Difference Between IFSC Code and Swift Code

Last Updated : July 30, 2024, 4:25 p.m.

In the banking sector, terms such as IFSC and Swift Code are used quite frequently. These codes play crucial roles in ensuring a safe and secure transaction process. However, both concepts differ in terms of usage, scope, and the institutions that issue them.

In this article, we will dive into the key differences between IFSC and Swift codes. But before that, let’s understand these terminologies and their significance in the banking and finance industry.

What is an IFSC Code?

IFSC refers to the Indian Financial System Code, which is an 11-digit alphanumeric code to identify specific bank branches that are located within the jurisdiction of India. This code is essential to transfer funds online via NEFT, RTGS, and IMPS. It facilitates electronic funds transfers between banks and ensures that the funds reach the intended recipient.

The IFSC code can be typically found on cheque book, the account holder’s passbook, and RBI’s official website.

Format of IFSC Code

The IFSC code consists of 11 characters. The first four alphabetic characters represent the bank name. The fifth character is always 0 and is reserved for future use. The last six characters (usually numeric but can be alphabetic) represent the bank branch.

What is a SWIFT Code?

A SWIFT Code is assigned to a particular banking or financial institution by the Society for Worldwide Interbank Financial Telecommunication. This code is crucial for international wire transfers, ensuring that funds are sent to the correct bank and branch.

It plays a key role in the smooth processing of cross-border payments, making them fundamental to international trade and finance.

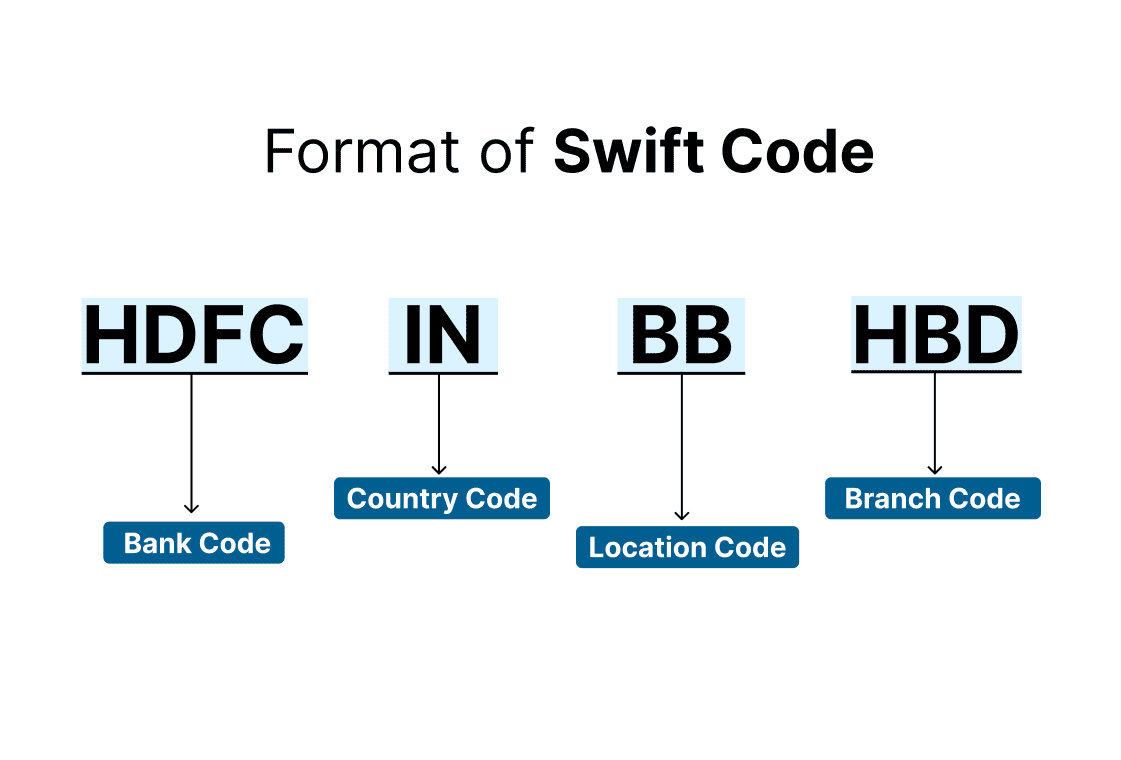

Format of Swift Code

It is a combination of numbers and letters and is generally 8-11 characters long. The code is divided into different sections. The first four characters represent the bank’s name, the next two characters represent the country code, followed by the location code, and in some cases, the branch code.

Is the IFSC code the same as the SWIFT code?

No, the IFSC code and the SWIFT code are not the same. The IFSC code is used primarily within India to facilitate electronic payments between bank branches across the country.

In contrast, the SWIFT code is used internationally to identify banks and financial institutions, making it crucial for international wire transfers and communications between banks in different countries.

The Main Differences Between IFSC Code and Swift Code

As mentioned above, IFSC and SWIFT codes serve different purposes. The table below outlines the main differences between IFSC and SWIFT codes:

IFSC | SWIFT |

|---|---|

This code is essential for transferring money from one account to another in India. | SWIFT code is used for hassle-free and easy transfer of money from a bank account in one country to one located in another country. |

An IFSC code is an 11-digit alphanumeric code. | A SWIFT code has 8-11 characters. |

This code is specific to India and is used by banks operating within the country. | The SWIFT code is a global standard recognized by banks and financial institutions around the world. |

It helps in routing domestic transactions to the specific bank branch in India. | It helps in routing international transactions to the correct recipient bank and branch. |

The Reserve Bank of India (RBI) issues and manages the IFSC code, which is part of the National Electronic Fund Transfer (NEFT) system. | The Society for Worldwide Interbank Financial Telecommunication (SWIFT) network issues and manages this code. |

The first four characters of the code identify the bank's name. The next two characters specify the country code, followed by the location code and sometimes the branch code. | The first four characters indicate the bank's name, followed by two characters for the country code, then the location code, and in some cases, the branch code. |

It is required to transfer funds within the borders of India using electronic fund transfer methods such as NEFT, RTGS, and IMPS. | It is required to transfer funds across borders, which include foreign currency transfers and international remittances. |

IFSC code is available on cheque book, passbooks, the bank’s website, and RBI’s website. | SWIFT Code can be found on your bank’s website or bank statements. |

This code is necessary for various banking activities in India, such as transferring money between banks, paying bills, and other electronic banking transactions. | It is an essential requirement for international trade and commerce that involves the transfer of funds in different currencies. |

Conclusion

In summary, the IFSC code is used for domestic bank transactions within India to identify specific bank branches. In contrast, the SWIFT code is used for international transfers to identify banks globally. Both codes ensure that money is transferred securely to the correct institution.

Frequently Asked Questions (FAQs)