How to Make a Payment Using an IFSC Code?

Last Updated : July 30, 2024, 12:55 p.m.

Making a payment with an IFSC code is a simple and secure process that ensures your funds are accurately directed to the correct bank branch. This unique code is essential for facilitating electronic payments, whether you're settling bills, sending money to loved ones, or conducting business transactions.

Using an IFSC code streamlines the payment process, making it quick and error-free. Let’s explore how you can utilize this method to make your financial transactions hassle-free.

What is an IFSC code?

IFSC, or Indian Financial System Code, is an 11-digit code made up of letters and numbers that is unique to each bank branch in India. It is used for online money transfers via NEFT, RTGS, and IMPS, helping to pinpoint the exact bank branches involved in a transaction.

Example of an IFSC code

In an IFSC code,

- The first four characters represent the bank name.

- The fifth character is always a zero.

- The last six characters denote the branch code.

Let’s understand this with an example.

SBIN0005943 is an IFSC code, where:

- The first four characters SBIN is the name of the bank.

- The fifth character is zero.

- The last six characters refer to the branch name. Here it is Kasturba Gandhi Marg, New Delhi.

Features of the IFSC Code

The IFSC code plays a major role in online money transfers in India and serves various purposes in banking transactions. Here are the main features of IFSC code:

Unique Identification

Each IFSC is an 11-digit alphanumeric code that uniquely identifies a specific branch within India. This uniqueness ensures that each transaction is directed to the correct account and branch.

Facilitates Electronic Payments

IFSC codes are essential for electronic payments using NEFT (National Electronic Funds Transfer), RTGS ( REal Time Gross Settlement), and IMPS (Immediate Payment Service). This ensures efficient and error-free fund transfers.

Ease of Tracking

The code helps in tracking and monitoring transactions, thus reducing the risk of fraud or misuse of funds. It plays a crucial role in maintaining the integrity of financial transactions.

Regulatory Compliance

IFSC codes are assigned and regulated by the Reserve Bank of India (RBI). This ensures a consistent approach to banking transactions across all banks and branches in the country.

Support for Online Transactions

The code is essential for various online transactions, including bill payments, insurance premiums, loan EMIs, taxes, and e-commerce purchases, enabling users to access their bank accounts anytime and anywhere.

