Best Home Loans in India

Last Updated : Sept. 24, 2024, 12:02 p.m.

How do you define a home? A home is a place where the times spent today become beautiful memories that are cherished forever. But, how many people are able to buy a home without a loan? Not many and that’s fine. We are living in a time when dreams are expensive and when you have top lenders offering home loans at a rate within your budget, everything seems sorted.

Compare Best Home Loans at Lowest Interest Rates in India 2024

Here are some of the top home loans in India for 2024, along with their housing loan interest rates:

List of Banks | Home Loan Interest Rates |

|---|---|

8.75% - 9.15% | |

9.16% - 15.00% | |

8.40% - 10.60% | |

8.40% - 10.70% | |

8.35% - 10.90% | |

8.40% - 11.75% | |

8.50% - 9.50% | |

8.80% onwards | |

8.50% onwards | |

8.70% - 9.30% | |

8.75% onwards | |

8.45% onwards | |

8.85% - 9.25% | |

8.35% - 10.0% | |

8.85% onwards | |

8.60% onwards | |

9.00% - 11.05% | |

8.75% onwards | |

10.50% onwards | |

8.55% - 10.0% | |

9.40% onwards | |

8.90% onwards | |

8.50% - 9.65% | |

8.95% onwards | |

8.40% - 10.40% | |

9.00% - 12.00% |

Compare Housing Finance Companies Home Loan Interest Rates in India 2024

Below we have listed the main housing finance companies along with their offered interest rates:

List of NBFCs | Housing Loan Interest Rates |

|---|---|

10.00% onwards | |

8.75% onwards | |

8.50% onwards | |

8.50% - 11.95% | |

8.75% onwards | |

9.50% Onwards | |

ICICI Home Finance | 9.10% onwards |

8.60% onwards |

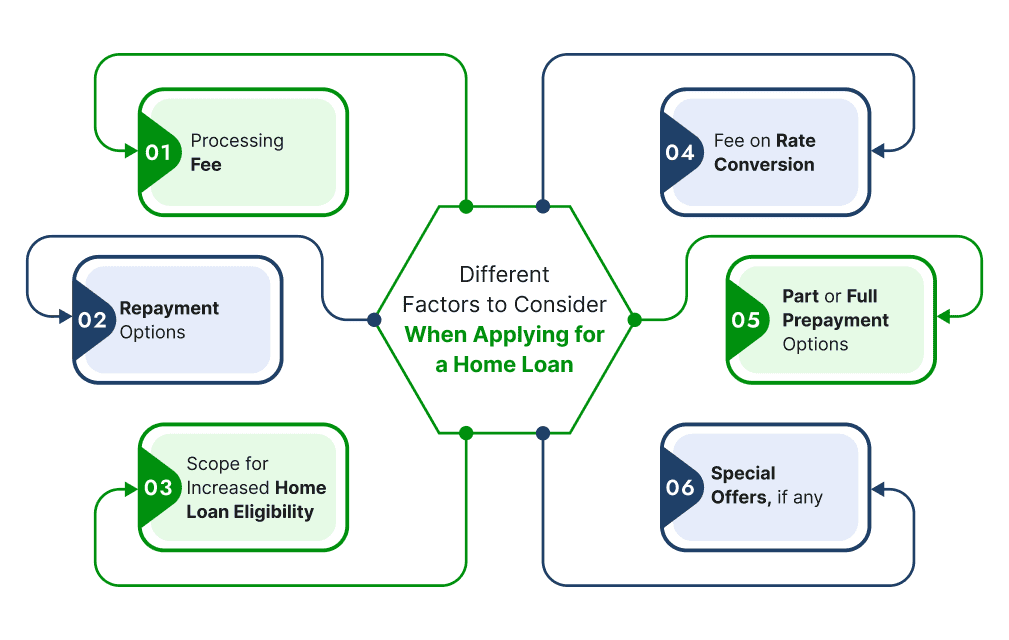

Different Factors to Consider When Applying for a Home Loan

The best home loan in India is not restricted to just the interest rate. You need to consider many aspects before zeroing in on the best home loan. So, without wasting any time, let’s check out all such aspects –

- Processing fee

- Repayment options

- Scope for increased home loan eligibility

- Fee on rate conversion

- Part or full prepayment options

- Special Offers, if any

Let’s talk about each of them individually.

- Processing Fees

The processing fee is the one-time fee you pay to the lender. As the home loan amounts remain much higher, with the average home loan size being INR 30-40 lakh, the processing fee even at the rate of 0.25%-1% can be a significant amount to pay. The processing fee may or may not include the legal and technical fees , so it depends pretty much on the lender. If the processing fee is not inclusive of legal and technical charges, you should check your savings and see whether you can pay that or not.

