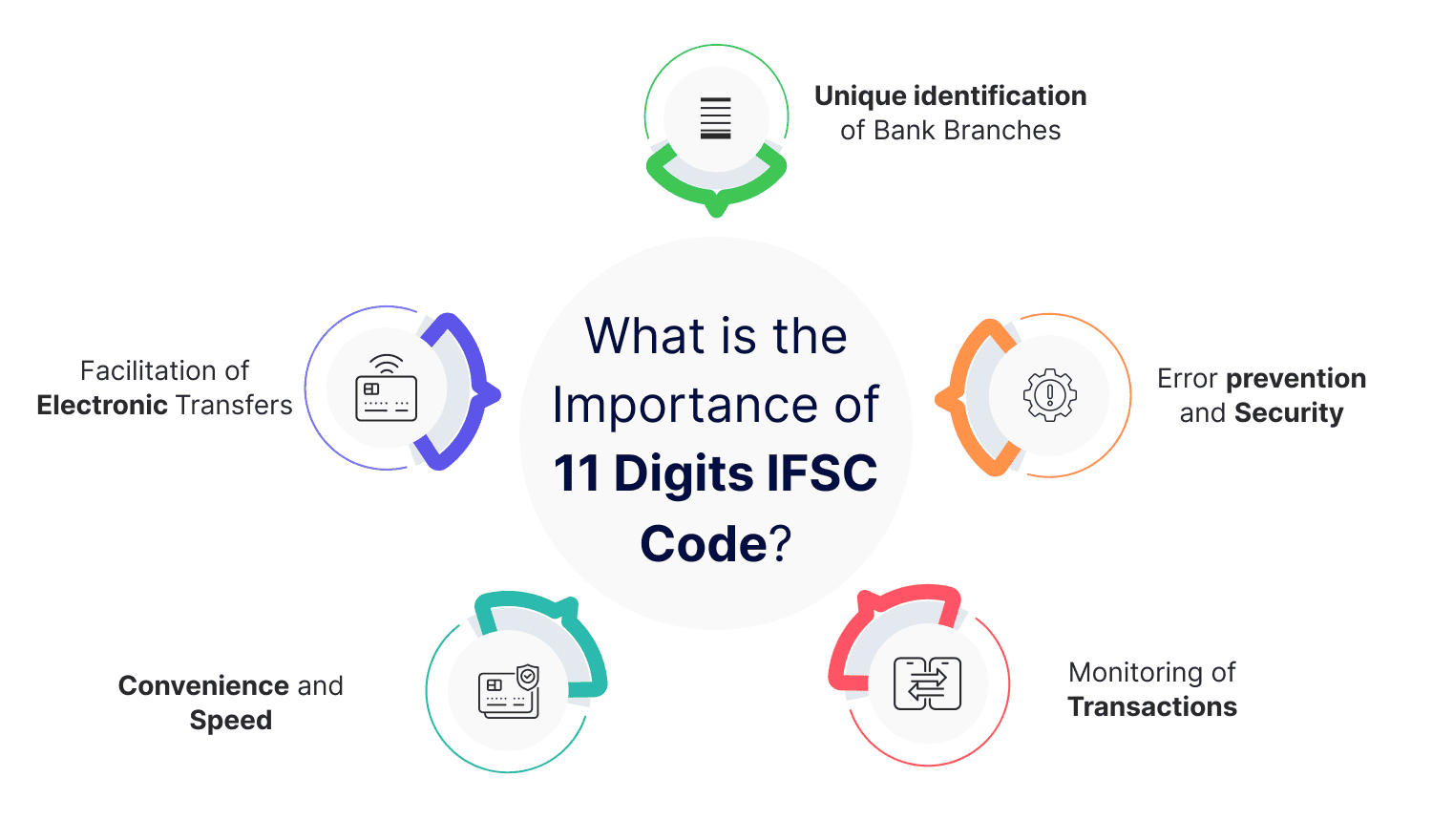

What is the Importance of 11 Digits IFSC Code?

Here are the main benefits of using an IFSC code for conducting electronic funds transfers:

- Unique identification of Bank Branches

The main benefit of using an IFSC code is that it helps identify bank branches participating in electronic payment systems regulated by the RBI. This unique identification ensures that funds are accurately routed to the correct branch, minimizing errors and delays in transactions.

- Error Prevention and Security

Using the right IFSC code ensures the funds are transferred to the correct bank branch and account. If you enter the wrong IFSC code, the transaction is likely to fail due to mismatch in details. This reduces the risk of funds being misdirected. Additionally, the IFSC code adds a layer of security by ensuring transactions are traceable and verifiable. This, in turn, reduces the risk of fraudulent activities.

- Monitoring of Transactions

RBI makes use of IFSC codes to monitor and regulate electronic transactions. This ensures transparency and accountability in the banking sector. This oversight helps protect consumer interests and maintain the integrity of the financial system.

- Convenience and Speed

IFSC codes enable quick and paperless transactions, allowing for instant or same-day fund transfers. This convenience is particularly beneficial for urgent transactions, as it eliminates the need for cheque or cash deposits. The digital nature of transactions facilitated by IFSC codes also supports eco-friendly banking practices.

- Facilitation of Electronic Transfers

The IFSC code is used to transfer funds using various electronic payment systems such as NEFT, IMPS, or RTGS. These systems rely on the IFSC code to process transactions accurately and efficiently. Without the correct IFSC code, these transactions cannot be completed, making it an essential component for online banking and fraud.

Conclusion

So, we hope, we made it clear through this article that IFSC is 11-digits long and used for safe and secure transfer of electronic payments. It has a unique format: the first four characters are for bank code, the fifth character is always 0 reserved for future use, and the last six characters denote the branch name. The IFSC code is essential for ensuring that financial transactions are processed accurately and securely across different banking platforms.

Frequently Asked Questions (FAQs)