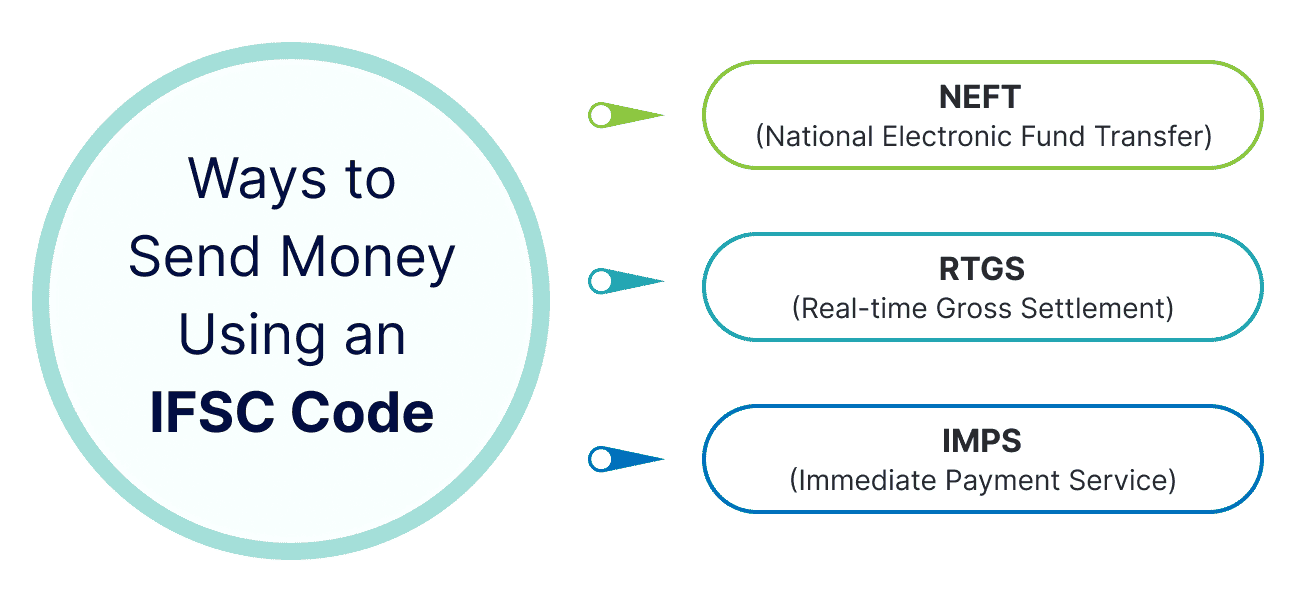

Ways to send money using an IFSC Code

IFSC is crucial for transferring money electronically using three main methods: NEFT, RTGS, and IMPS. These systems make transferring money from one account to another straightforward and reduce errors by ensuring transactions are only processed when correct details, like account numbers and IFSC codes, are provided.

- NEFT (National Electronic Fund Transfer): This system allows you to send money electronically between banks nationwide. Transactions are processed in groups and settled hourly throughout the day, under the oversight of the RBI. For NEFT transfers, you'll need the recipient's account number, name, bank branch name, and IFSC.

- RTGS (Real-time Gross Settlement): RTGS is used for large transactions that require immediate clearing. Funds transferred via RTGS are received instantly, making it essential for large transfers that banks need to settle immediately.

- IMPS (Immediate Payment Service): Operated by the National Payments Corporation of India, IMPS provides an instant, 24/7 interbank electronic fund transfer service. This system allows for fast and secure transfers, accessible through various channels like SMS, mobile, and online banking.

