How to Improve My Credit Score if My CIBIL is Below 700?

Last Updated : Jan. 9, 2025, 3:02 p.m.

A CIBIL score is an important factor impacting the approval of your CIBIL score. A good CIBIL score helps you in getting credit easily. A poor CIBIL score on the other hand creates financial challenges for you. You will seldom be able to get credit. Even if your CIBIL score is average, there may be some limitations to procure credit. In India, a CIBIL score above 700 is considered excellent. All lenders will be willing to lend and you will be able to get preferential interest rates.

Range of CIBIL Scores and their Meanings

CIBIL Score Range | Creditworthiness |

|---|---|

Below 600 | Immediate action is required |

600 to 649 | Requires improvement |

650 to 699 | Fair |

700 to 749 | Good |

750 to 900 | Excellent |

A CIBIL score below 700 is considered average. However, even if your credit rating is fair, you will still have limited lenders sanctioning credit to you.

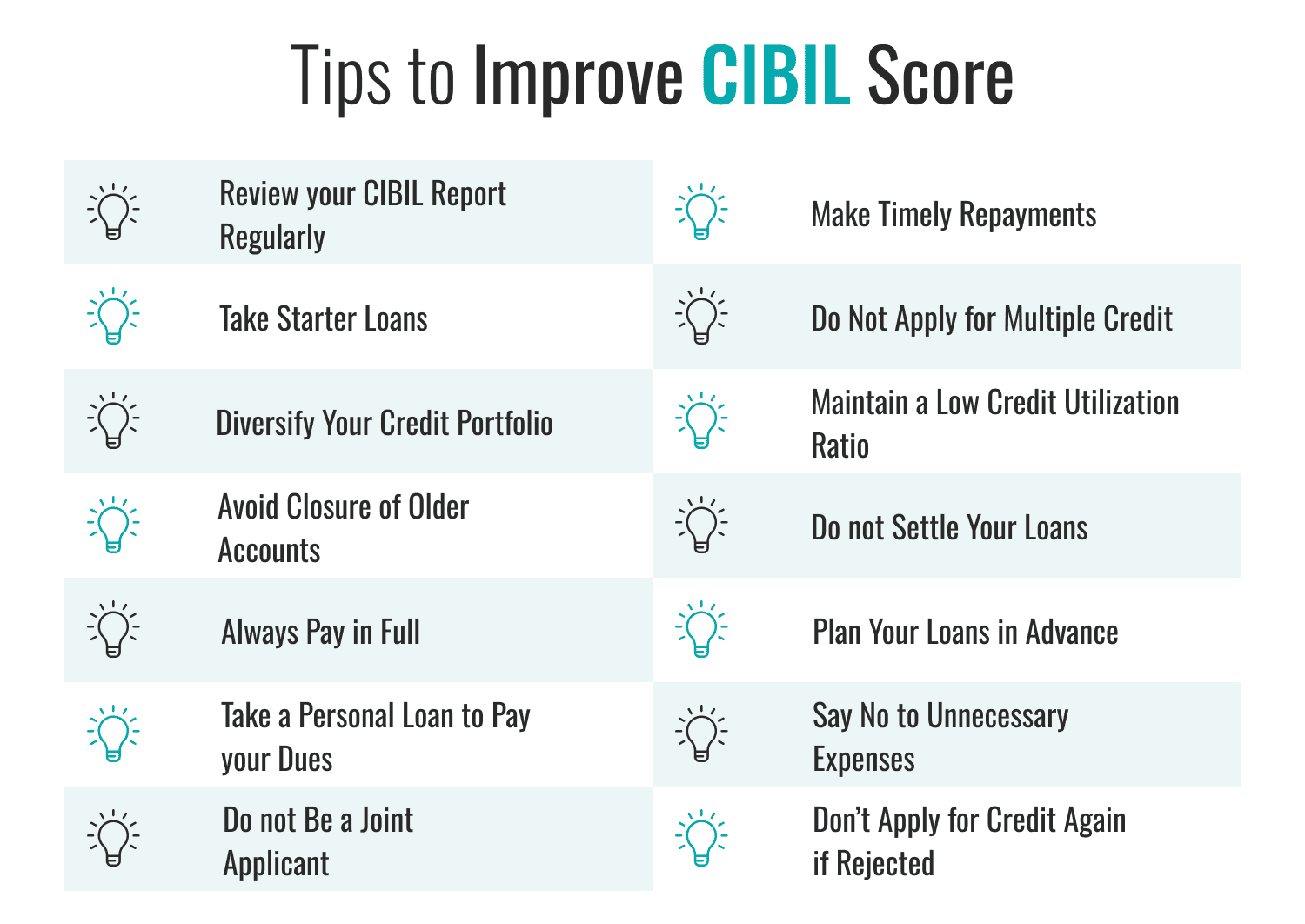

Simple & Effective Tips to Improve CIBIL Score

Review your CIBIL Report Regularly

Monitor your credit activity and CIBIL score regularly. If you find any information entered wrongly by CIBIL due to which your score is hurt, you can dispute it with CIBIL and get it cleared. Also, you can determine what credit activities are affecting your score and take steps to avoid them if possible. If your CIBIL score is low, you can also take steps to enhance it.

Make Timely Repayments

Making timely repayments of your EMIs and credit card bills is important. Even a single default can bring down your CIBIL score by a few points. Therefore, it is important to make timely repayments.

Take Starter Loans

If you are completely new to credit or if there is a dip in your CIBIL score, then you can take a small personal loan. You can then repay your EMIs on time and build a good CIBIL score. The interest rates may be high but if you continue to make the payments on time, you will be able to recover your CIBIL score . You can also take secured loans or secured credit cards backed by collateral or fixed deposits respectively and repay the EMIs and bills on time. This will put your CIBIL score back on track or help you build a good score.

Do Not Apply for Multiple Credit

Every time you apply for credit, a hard inquiry is conducted by the lenders on your credit report. Lenders want to check the credit history, repayment history, outstanding debts, and other appropriate financial information. For every hard inquiry, there will be a small drop in your credit score. A few hard inquiries won’t have much of an impact on your CIBIL score if your score is good. But, multiple hard credit checks will affect your CIBIL score drastically.

Diversify Your Credit Portfolio

It is ideal to have a good credit mix to build a good CIBIL score. An ideal credit mix would be a combination of revolving credit like credit cards and installment credit like loans. Also, include a variety of loans like vehicle loans, personal loans, business loans, and home loans in your credit mix. Ultimately, you should have a balance between secured credit and unsecured credit to have a positive impact on your CIBIL score.

