Best Personal Loan in India

Last Updated : June 14, 2025, 5:23 p.m.

When looking for the Best Personal Loan in India, many focus only on low interest rates. While important, interest rates aren't the only factor to consider. Look for lenders that match your loan amount with your income, offer low processing fees, and ensure fast disbursal. Comparing loan offers based on these aspects can help you find a deal that’s both affordable and convenient.

To make your search easier, we’ve listed the top banks offering the Best Personal Loan in India, covering interest rates, processing fees, eligibility, and disbursal time in this article-

What are Personal Loans?

Personal loans are unsecured loans offered by banks or financial institutions to meet various personal needs like travel, medical expenses, education, or debt consolidation. They require no collateral and are repaid in fixed EMIs over a set tenure.

Best Personal Loans at Lowest Interest Rates 2026 Comparison

This is the list containing the top and best banks for personal loans with low interest rates -

| List of Banks/Lenders | Personal Loan Interest Rates | Loan Amount | Processing Fee | Tenure |

|---|---|---|---|---|

11.25%- 22% p.a. | Up to 40 Lakh | Up to 2% of the loan amount + GST as applicable | From 12 months to 84 months | |

10.00% -31% p.a. | Upto INR 55,00,000 | Up to 3.93% of the loan amount | 96 months | |

Starting at 9.99% p.a, minimum and maximum up to 27% p.a. | Up to INR 50,00,000 | Up to 2% of the loan amount + GST | From 120 days up to 6 years | |

Starting from 10.85% p.a. | Maximum up to INR 25,00,000 | One-time fee of 1.00% of the loan amount, with a minimum of ₹2,500 and a maximum of ₹15,000. | Up to 84 months | |

Starting from 9.00% p.a. to 10.30% p.a. | Loan amount up to 20 times the Gross Monthly Income, capped at ₹20 lakh (for Maharashtra residents). | 1% of the loan amount and applicable GST. | Up to 7 years | |

14.25% up to 15.75% p.a. | Up to Rs 10 lakh | 50% of processing charges (0.50% of loan amount; ₹1,000–₹5,000 + GST) applicable till 30.06.2025. | Up to 60 months | |

11.65% or 12.40% (Based on Credit Score) | Up to INR 20 Lakh | 1% of the loan amount + GST For defence - NIL | Up to 84 months | |

13.00% - 25.00% | Upto INR 2 lakh | 3% of the loan per application | Upto 5 years | |

DBS | Starting from 10.99% up to 30% p.a. | Upto INR 15 lakh | Up to 3.00% + GST | Up to 60 months |

10.49% up to 17.99% p.a. | Upto INR 50,000 to 5 lakh | Starting from 1.5% of the loan amount | From 12-48 Months | |

10.90% p.a. to 24.00% p.a. | Up to 40 lakhs. | Up to ₹ 6,500/- + GST | Up to 5 years | |

Starting from 10.15% p.a. | Starting from INR 100,000 to INR 5,000,000 | Up to 2% of the loan amount | Up to 5 Years | |

Starting at 10.85% p.a. | Upto INR 50 lakh | 2% of the loan amount + GST | Up to 72 months | |

11.00%-15.50% p.a. | INR 50,000 - INR 10 Lakh | 1% of the loan amount + GST (minimum INR 2,500) | Minimum 12 months to maximum 72 months | |

Starting from 10.49% p.a. | Starting from ₹30,000 up to ₹5 lakh | Up to 3.5% of the sanctioned loan amount | 12 months to 48 months | |

Starting at 10.93% p.a. | Upto INR 50,00,000 | - | Up to 5 years | |

11.15% to 14.15% p.a. | Upto INR 25 lakhs | 0.5% of the loan amount, with a minimum of INR 1,000 + GST | Up to 72 months | |

10.99% Onwards | Upto INR 35 lakhs | Up to 5% of the loan amount + Applicable Taxes | up to 6 Years | |

10.35% - 12.90% p.a. | 10 lakh | 0.50% - 1.00% + GST | Up to 60 months | |

18.00% p.a. | From 30,000 Up to INR 5,00,000 | 2% of the loan amount | From 12 to 36 months | |

