IFSC Code - A Detailed Guide for Beginners

Last Updated : May 23, 2024, 7:12 p.m.

In recent years, electronic fund transfers have become increasingly popular, especially due to our growing economy and the impact of demonetization. This surge in popularity can be attributed to the unparalleled convenience and instant processing that electronic transfers offer. However, one key piece of information reigns supreme for domestic transactions to go smoothly: the IFSC Code .

Despite its importance, many individuals are unfamiliar with what an IFSC Code is and how to find one. This comprehensive guide aims to demystify the IFSC Code, highlighting its significance in facilitating seamless fund transfers.

Understanding the IFSC Code

An IFSC code is an 11-digit alphanumeric code assigned by the Reserve Bank of India (RBI). It helps identify the bank and its particular branch to initiate online fund transfers via NEFT, RTGS, and IMPS. The first four characters represent the bank name, the last six characters represent the branch, and the fifth character is zero, which is reserved for future use.

For instance, in the IFSC code ICIC0000021:

- The first four characters, ‘ICICI,’ represent the bank name.

- The fifth character, ‘0’, which is for future use.

- The last six characters, 000021 represent the branch name, which is Gurgaon in this case.

To initiate a fund transfer between two branches, you must know the receiver bank's IFSC code and the recipient's account number.

How to Search for IFSC Code?

The IFSC code can be searched easily. For instance, if you have an account with ICICI Bank, you can find the IFSC code on your cheque book and on the front page of your bank passbook. You can also simply Google the IFSC code.

Let’s look at some popular banks along with their IFSC codes:

