Home Loan Interest Rates

Last Updated : March 24, 2025, 4:41 p.m.

To buy a house through a home loan, we prefer the lowest home loan interest rates. Since a housing loan may last for 30 years, it is quite normal for people to look for a lower rate of interest. As a borrower, you can check home loan interest rates of different lenders and then select one.

To qualify for a home loan , it’s crucial to have solid proof of income. Your credit score and history also make a big difference in landing a good interest rate. Here’s a look at the current interest rates from some of the top banks in India.

Compare All Banks Home Loan Interest Rates in India 2025

Below is the table showing the interest rates and processing fee of home loans offered by several lenders.

List of Banks/NBFCs | Home Loan Interest Rates | Processing Fees |

|---|---|---|

8.75% onwards | Up to 1% of the Loan amount subject to a minimum of INR 10,000 Upfront processing fee of INR 5,000 + GST | |

8.91% - 13.08% | 1% of Loan Amount, Min INR 5,000 + GST | |

8.15% - 10.35% | For loans up to Rs 50 lakh, the fee is 0.50% of the loan amount, ranging from a minimum of Rs 8,500 (upfront) to a maximum of Rs 15,000. | |

8.15% - 10.60% | For individuals: 0.35% of the loan amount, with a minimum of ₹3,500 and a maximum of ₹30,000. | |

8.10% onwards | 0.25% of the loan amount + GST | |

8.15% - 11.00% | 0.50% of the loan amount + GST | |

8.25% - 9.25% | 0.50% of the loan amount subject to a maximum INR 20,000 + GST | |

9.90% onwards | 0.50% of the loan amount to a maximum of INR 7,500 + GST | |

10.00% onwards | 3% of the loan amount + GST | |

8.70% - 9.95% | Up to 0.50% of the loan amount or INR 3,000 whichever is higher, plus applicable taxes. | |

8.60% onwards | 1% of the loan amount or INR 10,000, whichever is higher. | |

9.00% - 10.05% | 0.50% to 2.00% of the loan amount or INR 3,000, whichever is greater. | |

8.40% - 12.65% | 0.50% of the loan amount to a maximum of INR 2,500 + GST | |

8.85% onwards | Up to 3% of the overall loan amount. | |

8.35% - 9.90% | 1% of the loan amount or INR 10,000, whichever is greater. | |

Sammaan Capital (Formerly known as Indiabulls Housing Finance) | 8.75% - 15.00% | 0.50% of the loan amount to a maximum of INR 15,000 + GST |

8.75% - 9.85% | 0.25% of the loan amount plus applicable GST, with a minimum of INR 2,000 + GST and a maximum of INR 50,000 + GST. | |

9.04% onwards | 0.50% of the loan amount + GST | |

8.75% - 11.65% | Loans up to INR 25 lakhs: INR 2,500 + GST | |

8.65% onwards | Zero processing fee for online application (up to 1.25% of Loan amount for offline application) | |

8.25% onwards |

| |

8.40% - 11.00% | As applicable | |

8.15% onwards | 0.35% of the loan amount, subject to a minimum and maximum of INR 2,500 and INR 15,000 respectively | |

8.15% Onwards | INR 10,000 + GST | |

8.35% - 9.85% | Loans up to INR 25 lakh – 0.15% of the loan amount, with a minimum of INR 1,000 and a maximum of INR 3,750. | |

9.75% - 13.00% | Up to 0.75% of the loan amount + GST | |

9.00% onwards | 1.25% of the loan amount. | |

8.25% onwards | 0.35 % of loan amount and maximum INR 10,000 +GST | |

8.95% onwards | Up to 1% of the sanctioned amount. | |

8.75% onwards | 2% of the loan amount + GST | |

8.15% onwards | 0.5% of the loan amount, to a maximum of INR 15,000 + GST | |

9.00% - 12.00% | 1.5% of the loan amount or a maximum of INR 10,000 + GST |

Note: As per RBI guidelines, prepayment of home loans linked to a floating rate of interest attracts no prepayment charges.