To make it easy for you, lenders can give you the option of including the processing fee and legal & technical fees (if not included in the former) in the loan amount. That will enhance your EMI and interest outgo than normal. So, like interest rates, you should compare the processing fee of different lenders too.

List of Banks/NBFCs | Processing Fees |

|---|---|

Up to 1% of the Loan amount subject to a minimum of INR 10,000 Upfront processing fee of INR 2,500 + GST | |

1% of Loan Amount, Min INR 5,000 + GST | |

| |

0.25% of the loan amount + GST | |

0.25% of the loan amount + GST | |

0.5% of the loan amount + GST | |

Waived up to 31.12.2024 | |

0.50% of the loan amount to a maximum of INR 7,500 + GST | |

3% of the loan amount + GST | |

Up to 0.50% of the loan amount or INR 3,000 whichever is higher, plus applicable taxes. | |

1% of the loan amount + GST or INR 10,000, whichever is higher | |

0.50% - 2.00% of the loan amount or INR 3,000/- whichever is higher. | |

0.50% of the loan amount to a maximum of INR 2,500 + GST | |

Upto 3% of the loan amount | |

INR 10,000 + GST | |

0.50% of the loan amount to a maximum of INR 15,000 + GST | |

0.25% of the loan amount to a maximum of INR 10,000 + GST | |

0.50% of the loan amount + GST | |

Loans up to INR 25 lakhs: INR 2,500 + GST | |

Zero processing fee for online application. (Upto 1.25% of Loan amount for offline application) | |

| |

As applicable | |

0.35% of the loan amount, subject to a minimum and maximum of INR 2,500 and INR 15,000 respectively | |

1% of the loan amount | |

Up to 0.25% of the loan amount to a maximum of INR 15,000 + GST | |

INR 5,000 - INR 15,000 of the loan amount + GST | |

0.35 % of the loan amount and a maximum INR 10,000 +GST | |

INR 10,000 + GST | |

Up to 5% of the loan amount + GST | |

0.5% of the loan amount, to a maximum of INR 15,000/- + GST | |

0.5% of the loan amount or a maximum of INR 10,000 + GST |

- Flexible & Extended Repayment Options

Home loan interest rates and processing fees are vital and so is repayment. Yes, the maximum time you can get to pay the loan is 30 years. But all that is subject to your age. While some lenders keep the loan running for the time you attain the age of retirement i.e. 60 years, others keep it for the time you become 70 years old.

- Scope for Increased Home Loan Eligibility

The home loan quantum is dependent on your income and repayment capacity, besides the value of the property you are looking to buy. In case the home loan eligibility comes less based on your income and repayment capacity, you might struggle to buy a home on your own. So, if you can add an earning co-applicant, the loan eligibility will enhance and boost your chances of buying a dream home. So, which lender is offering you the maximum based on your as well as the co-applicant’s income? Check that and decide accordingly.

- Fee Payable on Rate Conversion

As you would know the home loan is basically offered on a floating rate. But some borrowers are servicing the loan at a fixed rate basis too. Fixed rates can be 3%-4% above the floating rate and can make you pay more by the time the loan wraps up. You need to check the lender that charges less on converting the fixed rate into a floating rate. If we look at the floating rate system, housing loan interest rates are benchmarked to the base rate, MCLR, and RLLR.

- Check Prepayment Norms Carefully

People make prepayment either in full or in part to reduce their interest obligations. Usually, floating rate loans don’t come with charges on part prepayment. But there could be some lenders that will charge on part payment of a floating loan too. If you happen to be servicing your loan there, the joy of part payment could be reduced to a degree.

But, if you are yet to take a home loan, read the terms and conditions pertaining to part payment and act accordingly. Full prepayment comes with no charges if you do it from your own resources. But if you do it via a balance transfer, lenders can deduct applicable charges. Fixed-rate loans, on the other hand, have charges on both parts and full prepayment. It doesn’t matter if you do it from your own sources or via a home loan balance transfer .

- Special Offers

Check for special offers on home loan interest rates and processing fees if you are about to take a home loan. Lower interest rates can be the case if you already hold a relationship with the lender you are looking to take a loan from. Also, if you are working in a reputed MNC or any top-rated firm, you can get special rates on your home loans. There could be processing fee waivers too. But that will be for a limited period.

