How to Recover Money Sent to a Wrong Account?

Last Updated : July 30, 2024, 12:40 p.m.

In this digital era, the ability to quickly send and receive money has revolutionised personal and business transactions. However, while these platforms offer speed and security, they require us to manually input recipient details - like account numbers and IFSC codes - leaving plenty of room for human error.

Mistyping these details can lead to transferring money to the wrong account. If you’ve made such an error, you might be wondering what your next steps should be to try and recover the transferred funds.

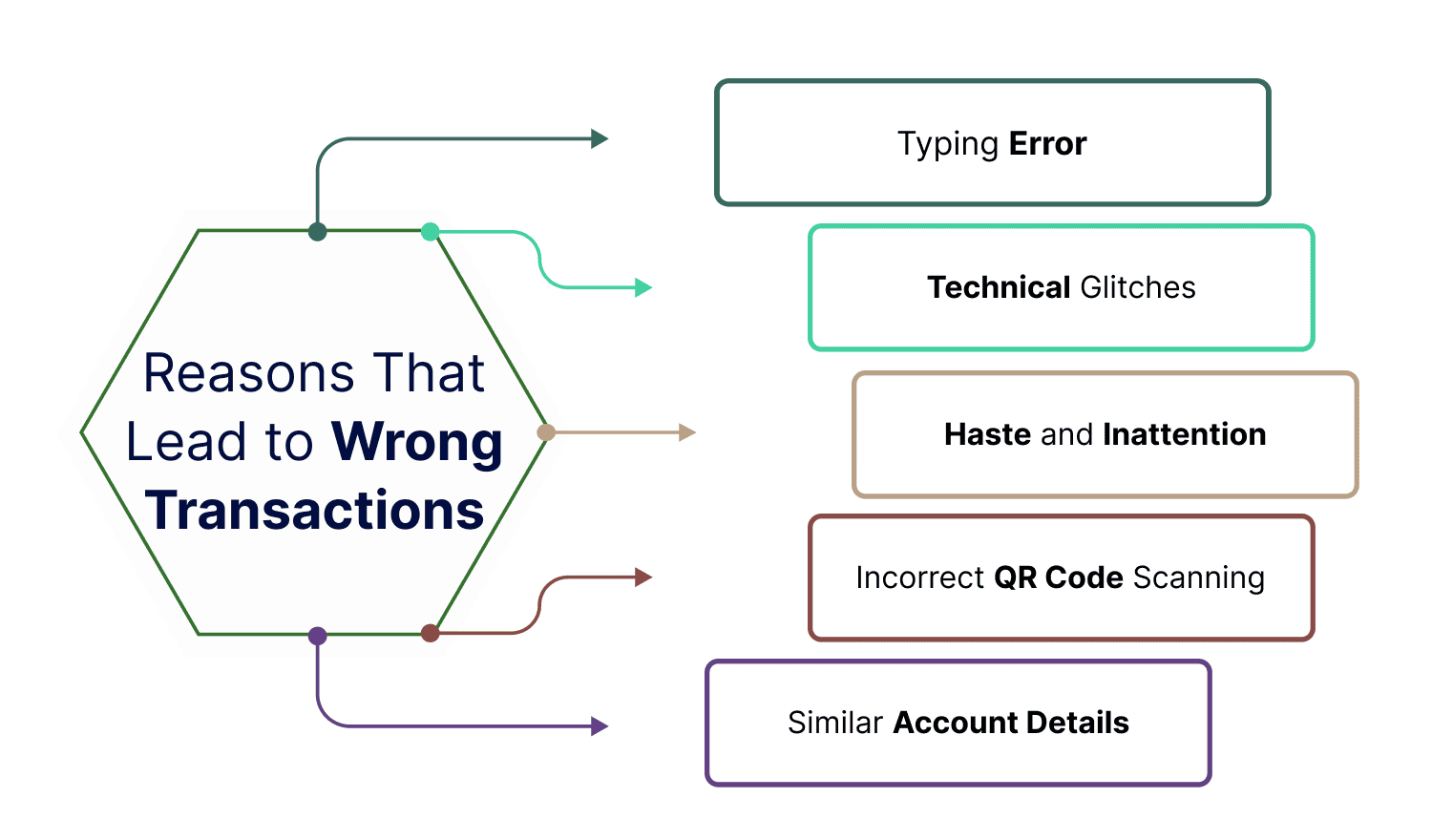

Possible Reasons That Lead to Wrong Transactions

Transferring money to the wrong account may happen due to several reasons. Here are some of the common reasons that you need to pay attention to:

- Typing error: One of the most prevalent causes of incorrect transfers is typing mistakes. This may happen when entering a long string of numbers, such as account numbers or IFSC codes, where even a single-digit wrong entry can lead to the funds being sent to the wrong recipient.

- Technical glitches: Although rare, technical issues with the banking or payment app’s server can lead to transactions being processed incorrectly. However, such glitches are rectified by themselves, with the money being credited to the sender’s account either instantly or within a few days.

- Haste and inattention: Rushing through the transaction process without double-checking the recipient’s details can lead to mistakes. The small size of keys on smartphones and laptops can also contribute to errors.

- Incorrect QR code scanning: Scanning a QR code for payment may result in an incorrect UPI address if the QR code is not generated correctly or there are scanning issues.

- Similar account details: Sometimes, account numbers or UPI addresses can be very similar, especially if they are based on common names or generic terms. This can lead to confusion and accidental selection of the wrong recipient.

