Best FD Rates of All Banks – Compare & Apply

Last Updated : Sept. 20, 2024, 1:46 p.m.

Looking for a reliable way to earn guaranteed returns on your savings? Fixed deposits (FDs) are a popular and straightforward choice because they offer assured returns at the best interest rates, regardless of market fluctuations.

Here's how a fixed deposit account works: When you open an FD account, you deposit a specific amount with the bank for a predetermined period at a fixed interest rate. At the end of this term, or on the maturity date, you receive the initial investment along with the accrued interest. The best FD interest rate is typically compounded, maximizing your returns over the deposit period.

FD interest is set by the bank when you open the fixed deposit account and remains constant throughout the deposit term. As a result, the depositor receives returns on the invested amount at this predetermined rate, ensuring predictable and steady growth over the deposit period.

Let’s explore the article to discover the best FD interest rates offered by various banks in India . These rates will help you make an informed decision and choose the right bank for your fixed deposit needs.

List of Banks Offering Best FD Rates in 2024

When it comes to growing your savings securely, fixed deposits (FDs) offer a reliable option with guaranteed returns. Banks throughout India are providing attractive fixed deposit interest rates , meeting a variety of investment needs and preferences. The two tables show the list of Public Sector and Private Sector Banks and a comprehensive overview of the best FD rates for senior citizens as well as for the general public, to help you find the best option for your financial goals:

List of Public Sector Banks in India

This is the list of best fixed deposit interest rates of Public Sector Banks in India -

Name of the Bank | FD Interest Rates (General Public) | FD Interest Rates (Senior Citizens) |

|---|---|---|

4.25% - 7.15% | 4.75%- 7.80% | |

3.00% - 7.25% | 4.50% to 7.25% | |

2.75% - 6.50% p.a. | 2.75-7.75% p.a. | |

4.00% - 7.25% | 5.00%-7.90% | |

3.50%-7.00% | 4.00%-7.50% | |

2.80%-7.25% | ||

4.00%- 7.30% | 4.50-7.80% | |

6.00%- 7.50% | 7.80% Senior citizens receive an additional 0.50% interest on term deposits below ₹3 crore. | |

2.70% to 3.00% | 4.00% -7.75% p.a. | |

3.50% to 7.00% | 4.00% - 7.75% | |

2.90% to 7.05% | Starting from 0.25% Additional interest for senior citizens is 0.25% for up to 1 year | |

2.75% to 7.50% | Up to 7.50% Resident senior citizens get an additional 0.50% interest over regular rates. |

List of Private Sector Banks in India

This is the list of best-fixed deposit interest rates of Private Sector Banks in India -

Name of the Bank | FD Interest Rates (General Public) | FD Interest Rates (Senior Citizens) |

|---|---|---|

3.00% - 7.25% | 3.50%- 7.90% p.a | |

3.00% - 8.10% | 3.75% - 8.50% p.a | |

CSB Bank Limited | 3.00% - 7.75% | 3.00% - 7.75% |

5.00% - 7.50% | 5.00% - 8.00% | |

3.75% - 8.05% | 4.25% - 8.55% | |

3.00 % -7.25% p.a. | 3.00%-7.75% p.a. | |

3.00% - 7.35% | 3.50% - 7.90% | |

3.00% - 7.25% p.a | 3.50% - 7.90% | |

3.00% - 7.25% p.a | 3.50% - 7.80% | |

3.90% - 7.99% p.a | 4.00% - 8.49% | |

3.00% - 7.75% | 4.00% - 8.49% | |

3.5% - 7.00% | 4.00% - 7.5% | |

3.50% - 7.65% | Up to 8.25% 0.50% will be extra for Senior Citizens | |

4.00% p.a. - 7.60% | 6.65% - 8.10% p.a | |

2.75% - 7.61% | 3.25% - 7.90% p.a. | |

3.25% -7.05% p.a. | 3.75% -7.55% p.a. | |

3.50% - 8.10% p.a. | 4.00% - 8.60% p.a. | |

2.90% - 7.00% p.a. | 3.40% - 7.50% p.a. | |

5.25% - 7.25% p.a. | 5.25% - 8.00% p.a. | |

3.25% - 8.00% p.a. | 3.75% - 8.24% p.a. | |

3.00% - 7.35% p.a. | 3.50% - 8.50% p.a. |

What is the Process of Interest Calculation on the Fixed Deposit?