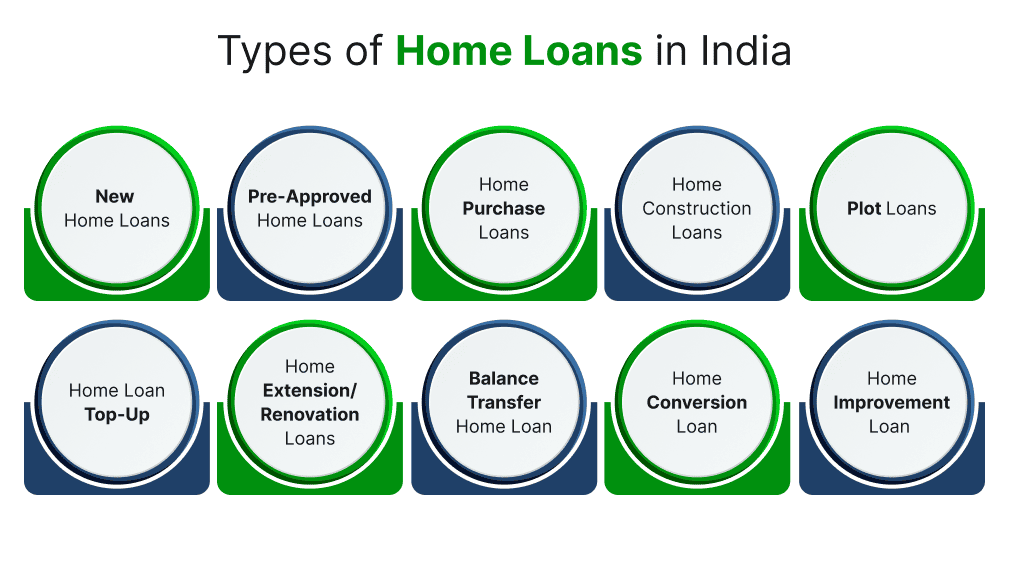

Types of Home Loans in India

Here's a list of the most popular housing loans offered by some of the Best Bank For Home Loans in India.

- New Home Loans: Good for customers who have never owned a house or property before.

- Pre-Approved Home Loans: These are for customers who have satisfied both income and credit standards (typically based on FICO score) and thus are given pre-approval instead of waiting until after the actual purchase.

- Home Purchase Loans: For buyers who need to buy a new house or apartment.

- Home Construction Loans: These home loans help customers who want to build a house on land they own.

- Plot Loans: For those who want to buy land for the purpose of constructing a home on it later.

- Home Loan Top Up: Existing loan borrowers will raise more funding than their current mortgage through this service.

- Home Extension/Renovation Loans: Loans for borrowers wishing to expand or renovate their existing house.

- Balance Transfer Home Loan: You can transfer your existing home loan to a different bank that will offer you lower interest rates.

- Home Conversion Loan: For those who already have a home loan but wish to buy and move into a different property.

- Home Improvement Loan: Financing to repair, improve, or renovate an existing property.

Key Eligibility Criteria to Apply for a Home Loan

Here are the main eligibility criteria you need to consider when applying for the best housing loan in India:

Age Requirements

- Minimum Age : 18 years

- Maximum Age : 70 years

Resident Type

- Resident Indian

- Non-Resident Indian (NRI)

- Person of Indian Origin (PIO)

Employment

- Salaried

- Self-employed

Net Annual Income

- At least Rs. 5-6 lakh, depending on the type of employment

Residence

- A permanent home

- A rental where the applicant has lived for at least one year before applying

Credit Score

- A good credit score of 750 or higher from a recognized credit bureau.

See Which Lender Can Offer You the Best Home Loan Rate Based on Your Good Credit Score?

Although a good credit rating is crucial for obtaining a home loan, it also has a significant impact on the interest rate you receive. With a good credit rating of 750 and over, the interest rate will be very low and help to keep your EMI payments down. The top lenders like SBI, ICICI Bank, HDFC Limited, and LIC Housing Finance give low-interest rate home loans to those with good credit records. However, the standard for the lowest rate changes from one to another bank, and even between branches of the same organization: For more information about it, please visit Home Loan Interest Rates by Credit Scores on this site.

Frequently Asked Questions (FAQs)

What is the interest rate for home loans in India?

What are the needed documents for applying for home loans?

How long does it take to get a home loan approved?

Can I prepay my home loan early?

How much home loan can I borrow?

Home Loan Calculator by Top Banks

- SBI Home Loan EMI Calculator

- HDFC Bank Home Loan EMI Calculator

- Tata Capital Home Loan EMI Calculator

- LIC Home Loan EMI Calculator

- PNB Housing Finance Home Loan EMI Calculator

- ICICI Home Loan EMI Calculator

- Bank of Baroda Home Loan EMI Calculator

- Axis Bank Home Loan EMI Calculator

- Indiabulls Home Loan EMI Calculator

- Reliance Home Loan EMI Calculator