How to Find Your Bank’s IFSC Code Easily?

Last Updated : July 30, 2024, 1:12 p.m.

IFSC, or Indian Financial System Code, is a unique 11-digit alphanumeric code essential for online fund transfers like NEFT (National Electronic Fund Transfer), IMPS (Immediate Payment Service), and RTGS (Real Time Gross Settlement). This code helps direct your money to the right bank account during transactions.

In this article, we'll show you how to find the IFSC code for any bank and explain why it's so important for banking transactions. Let's get started!

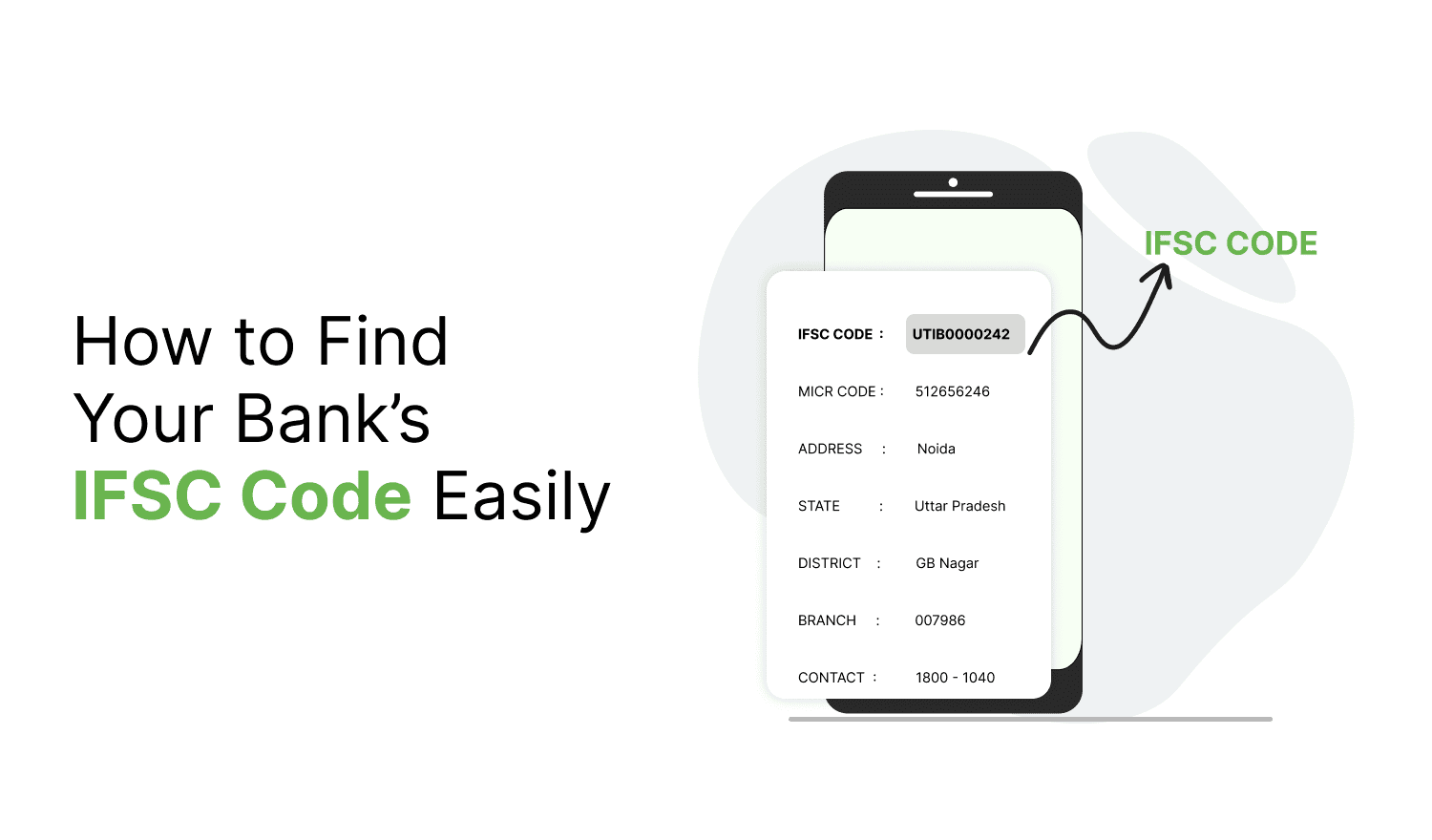

What is the Format of IFSC Code?

It is an eleven character code where the first code characters are the alphabets and represent the bank name. The last six characters of the code can be either numeric or alphabetic and represent the branch where the bank is situated. The fifth character is always zero and reserved for future use.