Types of Interest Rates in Home Loan

In India, home loans offer borrowers various options when it comes to interest rates. Understanding the different types of interest rates is crucial for borrowers to choose the most suitable option based on their financial circumstances and preferences. Here are the common types of interest rates available in home loans:

1. Fixed Interest Rate

- With a fixed interest rate, the rate remains constant throughout the loan tenure, providing borrowers with stability and predictability in their monthly payments.

- Borrowers benefit from knowing exactly how much they need to pay each month, regardless of fluctuations in market interest rates.

- However, fixed interest rates may be slightly higher than floating rates initially, and borrowers may miss out on potential savings if market interest rates decrease in the future.

2. Floating Interest Rates

- A floating interest rate, also known as a variable or adjustable interest rate, fluctuates based on market conditions and benchmark rates set by the lending institution or external factors like RBI policy rates.

- Borrowers may initially pay lower EMIs if market rates are low, but their payments could increase if interest rates rise.

- Floating rates offer the potential for savings over the loan tenure if market interest rates decrease.

3. Hybrid or Semi-Fixed Interest Rate

- Some lenders offer hybrid or semi-fixed interest rate options that combine features of both fixed and floating rates.

- Typically, these loans have a fixed interest rate for an initial period (usually a few years), after which they switch to a floating rate for the remaining tenure.

- Borrowers benefit from the stability of fixed rates during the initial period and the potential for savings with floating rates later on.

4. Base Rate and MCLR

- In India, lenders used to follow the Base Rate system to determine interest rates on loans. However, since April 2016, most banks switched to the Marginal Cost of Funds based Lending Rate (MCLR) system.

- Under the MCLR system, interest rates are determined based on the marginal cost of funds, taking into account factors such as repo rates, cost of deposits, and operating expenses.

- Home loan interest rates are typically linked to the bank's MCLR, with a margin added on top to determine the final rate charged to borrowers.

5. External Benchmark Rate

- In line with RBI directives, many banks have transitioned to linking their lending rates to external benchmarks such as the repo rate, Treasury Bill yield, or any other benchmark published by Financial Benchmarks India Pvt. Ltd. (FBIL).

- This move aims to ensure greater transparency and faster transmission of changes in policy rates to borrowers.

- Home loan interest rates linked to external benchmarks are subject to periodic reset based on changes in the benchmark rate.

Choosing the Right Interest Rate Option

When selecting an interest rate option for a home loan, borrowers should consider factors such as their risk tolerance, outlook on interest rate movements, and financial stability. Fixed rates offer certainty but may come at a higher cost, while floating rates provide flexibility but expose borrowers to interest rate fluctuations. Hybrid options offer a middle ground for those seeking a balance between stability and potential savings.

It's crucial for borrowers to carefully evaluate their options, assess their financial situation, and consult with financial advisors if needed to make an informed decision that aligns with their long-term financial goals. Additionally, borrowers should inquire about any associated fees, prepayment charges, and the process for switching between interest rate options to ensure they have a comprehensive understanding of the loan terms.

