EPFO KYCS

Last Updated : June 6, 2025, 2:31 p.m.

The EPFO share deducted from your salary is accumulated into your EPFO account. But many individuals claim the accumulated funds because of financial emergency. So you can make an online claim for the accumulated EPFO fund. But it is important to check EPFO KYCS which is “know your claim” status once you have made the claim. The EPFO members or pensioners who have claimed the EPFO funds can make use of this facility to track the claim status. There are various steps involved to know the status of your claim. You will have to follow each and every step carefully for EPFO KYC. Let’s move on to the process of knowing your claim status online through EPFO’s official website.

What is EPFO KYC?

EPFO KYC is the process of verifying and linking an employee’s identity and financial details to their UAN. It ensures that PF contributions, withdrawals, and other transactions are processed securely and accurately. KYC compliance is mandatory for online services through the EPFO Unified Member Portal (https://unifiedportal-mem.epfindia.gov.in/) and is a prerequisite for claim settlements, transfers, and other PF-related activities.

Do the EPFO KYC through the EPFO Official Website

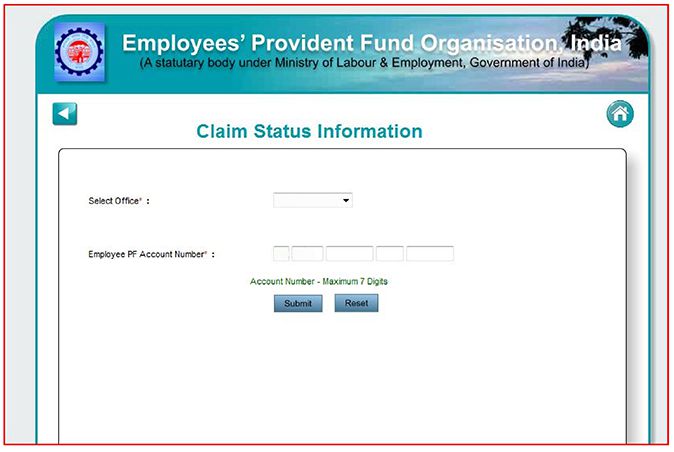

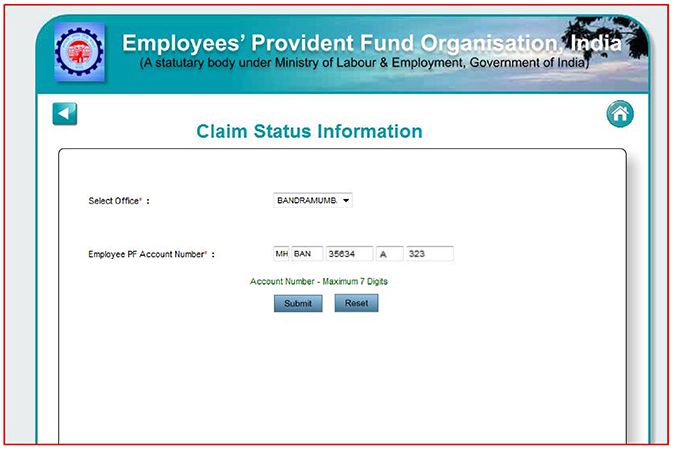

Make sure you have the PF account number before you do the EPFO KYCS. Now, let’s move on to the steps to check the claim status.

- You will have to visit the EPFO Official website and make the UAN login .

- Then open the KYC page after making the login.

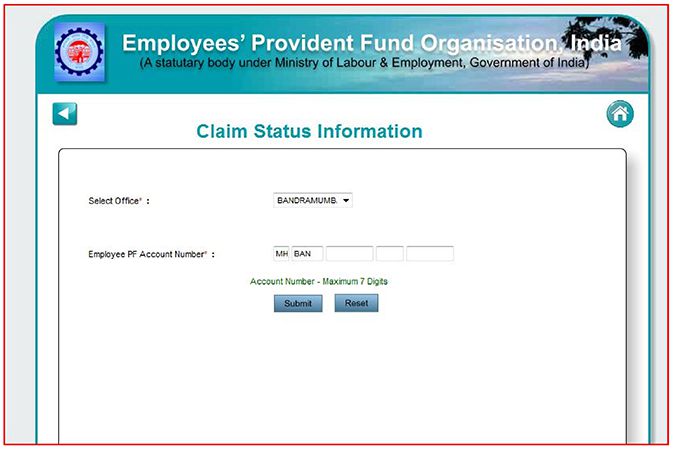

- Now choose the EPF Office from where your claim has to be settled and the office will appear in the dropdown list.

