Car Loan Interest Rates of All Banks

Last Updated : Sept. 20, 2024, 12:44 p.m.

Do you fantasize about owning a high-end vehicle? Want to improve your standard of living but don’t know where to start? Let us help you with the best car loan interest rates. Whenever purchasing a car, whether new or used, understanding car loan interest rates is crucial for making an informed financial decision. The interest rate on your car loan plays a significant role in determining your monthly payments, the total cost of the loan, and ultimately, the affordability of your vehicle. It can be either fixed or variable. In this article, we'll break down everything you need to know about car loan interest rates so that you can drive away with confidence.

New Car Loan Interest Rates All Banks 2024

Check and compare the car loan interest rates of all the banks in India in the table below.

Banks | Interest Rates |

|---|---|

9.30% p.a. | |

9% onwards | |

Starting from 8.85% | |

Starting from 8.85% | |

8.75% - 11.95% p.a. | |

8.70% to 10.15% | |

DBS | 6.25% p.a. onwards |

Federal Bank | 8.85% p.a. onwards |

7% - 13% p.a. | |

9.1% Onwards | |

9.65% Onwards | |

Jammu & Kashmir Bank | 8.70% Onwards |

Karnataka Bank | 8.88% p.a. - 11.24% p.a. |

Karur Vysya Bank | 9.60% to 10.10% |

Nainital Bank | 10% to 15% p.a. |

Punjab & Sind Bank | Starting from 8.45% p.a. |

Punjab National Bank | Starting from 9.75% p.a. |

From 9.15% to 10.10% | |

8.70% p.a. at present | |

Current car loan rates depend on credit scores, repayment tenure, | |

Union Bank | Starting from 8.70% p.a. |

Indian Bank | Starting from 8.75% p.a. |

Best Interest Rates for Used Car Loan

These are the best interest rates for used car loans provided by different banks -

Bank Name | Interest Rates |

|---|---|

Axis Bank | 13.55% and 15.80 |

Bank of Maharashtra | Starting from 12.45% (Depending upon your CIBIL Score ) |

DBS | RBI Repo Rate (6.25%) + Spread |

Federal Bank | 16.30% (Repo Rate + 9.80) |

HDFC Bank | From 9.70% - 16.70% |

ICICI Bank | starts from 11.25% onwards depending on the applicant's CIBIL score and the car segment." |

Indian Bank | 10.80% to 12.90% |

Jammu & Kashmir Bank | upto 04 years: RLLR+3.75% (Fixed) Above 04 years:RLLR+4.75% (Fixed) |

Karnataka Bank | 12.11% |

Karur Vysya Bank | 40% (not Older Than 5 Years) |

Punjab & Sind Bank | From 11% -12.50% |

SBI | From 11.75% to 15.20 |

UCO Bank | For vehicles up to 3 years old:

|

Union Bank | 12.85% to 12.95 % (depending upon your CIBIL Score) |

YES Bank | 10%-24% depending on your credit profile |

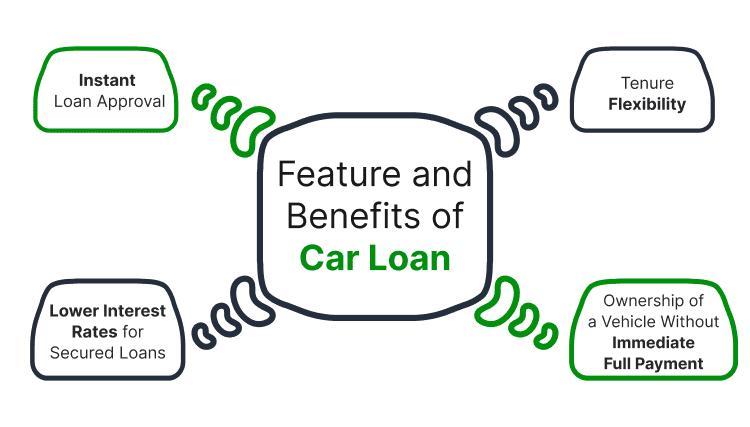

Feature and Benefits of Car Loan

These are some benefits and features of car loans from the top banks with low interest rates -

- Instant Loan Approval - You can apply for a car loan online , with funds disbursed almost instantly. Borrowers no longer have to wait days for the funds to be credited to their accounts. For instance, Finnable disburses vehicle loan funds within 6 hours of document approval, ensuring a quick and hassle-free process.

