Everything You Should Know About IFSC and MICR Code

Last Updated : July 30, 2024, 3:36 p.m.

When dealing with bank transactions, you often encounter terms like IFSC and MICR codes. These codes play crucial roles in ensuring your money transfers smoothly and securely. The IFSC code helps in identifying a specific bank branch, essential for online transactions.

On the other hand, the MICR code is used mainly for processing cheques. Both these codes make sure that your transactions are not only fast but also error-free. Understanding these codes can make your banking experience smoother and more efficient.

What is IFSC code?

IFSC stands for Indian Financial System Code, which is an 11-digit alphanumeric code used to uniquely identify bank branches within the National Electronic Fund Transfer (NEFT) network by the central bank. This code is mandatory for fund transfers from one bank to another.

In an IFSC code, the first four characters represent the bank and the last six digits refer to the branch name. The fifth character is always ‘0’.

Let’s understand this with an example:

SBIN0005943 is an IFSC code, where:

- The first four characters SBIN is the name of the bank.

- The fifth character is zero.

- The last six characters refer to the branch name. Here it is Kasturba Gandhi Marg, New Delhi.

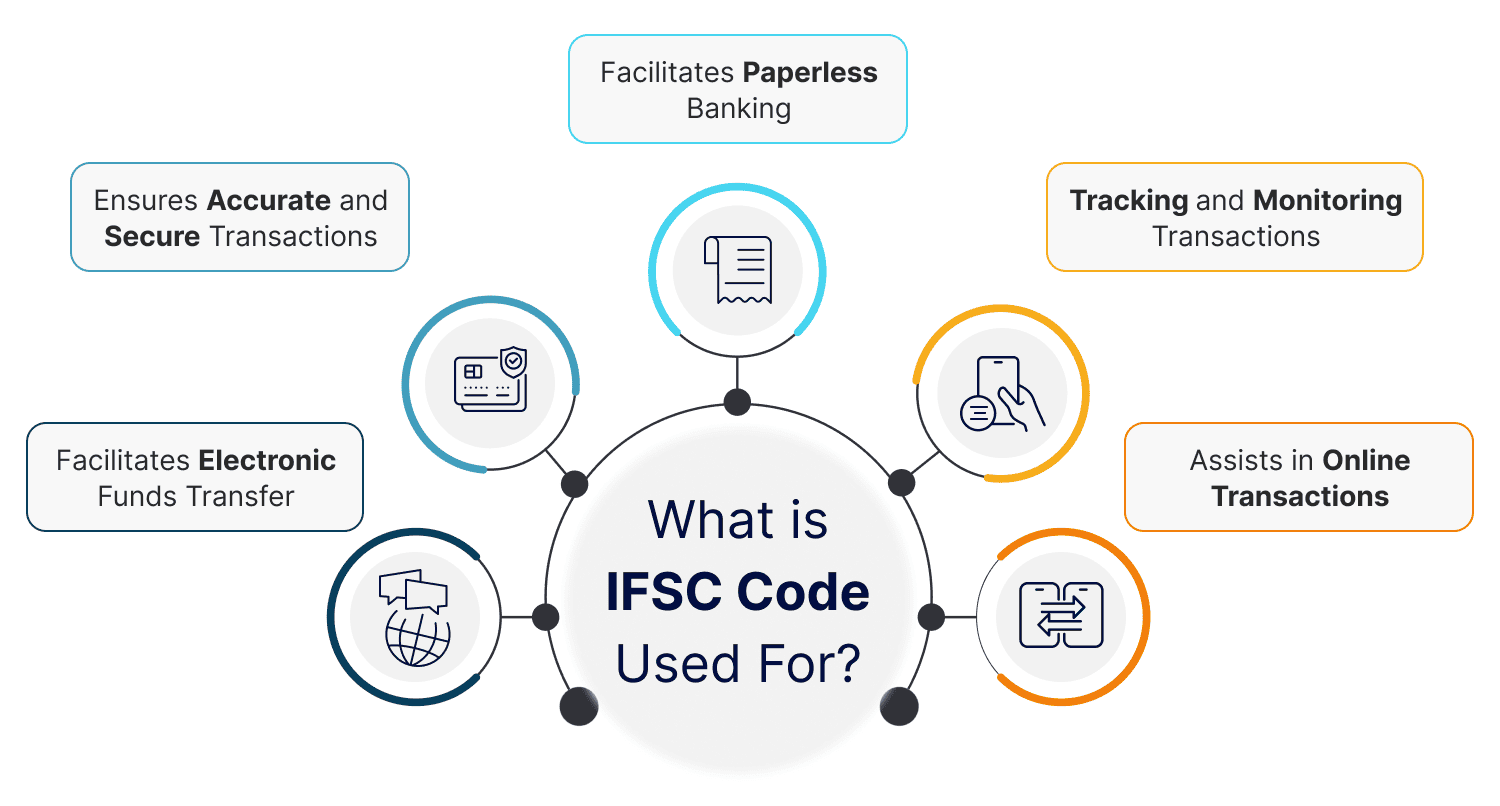

What is IFSC code used for?

The IFS Code serves several key purposes in the banking and financial sector in India, primarily facilitating electronic fund transfers. Here are the main uses of IFSC:

- Facilitates Electronic Funds Transfer: IFSC codes are crucial for conducting electronic money transfers between bank accounts in India. They are used in various electronic payment systems like the NEFT, RTGS, and IMPS.