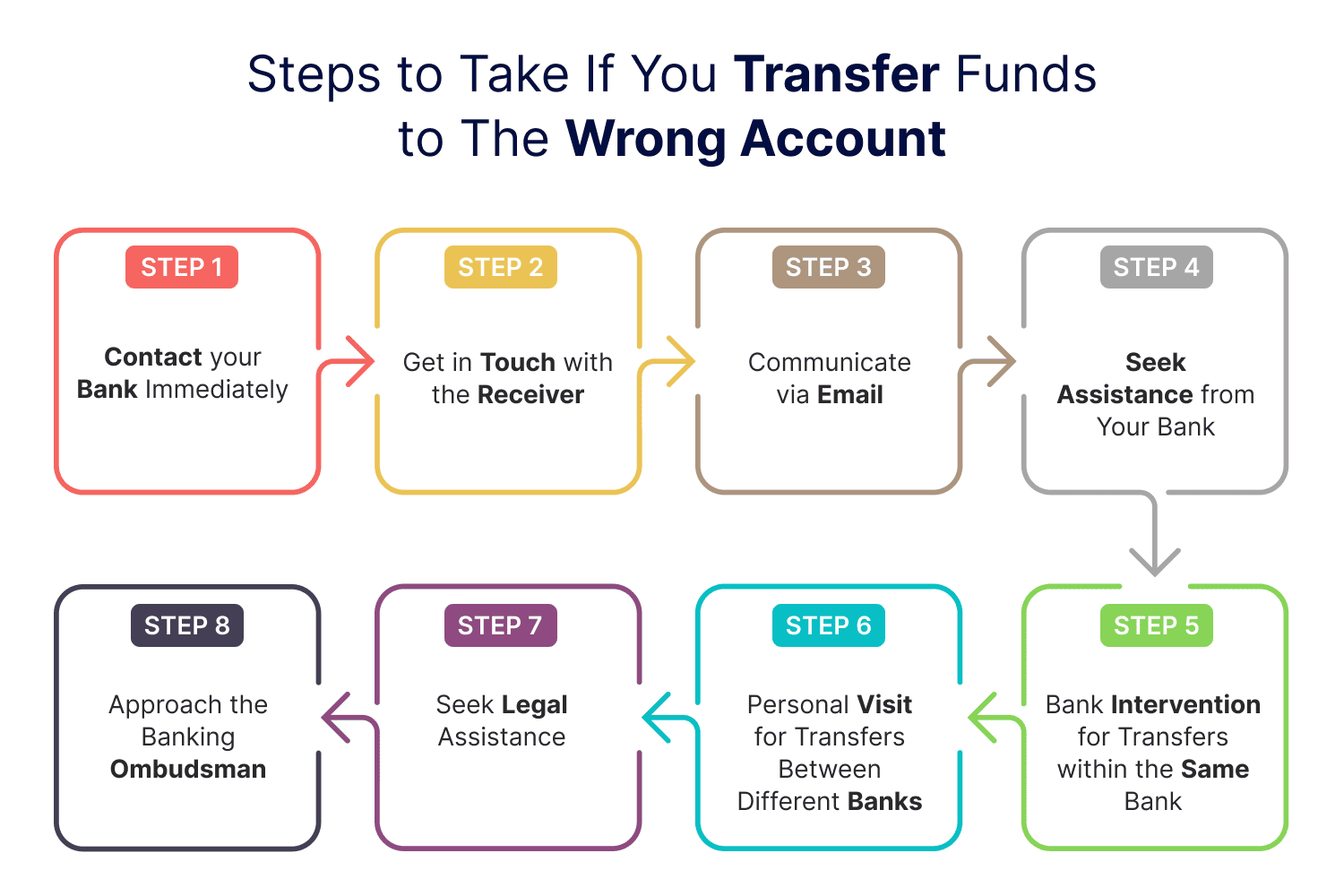

Steps to Take If You Transfer Funds to The Wrong Account

If you've accidentally sent money to the wrong account, it's important to act quickly and follow a series of steps to attempt to recover the funds. Here's what you should do:

- Contact Your Bank Immediately: As soon as you realise your mistake, contact your bank or financial institution. Provide them with all your transaction details, including the date, amount, and incorrect bank account number to which the funds were transferred. You can contact the bank through your customer relationship manager or customer care representative immediately.

- Get in Touch with the Receiver: Contact the person who has received your funds and ask them to refund it. Provide them with the necessary details and ask for their cooperation in returning the money.

- Communicate via Email: Write a detailed email for the bank outlining the error in the recent transaction. Include every piece of relevant information and documentation to support your assertion that this was a mistaken transfer. You should provide the correct account details for the intended recipient, the transaction ID, the wrong account information used, and any additional evidence that may help clarify the situation.

- Seek Assistance From Your Bank: Visit your bank and inform them of the wrong transaction. Provide them with all the necessary details and documentation. They can help initiate the chargeback process to recover the transferred funds.

- Bank Intervention for Transfers within the Same Bank: If you've sent money to the wrong account and both accounts are at the same bank, the bank can contact the unintended recipient to ask if they can reverse the transaction. If the recipient agrees, your funds should be returned to your account within 7 working days.

- Personal Visit for Transfers Between Different Banks: If the mistaken transfer was to a recipient at a different bank, you might need to go to that bank personally. Visit the branch and speak with the bank manager, provide all necessary documents, and request help to reverse the transaction.

- Seek Legal Assistance: If the recipient refuses to return the money, you may need to take legal action. The bank will guide you on the necessary steps, which may involve obtaining a court order for the funds to be returned.

- Approach the Banking Ombudsman: If you're not happy with how your bank or the UPI app's customer service handled your issue, you can take your complaint to the Banking Ombudsman. They will help mediate the situation between you and the involved parties to help resolve the dispute.

Summing Up!

Recovering money sent to a wrong account can be a stressful but manageable process. It’s important to act quickly by notifying your bank immediately and providing all necessary transition details. But remember, prevention is always the best approach, so always double-check all details before confirming any future transactions.

Frequently Asked Questions (FAQs)