- Then in the first box, the Mandatory Region Code will be filled automatically.

- In the second box, the office code will be filled automatically.

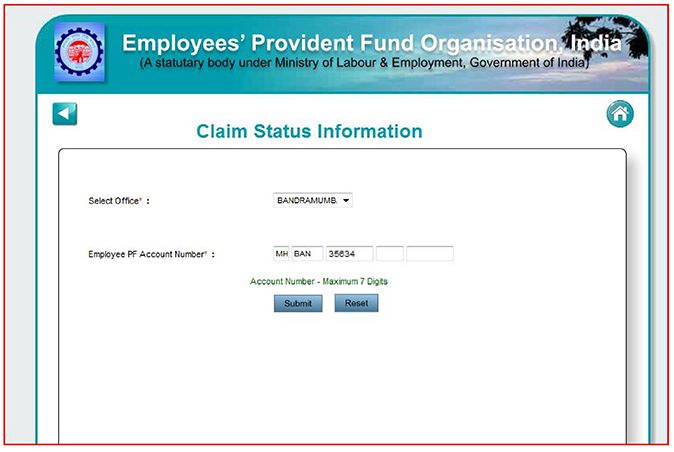

- Then enter the establishment code in the third box and it can be a maximum of 7 digits.

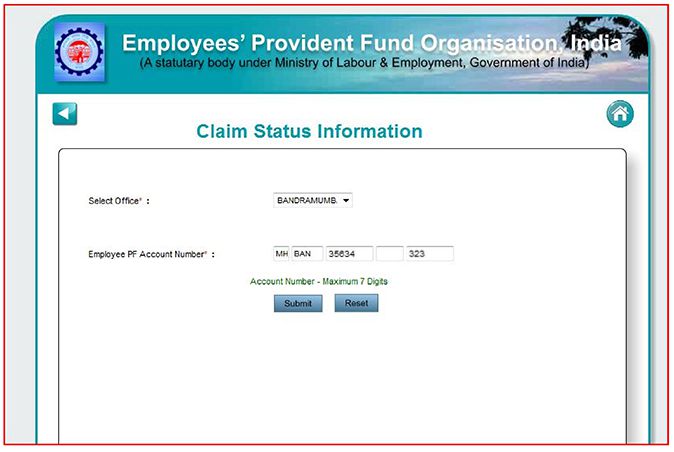

- In the fourth box, you can either enter the Extension Code or the Sub-Code that can be in digits or alphabets with a maximum of 3 characters. If you don’t have an extension code or sub-code then you can leave the fourth box blank.

- In the fifth box, you will have to enter your account number and it can be a maximum of 7 digits.