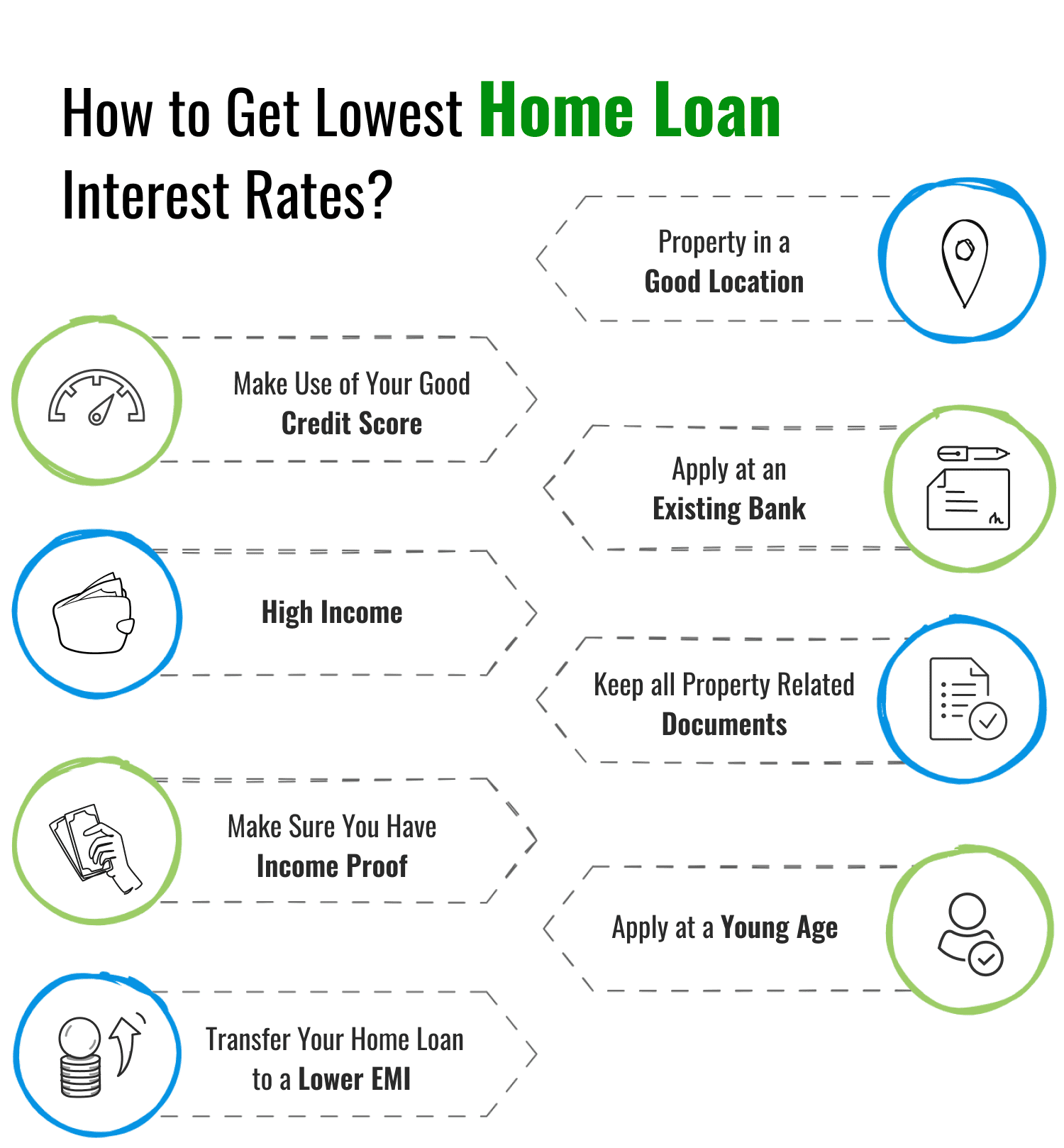

How to Get Lowest Home Loan Interest Rates?

There are certain factors based on which a home loan interest rate is offered which are as follows:

- Property in a good location – Property in an approved society has more chance of getting a loan amount of up to 75-90% of the property value.

- Make use of your good credit score – You must have a CIBIL score of 650 or above to get approval for it.

- Apply at an existing bank – A good understanding of the bank helps you avail a high loan amount and that too at a competitive rate of interest on your home loan without any hassle.

- High Income – A person earning a high income has more chances of getting a lower rate and a higher amount.

- Keep all property-related documents – It is very important to maintain and keep all the property documents with you. As it helps the lender identify your property and its worth properly and thus trust your profile.

- Make sure you have income proof – Many people do not know that your loan application may be rejected. If you do not have an income proof or salary slip. Only a few NBFCs accept such cases but then they give high rates.