Now that you’re familiar with the best FD interest rates in India, you might be wondering how banks calculate interest on these deposits. Banks typically use two methods: cumulative and non-cumulative interest calculations. You have the option to choose between these two.

We will explain both processes in detail, so you can make an informed decision and choose the best option for your financial needs.

The formula for Calculating FD Interest Rate -

A = P * (1+ r/n) ^ n*t

Where,

I = A – P

A stands for Maturity Amount

P stands for Principal Amount

r stands for Rate of Interest

t stands for Tenure

n stands for Compounded interest frequency

I stands for Interest earned

Cumulative Interest Calculation:

In this method of FD interest rate calculation, known as the cumulative option, you deposit a fixed sum of money for a specified period. The interest is typically calculated every quarter, and at the end of each quarter, the earned interest is added to your principal amount. This reinvestment of interest helps your deposit grow faster through compounding. At the end of the deposit term, which can range from as short as 7 days to as long as 10 years, you receive the total accumulated amount, including both your principal and the compounded interest. This option is ideal for those looking to maximize their returns over time.

This option is typically chosen by those who want to save and accumulate a significant amount over a long investment period. You will receive both the principal and the accumulated interest only at the end of the maturity period, making it ideal for long-term financial goals.

For example, if you invest an amount of INR 4,00,000 for 4 years at an FD interest rate of 8.1% per annum, then at the end of your maturity period you will get a total amount of INR 5,90,457 including interest of INR 1,90,457.

Non-Cumulative Interest Calculation:

In the non-cumulative method of FD rate calculation, the interest on your deposited amount is calculated based on the frequency you choose, that is, monthly, quarterly, half-yearly, or yearly. Unlike the cumulative process, the interest earned is not reinvested with the principal. Instead, it is paid out to you at regular intervals, depending on your selected payout frequency. This option is ideal for those who prefer to receive a steady income from their fixed deposit, rather than waiting until the maturity period. Keep in mind that since the interest isn't compounded, the overall returns may be lower compared to the cumulative option.

One of the examples is of the Senior Citizens who also enjoy higher fixed deposit rates. As compared to the standard rate of interest and want a fixed source of income during their retirement years.

For example, if you invest an amount of INR 10,000 for 1 year at an FD interest rate of 7.6% per annum. The amount you get at different frequencies can be seen in the table given below.

| Frequency | Interest Rate | Interest Payout (In ₹) |

|---|---|---|

| Monthly | 7.35% | 612 |

| Quarterly | 7.39% | 1848 |

| Half-yearly | 7.46% | 3730 |

| Yearly | 7.60% | 7600 |

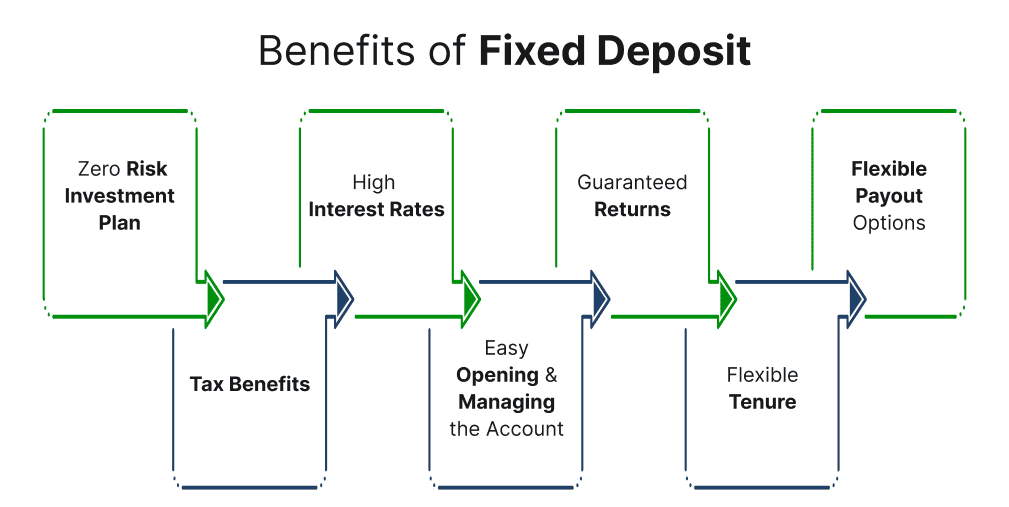

Benefits of Fixed Deposit

There are several benefits and advantages of fixed deposit with top banks of India, some of which are mentioned below -