Maintain a Low Credit Utilization Ratio

Credit utilization ratio is defined as a percentage of credit used from the total available credit. Experts recommend a CUR within 30%. A high CUR could indicate that you are over-dependent on credit and could impact your CIBIL score.

Avoid Closure of Older Accounts

A longer credit history has a good impact on your credit score. Hence, do not close old accounts which have shown good credit activity because it proves your long term association with lending institutions. This is considered good by credit bureaus and improves your CIBIL score.

Do not Settle Your Loans

If you cannot pay your dues on time, the bank may offer to settle the loan. You can settle your loan by making a small one time payment. But this impacts your CIBIL score the most. If you have any old loans that you had settled earlier, get in touch with the lender and pay the dues so that it can be closed.

Always Pay in Full

Many people accumulate a lot of debt by just paying only the minimum amount due. However, when you do so, you must understand that the amount carried forward will continue to accrue interest. This will further reduce your CIBIL score. On the other hand, making regular payments on time will help you in improving your CIBIL score over a period of 1 or 2 years.

Plan Your Loans in Advance

Draw a budget before you apply for a loan . Use an EMI calculator to compute your EMIs. Then, take a loan according to your payment capacity. In this way, you will be able to make timely payments and improve your CIBIL score.

Take a Personal Loan to Pay your Dues

A personal loan has a lower interest rate compared to that of credit cards . So, it is recommended to pay your credit card balance using your personal loan. Then you can pay the personal loan through regular EMIs.

Say No to Unnecessary Expenses

With so many attractive offers and discounts in place, it is tempting to overspend. Doing so will lead to an unending debt trap. This is actually bad for your CIBIL score. So, in order to avoid this, you can prepare a list of items you have to spend on every month. Sticking to this list will help you save a lot. Check your bank statements every month and analyze your spending, especially the extra expenditures.

Do not Be a Joint Applicant

If you are a joint applicant for a loan taken by someone else, then your credit score will also go down when there is a default. The default will reflect in your credit report as well. The best way to avoid this is to ensure that EMIs and credit card bills are paid on time.

Don’t Apply for Credit Again if Rejected

If your loan or credit card application has been rejected, the information will go down in your credit report. If you go to another bank and apply immediately, then they will see your low score and check why you have been rejected earlier. Then again, your application will get rejected. So, ideally, improve your credit score and re-apply.

Frequently Asked Questions (FAQs)