How Can You Get A Perfect Credit Score?

Last Updated : Jan. 29, 2025, 5:22 p.m.

Achieving a perfect credit score or CIBIL score takes consistent financial discipline. A few payment defaults or over utilization of credit can quickly bring down your credit score. But refurbishing your credit score takes time and consistent efforts. Let us now understand how to get a perfect credit score of 850 or above.

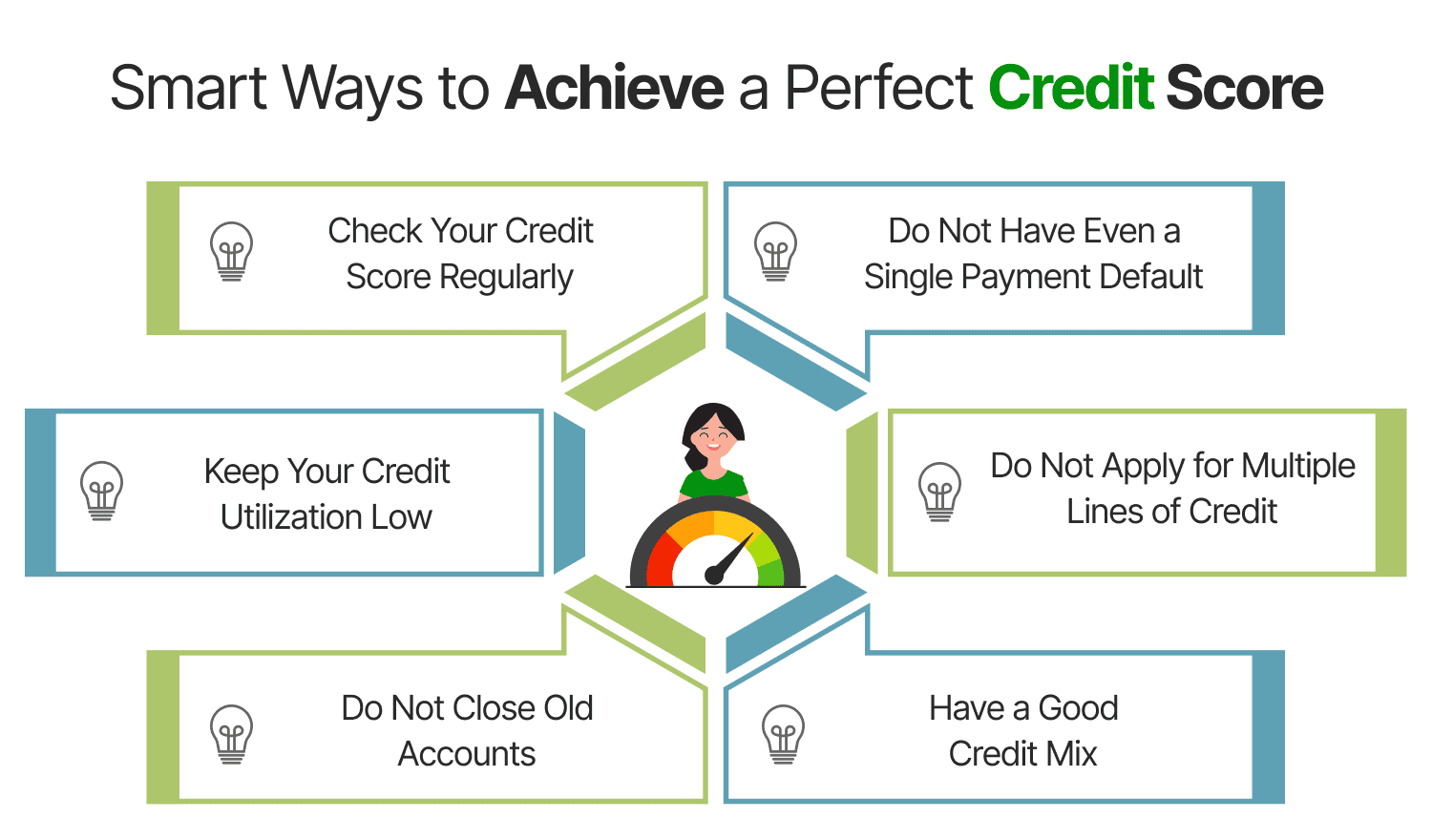

Smart Ways to Achieve a Perfect Credit Score

Tip 1: Check Your Credit Score Regularly

Monitoring your credit score regularly will help you build and maintain a good credit score. When you check your credit report regularly, you will be able to spot discrepancies in your credit report. Once you identify the errors, you can get them corrected by raising a dispute with one of the credit bureaus. This will remove erroneous information that brought down your credit score.

Tip 2: Do Not Have Even a Single Payment Default

Your payment history is the most important factor that contributes to your credit score. It makes up to 35% of your credit score. So, making timely payments is very important to build and maintain a perfect credit score of 750 and above. If your score is already average, a single payment default can lead to a drop. Multiple payment defaults can bring down your credit score drastically. Hence make sure that you pay your credit card bills and loan EMIs on time.

Tip 3: Keep Your Credit Utilization Low

The credit utilization ratio is again a high impacting factor on your credit score. It makes up to 30% of your credit score. It is defined as the ratio of credit utilized to the total available credit. This ratio should be kept low within 30% to 40%. The higher the CUR, the lower the credit score. To achieve a perfect credit score, you must be cautious to maintain the recommended CUR. A high CUR always gives the impression to lenders that you are overspending and you will be seen as a risky borrower.

Tip 4: Do Not Apply for Multiple Lines of Credit

Avoid applying for multiple lines of credit simultaneously. Each time you apply for credit, a hard inquiry or hard pull will be conducted on your credit report. Too many hard inquiries within a short duration may raise questions about your creditworthiness and negatively impact your credit score. So, before applying for additional credit, analyze if you really need it. Also, do not apply for credit immediately after rejection. Instead, focus on improving your credit score and then re-apply.

