Benefits of IFSC Code: Everything you Need to Know

Last Updated : July 30, 2024, 4:38 p.m.

IFSC, or the Indian Financial System Code, is crucial information for anyone conducting electronic transactions in India. This 11-character code plays a vital role in ensuring your money reaches the right account safely.

Whether you’re transferring funds, making EMI payments, or bill payments, knowing about IFSC codes can make your financial dealings much smoother. In this blog topic, we will explore all the benefits of IFSC codes and why they are essential for modern banking.

Let’s dive in!

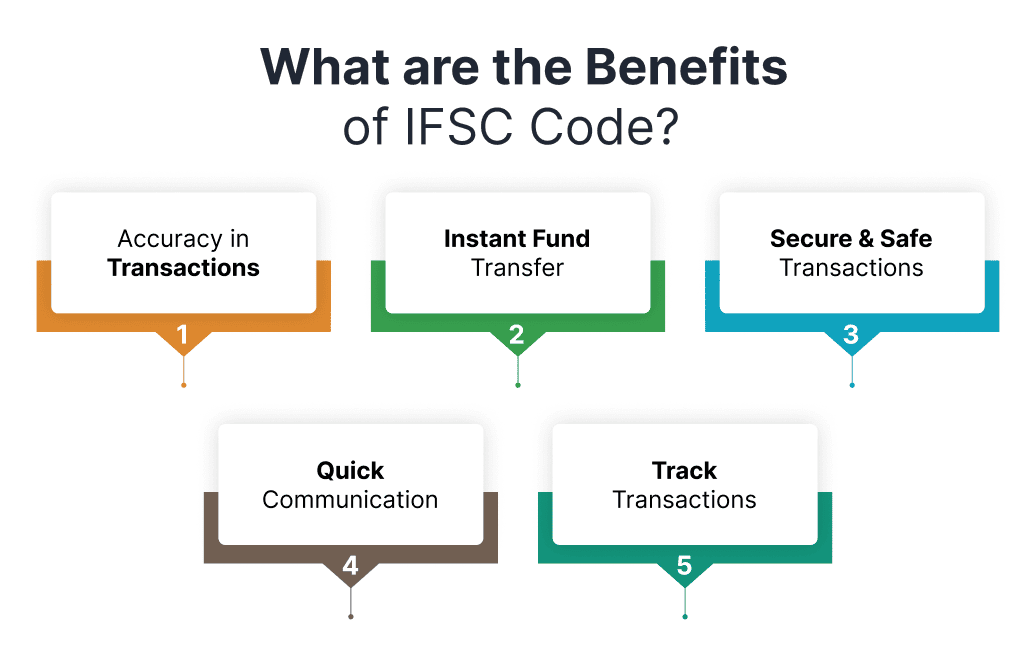

What are the benefits of the IFSC Code?

In this section, we will highlight the main benefits of the IFSC code in facilitating electronic fund transfers. Let’s begin!

Accuracy in Transactions

IFSC codes play an integral role in ensuring money is transferred to the correct bank branch during electronic transactions. By providing a unique identifier for each branch, IFSC codes minimize the risk of transferring funds to the wrong account. This is especially important in a large, complex banking system like India’s.

Instant Fund Transfer

The IFSC code is unique to each bank and its branch, making fund transfers smooth and hassle-free. With an IFSC code, there's no need to wait in long lines at the bank to deposit money. It ensures that transactions are completed quickly and securely from anywhere in the world. This is especially helpful for urgent transfers, as the IFSC code allows transactions to be completed in just a few seconds.

Secure & Safe Transactions

IFSC code enables safe and secure transactions by distinctly identifying the recipient’s bank branch in a transaction, ensuring the funds are sent to the correct destination. This specificity reduces the likelihood of fraud or theft as these codes cannot be breached.

Quick Communication

When you initiate a transaction, the IFSC code plays an essential role in facilitating communication between the sender and recipient. When you make a transaction using NEFT, IMPS, or RTGS, your bank promptly sends an alert to both your mobile and email ID.

Track Transactions

IFSC helps track and monitor your transactions, thus reducing the risk of fraud or misuse of funds. With IFSC, the RBI can monitor and regulate all electronic transactions in the banking system. This promotes transparency and accountability in the sector and protects consumer interests.

How IFSC codes enhance the Efficiency of Indian banks?

The Indian Financial System Code (IFSC) brings numerous benefits to the Indian banking sector, enhancing the efficiency, security, and convenience of financial transactions. Here are the key ways in which the IFSC Code benefits the banking sector:

Facilitates Electronic Fund Transfers

IFSC codes, including NEFT, RTGS, and IMPS methods, are essential for conducting electronic fund transfers within India. They ensure that funds are accurately routed from one bank account to another, making transactions smooth and efficient.

Supports Nationwide Connectivity

IFSC codes enable banks to connect and transact with each other across the country. This nationwide connectivity is crucial for the seamless operation of the banking network, allowing customers to conduct transactions regardless of their geographical location.

Promotes Online and Digital Banking

The use of IFSC codes aligns with the digital nature of modern banking, supporting various online transactions such as bill payments, EMIs, and e-commerce purchases. This digital convenience enhances customer experience and encourages the adoption of online banking services.