- Ensures Accurate and Secure Transactions: By uniquely identifying each bank branch, IFSC codes help in reducing the errors during transactions. They ensure the funds are transferred to the correct account. This enhances the security of electronic fund transfers and reduces the chances of fraudulent activities.

- Facilitates Paperless Banking: The use of IFSC codes in electronic fund transfers facilitates paperless banking. This is not only convenient but also environmentally friendly.

- Assists in Online Transactions: IFSC codes play a crucial role in various online transactions, including bill payments, insurance premiums, loan EMIs, taxes, e-commerce purchases, and sending money to friends and family. This offers users access to their bank accounts anytime and anywhere for a hassle-free banking experience.

- Tracking and Monitoring Transactions: These codes help in tracking and monitoring transactions, thereby reducing the risk of fraud or misuse of funds. With the RBI able to monitor and regulate all electronic transactions in the financial and banking system, IFSC codes promote transparency and accountability in the banking sector, protecting consumer interests.

What is MICR code?

MICR, short for Magnetic Ink Character Recognition, is a unique 9-digit code used to identify specific bank branches. Its primary purpose is to speed up and ensure accuracy in processing cheques. This code assists banks in verifying the authenticity of cheques and detecting any counterfeit ones.

The MICR code format includes:

- The first three digits denote the city code

- The next three digits represent the bank code

- The final three digits signify the branch code

For example, let's consider the MICR code of the State Bank of India (SBI) Kolkata Main branch: 700002021. Here, "700" stands for the city code (Kolkata), "002" indicates the bank code, and the last three digits identify the specific branch.