- Tenure Flexibility - Borrowers can set repaying options according to their flexibility. Lenders typically offer flexible repayment tenures, allowing you to choose a schedule that fits your budget, with options ranging from 1 to 7 years.

- Lower Interest Rates for Secured Loans: Car loans are secured against the vehicle, which often results in lower interest rates compared to unsecured loans like personal loans .

- Ownership of a Vehicle Without Immediate Full Payment: A car loan allows you to own a vehicle without paying the entire amount upfront. This helps manage your finances better by spreading the cost over some time.

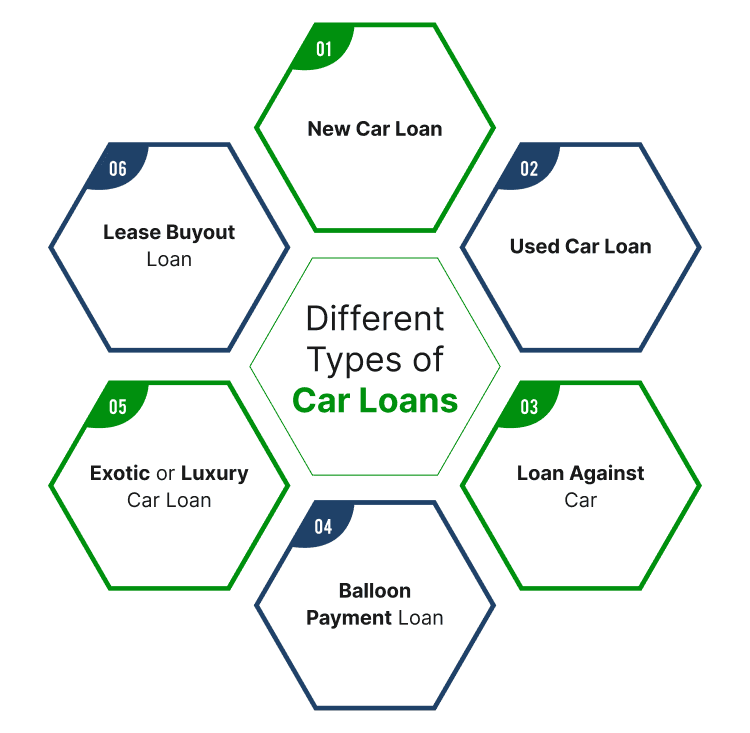

Different Types of Car Loans

Here are the different car loans mentioned for your reference -

- New Car Loan - New car loans are meant for buying a brand-new vehicle and often come with lower interest rates because new cars have a higher resale value. Depending on the lender and the borrower’s credit, the loan can cover up to 100% of the car’s on-road price.

- Used Car Loan - Used car loans are for people buying a second-hand vehicle. The interest rates are usually a bit higher than new car loans, and lenders may offer to finance a smaller portion of the car's price.

- Loan Against Car - This is a secured loan where the car is pledged as collateral. It allows car owners to raise funds by borrowing against the value of their existing vehicle. It’s an option for those needing liquidity while retaining ownership of their car.

- Balloon Payment Loan - A balloon payment loan lets borrowers make smaller monthly payments for most of the loan term, with a large, one-time payment at the end. This option is good for people who expect to have a large sum of money later to cover the final payment.

- Exotic or Luxury Car Loan - These loans are made for buying high-end luxury or exotic cars and usually come with stricter eligibility requirements and higher interest rates, due to the expensive nature of the vehicles.

- Lease Buyout Loan: For individuals who have been leasing a car and wish to buy it at the end of the lease term, a lease buyout loan is available. This allows them to finance the purchase of the leased vehicle rather than paying a lump sum.

