How can the IFSC Code help you transfer amounts through NEFT?

Last Updated : July 30, 2024, 3:10 p.m.

Transferring money might sound straightforward, but it involves making sure your funds end up in the right place. That's where the IFSC code comes in—especially when you're using NEFT, or National Electronic Funds Transfer, to move money between bank accounts.

This unique code identifies each bank branch in India, acting like a postal code to make sure your money doesn’t go astray.

Let’s dive into how the IFSC code ensures your transfers are not only fast but also land exactly where they need to.

Understanding NEFT

NEFT, or National Electronic Funds Transfer, is a fund transfer mechanism initiated by the RBI in 2005. It settles transactions in half-hourly batches. You can initiate NEFT transactions via internet banking, mobile banking, or by visiting the bank branch.

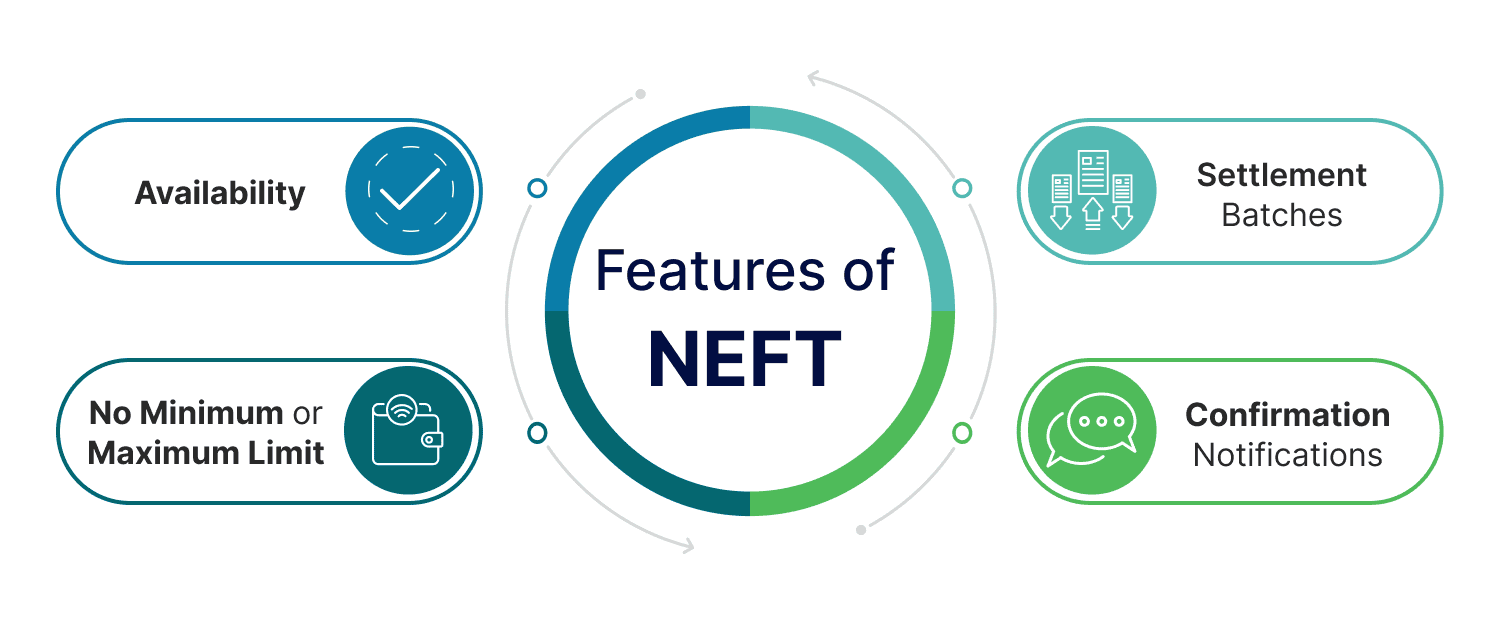

Key features of NEFT

Here are the main features of NEFT:

- Availability : NEFT is available 24*7, including weekends and holidays, ensuring that users can initiate funds anytime.

- Settlement batches: Transactions are processed in half-hourly batches throughout the day, providing near-real-time fund transfers to beneficiaries.

- No minimum or maximum limit: When it comes to NEFT, there is no minimum or maximum limit on the amount of funds that can be transferred. This makes it suitable for both small and large transactions.

- Confirmation notifications: Once the funds are transferred successfully, both the sender and receiver are notified. This ensures transparency and peace of mind.

Understanding IFSC

IFSC, or Indian Financial System Code, is an 11-digit alphanumeric code that plays a crucial role in electronic funds transfers in India. It uniquely identifies each bank branch participating in the country’s main electronic payment and settlement systems, namely the NEFT, IMPS, or RTGS.

The IFSC code consists of three main parts:

- The first four characters represent the bank name.

- The fifth character is always 0, reserved for future use.

- The last six characters identify the specific bank branch.

