What is the Minimum CIBIL Score Required to Get a Credit Card?

Last Updated : Jan. 2, 2025, 3:23 p.m.

A good CIBIL score is required to get easy and trouble free approval for a credit card. Let us now read on to find out what is the minimum CIBIL score for hassle free approval of credit cards.

Having a low credit score or no credit history might stop you from using best credit cards . Some of the top credit card providing companies have a minimum credit score requirement. CIBIL is among the top credit bureaus companies that provides credit score and report. The score generated by them is called CIBIL score which is a 3-digit number showing the payment history of an individual. The score ranges from 300-900 wherein the higher range represents strength of the score. Financial institutions consider a credit card application suitable on the basis of this score. In this article, we will talk about the minimum CIBIL score required to apply for a credit card or get approval for it.

What is the Minimum CIBILSscore for Credit Cards?

Credit cards vary according to your needs. One of the most important factors required to qualify for a credit card is a good credit score. Generally, a CIBIL score of 750 or above is considered excellent for credit cards. The closer the score is to 900, the easier the approval for credit cards. Many banks also accept a CIBIL score between 700 to 750. Some banks even give credit cards to people with a low CIBIL score, but applicants also have to meet other eligibility criteria like income, age, employment, residence, etc. Those applicants who are new to credit history or credit score can procure secure credit cards.

Why Do Financial Institutions Check Your CIBIL Score for Credit Card Approval?

Financial institutions and banks check your CIBIL score before sanctioning a credit card in order to avoid risky customers and default issues. This is an easy and assured way of determining the financial capability of a person. Banks do this by referring to CIBIL scores and reports, which the credit bureau will provide on request. Banks will come to know about your defaults and late payments by evaluating your credit history. They also ascertain your financial discipline and the number of credit card and loan applications made by you. The bank will come to know about your credit utilization ratio, credit history, number of active accounts with past payments, missed payments, days past dues (DPD) etc. Often, your credit card application may be rejected if the bank is not convinced about your credit report. Further, having no credit score or credit history is also considered poor credit history.

Benefits of Having a Good CIBIL Score for Credit Cards

The advantages of having a good CIBIL score for credit cards are as follows:

Eligibility for top credit cards

Suitability for a higher credit limit

Lower interest rates on credit cards

Hassle free and easy credit card approval.

Power to negotiate on credit card interest rates and thus getting preferential interest rates.

Reasons for Why Even a Good CIBIL Score is Not Enough?

Sometimes, even a good CIBIL score is not enough to get approval for a credit card. Given below are some red flags which lead to credit card application rejection.

Excessive debt (Even if one pays them off on a regular basis).

Higher credit utilization ratio

When you have more unsecured loans as compared to secured loans.

Payments delayed recently, DPDs, or other negative entries in the credit report.