12.15% p.a onwards | INR 20,00,000 depending upon the repaying capacity. | 1.00% of the loan amount For Defence Personnel - Nil | Up to 72 months | |

Starting from 10.30% | Upto INR 35 lakh | 1% of the loan amount plus applicable GST (Minimum - 1000 Maximum 10,000) | Depends on the internal policy of the bank | |

10.25% to 23% per annum | Rs.1 lakh to Rs.50 lakh | up to 2.25% of the loan amount | Up to 6 years | |

UCO Bank | 10.70%-13.70% p.a. | Up to ₹20 Lakhs | 1 % of the loan amount (minimum INR 750) | Up to 84 months (depends on the employment) |

Union Bank of India | Starting from 10.75% p.a. | Up to INR 20 Lakhs for Salaried, Non-Salaried, and Government employees | NIL | Up to 5 years |

11.25% to 21% p.a. | Up to INR 50 lakh | Upto 2.50% of the loan amount | 72 months | |

Starting at 11.99% p.a. Up to 35% p.a. | From ₹40,000 to ₹35,00,000 | 4% of the loan amount + GST | Upto 6 Years | |

13% Onwards | Upto INR 30 lakh | 5% of the loan amount G+ ST | Up to 5 years |

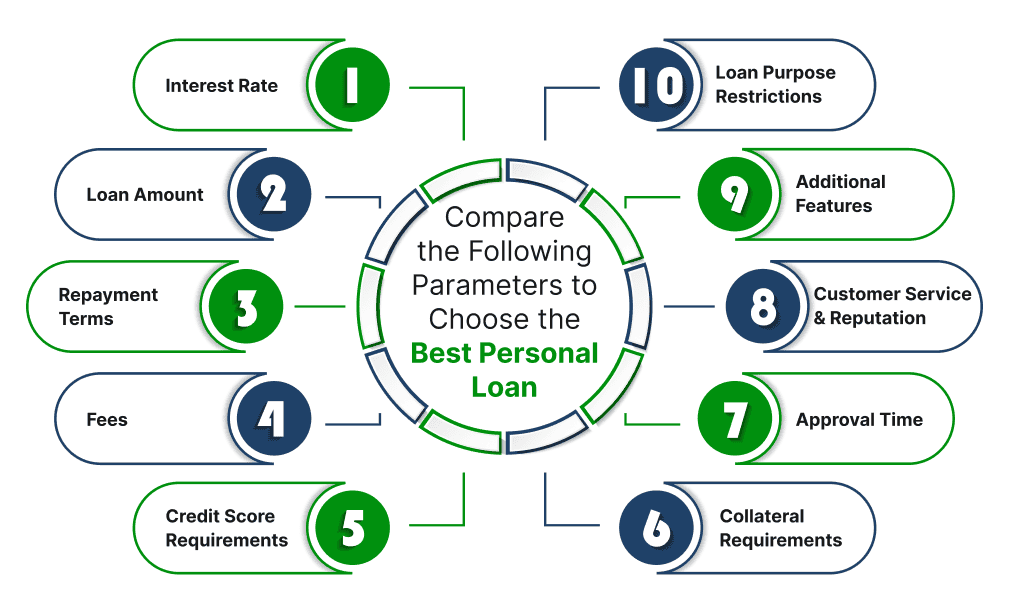

Compare the Following Parameters to Choose the Best Personal Loan

When choosing the best personal loans online, it's important to evaluate several factors to find the deal that best fits your financial needs. Here are the key parameters to consider:

- Interest Rates - Compare both fixed and floating rates. Lower interest rates reduce your borrowing cost, but floating rates may change over time.

- Loan Amount Offered - Ensure the lender provides a loan amount that suits your financial needs and aligns with your income and repayment ability.

- Repayment Terms - Review the loan tenure options. Longer tenures reduce monthly EMIs but may increase total interest paid.

- Charges & Fees - Be aware of hidden costs, such as processing fees, late payment charges, and prepayment penalties, which can accumulate over time.

- Credit Score Criteria - Check the minimum credit score requirement. A strong score improves your chances of approval and better interest rates.

- Security/Collateral - Understand if the loan is secured or unsecured. Secured loans are backed by collateral, which usually allows lenders to offer them at lower interest rates.

