EPFO Withdrawal Claim Rules

Last Updated : Aug. 2, 2024, 3:43 p.m.

An employee can make partial withdrawals from his accumulated Provident Fund. You can withdraw the necessary funds by making the EPFO Claim Online simply by filling out the form online. EPFO only permits employees to withdraw funds if the employee will link their Aadhar to their UAN. As a result, you can use the employee login portal to submit an EPF Claim Online. Here we will talk about the process as well as the PF withdrawal rules for an EPFO Claim.

Online Process of EPFO Withdrawal Claim

You must check the steps involved in filing an EPFO Claim online. There are some simple steps that will definitely help you to make a withdrawal from your EPF balance .

- To sign in, enter your UAN and Password at the UAN Member Portal.

- Head over to the Online Services Tab from the extended list.

- Choose the Composite Claim (FORM-31, 19&10C) option.

- Then, you will be able to see the member and KYC details. Now you have to enter your account number which is already there in the EPFO database.

- Once you have entered your account number, hit the verify button.

- Agree to sign the Certificate of Undertaking.

- Now click on the “Proceed to Claim Option” to move on to the next page.

- On the very next page, select the Form type (Form 31,19,10C & 10D) that you want to apply for in the “ I want to Apply for” Section

- In the next field, you need to select “Select Service” which means the company you are working in.

- Select the Purpose for which advance is required’ option to withdraw the PF amount. At the same time, you can also see the employees who are not eligible for the withdrawal in the Red Warning Box.

- Now enter the Withdrawal Amount you want to claim in the “Amount of advance’’ box.

- Provide the employee address (Locality, Street, State, City, and 6-digit PIN code).

- Now you need to upload your Bank Passbook/cheque scanned copy (Note* Make sure that the Passbook /cheque has your Complete Name, Bank account No & IFSC code clearly mentioned on it).

- Authorize by clicking the checkbox.

- To validate your Aadhaar Card Number click on “Get Aadhar OTP’’ and enter the 6-digit OTP you will receive on your registered mobile number. Validate your OTP and Submit the Claim form.

- Now you can see, your application has been submitted successfully.

- Once you apply successfully you can download your claim receipt for further reference and you have to click on the “Click Here” to view the PDF file.

The EPFO will send you a claim notification to your registered mobile phone number. Although there is no set period for the transfer of money, it may take up to 15-20 days for the withdrawn funds to reflect in your account.

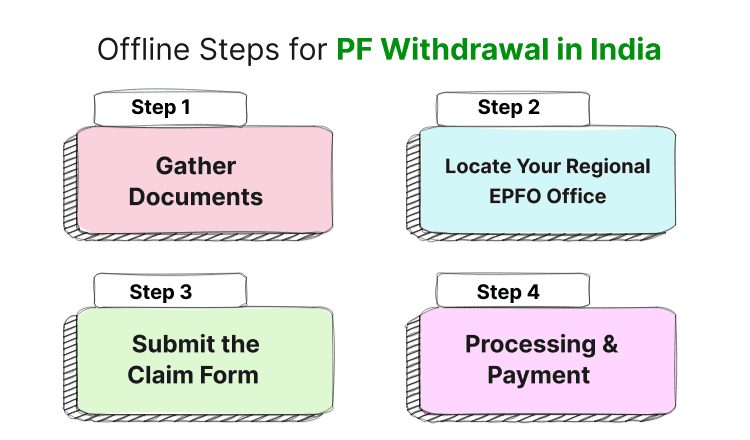

Offline Steps for PF Withdrawal in India

While online PF withdrawal is becoming increasingly popular, there's still an option to complete the process offline. Here's a breakdown of the steps involved:

1. Gather Documents

Before heading to the EPFO office, ensure you have the following documents in order:

- Completed Composite Claim Form (Aadhaar or Non-Aadhaar):

- Download the form from the EPFO website (https://www.epfindia.gov.in/site_en/WhichClaimForm.php).

- Choose the appropriate form based on whether you have linked your Aadhaar card with your UAN account. (Aadhaar - No employer attestation required / Non-Aadhaar - Requires employer attestation)

- Fill out the form carefully, providing accurate details.

- Identity Proof: A copy of a government-issued ID card like PAN card, Passport, Voter ID, or Aadhaar card.

- Address Proof: A copy of a document that verifies your current address like utility bill (electricity, water), bank statement, or passport.