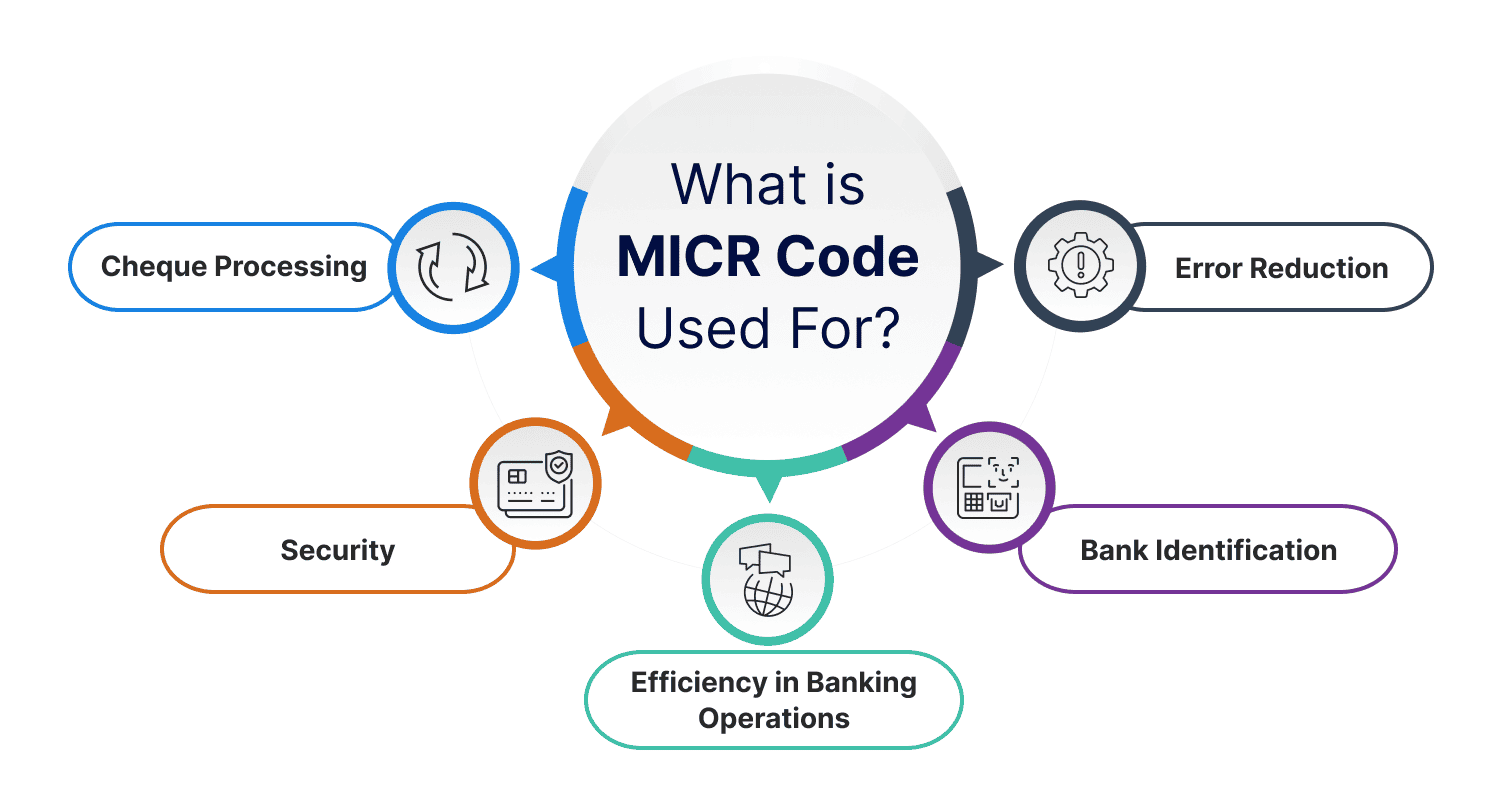

What is MICR code used for?

MICR code is used primarily for the processing and clearance of cheques within the baking industry. Here are the key uses and functions of the code:

- Cheque Processing: MICR codes help in the fast and accurate processing of cheques. They help in the automation of cheque sorting and clearance processes. This speeds up the transaction time and reduces the possibilities of errors.

- Security: MICR codes enhance security in terms of financial transactions. The special ink used allows the characters to be read by machines even if they are overprinted with other marks, such as stamp marks or signatures. This feature also helps in preventing cheque fraud, as the magnetic ink is difficult to replicate.

- Efficiency in Banking Operations: MICR codes improve the overall efficiency of the banking system’s document handling. They do so by enabling quicker verification and sorting of cheques.

- Bank identification: Each MICR code uniquely identifies a specific bank and branch, which is crucial for routing cheques to the correct location for processing.

- Error Reduction: The machine-readable nature of MICR codes minimizes human errors in data entry, which is common in manual processing.

Wrapping Up!

In summary, IFSC and MICR codes are essential tools in the banking sector for ensuring secure and efficient financial transactions. IFSC codes are used for electronic payments, while MICR codes facilitate the processing of cheques. Both codes help improve accuracy, speed up transactions, and enhance security in the banking system.

Frequently Asked Questions (FAQs)