- Loan Disbursal Time - Evaluate how quickly the loan gets approved and disbursed, especially if you need urgent funds.

- Lender Reputation – Choose financial institutions with a strong track record, good customer feedback, and reliable support services to ensure a smooth and trustworthy borrowing experience.

- Extra Benefits - Look for features like top-up loans, flexible EMIs, or zero prepayment charges that add value to your borrowing experience.

- Usage Flexibility - Some loans may be limited to specific uses. Ensure the loan allows you to use the funds as per your intended purpose.

By comparing these parameters, you can make an informed decision and choose between the best personal loans in India that best fit your financial goals and circumstances.

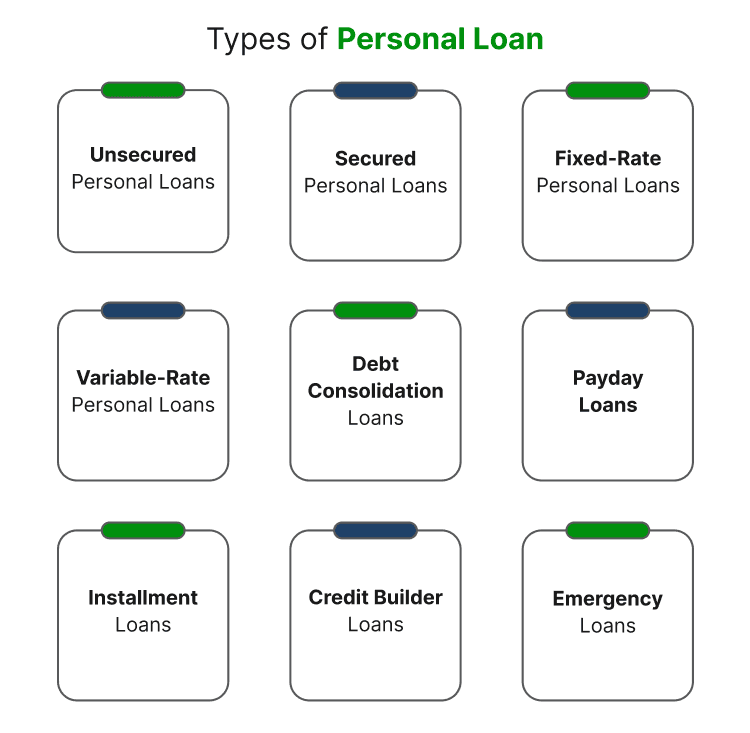

Types of Personal Loan

When it comes to personal loans, there's a variety of options to suit different needs. Here are some common types:

- Unsecured Personal Loans

These loans are offered without any collateral, making them widely accessible to salaried and self-employed individuals. However, since they involve a higher risk for the lender, the interest rates are generally higher compared to secured options. - Secured Personal Loans

Backed by an asset such as a fixed deposit, vehicle, or property, secured personal loans come with lower interest rates due to reduced lender risk. They're ideal for borrowers seeking larger loan amounts with better repayment terms. - Fixed-Rate Personal Loans

With a fixed interest rate, your EMI remains the same throughout the loan tenure. This provides predictability and simplifies budgeting, especially for long-term planning. - Floating or Variable Rate Loans

These loans come with interest rates that fluctuate based on market conditions or RBI policies. While the initial rate might be lower, it can rise over time, affecting your monthly repayments. - Debt Consolidation Loans

This type of personal loan helps borrowers merge multiple debts, like credit cards and other loans, into a single, more manageable loan. It often comes with a lower interest rate, simplifying your finances and potentially reducing overall interest payments. - Payday Loans

Payday loans are short-term, high-interest loans designed to be repaid by your next salary credit. While they offer quick cash, they are expensive and typically suited for urgent, small-ticket needs. - Installment Loans

Repayable through fixed monthly installments over a specified tenure, installment loans offer structured repayment. This makes them useful for planned expenses like weddings, education, or home renovations. - Credit Builder Loans

These loans are ideal for individuals with little or no credit history. The borrowed amount is usually held in an account while the borrower makes monthly payments, which are reported to credit bureaus, helping them build or improve their credit score. - Emergency Loans

Designed for urgent situations like medical emergencies, car repairs, or sudden travel, emergency loans are disbursed quickly and may have minimal documentation requirements, depending on the lender.

