How to Improve your CIBIL Score Immediately?

Last Updated : Jan. 11, 2025, 12:19 p.m.

A CIBIL score is the most important thing a bank checks before approving your credit application. Hence, it is very important to have a good CIBIL score. Check your CIBIL score and CIBIL report regularly. If your score is not good, take steps to improve it. Here are 7 best ways to improve your CIBIL score immediately.

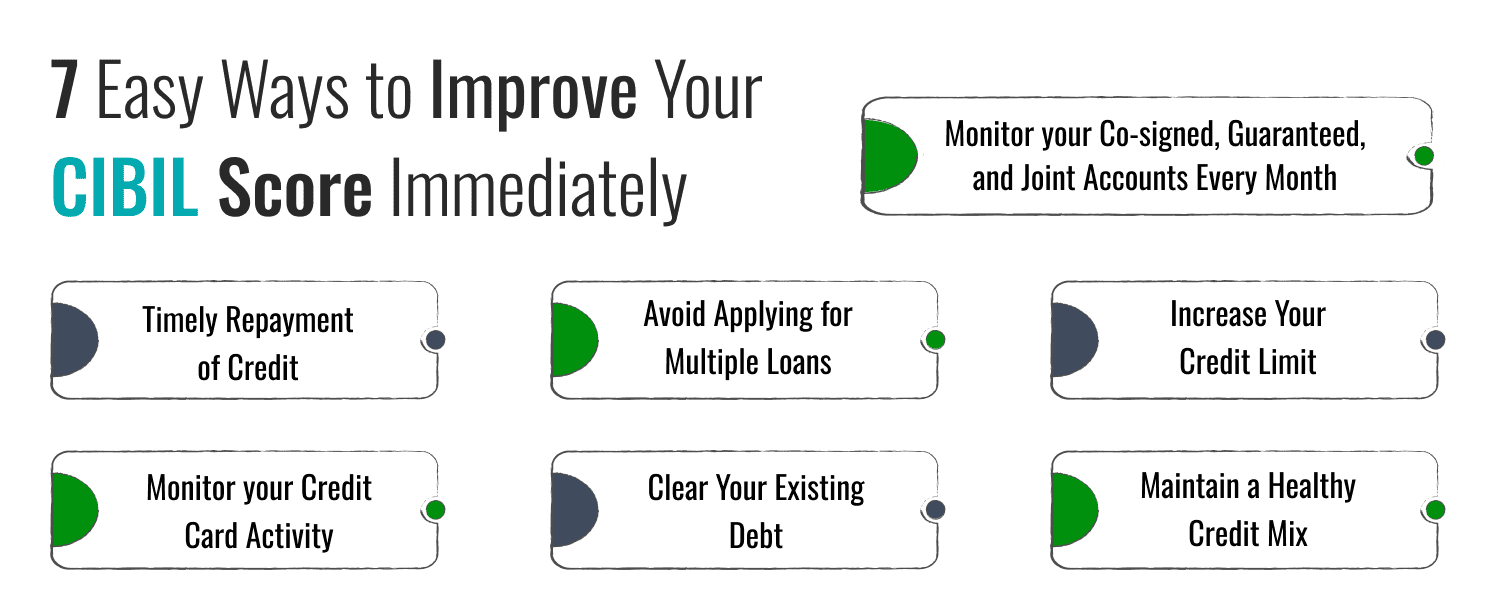

7 Easy Ways to Improve Your CIBIL Score Immediately

Timely Repayment of Credit

Timely repayment of your loan EMIs and credit card bills are essential to maintain a good CIBIL score. Payment history constitutes up to 35% of your CIBIL score. Defaults can lead to a decrease in the CIBIL score. Timely repayment helps in building a good credit history and reflects that you are handling your credit responsibly. Hence lenders see you as a trustworthy borrower.

Avoid Applying for Multiple Loans

Whenever you apply for a loan , a hard inquiry is triggered. These are credit pulls made by the lender to know your financial information. A few hard credit pulls may not reduce your CIBIL score but multiple hard inquiries will. Also, lenders will see you as credit hungry and as someone who is not able to manage his or her finances.

Increase Your Credit Limit

Credit utilization ratio is the ratio of credit used by the total credit limit available. By obtaining a higher credit limit while keeping expenditures the same, your credit utilization ratio will be lower. Experts recommend a credit utilization ratio within 30% of your available credit limit. A CUR within 30% indicates responsible credit management to lenders. This lower CUR will gradually lead to an improved CIBIL score.

Monitor your Credit Card Activity

It is important to monitor your credit card reports and credit card statements regularly. In this way, you can identify errors or discrepancies in your credit report. You can then raise a dispute with the credit bureau from which the score is obtained to get the error rectified. In this way, the error gets corrected.

Clear Your Existing Debt

Outstanding debt is noted on your CIBIL report. This will have a negative impact on your CIBIL score. So, clear the dues to enhance your CIBIL score. To do this, you can repay your debt within its duration or foreclose it. Handling credit responsibly will improve your CIBIL score.

Maintain a Healthy Credit Mix

Always have a diverse credit portfolio. When you go in for credit, you should have different types of credit like installment loans, revolving credit, and mortgages. Having a good credit mix indicates that you are capable of handling varied types of credit simultaneously. Also you must maintain a good balance between secured and unsecured loans.

Monitor your Co-signed, Guaranteed, and Joint Accounts Every Month

It is important to monitor your Co-signed, guaranteed, and joint accounts every month. This is because you are equally responsible when payments are missed by other account holders. Your joint account holder’s defaults can create an impact on your ability to access credit when you need it. It is advisable not to become a joint account holder or a guarantor of loans.

Check your Free CIBIL Score on Wishfin

Wishfin is the first official fintech partner of CIBIL. You can do a free CIBIL score check and view your CIBIL report on the website. At Wishfin, you can do the following:

Once you login to Wishfin, you can view the preapproved loan and credit card offers you are eligible for.

Check your CIBIL score for free.

View your CIBIL report.

You can apply for various types of loans like personal loans , vehicle loans, home loans , car loans, etc.

You can apply for credit cards. Wishfin gives a list of the credit cards you are eligible for.

Cibil Score Pattern by Banks

| CIBIL Score | CIBIL Score Type | Interest Rate Provided | Loan Approval(Yes/No |

|---|---|---|---|

| 700 and Above | Excellent | Lowest | Yes (easily) |

| 600 to 700 | Good | Higher | Yes |

| 300 to 600 | Poor | Higher | No |

| 1 to 5 | New Borrower (Credit history of fewer than six months) | Nominal | Yes |

| -1 | New Borrower (No credit history) | Nominal | Yes |

If the credit score is 750 or higher, banks will approve the majority of loans.

Frequently Asked Questions (FAQs)