- Two Revenue Stamps: Affix one cancelled and one uncancelled revenue stamp on the claim form.

- Bank Account Details:

- A copy of a cancelled cheque from the bank account where you want the PF amount to be deposited. OR

- A bank statement (in your name) showing your account number and IFSC code.

- Additional Documents (if applicable)

- For claiming full PF amount before 5 years of service: Copies of ITR Forms 2 and 3

2. Locate Your Regional EPFO Office

You can find the address of your jurisdictional EPFO office through the following methods:

- EPFO Website: Go to the EPFO website ( https://www.epfindia.gov.in/site_en/WhichClaimForm.php ) and navigate to the "Our Offices" section. You can search for the office by state and location.

- UAN Portal: Log in to the UAN member portal ( https://unifiedportal-mem.epfindia.gov.in/ ) and check the "Contact Us" section. Your regional office details should be listed there.

3. Submit the Claim Form:

Visit your jurisdictional EPFO office during their working hours and submit the duly filled Composite Claim Form along with all the required documents.

4. Processing and Payment:

Once you submit the claim form, the EPFO will verify your details and process your request. The processing time can vary, but you'll typically receive the PF amount within a few weeks. The funds will be deposited directly into the bank account you specified in the claim form.

Impotant Note:

- Employer Attestation (Non-Aadhaar Form): If you're using the Non-Aadhaar Composite Claim Form, you'll need to get it attested by your current or previous employer before submitting it to the EPFO office.

- UAN Activation: Ensure your UAN is activated before initiating the offline PF withdrawal process.

By following these steps and keeping the necessary documents handy, you can efficiently complete your PF withdrawal offline at the EPFO office..

EPFO Withdrawal Claim Rules 2024

Once you decide to withdraw the PF amount to meet your financial emergency, there are some PF withdrawal rules that you might need to look out for before filling out forms for EPFO claims online.

- The member shall activate their UAN (Universal Account Number), and the mobile number used to activate the UAN must be operational.

- While submitting the claim, the member’s Aadhaar details should be present in the EPFO and the member should use the OTP option to validate e-KYC from UIDAI.

- The EPFO database should be up to date with the member’s bank account information, including the IFSC code.

- If the service period is shorter than five years, the member's Permanent Account Number (PAN) must be updated in the EPFO database for PF Final Settlement Claims.

- Withdrawals from the Provident Fund within five years of opening the account are taxable. However, if the withdrawal amount is less than Rs. 50,000, no TDS (Tax Deducted at Source) will be applied.

- After your retirement, you can withdraw the whole EPF balance.

- EPFO permits the withdrawal of up to 90% of the EPF corpus one year before retirement, provided that the individual is at least 54 years old.

- According to EPFO, the earliest retirement age is 55 years.

- According to the EPF withdrawal rules, EPFO only permits partial withdrawals if there is a medical emergency, higher education, property purchase, or construction which is also subject to the years of service/membership with EPFO.

- EPFO permits the withdrawal of 75% of the EPF funds after one month of unemployment. The remaining 25% can be transferred to a new EPF account upon gaining new employment.

EPF Withdrawal After 5 Years of Service

If you want to withdraw funds before 5 years of service, you need to keep the following rules in mind:

- The latest changes to ITR Forms 2 and 3 require the assessee to provide a detailed breakdown of annual deposits into the PF account.

- EPF contributions are made up of four components: the employee's contribution, the employer's contribution, and the interest earned on these contributions.

- If the employee has previously claimed an exemption on EPF contributions under Section 80-C, then upon withdrawal, all four parts become taxable.

- If no exemption was claimed in the previous year, the employee's contribution is exempt from tax at withdrawal.

- The Income Tax Department reviews the detailed breakdown of PF contributions to assess the taxability of a withdrawal.

- They also determine if additional tax is due after re-evaluating the account.

- Tax on the withdrawal is based on the income tax slab of the employee for each year considered.

- Although the tax applies in the year of withdrawal, it considers the employee's tax bracket for each specific year of contribution.

PF Withdrawal for Home Loan Repayment

EPF members can now use the funds in their EPF accounts to support their housing needs after three years of opening their accounts. According to the newly added Para 68-BD in the EPF Scheme, 1952, members can withdraw up to 90% of their accumulated funds for down payments, EMI payments, or to construct a new house.

Previously, the maximum withdrawal amount was limited to the total contributions from the employee and employer plus three years' worth of interest, or the cost of the property, whichever was lower. Members did not need to be part of any housing scheme; they only needed to have been EPF members for five years.