- Zero Risk Investment Plan - A fixed deposit offers minimal to no risk, making it a popular choice for risk-averse investors. It’s an ideal starting point for those looking to begin saving, as it allows you to set aside your savings while earning a fixed interest rate.

- Tax Benefits - There are certain types of FDs, such as tax-saving fixed deposits with a lock-in period of 5 years which offer tax deductions under Section 80C of the Income Tax Act.

- High Interest Rates - FDs typically offer higher interest rates compared to regular savings accounts which makes them a better option for growing your savings.

- Easy Opening and Managing the Account - Fixed deposits are easy to open, either online or at a bank branch, and they require minimal paperwork and management.

- Guaranteed Returns - Fixed deposits offer a secure investment with guaranteed returns, regardless of market fluctuations, providing financial stability.

- Flexible Tenure - Fixed Deposits come with flexible tenures, ranging from as short as 7 days to as long as 10 years. It allows you to choose a term that fits your financial goals.

- Flexible Payout Options : You can choose between cumulative FDs, where interest is compounded and paid at maturity, or non-cumulative FDs, where interest is paid out at regular intervals, depending on your financial needs.

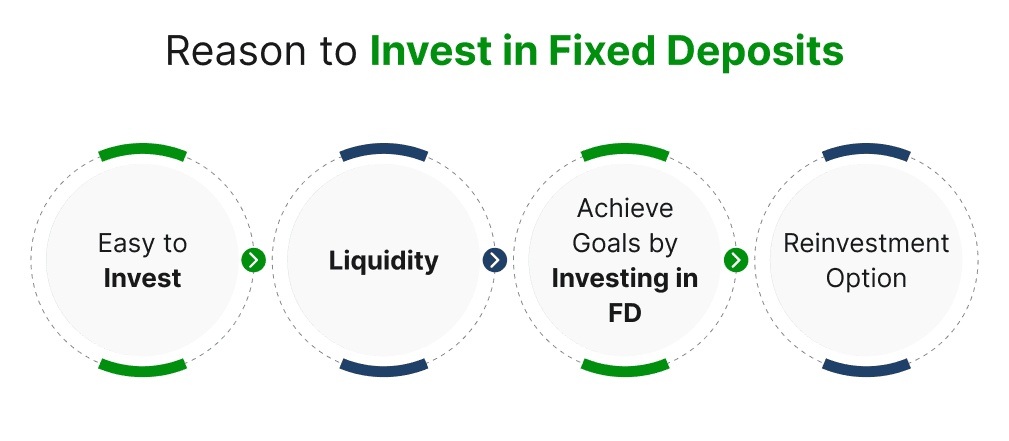

Reason to Invest in Fixed Deposits

Here are some of the reasons why you should consider investing in Fixed Deposits -

- Easy to Invest - Compared to other investment options, investing in an FD is quick, convenient, and hassle-free. If you open an FD with the same bank where you hold a savings account, minimal or no documentation is typically required. Additionally, these FDs can be seamlessly linked to your savings account which allows surplus funds in your account to be effortlessly invested in fixed deposits for better returns.

- Liquidity - While FDs are meant to be held until maturity, they can be broken prematurely in case of emergencies, If it is broken before maturity there will be a high chance that this might come with a penalty.

- Achieve Goals by Investing in FD - A fixed deposit is ideal for short-term financial goals, as it safeguards your capital while earning interest on the invested amount. Many people choose FDs to achieve short-term objectives such as buying a car, saving for a vacation, purchasing electronics, and more.

- Reinvestment Option - FDs often provide an option to reinvest whatever the interest has been earned which allows the investment to compound over time.

Frequently Asked Questions (FAQs)