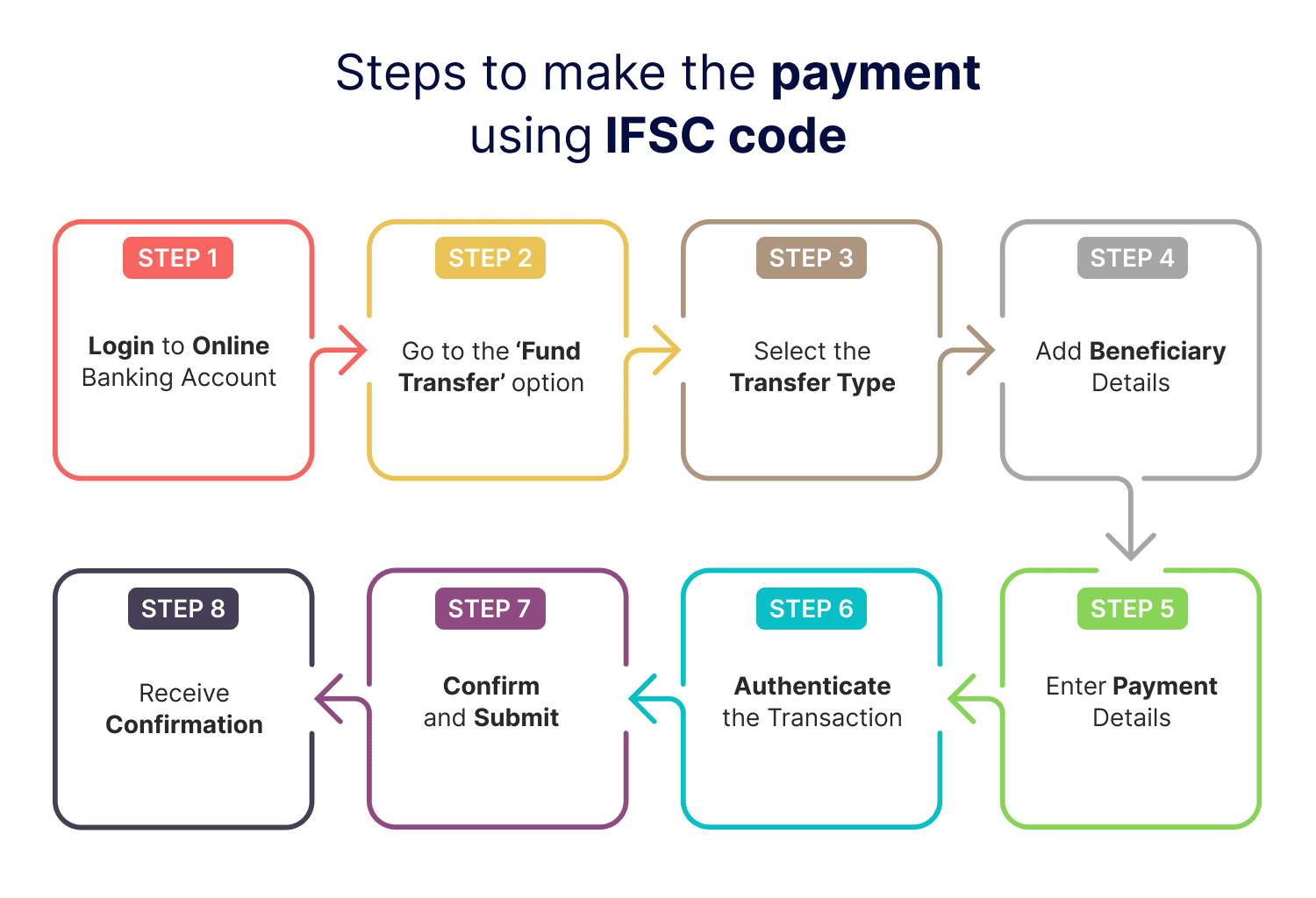

Steps to Make the Payment using IFSC Code

Once you are aware of the different methods that can be used to transfer money, here are the steps to follow to make the payment:

Step 1: Log into online banking account

Access your bank’s online portal using your username and password.

Step 2: Go to the ‘Fund Transfer’ option

Look for the option to transfer funds or make a payment. This could be labeled differently depending on your bank, such as ‘Payment’, ‘Fund Transfer’, or ‘Send Money’.

Step 3: Select the Transfer Type

Now you need to choose the appropriate method to transfer the money. This could be NEFT, RTGS, or IMPS. Select the one depending on your needs and the amount to be transferred.

Step 4: Add beneficiary details

You need to add the recipient as beneficiary if you haven’t done it yet. This typically involves entering the beneficiary’s name, bank account number, and the IFSC code of the bank branch. The IFSC code plays a crucial role here as it helps identify the branch where the recipient’s account has been opened.

Step 5: Enter payment details

Once you have entered the beneficiary details and added them, enter the amount you wish to transfer. You may also need to enter the description or remarks for the transaction you proceed.

Step 6: Authenticate the transaction

Then complete the authentication process, which may involve entering a one-time password (OTP) sent to your registered mobile number, email, or using other security measures set by the bank.

Step 7: Confirm and submit

Review all the details to ensure they are correct, then confirm and submit the payment.

Step 8: Receive confirmation

After submitting, you should receive a confirmation from your bank that the transaction is successful. Keep this confirmation for your records.

How to find the IFSC code?

If you need to find your bank's IFSC code, here are some easy methods you can use:

- Cheque book: One of the easiest ways to find the IFSC code is to check your cheque book. The IFSC code is usually printed at the end of the bank's address on each cheque leaf.

- Passbook: Your passbook also contains the IFSC code. It's typically printed on the front page along with your account and branch details.

- RBI website: Visit the Reserve Bank of India's official website and look for the 'IFSC codes' section. Here, you can select your bank from a dropdown menu and enter your branch name to retrieve the IFSC code. If you don’t know your branch name, entering just the bank's name will display a list of all branches and their codes.

- Bank’s website: Most banks offer a branch locator feature on their websites. You can use this tool to find the IFSC code by locating your branch on the bank’s website.

Frequently Asked Questions (FAQs)