UAN Activation

Last Updated : April 10, 2025, 12:44 p.m.

The EPFO is behind assigning UANs, or Universal Account Numbers. When a person is assigned multiple Member IDs by various organizations, the UAN will serve as a single point of contact.

EPFO is the Employee Provident Fund Organization where the employee and the employer register themselves to make contributions. On the other hand, they need a Universal Account Number to access their EPF account. EPFO UAN is a 12 digit number issued by EPFO so that the employee can access their previous and present PF accounts. To access easily you must be well versed with UAN Activation Process to smoothly access your EPFO accounts. To activate UAN the process is simple and less complex. There are two options, either you can visit the official website of EPFO to activate UAN or download the Umang app. We will help you with both the methods for EPFO UAN activation.

Process of UAN Activation

You must go through both of the activation options which are present , as the information has already been delivered to you, you can easily activate UAN using the Umang App and the EPFO website. There are simple steps involved that will help you to activate the EPFO UAN.

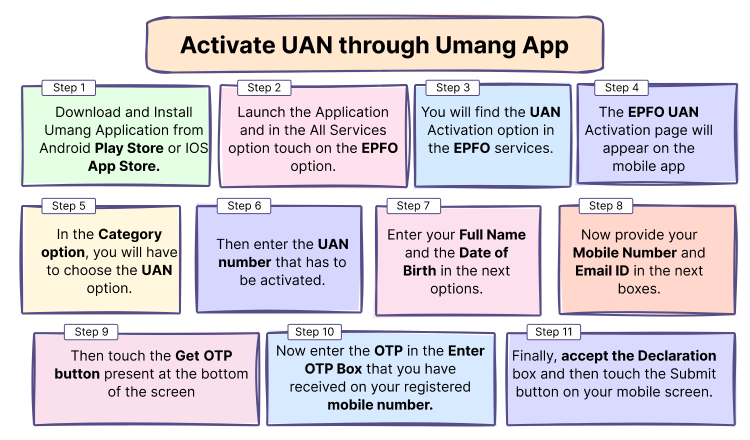

Activate UAN through Umang App

- Download and Install Umang Application from Android Play Store or IOS App Store.

- After Opening the application, click on the EPFO option under All Services .

- You will find the UAN Activation option in the EPFO services.

- The EPFO UAN Activation page will appear on the mobile app.

- Under Category option, you will have to choose the UAN option.

- Then enter the UAN number that has to be activated.

- Enter your Full Name and the Date of Birth in the next options.

- Fill your Mobile Number and Email ID in the next boxes.

- Then touch the Get OTP button present at the bottom of the screen.

- Now enter the OTP in the Enter OTP Box that you have received on your registered mobile number.

- After the final step , tap on the submit button on your mobile phone after clicking on declaration.

You have done Umang UAN Activation and you will receive a confirmation message saying “Your UAN is Activated. The password is sent to your registered mobile number”. So, by using the UAN and Password, you can make the UAN Login and manage your EPFO account.

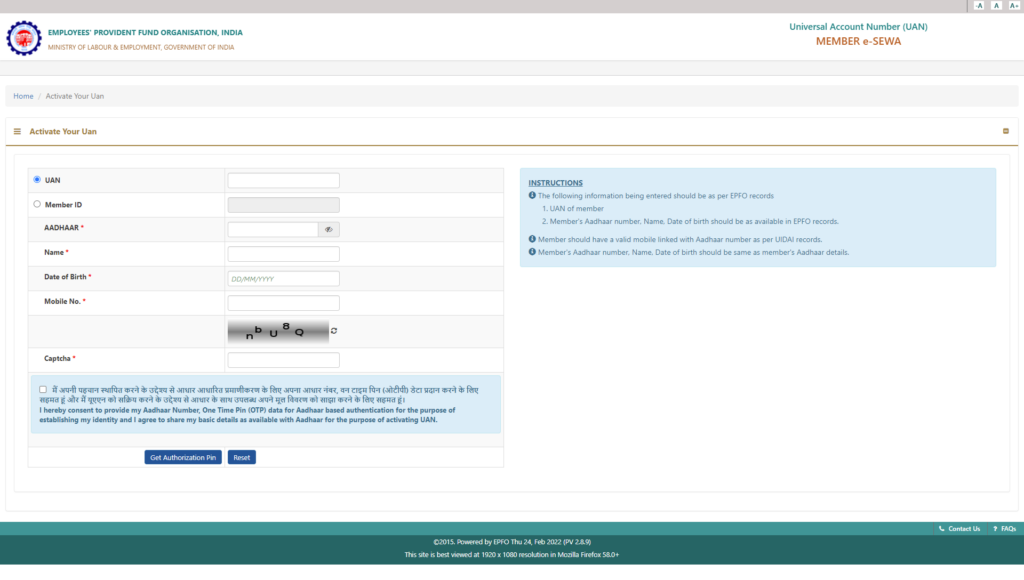

Activate UAN through EPFO Official Website

To access various services of EPFO , use the official portal. Before proceeding you have to activate the UAN Portal. EPF Services will not open , if you don't activate your UAN services portal.