| Bank Name | Branch Name | IFSC Code |

| HDFC | HDFC Bank, Tulsiani Chmbrs - Nariman Pt, Mumbai | HDFC0000001 |

| Kotak | Kotak Mahindra Bank Limited, Delhi - Koral Bagh, Delhi | KKBK0000191 |

| SBI | State Bank Of India, Mumbai Main, Mumbai | SBIN0000300 |

| Axis | Axis Bank, Mumbai Branch, Mumbai | UTIB0000004 |

| ICICI | ICICI Bank Limited, New Delhi - Rohini, Delhi | ICIC0006298 |

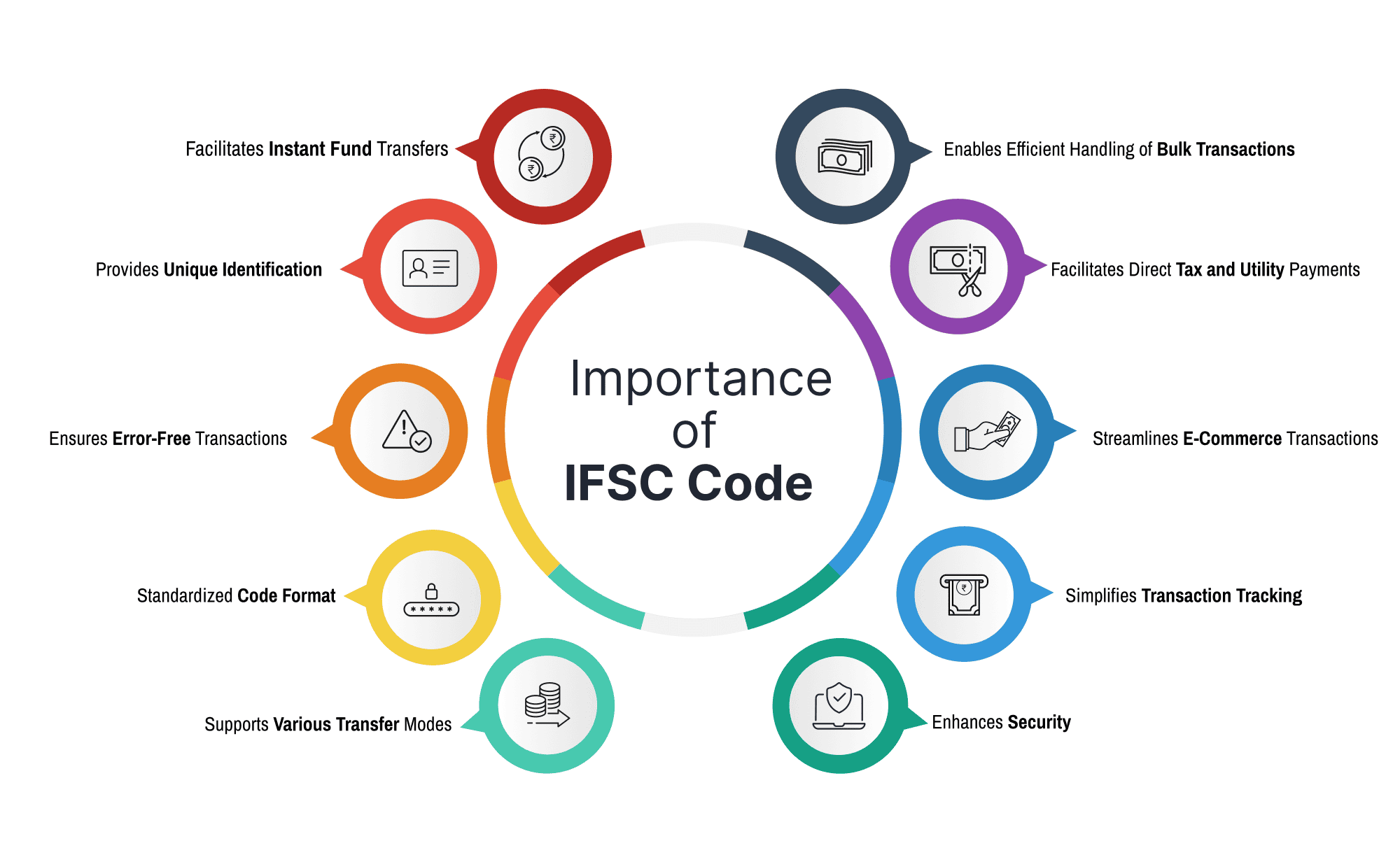

The Importance of the IFSC Code

The IFSC Code is super important for identifying each bank branch, making electronic transfers efficient and safe. Here's why it's useful:

Facilitates instant fund transfers

The IFSC code enables the swift and efficient electronic transfer of funds between bank accounts. This is crucial for managing both domestic and international transactions and facilitating the electronic movement of money. The code ensures that funds reach their intended destination promptly, especially useful for time-sensitive payments like bill settlements, insurance premiums, and EMI payments.

Provides unique identification

Each IFSC code is unique to a specific bank branch, which is critical in accurately identifying and confirming the branch involved in a financial transaction. This unique identification helps reduce confusion and errors in the vast network of bank branches.

Ensures error-free transactions

Utilizing the IFSC code minimizes the risk of transactions being misrouted or sent to the wrong branch. This level of precision is essential for ensuring that online transfers are executed correctly, enhancing the reliability and smoothness of financial operations.

Standardized code format

The IFSC code follows a standard 11-digit alphanumeric format to facilitate the automated processing of electronic payments. The first four alphabetic characters represent the bank's name, the fifth character is reserved as zero for future use, and the last six characters (usually numeric) signify the specific branch. This standardization helps integrate various banking systems and simplifies the processing of numerous transactions.

Supports various transfer modes

The IFSC code is versatile and used across different electronic fund transfer systems such as NEFT (National Electronic Funds Transfer), RTGS (Real-Time Gross Settlement), and IMPS (Immediate Payment Service). This makes it a crucial tool for supporting various transaction types and sizes, ensuring flexibility in consumer banking operations.

Enhances security

By requiring an IFSC code for transactions, an additional layer of security is incorporated into financial operations. It ensures that money transfers occur only between authenticated bank branches, safeguarding against fraudulent activities and unauthorized access to funds.

Simplifies transaction tracking

The IFSC code makes tracking transactions easier for customers and banks. Each transaction can be precisely identified and traced back to its source branch, thanks to the unique code recorded in the transaction details. This is beneficial for maintaining clear and accurate financial records and aids in the quick resolution of any discrepancies or issues.

Streamlines e-commerce transactions

For online shopping, many e-commerce platforms require the IFSC code to process payments via net banking. It ensures that funds are debited from the correct account, providing a seamless shopping experience.

Facilitates direct tax and utility payments

Taxpayers can use the IFSC code to make direct tax payments online, ensuring that their funds reach the correct government account. Similarly, utility payments such as electricity and water bills can be automated using the IFSC code, ensuring timely and error-free payments.

Enables efficient handling of bulk transactions

Businesses benefit from the IFSC code when handling payroll or vendor payments, as it helps in processing bulk transactions efficiently and accurately, ensuring that all funds are correctly allocated to the intended recipient accounts.

IFSC Code: A Few Facts to Consider

Below, we have listed a few facts about the IFSC code that you must consider:

Managed and allotted by RBI

The Reserve Bank of India is in charge of creating and managing IFSC codes, not the banks themselves. These codes are like unique IDs for the bank branches and used for smooth online fund transfers. You can visit the RBI's official website if you require an IFSC code for a particular bank branch.

There, you'll find a link in the footer menu that takes you to a page where you can select your bank from a drop-down menu and type in the branch name to get the IFSC code. It's all handled by the RBI to make sure everything runs smoothly when you transfer money online.

Unique branch identifier

Each bank's IFSC code is unique, much like a train's PNR number, ensuring no two passengers claim the same seat. IFSC codes serve to expedite electronic fund transfers smoothly and without trouble. They're crucial for RTGS and NEFT transfers, where both the account number and IFSC code are key players in the process.

Environmental benefits

IFSC codes facilitate paperless banking, which contributes to environmental conservation by reducing the need for physical documentation.

Prone to errors

The transaction won't go through if you enter the wrong IFSC code while transferring money. So, always double-check before hitting 'submit'. Usually, the money bounces back to your account if you make a mistake. It's rare for it to go to the wrong account. But getting it back might take some time.

Frequently Asked Questions (FAQs)