Regulatory Compliance and Monitoring

IFSC codes are mandated by the Reserve Bank of India (RBI) to standardize and secure electronic fund transfers. They enable the RBI to monitor and regulate all electronic transactions, promoting transparency and accountability in the banking sector.

Simplifies Accounting and Record-Keeping

Transactions facilitated by IFSC codes are easier to track and record, aiding in accurate accounting, reconciliations, and audit processes. This contributes to transparency and compliance in the banking sector.

How are the IFSC codes Assigned?

The assignment of IFSC codes is managed by the RBI in India. It is an 11-digit alphanumeric code that serves as a unique identifier for each bank participating in the electronic funds transfer systems, such as NEFT and RTGS, regulated by the RBI.

The structure of the IFSC code is such that the first four characters represent the bank name, the fifth character is always zero (reserved for future use), and the last six characters represent the branch name.

What is an IFS code error, and how can it be fixed?

This error occurs when the IFS code entered during a transaction does not match the correct code assigned to a bank branch by the RBI. This mismatch can lead to transaction failures, delays, or in worse cases, the transfer of funds to the wrong account. Here are a few common reasons for IFS errors and how to resolve them:

Common Reasons for IFS Code Errors

- Incorrect entry: The most common reason for an IFS code error is the user's incorrect code entry. This can happen due to typographical errors or confusion between similar-looking characters .

- System issues: Sometimes, technical glitches in the banking system or the transaction platform can cause valid IFSCs to be mistakenly flagged as incorrect.

- Bank branch changes: If a branch is relocated, merged, or closed, its IFSC may change. Users might not be aware of these changes and continue using the old IFSC.

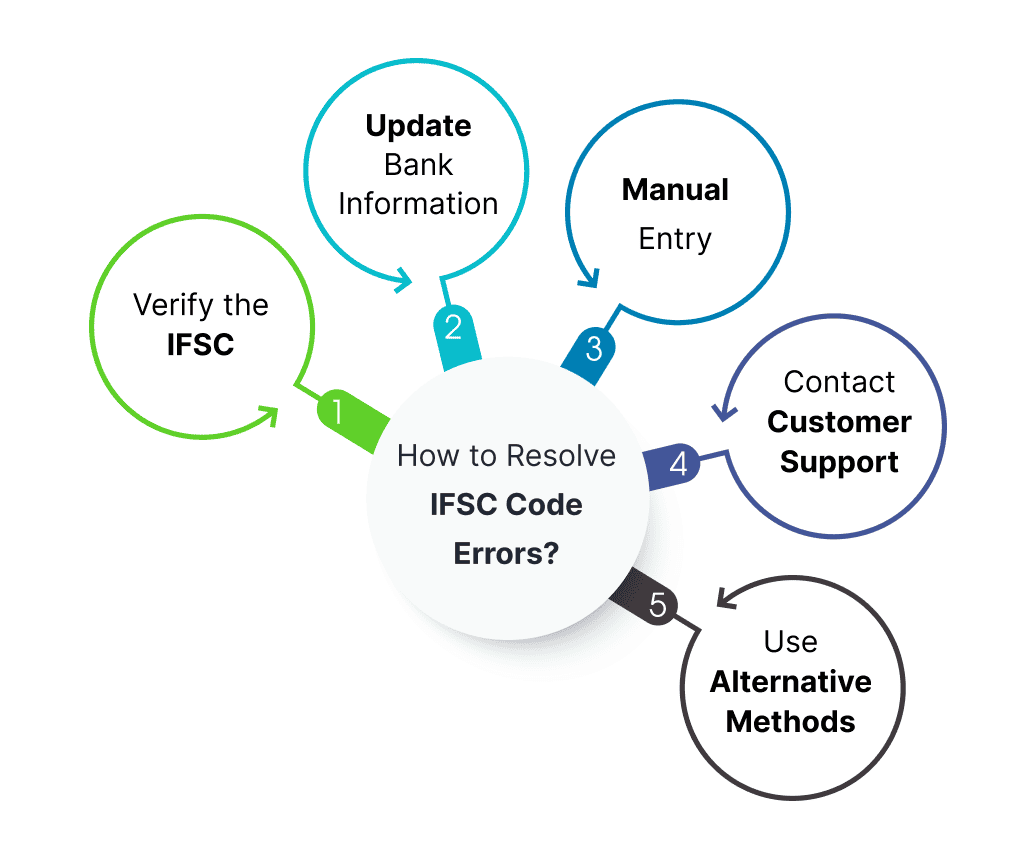

How to Resolve IFS code Errors?

- Verify the IFSC: Double-check the IFSC against reliable sources such as the bank's official website, your checkbook, or your passbook. Ensure that you are using the correct code for your specific bank branch.

. - Update bank information: If your bank branch has been relocated or merged, contact your bank for the updated IFSC. Then, update your banking details accordingly in any saved templates or beneficiary lists.

- Manual entry: If you're facing issues with system-recognized IFSCs, try entering the bank details manually if the platform allows it. This can sometimes bypass system errors.

. - Contact customer support: If you can't resolve the issue on your own, contact the customer support of the bank or the platform you're using for the transaction. They can provide guidance and, if necessary, escalate the issue to technical teams for resolution.

- Use alternative methods : If the IFSC error persists, consider alternative methods for the transaction, such as a different electronic funds transfer system, until the issue is resolved.

Frequently Asked Questions (FAQs)