- Apply at a young age – If your age at the time of applying is in your early 30s or late 20s. You are more eligible for a higher loan amount as you have fewer financial liabilities.

- Transfer your home loan to a lower EMI – You can transfer your existing home loan to a lender offering a lower rate on your home loan to save your money.

How to calculate your Home Loan EMI?

A home loan EMI calculator is used for checking monthly installments on a housing loan. You have to mention the housing loan interest rate, total loan amount, and tenure. The formula used for the calculation is as follows:

EMI = [P x R x (1+R)^N]/[(1+R)^N-1]

where,

EMI = Equated Monthly Installment

P = Principal Loan Amount

R = Monthly Interest Rate

N = Number of Monthly Installments

Home Loan Interest Rate Calculator

One of the most critical factors to consider when taking out a home loan is the interest rate. Even a slight difference in interest rates can significantly impact the total amount you pay over the loan tenure. To help borrowers estimate their potential monthly payments and total interest costs, many lenders and financial websites offer home loan interest rate calculators.

How does It Works?

A home loan interest rate calculator is a simple yet powerful tool that allows borrowers to input key variables such as the loan amount, interest rate, loan tenure, and sometimes additional parameters like processing fees or prepayment options. Based on this information, the calculator computes the monthly EMI (Equated Monthly Installment) and the total interest payable over the loan tenure.

Benefits of Using a Home Loan Interest Rate Calculator

- Accurate Estimation: By inputting specific loan parameters, borrowers can obtain a precise estimate of their monthly payments and total interest costs. This allows for better financial planning and budgeting.

- Comparison Tool: Home loan interest rate calculators enable borrowers to compare different loan options offered by various lenders. By tweaking the interest rate or loan tenure, borrowers can see how different scenarios affect their repayment obligations.

- Decision Making: Armed with accurate financial data, borrowers can make informed decisions about the affordability and suitability of different loan options. They can assess whether a particular loan aligns with their financial goals and budget constraints.

- Prepayment Planning : Some calculators also allow borrowers to simulate the impact of making additional payments or lump-sum prepayments towards the loan principal. This feature helps borrowers understand how prepayments can reduce the loan tenure and overall interest costs.

- Accessibility: Many home loan interest rate calculators are available online and can be accessed for free on lender websites or financial portals. This accessibility allows borrowers to use the calculator multiple times, exploring various scenarios before making a decision.

Using a Home Loan Interest Rate Calculator: Step-by-Step Guide

- Input Loan Details: Enter the loan amount, interest rate, and loan tenure into the designated fields.

- Add Additional Parameters (Optional): Depending on the calculator, you may have the option to include additional parameters such as processing fees or prepayment options.

- Review Results: Once you've entered all relevant information, the calculator will generate the estimated monthly EMI and total interest payable over the loan tenure.

- Analyze and Compare: Analyze the results to understand the affordability of the loan and how different scenarios impact your repayment obligations. Compare multiple loan options to find the most suitable one.

- Consider Prepayment Options: If applicable, use the calculator to explore the impact of making extra payments towards the loan principal. This can help you plan for accelerated repayment and savings on interest costs.

By utilizing a home loan interest rate calculator, borrowers can gain valuable insights into their potential loan obligations and make well-informed decisions that align with their financial objectives. Whether you're a first-time homebuyer or looking to refinance an existing loan, this tool can be instrumental in navigating the complexities of home loan financing.

How Can You Make the Most of Lower Home Loan Interest Rates?

If you are eligible for lower interest rates, not only should you grab it at the earliest. But also make sure the loan tenure is optimized to save you more. An optimized tenure means neither too short nor too long. An example below can help you understand it better.