Steps to activate UAN online through the UAN portal:

- First, go to the Member Portal for EPF.

- Select "UAN Activation."

- After your name, mobile number, Aadhar card number, and other information add UAN Number.

- Complete the captcha present on the screen and select " Get Authorization PIN. "

- On your registered mobile a PIN will be generated.

- Enter the pin which is there on the website and select “ Validate OTP and Activate UAN ” After clicking on the Validate OTP and Activate UAN button , your UAN will be finally activated. And then you will receive the UAN password on your phone and your UAN will be enabled.

- UAN and UAN password can be used to access your EPF account every time.

.You will receive a confirmation message on the screen that says “Your UAN is activated. The Password is sent to your registered mobile number”. You can easily manage your EPFO account using the UAN and the password you have received on your mobile phone.

EPFO Face Recognition For UAN Activation

The EPFO (Employees' Provident Fund Organisation) introduced Face Recognition Technology as a convenient method for UAN (Universal Account Number) activation and identity verification, especially helpful for pensioners and employees who face difficulties with other KYC methods like Aadhaar OTP or fingerprint authentication.

What is EPFO Face Recognition for UAN Activation?

It is a biometric-based verification system where the individual's facial data is used to authenticate their identity. It helps:

- Activate UAN for first-time users

- Verify identity for services like life certificate (Jeevan Pramaan) submission, especially for pensioners.

- Ensure a touchless, OTP-free process, which is useful for users without mobile access or with fingerprint mismatches.

Step-by-Step: How to Instantly Generate and Activate UAN Using Face ID

As of now, EPFO’s face authentication is being rolled out in phases, mostly through:

Download the Required Apps

- Install the UMANG App from the Google Play Store or Apple App Store.

- Also, install the Aadhaar Face RD App from the Play Store (used for face authentication).

Open the UMANG App

- Launch the UMANG App and navigate to EPFO services.

- Choose the option to Generate UAN via Face Authentication.

Enter Basic Details

- Provide your Aadhaar number and complete other basic information like name, date of birth, and mobile number (linked with Aadhaar).

Face Authentication

- The UMANG App will prompt the Aadhaar Face RD App to open your front camera.

- Align your face as instructed for successful biometric capture.

- The app will automatically verify your identity against Aadhaar records.

UAN Generation and Activation

- Once authentication is successful, your UAN will be generated and activated instantly.

- You’ll receive a confirmation message and details on your registered mobile number.

Download e-UAN Card

- After activation, you can download your e-UAN card in PDF format directly from the UMANG App.

- This digital card can be shared with your employer for easy EPF onboarding.

Additionally, EPFO members can now download their e-UAN card in PDF format, which can be conveniently shared with employers to streamline the onboarding process.

You’ll typically need:

- A smartphone or laptop with a webcam

- A valid Aadhaar linked to UAN

- Good lighting and stable internet for proper facial capture.

Key Benefits of Using Face Authentication Technology (FAT) for UAN Activation

Using Face Authentication Technology (FAT) for the UAN activation process offers several key advantages:

Foolproof Aadhaar Validation

User details are fetched directly from the Aadhaar database, ensuring complete authenticity and minimizing the chances of identity mismatch.

Instant UAN Activation

- The UAN is generated and activated in real time, eliminating the need for any separate activation steps or waiting periods.

Immediate Access to EPFO Services

Once the UAN is active, members can instantly begin using EPFO services such as:

- Viewing passbooks

- Tracking claim status

- Updating KYC details

- Managing personal and employment records

Digital Convenience

- Members can download their e-UAN card in PDF format for easy sharing with employers, enabling quicker onboarding and seamless recordkeeping.

No Biometric Devices Needed

- The process is completely touchless, requiring only a smartphone or device with a front camera, making it especially useful in remote or rural areas.

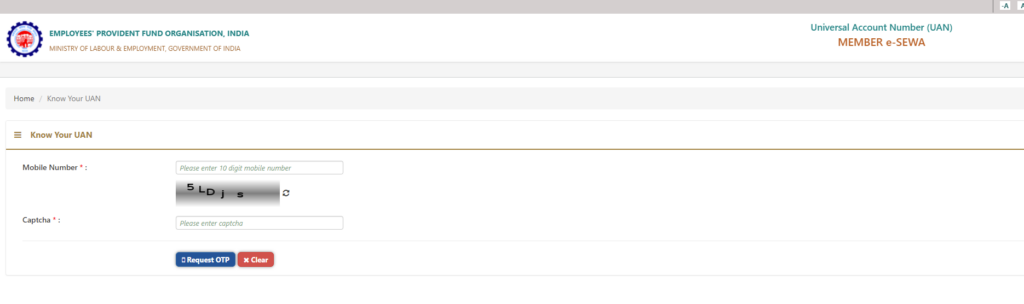

How to Know Your UAN?

