EPFO Member Passbook

Last Updated : March 4, 2025, 3:09 p.m.

Contributions made to an investment fund called Provident Fund by both the business and the government can be beneficial for the employee's retirement corpus .Every PF investment is made into the EPFO (Employees' Provident Fund Organisation) account.

Both the employee and the employer contribute equally to the EPFO account. Generally, the employee contributes around 12% of their basic income to the EPF account, while the employer contributes 8.33% of the basic salary to EPS and 3.67% to EPF. A member can anytime use his EPF Passbook to view the record of contributions. The EPF passbook contains a list of all contributions made to the EPF account by both the employee as well as the employer. Through the EPF Member Passbook Login, you can also see the interest that has been credited to your account. Therefore, you should be aware of how to see and download your EPF passbook online.

What is an EPF Passbook?

A monthly contribution of 12% of the employee's basic salary + Dearness Allowance (DA) is made to their Provident Fund (PF) account. Employees' PF is matched by the employer, which contributes 12% in total. In addition, the EPFO offers its members interest each year based on their EPF balance.

Members of the Employee Provident Fund (EPF) have the ability to access their EPF UAN passbook online, which includes information on the quantity and status of their contributions, as well as the date and interest credited by the EPFO annually. There are several ways for a PF account holder or member to view their passbook.

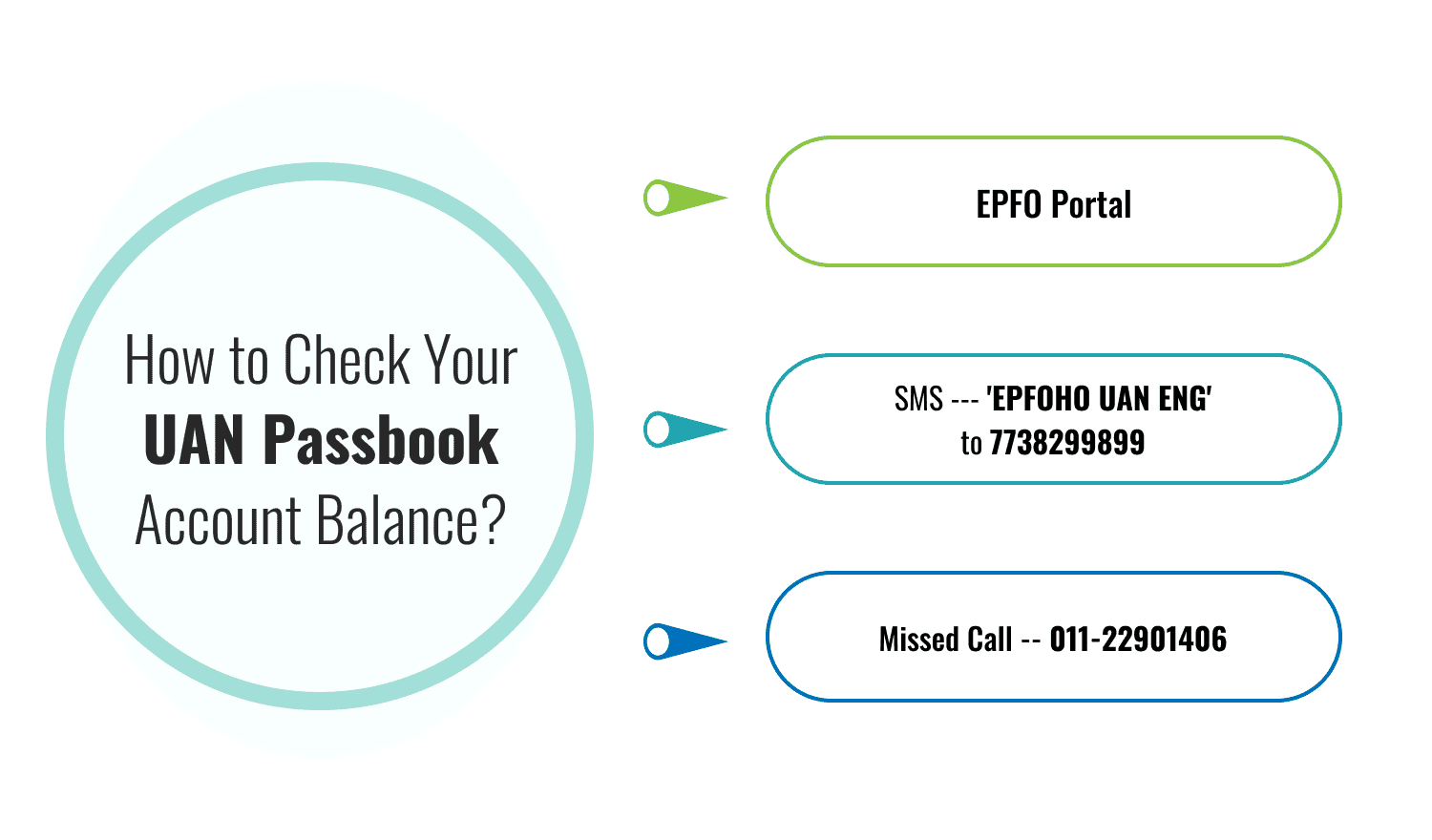

How to Check Your UAN Passbook Account Balance?

You can check your account balance through various methods that are as follows:

EPFO Portal

Follow the steps given below to check your account balance on the EPF Portal.

- Visit EPFO Portal – Go to the EPFO website and select ‘For Employees’ under ‘Services’.

- Access Passbook – Click on ‘Member Passbook’.

- Login – Enter your username, password, and captcha to view your UAN passbook.