Example – You are earning INR 80,000 (Net) in a month. A lender has come with a loan offer of INR 40 lakh at 7.60% per annum. Now, you are looking for a 20-year deal. But what if you curtail it to 15 years? Let’s check out the table below to know the differences of payment between these two tenure options.

| Tenure Options | EMI | Interest Outgo |

|---|---|---|

| 20 Years | INR 32,469 | INR 37,92,453 |

| 15 Years | INR 37,308 | INR 27,15,497 |

So, you can see a savings of around INR 10,76,956 (37,92,453-27,15,497) on reducing the tenure to 15 years instead of continuing it for 20 years. Yes, the EMI will rise by around INR 4,839 (37,308-32,469) when you choose a tenure of 15 years. Despite that, the EMI constitutes below 50% of your net monthly income. The lender can approve such a repayment tenure if you don’t have any other obligation.

Do Lenders Give You the Interest Rate Conversion Facility on a Home Loan?

Home loans are offered at both fixed and floating interest rates. Fixed-rate loans come with the same rate of interest throughout the tenure. Whereas floating-rate loans will see changes in the interest rate as and when changes take place in the market. Even with rate changes, floating-rate home loans have lesser interest obligations for borrowers than what could be the case with fixed-rate loans. So, if your home loan is on a fixed rate, you can get it converted into a floating rate and save on the interest. However, banks can charge on the conversion. Check out the table below to know the conversion fee applicable to changing from a fixed rate to a floating rate.

| Lenders | Conversion Charges |

|---|---|

| State Bank of India (SBI) | 0.56% of the outstanding amount |

| HDFC Limited | 1.75% + applicable taxes on principal outstanding |

| ICICI Bank | INR 3,000 |

| LIC Housing Finance (LIC HFL) | INR 3,000 |

| Punjab National Bank (PNB) | As Applicable |

| PNB Housing Finance (PNBHFL) | 0.50% of the principal outstanding |

| Axis Bank | 0.5% - 1% of the loan amount |

| Kotak Mahindra Bank | 0.50% of the principal outstanding |

| YES BANK | 0.50% of the principal outstanding |

Is the Conversion Allowed Within a Floating Rate Home Loan?

Switching from a fixed rate to a floating rate means considerable benefits for borrowers in terms of interest savings. You can further enhance your savings by switching to the most cost-efficient floating interest rate benchmark. Presently, there are base rate, the marginal cost of lending rate (MCLR), and repo-linked lending rate (RLLR) benchmarks. Of these, the RLLR is an external benchmark and is more transparent to the rate changes made by the Reserve Bank of India (RBI) than the other benchmarks. If you compare well. You’ll find that RLLR-based home loans come with an interest rate lower than the MCLR-based one by at least 0.30%-0.40% on average. So, if you’re in the base rate or MCLR and want to get into an RLLR-based home loan. The conversion fee will apply. Want to see the fee? Check out the table below.

| Lenders | Conversion Charges |

|---|---|

| State Bank of India (SBI) | INR 5,000 |

| ICICI Bank | 2% of the principal outstanding |

| Punjab National Bank (PNB) | As Applicable |

| Bank of Baroda | NA |

| Axis Bank | INR 1000 - 5000 |

| Kotak Mahindra Bank | As Applicable |

| YES BANK | NIL |

What Should You Do if the RLLR-based Home Loan Rate of Your Bank is Higher than the Prevailing Market Rate?

In case your home loan interest rate despite RLLR is higher than the average market rate, maybe you should do a balance transfer to another lender at a lower rate. The immediate benefit can be in the form of a lower EMI. This will go on to reduce your interest obligation substantially over time, provided the new rate is at least 0.25%-0.50% lower than the existing rate and there’s quite a lot of time left for the loan repayment.

The balance transfer will come with a switchover fee. Which can be a flat amount or a percentage of the transferred balance. Some lenders can also give you a waiver on the balance transfer fee. However, such offers don’t last forever as they are valid for a specific period. So, if your home loan rate is quite high and you see a lender giving you the balance transfer facility at a lower rate, grab it at the earliest. If that comes with a fee waiver too, you will only gain more from this transaction.

Frequently Asked Questions (FAQs)