Apply for the credit card best aligned with your spending habits here at Wishfin. We give you a list of best credit cards from top lenders. Apply for it and enjoy instant approval and unlimited benefits.

Tip 5: Do Not Close Old Accounts

Old accounts which show a great credit history should not be closed. These accounts contribute to your positive credit score and also show your long term association with lenders. Age of credit is an important factor for your credit score. Longer the credit history, better is your credit score. So, do not close accounts with a long credit history.

Tip 6: Have a Good Credit Mix

Having a diverse portfolio will enhance your credit score. Although this is only a low impacting factor, it is good to have a mix of credit like installment loans, mortgages, revolving credit like credit cards etc. This factor contributes to 10% of your credit score. When you have a variety of credit, lenders get a favorable impression that you are capable of handling various types of credit simultaneously. It is also important to have a good balance between secured and unsecured loans.

How Many People Have a Perfect Credit Score?

Achieving a perfect credit score of 850 or above is very rare but not impossible. Getting to this credit score is highly challenging due to the various factors considered by credit bureaus. Achieving a credit score of 750 or above is easier. It is also highly beneficial and can give you better financial opportunities. With a credit score of 750 or above, you will be able to get your credit card or loan applications approved quickly.

What Can you Do with a Credit Score of 850 or Above?

Having a credit score of 850 or above or even 750 or above has great benefits. Lenders consider individuals with high credit scores as low risk borrowers. They are ready to lend and your application for credit gets approved swiftly. Other benefits of a high credit score include:

- You will be eligible for higher loan amounts and higher credit limits

- You will have a higher chance of getting approval for loans and premium credit cards .

- A high credit score can help you get better credit card rewards.

- Although not widely practiced in India, landlords and prospective employers may look at your credit score to rent out an apartment to you or give you a job. With a high credit score, you will have more options for renting houses and for jobs.

- You may also get better insurance rates.

Frequently Asked Questions (FAQs)