High EMI to NMI ratio

Short credit history

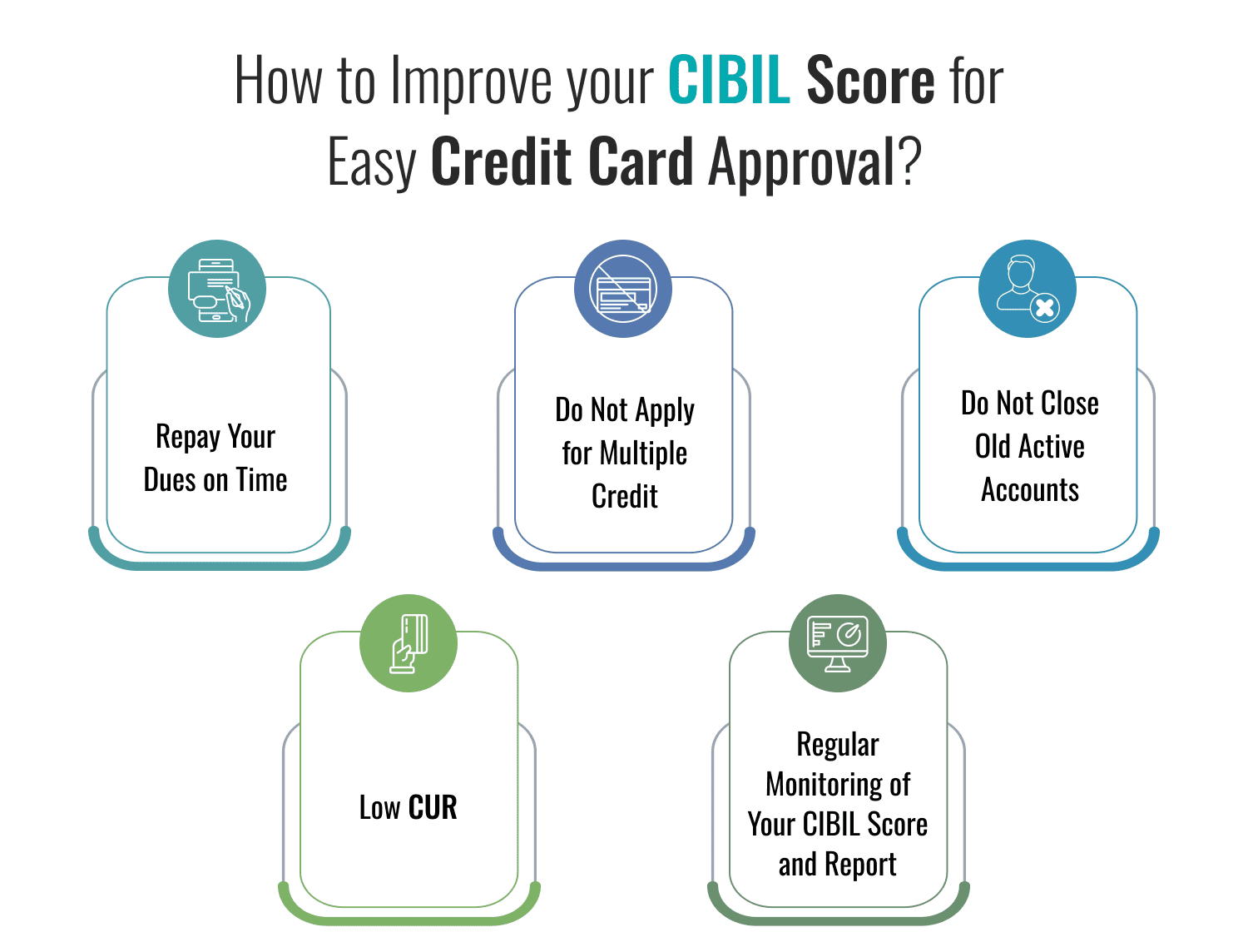

How to improve your CIBIL Score for Easy Credit Card Approval?

It is very important to check your CIBIL score before applying for credit cards. If your score is low, you can take steps to enhance it. Here are some ways in which you can boost your CIBIL score.

Repay your dues on time: It is very important to repay your dues like EMIs and credit card bills on time to maintain a good CIBIL score. Even one single default can bring down your CIBIL score by a few points.

Do not apply for multiple credit: Every time you apply for a loan or credit card, a hard inquiry will be conducted by credit bureaus. They will want access to your credit report in order to ascertain your financial capability. Every time a hard inquiry is done, your credit score goes down. Besides if you have too many credit applications, you will be perceived as credit hungry. So, apply for credit only when needed and do not put several credit applications.

Do not close old active accounts: Your CIBIL score is determined by the length of your credit history. The greater the length, the higher your CIBIL score. So, do not close old active accounts which you have paid off.

Low CUR: Experts recommend a CUR within 30%. The credit utilization ratio is a percentage of the credit limit you use. A low CUR indicates that you are financially disciplined and in control of your spending. A low CUR helps you to maintain a good CIBIL score, get affordable interest rates on your loans, and also enhances your chances to get a higher credit limit.

Regular monitoring of your CIBIL Score and report: Regularly monitor your CIBIL report to check if there are any errors pulling down your CIBIL score. If there are any, you can immediately dispute it with the bureau and clear them. Also, checking your CIBIL report regularly will help you know where you are placed with respect to your CIBIL score. If it is not up to the mark, you can take immediate action to improve it.

Credit Cards for People with a Low CIBIL Score

Although credit cards can be obtained in a hassle free manner for those who have a good CIBIL score, there are credit cards available for those with a low CIBIL score also. Secured credit cards are available for people with low CIBIL scores. These are credit cards that you can obtain against your fixed deposit. The credit limit of your credit card will be equal to or little less than the amount in your fixed deposit. Credit limits often vary between 80 to 100% of the FD amount. These credit cards help you build or improve your CIBIL score. Obtain a secured credit card and pay your dues on time. You can then get your secured credit card converted to an unsecured one. Some of the best secured credit cards in India are SBI Card Unnati, Axis Insta Easy Credit Card, IDFC First WOW Credit Card!, Kotak 811 #DreamDifferent Credit Card, and a lot more.

How to Check CIBIL Score Free Online?

If you haven’t checked your CIBIL score yet, you may follow the below steps wherein it can be done with PAN instantly. Here are the simple steps that are to be followed to check CIBIL score check for free .

Visit ‘Check CIBIL Score’ page at Wishfin.com

Provide your full name as mentioned on the PAN card

Enter your Date of Birth

Choose the gender you belong to

Mention your PAN card number

Enter your contact address

Provide the email ID fn which you want to get the credit report

Enter your mobile number

Submit the form

Which Banks Give you Credit Card with Zero CIBIL Score?

As mentioned above, there are many banks that accept credit card applications from those who have zero CIBIL score or no credit history if you have a salary account with the bank. Some of the banks offering this facility are mentioned below:

- SBI

- HDFC Bank

- ICICI Bank

- Kotak Mahindra Bank

- Axis Bank

- RBL Bank

- Standard Chartered Bank

Conclusion

On a concluding note, if you want to enjoy the maximum benefits on a credit card, you must maintain a minimum CIBIL score of 750.

Frequently Asked Questions (FAQs)