SMS

- Send an SMS from your registered mobile number to 7738299899 in the format: ‘EPFOHO UAN

’ (e.g., EPFOHO UAN ENG for English). - The service is available in 10 languages: English, Hindi, Telugu, Punjabi, Gujarati, Marathi, Malayalam, Tamil, Kannada, and Bengali.

- Ensure your Aadhaar, PAN, and bank details are digitally verified; otherwise, you may not receive a response. Contact your employer if verification is pending.

- After a successful request, EPFO sends an SMS with your account balance, last contribution details, and KYC document status.

Missed Call

The account holder must confirm that the KYC details have been linked and merged with the UAN before being allowed to see the account balance through missed call. When the KYC has been successfully linked, make a missed call from your registered phone to 011-22901406 and an SMS with EPFO data will be sent to you shortly.

Check EPFO Balance Via the UMANG App

You can also check your EPFO account balance with the help of the UMANG App -

- Download the UMANG App – Get it from the Google Play Store (Android) or Apple Store (iPhone).

- Open the App – Select ‘EPFO’ from the options.

- Go to Services – Click on ‘Employee Centric Service’.

- Enter UAN – Provide your UAN number.

- Verify OTP – Enter the One-Time Password (OTP) sent to your registered mobile number.

- View Passbook – Click on ‘View Passbook’ under the EPFO option to check your balance.

How to Download EPFO Passbook?

To download your EPF passbook, you will need a UAN and password.The employee can view several transactions, monthly contributions, withdrawals, and a plethora of other information in their EPF passbook.

Additionally, in order to use the UAN passbook, you will need to complete an employee login. You only need to take the easy actions shown below to log in:-

- Step 1: The worker needs to go to https://www.epfindia.gov.in/site_en/index.php first.

- Step 2: The employee then needs to select "e-Passbook."

- Step 3: The employee needs to input their password, UAN, and captcha information on the new tab.

- Step 4: The employee then needs to select 'Login'.

- Step 5: The employee's Member ID will be shown on the next page. If an employee has more than one Member ID, they will all appear on the screen.

- Step 6: To download a PF statement, the employee needs to click on the Member ID of that person.

- Step 7: A list of details, including the name of the business, the employee's name, address, and the percentage of ownership held by the employer and employee, as well as the amount contributed to the Employees' Pension Scheme (EPS) account, will show up when an employee clicks on their Member ID.

- Step 8: The employee will also be able to download and print the PF statement in PDF format.

What is Shown in UAN Passbook?

After you have successfully logged in to your EPF account you can open and download your UAN passbook. After downloading the UAN Passbook, you can find multiple details in it.

Mainly, the components available in UAN passbook are as follows:

- Your EPF Account Number

- 12 Digit Universal Account Number (UAN)

- Basic Details like Name of the Establishment, Establishment Address, Member’s Name, Date of Birth, and Date of Joining the Organization, etc.

- Opening Balance of your passbook that will include the employer and employee column.

- Monthly Contributions by the employer and the employee.

- Withdrawals made throughout your employment.

- Closing Balance of the year.

Features & Benefits of EPFO Member Passbook

- Access to Member Passbook – Registered members can view their passbook on the Unified Member Portal .

- Availability After Registration – Passbook becomes accessible 6 hours after registration on the Unified Member Portal. Any changes in credentials on the portal will reflect after 6 hours.

- Reconciled Entries – The passbook includes only reconciled transactions processed by EPFO field offices.

- Exclusions – The passbook facility is not available for members of Exempted Establishments.

- Online Claim Submission – Paperless and speedy settlement of claims, including death claims.

- Direct Online Payments – Provident Fund (PF), Pension, and Insurance (EDLI) benefits up to ₹7 lakhs are directly transferred to eligible family members.

Contents of UAN Passbook

The UAN Passbook contains -

- ID for the establishment and the name of the business or employer

- Name and ID of the member

- The EPFO's office name and kind

- Share of Employers and Employees in the EPFO

- The employee and employer each make a monthly withdrawal from a depository.

- Monthly payment made to the worker's pension account.

- The day and hour the passbook was printed is included at the end of the statement.

Conclusion

Think of your passbook as an exhaustive record of the funds you have added to your retirement account. By experiencing and gaining experience you can come across an EPF account in various interest that have accrued and the payments which you and your employer made till date.

Along with these benefits, the EPF passbook has a lot of information related to your EPFO account and you can access the passbook anytime using your UAN and password. On the other hand, you can download the statement and see the monthly contributions to your PF account. The passbook will also show the withdrawals and the interest credited to your PF Account.

Frequently Asked Questions (FAQs)

Is it possible to view the EPF passbook online without the Universal Account Number (UAN)?

Can I download or view my EPF passbook online?

How can I check the status of my EPFO claim?

What are other ways to check UAN Passbook Account Number?

How do I make an online EPF transfer?

How to activate UAN online and link my mobile number with the EPF portal?

Is the EPF passbook facility available to all EPFO members?

How much time does it take for any update to show in the UAN passbook?

Who allocates UAN?

Is it compulsory to withdraw the entire amount from my EPF account after retirement?

After registration in the UAN how much time it takes to appear online?

I cannot find my PF passbook online , why?

Best Offers For You!

Home Loan by Top Banks

Personal Loan Rates by Top Banks

- HDFC Personal Loan Interest Rates

- ICICI Personal Loan Interest Rates

- Kotak Personal Loan Interest Rates

- IndusInd Bank Personal Loan Interest Rates

- RBL Bank Personal Loan Interest Rates

- YES BANK Personal Loan Interest Rates

- IDFC First Bank Personal Loan

- Tata Capital Personal Loan

- SMFG India Credit Personal Loan

- SCB Personal Loan Interest Rates

- SBI Personal Loan Interest Rates

- Axis Bank Personal Loan Interest Rates