By knowing the different types of personal loans available, borrowers can make informed choices and pick the one that best fits their financial goals and repayment capacity.

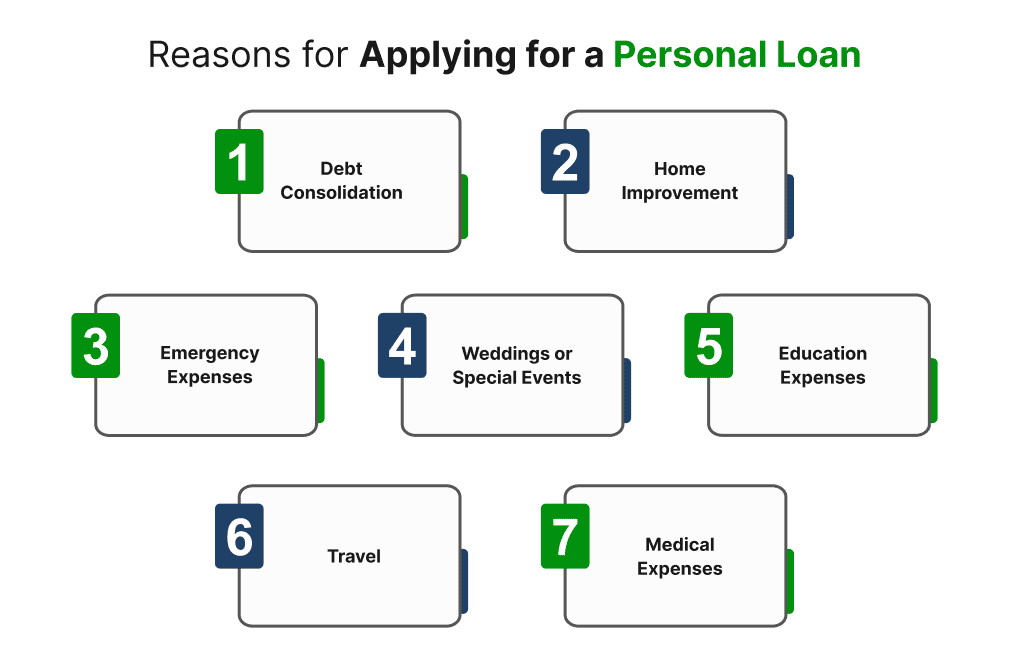

Top Reasons Why People Apply for Personal Loans

Personal loans are versatile financial tools that can be tailored to suit a wide range of needs. Depending on their financial goals and life events, individuals often turn to personal loans for the following purposes:

- Consolidating Debt

One of the most common reasons to take a personal loan is to combine multiple debts, like credit card balances or high-interest loans, into a single, manageable EMI. This helps streamline finances and can reduce the overall interest burden. - Home Renovation or Repairs

Whether it's upgrading your kitchen, fixing a leaking roof, or redesigning interiors, personal loans provide quick funding for enhancing your living space and increasing your property’s market value. - Handling Emergencies

Life is unpredictable. Sudden expenses like medical emergencies, urgent travel, or car breakdowns may require immediate financial support. Personal loans can offer fast access to cash during such unforeseen situations. - Wedding Expenses

Indian weddings can be lavish and expensive. Personal loans help families manage big-ticket wedding costs—from venues and decor to catering and outfits—without draining long-term savings. - Education Financing

Personal loans can also bridge gaps in education-related expenses, especially for students who don’t qualify for traditional education loans. They can be used for tuition fees, books, or certification programs. - Medical Treatments

When insurance doesn’t fully cover treatment costs or in case of elective procedures, a personal loan can help fund surgeries, therapy, dental work, or specialized medical care without delay. - Travel and Vacation Plans

Many individuals use personal loans to fund dream vacations or international travel. It allows them to explore new destinations without postponing plans or dipping into savings.

By understanding the reasons for applying for a personal loan, borrowers can make informed decisions about how to best utilize the funds and achieve their financial objectives.