After the UAN generation , the employees will receive both the UAN and EPF account number from their employers.

If you don’t know your Universal Account Number then you can follow the steps given below to generate the number:-

- Visit the member portal for EPF.

- Select the "Know Your UAN" option now.

- Put the mobile number which you have provided to your employer.In order to activate their UAN number, they have registered this cell phone number.

- Utilize similar to identify your UAN

- After entering the Captcha code, select “Request OTP.”

- Enter the captcha and the OTP that you will receive on your phone.

- Input your personal information, including your name, Aadhar card number, PAN, and the verification captcha.

- After Selecting “Show my UAN.” You will be able to know your UAN.

Once you have the UAN, you can activate it by following the steps given above.

Link your Aadhaar with UAN

- Visit the EPFO Portal and log in with your UAN & password.

- Go to ‘Manage’ → ‘KYC’ and select ‘Aadhaar.’

- Enter the Aadhaar number & name, then click ‘Save.’

- Check ‘KYC Pending for Approval’—employer approval & UIDAI verification will confirm the update.

Documents Needed for UAN Activation

You will have to enter the details of the following documents at the time of registering and activating UAN.

- Aadhar Card

- PAN Card

- Bank Account Details with IFSC

- Driving licence

- Passport

- Voter ID

- Proof of Address

- ESIC Card

Relevance of Universal Account Number (UAN)

- Enables Online Access – Activating UAN allows members to use all EPFO online services.

- Consolidates EPF Accounts – Members can track all their EPF accounts under one UAN.

- Simplifies PF Transfers – PF balance can be easily transferred online from an old account to a new one.

Need for a UAN

Earlier, employees used to get only the PF account number and it became difficult for them to calculate the exact value of their funds. But after the introduction of Universal Account Number, all the PF accounts associated with multiple IDs of different corporate organizations were assembled in one place. Now, an employee can easily withdraw or transfer funds with the help of a Universal Account Number. Therefore it is necessary for every employee to activate the UAN in order to manage his EPFO account.

Advantages of Activating UAN for Employer and Employee

- The employee can view and download the passbook with the help of EPFO UAN.

- You will have to enter UAN and Password while making an Employee or Employer Login.

- Employers’ involvement has decreased after the introduction of a UAN.

- Employees can easily transfer their old PF to the new PF account with the help of a UAN and KYC.

- After registering at the UAN portal you can easily receive the contribution alerts on your mobile phones through an SMS.

- The UAN helps the EPFO to track the change in the job of the employee.

- Whenever you change your job, you will have to link a new PF account to the UAN and the EPFO will update the same in the records.

- EPFO UAN helps to withdraw and transfer funds online when you change your job.

- UAN also ensures the authenticity of the employees who are registered in EPFO.

Link Aadhaar Card with UAN

To access your EPF and associated services, you must link your Aadhar Card and UAN. You must take the following actions in order to link your Aadhaar with UAN :-

- Access your EPF account by visiting the EPF Member Portal and logging in.

- Choose "KYC" from the "Manage" menu.

- To pick Aadhar, click on the box in front of it.

- Enter your name and 12-digit Aadhar Card number.

- Choose "Save."

- You will receive a notification saying that "KYC Pending for Approval".

It will require several days for UIDAI to verify your information.

When it's finished, a note saying "Verified by UIDAI" appears on your Aadhar and your employer's name is listed as "Approved by Establishment."

Benefits of UAN

Here are the benefits of UAN -

- A single UAN account will house all newly opened PF accounts associated with new jobs.

- You can easily withdraw PF using this UAN.

- The employees can also transfer the PF balance from old PF number to new PF number through UAN.

- Logging in with your member ID or UAN will allow you to download your PF statement at any time.

- UAN makes sure that employers are unable to access or withhold their employees' PF funds.

Conclusion

Now you know the whole process of EPFO UAN activation. You have two options to activate UAN either through the Umang app or EPFO official website. If it is feasible for you to activate UAN through the Umang app then you can easily do the same if you have a smartphone.

On the other hand, you can activate the EPFO UAN through the official website and manage your funds online.

Frequently Asked Questions (FAQs)

What is UAN?

How to Activate UAN through SMS?

Can I activate UAN through Mobile?

What are documents needed for UAN registration?

Will I have to activate UAN again if I switch my job?

Do I need an Aadhar to activate UAN?

Can Employers see the UANs Allotted to its Employees?

Best Offers For You!

Home Loan by Top Banks

Personal Loan Rates by Top Banks

- HDFC Personal Loan Interest Rates

- ICICI Personal Loan Interest Rates

- Kotak Personal Loan Interest Rates

- IndusInd Bank Personal Loan Interest Rates

- RBL Bank Personal Loan Interest Rates

- YES BANK Personal Loan Interest Rates

- IDFC First Bank Personal Loan

- Tata Capital Personal Loan

- SMFG India Credit Personal Loan

- SCB Personal Loan Interest Rates

- SBI Personal Loan Interest Rates

- Axis Bank Personal Loan Interest Rates