With the introduction of Para 68-BD, the eligibility period was shortened to three years, and members were given more flexibility in using their funds. The minimum PF balance required is Rs. 20,000, either individually or combined with a spouse's balance if they are also an EPFO member. Withdrawals for property payments can be made only once in a lifetime.

Key points for home loans on EPF include:

- The applicant must be part of a registered housing society with at least 10 members.

- Banks can use the Commissioner’s certificate of PF contributions to determine withdrawal amounts for EMIs.

- Composite claim forms are available for this purpose.

- Members must provide an authorization letter to use PF funds for EMI payments.

- This facility can be combined with the Pradhan Mantri Awas Yojana (PMAY) to receive housing subsidies.

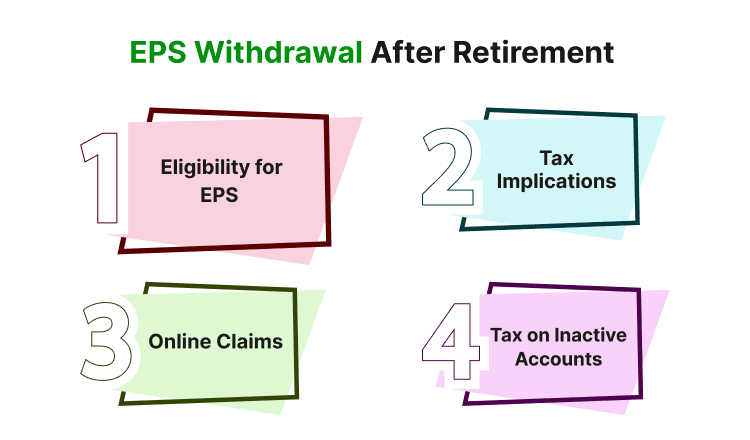

EPF Withdrawal After Retirement

Under the EPF Act, members must apply for their final settlement upon retiring at the age of 58. The total PF balance includes both the employee's and employer's contributions. Here are the key points simplified:

Eligibility for EPS : Members qualify for the Employee Pension Scheme (EPS) amount if they have continuously worked for more than 10 years.

Withdrawal Conditions :

- If a member has not completed 10 years of service by retirement, they can withdraw the entire EPS amount along with their EPF.

- Members who have completed 10 years of service are entitled to pension benefits post-retirement.

Tax Implications :

- Withdrawals from the EPF after retirement are completely tax-free.

- However, any interest earned on the EPF corpus after retirement is taxable.

Online Claims : Employees registered on the EPF member portal can submit their claim forms online to access their funds.

Tax on Inactive Accounts : If the member does not withdraw the funds within three years of retirement, the interest accrued during that period becomes taxable.