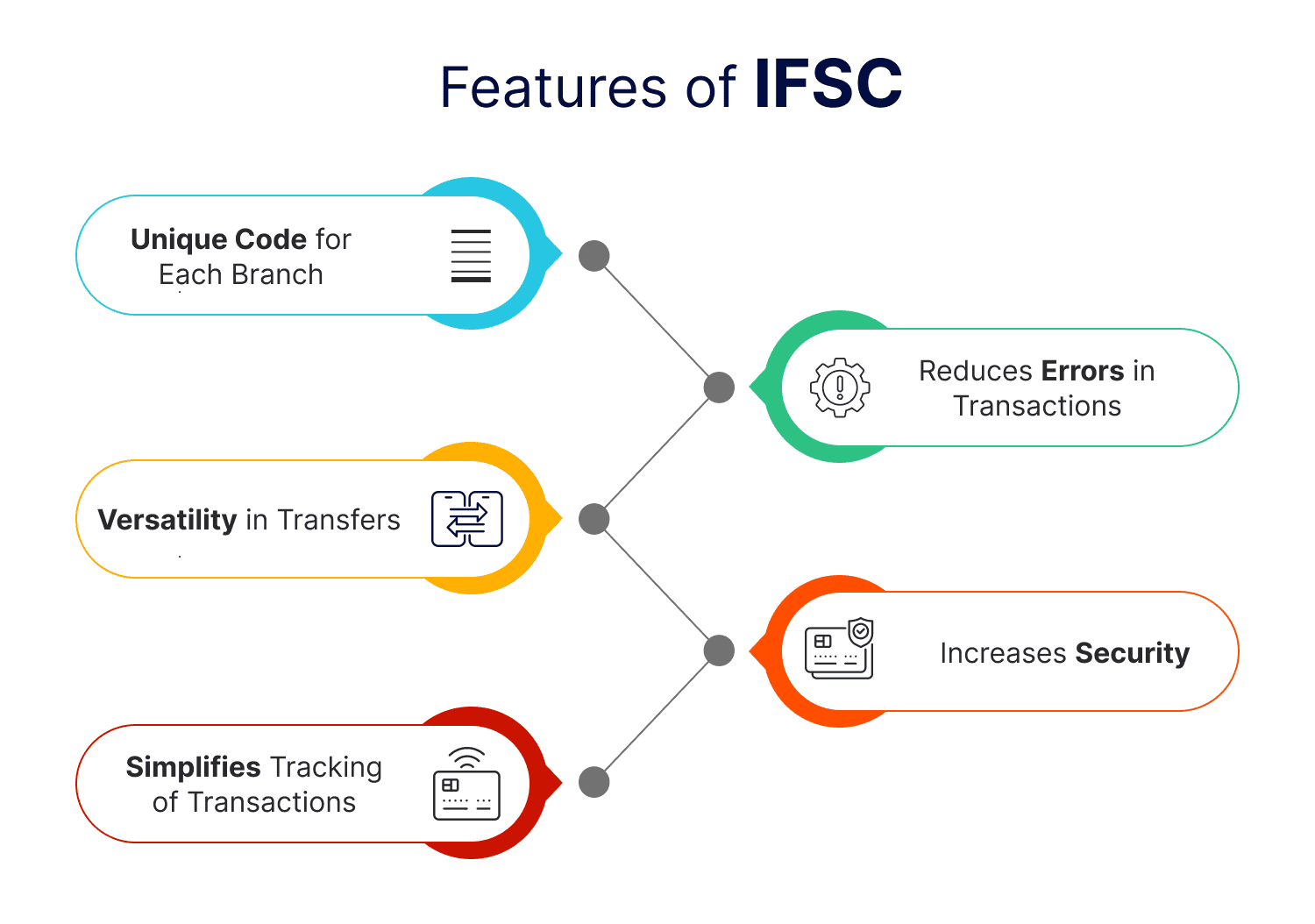

Key features of IFSC

Here are the main features of IFSC:

- Unique code for each branch: Every IFSC code is unique to a particular bank branch, which ensures that transactions are accurately directed to the correct location.

- Reduces errors in transactions: Using the correct IFSC code helps ensure that your money reaches the right bank branch, reducing the likelihood of errors in the transfer process.

- Versatility in transfers: IFSC codes are essential for various types of electronic transfers including NEFT, RTGS, and IMPS, accommodating different transaction volumes.

- Increases security: The use of an IFSC code in transactions adds an extra layer of security, helping to prevent fraud by confirming that transfers occur between verified bank branches.

- Simplifies tracking of transactions: With IFSC codes, it’s easier for both banks and customers to keep track of transactions. Each transfer is uniquely identified by its code, making it easier to maintain accurate and clear financial records.