Documents Required by Top Banks For Personal Loan in India

Here is the list of documents that are required by the Top Banks while applying for a personal loan -

- Identity Proof – Any PAN Card, Voter ID, Driving License, Aadhaar Card or Passport

- Residence Proof – Any Voter ID, Driving License, Aadhaar Card or Passport or Utility Bill

- Employment Proof – Appointment Letter, Employee ID Card

- Income Proof – Latest salary slips, Form 16 (Salaried)

- Business Continuity Proof – Rent Receipts/Lease Deed, Ownership Document, Income Tax Return (ITR), audited balance sheet, and profit & loss account for the last 3 years

- Last 3-6 months bank statement

- Duly filled & signed application form

- Latest passport-size photographs

Eligibility Criteria for Personal Loans in India

Personal loan eligibility requirements may vary across lenders, depending on their credit risk policies, the type of loan offered, and the applicant’s professional profile. However, most lenders follow these standard criteria, and borrowers should know about these criteria to obtain the best personal loan in India:

- Age : Applicants must typically be between 18 and 60 years of age.

- Minimum Monthly Income (Salaried) : ₹15,000 or more per month is generally required.

- Minimum Annual Income (Self-employed) : Should earn at least ₹5 lakh per annum, though this may vary by lender.

- Credit Score : A score of 750 or above is preferred, as it significantly enhances the likelihood of loan approval.

- Employment Stability (Salaried) : At least 1 year of continuous employment, although some lenders may ask for longer experience.

- Business Continuity (Self-employed) : A minimum of 3 years in the current business, with some lenders requiring a longer operational history.

- Employment Type : Salaried individuals employed with the government, public sector units, MNCs, or reputed private companies are usually preferred.

Conclusion

Selecting the best personal loan in India involves more than just comparing interest rates. It's important to assess factors such as loan amount eligibility, repayment flexibility, processing fees, prepayment charges, and the lender’s overall credibility. The ideal loan should balance affordability with convenience, offering transparent terms and responsive customer support. Whether you're a salaried individual or self-employed, ensure the loan fits your financial needs and repayment capacity without straining your budget.

Frequently Asked Questions (FAQs)

What are the Top banks that give the best personal loans in India?

What is the lowest interest rate on personal loans in India?

How can I select the right personal loan based on my financial needs?

Can I get a personal loan with a low credit score?

How much personal loan am I eligible for with a ₹30,000 monthly salary?

Is it better to take a personal loan from a bank or an NBFC?

How long does it take to get a personal loan approved?

What documents are required for a personal loan in India?

Can I prepay or foreclose a personal loan early?

What is the maximum tenure for personal loans in India?

Best Offers For You!

Personal Loan Rates by Top Banks

- HDFC Personal Loan Interest Rates

- ICICI Personal Loan Interest Rates

- Kotak Personal Loan Interest Rates

- IndusInd Bank Personal Loan Interest Rates

- RBL Bank Personal Loan Interest Rates

- YES BANK Personal Loan Interest Rates

- IDFC First Bank Personal Loan

- Tata Capital Personal Loan

- SMFG India Credit Personal Loan

- SCB Personal Loan Interest Rates

- SBI Personal Loan Interest Rates

- Axis Bank Personal Loan Interest Rates

Personal Loan

- Personal Loan

- Personal Loan Eligibility Calculator

- Personal Loan EMI Calculator

- Personal Loan Interest Rates

- Pre-approved Personal Loan in India

- Personal Loan Top Up in India

- Personal Loan Balance Transfer

- Apply Personal Loan on WhatsApp

- Personal Loan for Unemployed

- Personal Loan for Government Employees

- Personal Loan Without CIBIL Score

- Minimum CIBIL Score for Home Loan

Personal Loan Calculator by Top Banks

- HDFC Personal Loan EMI Calculator

- ICICI Personal Loan EMI Calculator

- Kotak Personal Loan EMI Calculator

- IndusInd Bank Personal Loan EMI Calculator

- RBL Bank Personal Loan EMI Calculator

- YES Bank Personal Loan EMI Calculator

- IDFC First Bank Personal Loan EMI Calculator

- Tata Capital Personal Loan EMI Calculator

- SMFG India Credit Personal Loan EMI Calculator

- Standard Chartered Personal Loan EMI Calculator

- SBI Personal Loan EMI Calculator

- Axis Bank Personal Loan EMI Calculator