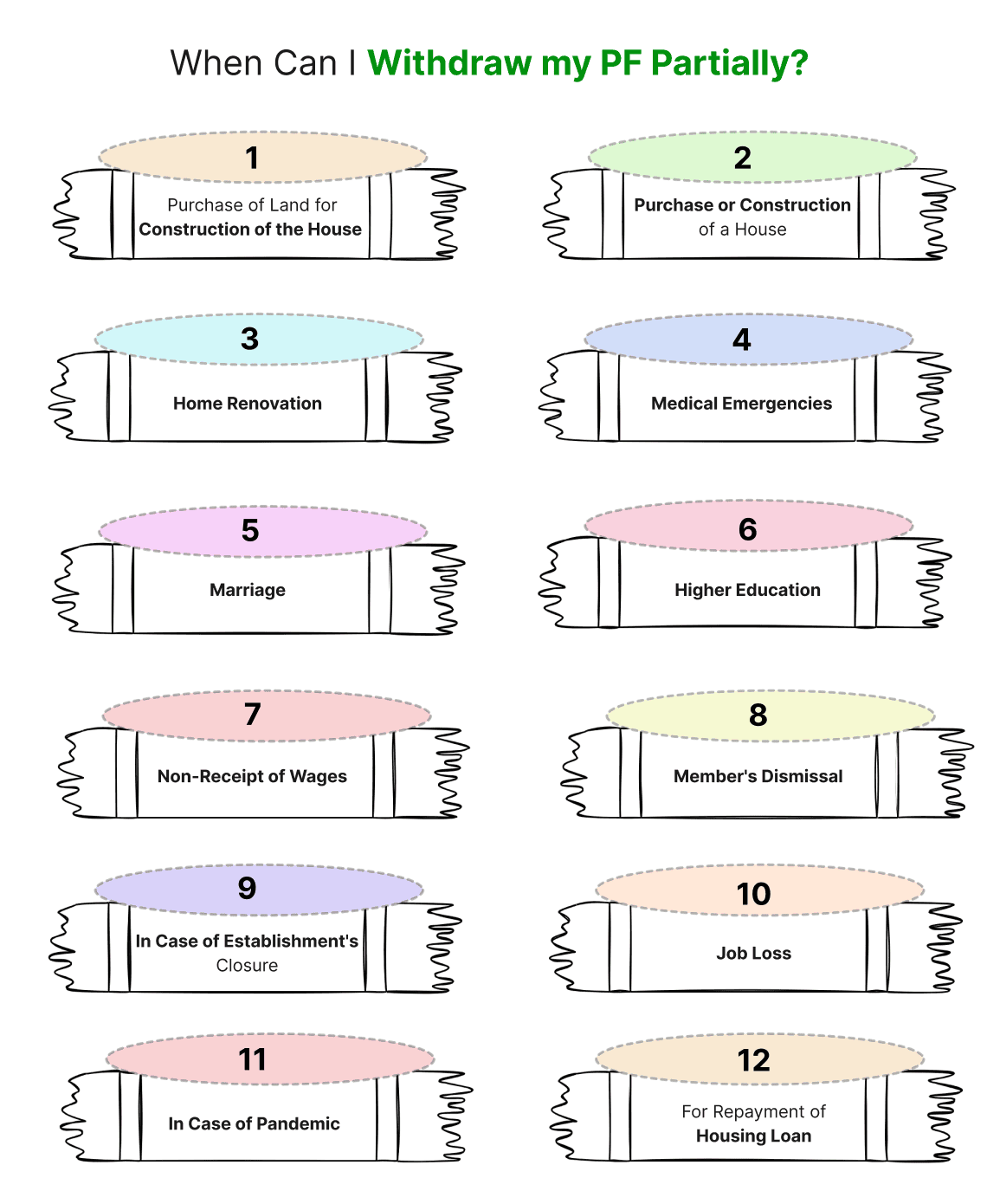

When Can I Withdraw my PF Partially?

There are several instances when you can partially withdraw from the PF account. However, EPFO needs to permit the withdrawal in case of partial withdrawal. EPFO generally permits the withdrawal, in case of an emergency or an unexpected expense. The eligibility for different types of partial withdrawals is below:

Purchase of Land for Construction of the House

- The land should be in your name and/or spouse.

- You should be an EPF member, at least 5 years old.

- The maximum amount that can be withdrawn should be equal to your 24 months basic wages and dearness allowance.

- Your contribution along with the employer’s contribution plus the interest.

- The actual cost that was payable while acquiring the property.

Purchase or Construction of a House

- The house should be in the name of the individual and/or spouse.

- The borrower should be at least 5-year-old EPF member.

- The maximum amount you are willing to withdraw should not exceed 36 month’s basic pay and dearness allowance of the member.

- Member’s as well as the employer’s share of contribution along with the interest.

- The total cost of construction.

Home Renovation

- The home that you want to renovate should be under the name of the member and/or spouse.

- The EPF membership should be at least 5 years old.

- The maximum amount withdrawn should not be more than the total of 12 months' basic wage and the dearness allowance of the member.

- The Member’s share of contribution plus interest.

Medical Emergencies

- Should be specifically either the member’s medical treatment or any of the member’s family members.

- There is no limit for the EPF membership in this type of withdrawal.

- The withdrawal amount can be a maximum of 6 months of basic pay of the member along with the dearness allowance.

- Member’s share of contribution along with the interest.

Marriage

- Can be either the member’s own marriage or of someone who is in blood relation with the member.

- You can complete the withdrawal only after 7 years of EPF membership.

- The only amount that can be withdrawn is 50% of the employee’s share of the contribution along with the interest.

Higher Education

- Education can be of either the member’s son or daughter after 10th class.

- Can only withdraw if the membership is of more than 7 years.

- The maximum amount that can be withdrawn is 50% of the employee’s share of contribution plus interest.

Non-Receipt of Wages

- No limit on the EPF membership.