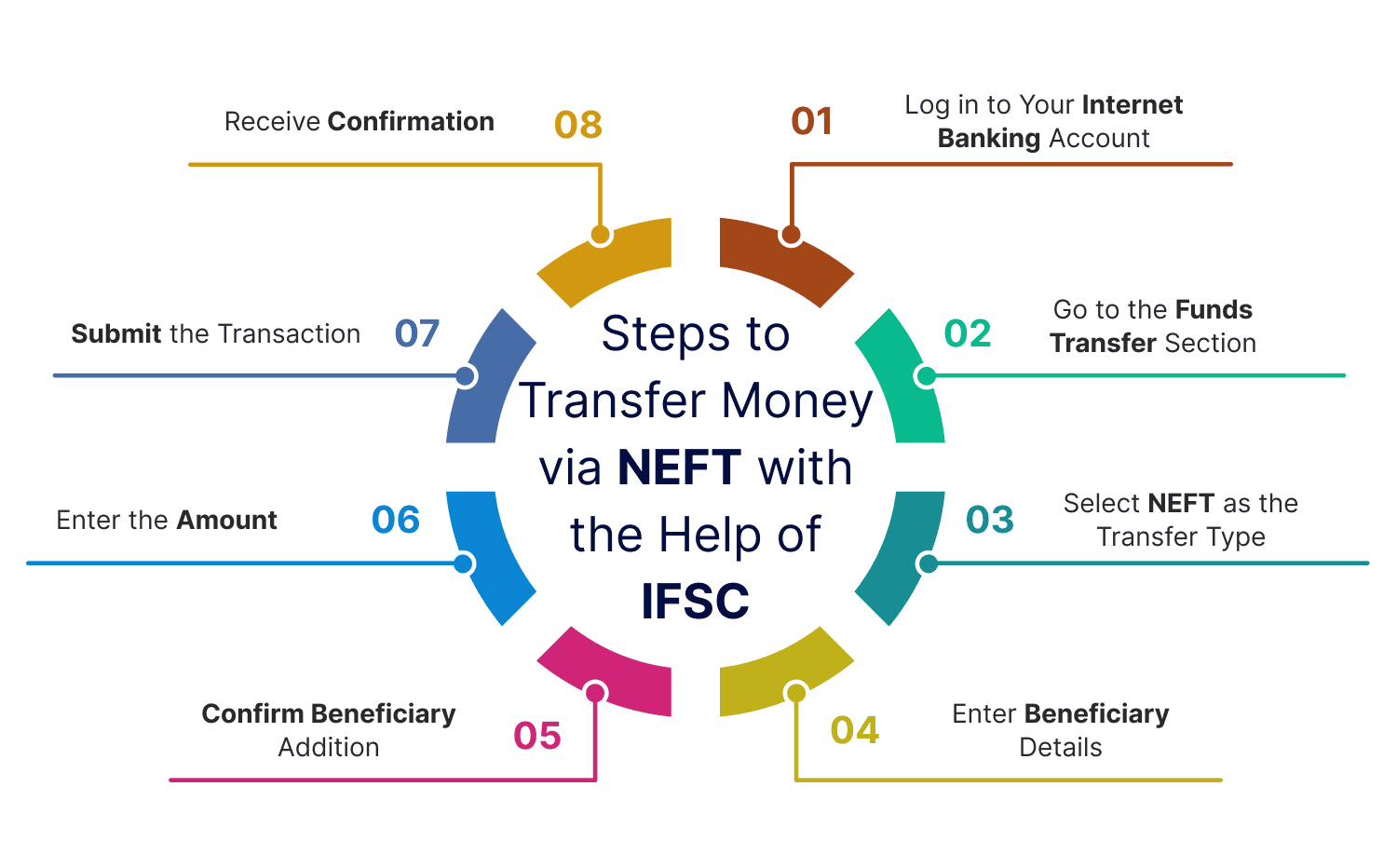

Steps to transfer money via NEFT with the help of IFSC

If you are looking to transfer money through NEFT using an IFSC code, follow the below-mentioned steps:

Step 1: Log in to your internet banking account

Access your bank’s internet banking platform using your username and password.

Step 2: Go to the Funds Transfer section

Find and click on the 'Fund Transfer' option on the main page of your internet banking portal.

Step 3: Select NEFT as the transfer type

Choose NEFT from the available transfer options. It is suitable for any amount and is processed in batches throughout the day.

Step 4: Enter beneficiary details

You will need to enter beneficiary details, including:

- Recipient’s name

- Recipient’s bank account number

- Recipient's bank name

- IFSC code of the recipient’s bank branch

Step 5: Confirm beneficiary addition

After entering the beneficiary details, confirm the addition. You may need to verify this action by entering an OTP sent to your registered mobile number. Please note that the beneficiary might take up to 24 hours to be activated for transfers.

Step 6: Enter the amount

Once the beneficiary has been added, enter the amount you would like to transfer. Also, add remarks if necessary. Confirm the transaction details. You might be required to again enter an OTP for the same.

Step 7: Submit the transaction

Click on ‘Confirm’ or a similar option to finalize the transaction. The funds will be transferred from your account to the beneficiary’s account.

Step 8: Receive confirmation

You will get confirmation from your bank via SMS or email that the transaction has been processed. You can also check your account statement or transaction history to verify that the transfer has been completed.

Frequently Asked Questions (FAQs)