For example, in the IFSC code SBIN0001707, the four letters SBIN represent the bank name - State Bank of India in this case. The fifth digit ‘0’ is kept aside for future use. The following six digits, ‘001707’ represent the bank branch. In this case, it is Azadpur, New Delhi.

How to Find IFSC Codes of Different Banks in India?

The IFSC code is crucial for customers as all electronic fund transfers rely on it. Generally, IFSC codes are used to distinguish between banks and their respective branches. This ensures accuracy and reduces mistakes that tend to occur during various transactions, including NEFT, IMPS, or RTGS.

There are several ways in which a customer can identify the IFSC code of their bank.

- Bank Account Passbook: The front sheet of your bank passbook contains the account and branch details. This includes the IFSC code as well. It is usually printed on the top right corner of the front sheet.

- Cheque Leaf: The IFSC is usually given at the end of the branch address on the top left corner of the cheque leaf.

- RBI Website: You can find the IFSC codes of different banks along with their branches using the RBI’s official website.

- Branch Locator Tool: Most banks have a branch locator tool on their website. You can use it to find IFSC of a specific branch by entering the state, city, and branch name.

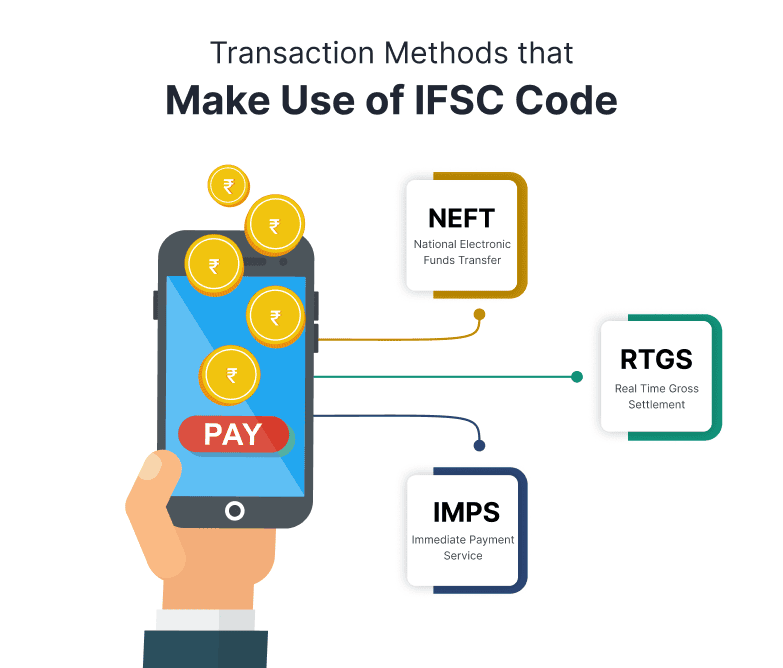

Transaction Methods that Make Use of IFSC Code

IMPS, RTGS, and NEFT are the three primary banking transaction or payment methods that make use of the IFSC code for transfer of funds. Each of these methods is different from one another, and hence, functions in different ways.

- NEFT

NEFT, or National Electronic Fund Transfer is a nationwide payment system that allows for electronic transfer of funds across banks. The transactions made through NEFT are processed in batches and settled in hourly intervals throughout the day. There is no set limit by the RBI for the amount of money you can transfer through the NEFT system. The payer may incur certain charges which may range from Rs. 2.5 to Rs. 25 along with taxes. These charges usually depend on the amount of money involved in the transaction.

- RTGS

RTGS, or Real Time Gross Settlement, is a system where money or securities are transferred from one bank to another in real-time and on a "gross" basis. This means that when a bank executes an RTGS transaction, the funds are moved and appear in the recipient's account almost instantly—typically within a few minutes, although it could take up to a few hours in some cases. The minimum amount that can be transferred through RTGS is Rs. 2 lakh.

- IMPS

IMPS, short for Immediate Payment Service, is a quick way to transfer money between banks in India. It is managed by the National Payments Corporation of India (NPCI) and allows for instant, 24/7, safe transfers across different banks throughout the country. The charges for IMPS transactions usually vary between Rs. 5 to Rs. 15, depending on the bank's specific policies. It's advisable to check with your bank to understand the exact fees that will apply to your transactions.

Wrapping Up!

Finding your bank's IFSC code is straightforward. You can look it up online through your bank's website, check your bank statement, or visit your bank branch. Knowing your IFSC code is crucial for conducting secure and efficient online transactions via IMPS, RTGS, or NEFT. Always make sure you have the correct code to ensure your money reaches the right destination.

Frequently Asked Questions (FAQs)