- Can only be withdrawn if the employee has not received his wage for 2 consecutive months. ( Reasons other than strike)

- In case of a lockout or closure of the establishment for more than 15 days.

- If the employees are under unemployment without compensation.

- The maximum amount that can be claimed is the employee’s share along with the interest.

Member’s Dismissal

- The EPFO claim can be made in case of Discharge/Dismissal/retrenchment of the member challenged by him /her in the court.

- No limit of the EPF membership.

- A maximum of 50% of the employee’s share along with the interest.

In Case of Establishment’s Closure

- The claim can be made if the establishment’s been shut for over 6 months and the employees are kept without compensation.

- No limit on the EPF membership.

- In such an event, you can withdraw 100% of the Employee’s share along with the interest.

Job Loss

- If an employee is under unemployment for a continuous period of not less than a month.

- EPF membership is not under consideration.

- The maximum amount that can be withdrawn is evaluated as 75% of the total EPF balance i.e. member’s and the employer’s share and the interest amount.

- You can withdraw the remaining 25% after being jobless for a continuous period of two months.

In Case of Pandemic

- In case of a pandemic emergency, a withdrawal can be made only if the area is declared to be affected by the pandemic.

- Membership isn’t considered in case of a pandemic.

- Withdrawal’s maximum amount is set to be either 3 month’s basic wages and dearness allowance of the member or 75% of the total EPF balance which includes the member’s share along with the employer’s share plus interest.

Withdrawal Within One Year Before Retirement

- If the member has attained 54 years of age or within 1 year before his actual retirement, on superannuation, whichever is later.

- The maximum withdrawal can be up to 90% of the EPF balance i.e. Member’s share plus employer’s share and the interest amount.

For Repayment of Housing Loan

- The Loan you are repaying should be in the name of Individual and/or spouse.

- You can withdraw only if you hold 10 years of EPF membership.

- The maximum amount you are willing to withdraw shall not exceed 36 months’ basic wages and dearness allowance of a member.

- Member’s share of contribution along with employer’s share of contribution.

- Amount of outstanding principal and interest of the loan that is repayable including the interest.

Apart from the purposes above, an employee can claim an advance or withdrawal from his EPF account for the below scenarios–

- In case the injury is caused to the member by any exceptional natural calamity like earthquake, floods, etc. If a member is injured by riots, then the scenario shall also be considered.

- If a member gets affected by any of the establishment’s electric shortcomings.

- Any purchase of the equipment that is to be used by physically handicapped members.

Documents Required for EPF Withdrawal

You do not need to provide any documentation to register an EPF claim online; however, you must upload a scanned copy of your cheque or passbook on the EPFO member Portal .

The bank account number, IFSC code , and name should all be visible and readable on the cheque/passbook. If the scanned copy of the cheque is not readable, the EPFO claim might get rejected.

Online Grievances Portal for PF Withdrawal

The EPFO has updated its EPF i-Grievance Management System (EPFiGMS) to enhance how customer complaints are received, addressed, and resolved. This system is available for all PF official members, pensioners, and employers to use.

Through the EPFiGMS portal, users can file grievances, send reminders, check the status of their complaints, upload related documents, and even change their passwords. Specifically, it allows for the registration and tracking of complaints related to PF withdrawals, including the ability to upload relevant documents.

Conclusion

Now you know the process of making an EPFO Online Claim via the EPFO official website. The online claim helps you to withdraw money from your EPF account and use it in case of an emergency. On the other hand, you will always need an UAN and a password to log in and initiate the claim process. After making the claim, the withdrawn amount usually takes about 15 to 20 days to get credited into your bank account.

Frequently Asked Questions (FAQs)

How to withdraw PF money online from EPFO?

How to claim EPF Online?

What is the process of EPF withdrawal?

Can I withdraw full money from my PF account?

What happens if PF is not transferred?

Best Offers For You!

Home Loan by Top Banks

Personal Loan Rates by Top Banks

- HDFC Personal Loan Interest Rates

- ICICI Personal Loan Interest Rates

- Kotak Personal Loan Interest Rates

- IndusInd Bank Personal Loan Interest Rates

- RBL Bank Personal Loan Interest Rates

- YES BANK Personal Loan Interest Rates

- IDFC First Bank Personal Loan

- Tata Capital Personal Loan

- SMFG India Credit Personal Loan

- SCB Personal Loan Interest Rates

- SBI Personal Loan Interest Rates

- Axis Bank Personal Loan Interest Rates