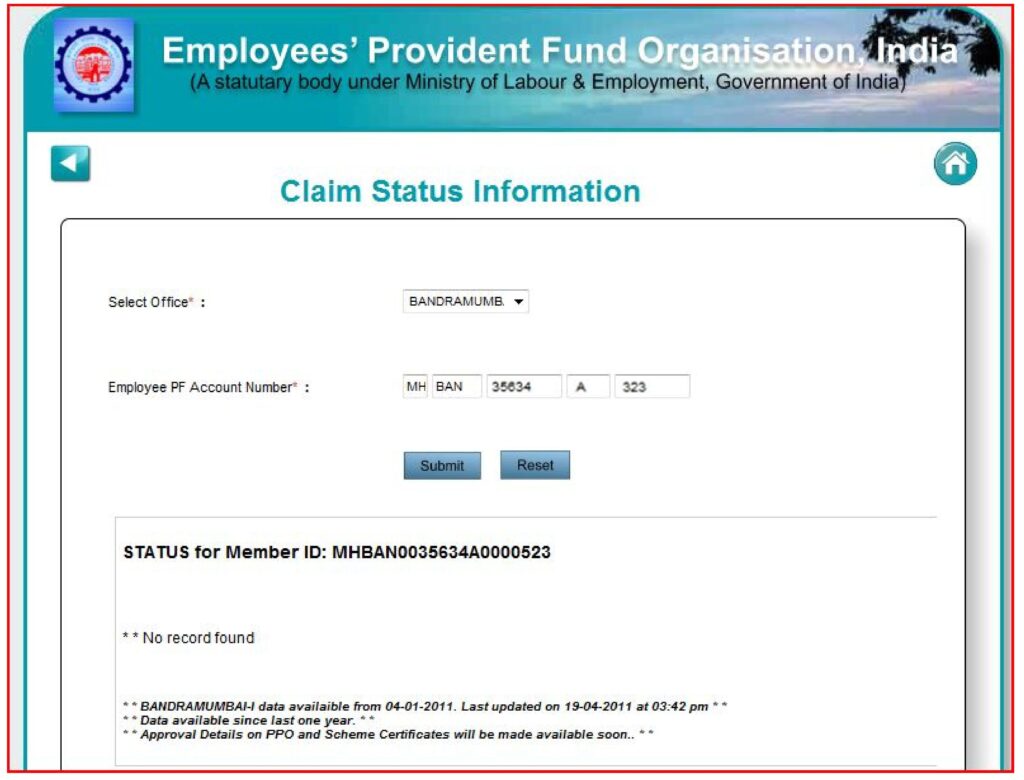

- Finally, click on the Submit button to get the status of your claim.

You will get a message at the bottom of the page about the claim you have made. If the system doesn’t have the information about the member ID then it will display a “No Record Found” message. You will also receive the same message if you enter any wrong information whether it is the establishment code or the account number.

Things to Check Before Making the Claim

- Make an EPF Balance check before making a claim to know the exact value of the accumulated funds.

- See all the terms and conditions that are related to the claim.

- Know the exact amount of claims you can make at a particular time.

- Check the reasons for which you can make the partial claims.

- Download EPF Member Passbook to know and verify all the entries of the contribution made by the employer into your EPFO account.

Recent Updates

- Aadhaar-Based OTP Verification : EPFO has expanded OTP-based authentication, reducing dependency on employer approvals for certain claims.

- Auto-Approval for KYC : Some KYC updates (e.g., Aadhaar and PAN) are auto-verified through integration with UIDAI and NSDL databases, speeding up the process.

- Mobile App Integration : KYC updates can now be initiated via the UMANG app or EPFO Member App, with employer verification still required.

- Enhanced Security : EPFO has introduced stricter validation to prevent mismatches in names or document numbers.

- Grievance Redressal : The EPFiGMS portal (https://epfigms.gov.in/) now offers dedicated support for KYC-related issues.

Conclusion

Now you know the process of EPFO KYCS and can check the status of your claim. It will be easy for you to know the claim online by visiting the EPFO official website. The status will be shown to you as soon as you enter the Region Code, Office Code, Establishment Code, Sub Code, and account number. The maximum limit of characters is mentioned above which you can see in the steps. After entering the above information you can easily do the EPFO KYC and know the exact status of your EPF Claim.

Best Offers For You!

Home Loan by Top Banks

Personal Loan Rates by Top Banks

- HDFC Personal Loan Interest Rates

- ICICI Personal Loan Interest Rates

- Kotak Personal Loan Interest Rates

- IndusInd Bank Personal Loan Interest Rates

- RBL Bank Personal Loan Interest Rates

- YES BANK Personal Loan Interest Rates

- IDFC First Bank Personal Loan

- Tata Capital Personal Loan

- SMFG India Credit Personal Loan

- SCB Personal Loan Interest Rates

- SBI Personal Loan Interest Rates

- Axis Bank Personal Loan Interest Rates