What is Credit Mix? How Does it Impact Your Credit Score?

Last Updated : Jan. 10, 2025, 5:51 p.m.

Before approving your loan application, lenders check your credit score in order to determine your creditworthiness. If you have a good credit score, your application will get approved instantly without any hurdles. There are various factors that result in a good credit score and one of them is having a diverse portfolio of credit. A credit mix refers to different types of credit accounts that an individual can hold. This includes a variety of credit like installment loans, revolving accounts like credit cards, and mortgages. When an individual is able to handle diverse credit responsibly, it shows a positive impact on the credit score. Also, you should exhibit a balanced ratio between secured and unsecured loans.

How does a Credit Mix Work?

When credit scores are computed, they take credit mixes into account. When you have a diverse mix of credit, you have a more comprehensive profile establishing your trustworthiness and capacity to manage different types of credit successfully. It boosts your chances of procuring favorable loan terms and interest rates on future loans or lines of credit.

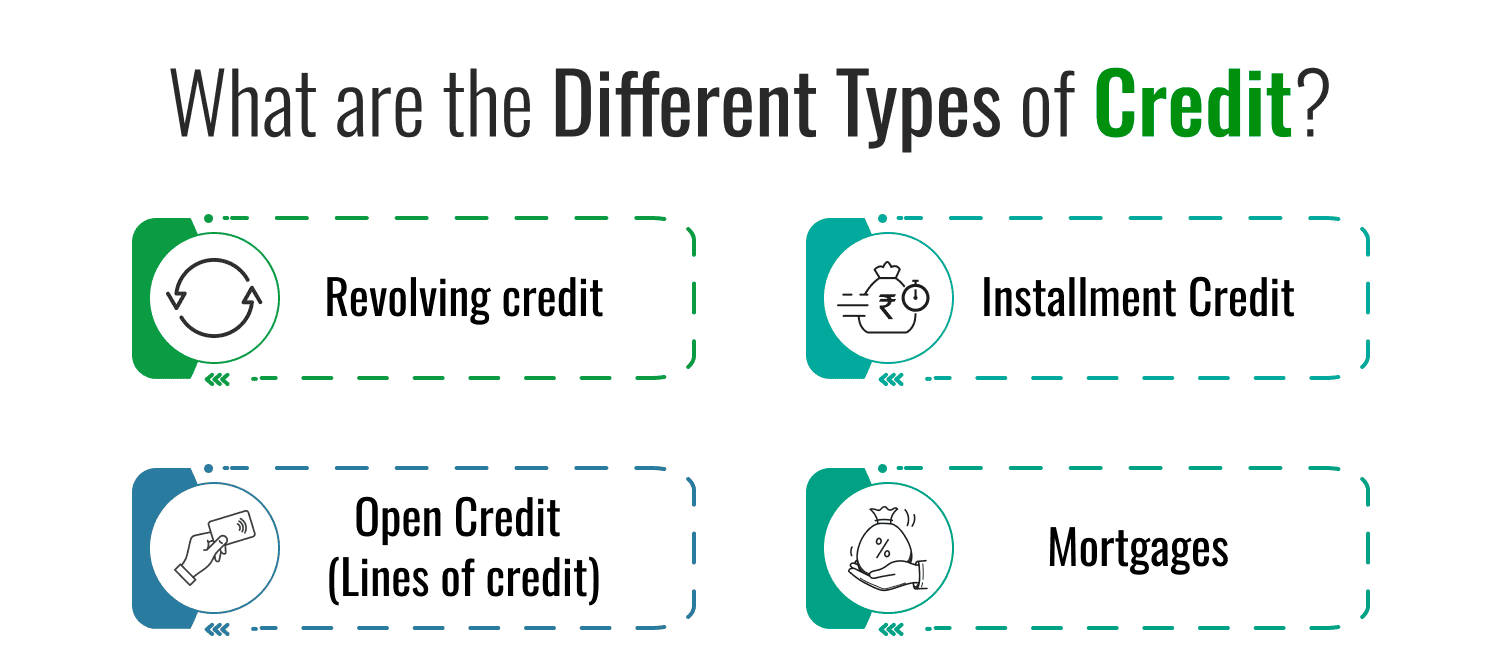

What are the Different Types of Credit?

The various types of credit are as follows:

- Revolving credit: A credit which has no set balance or end date is called revolving credit. You have to pay a minimum amount every month. You can also pay more than the least amount due, but that is not mandatory. A typical instance of revolving credit is a credit card .

- Installment Credit: This type of credit has a duration and you have to pay the due every month. Loans and mortgages are examples of installment credit.

- Open Credit (Lines of credit): Similar to revolving credits, for open credits, you can access funds up to a certain pre decided limit. However, you may have to pay them in full or make higher minimum payments at regular periods.

- Mortgages: Mortgages are loans that are used to fund the purchase of a home or property. They are repaid in fixed monthly payments over an extended period of time.

What are the Loans that do not Feature in a Credit Mix?

Although most forms of credit are included in your credit mix, there are some that are not considered. This is because they do not show up on your credit report and hence are not part of credit score calculations.

- Payday loans

- Auto title loans

- Buy now pay later loans

It is important to keep in mind that the lender may send the debt to a collection agency. It will be reported as a collection account. A debt in collections will not affect your credit mix. However, it is a black mark in your history of payments, which is the most impacting factor in your credit history.

Impact of Credit Mix on Credit Scores

Credit scoring models like CIBIL give weightage to the credit mix when computing the credit score. The credit mix is one of the 5 important factors that impact your score and accounts for 10% of your credit score. A diverse credit mix means that you can handle all types of credit responsibly. It acts as an indicator of disciplined financial behavior. This will give you a higher credit score. Let us now take an example to see this.

Example 1: An individual with only one type of loan versus someone with a multiple credit mix type

X has only one type of loan, say a personal loan. Y has a diverse portfolio, say a mix of installment loans like personal loans, car loans, etc. revolving credit like credit cards, and mortgages. Y’s diverse portfolio of credit shows more financial responsibility. He can manage different types of debt at a time. This will result in a higher credit score compared to X.

Does Not Having a Credit Mix Hurt Your Credit Score?

Yes, not having a credit mix hurts your credit score . Depending only on one type of credit such as installment loans, revolving credit, etc. will send across the message to lenders that you cannot handle various types of debt simultaneously. So, lenders will see you as a risky borrower and may hesitate to sanction your loan or any other form of credit. This restricts your credit potential and makes it more challenging to get favorable terms and preferential interest rates on credit.

Frequently Asked Questions (FAQs)