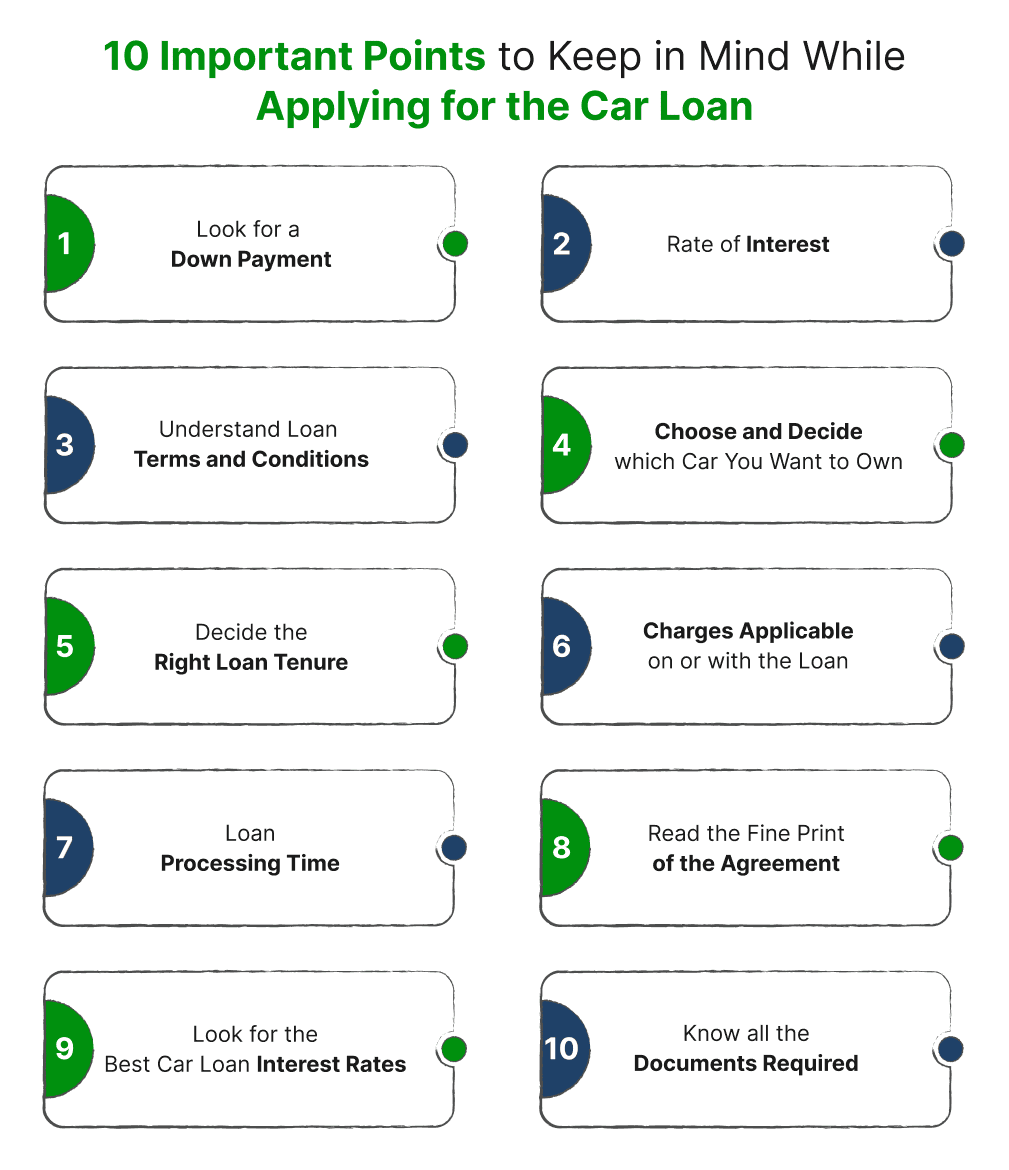

10 Important Points to Keep in Mind While Applying for the Car Loan

Here are some important factors that need to be considered while applying for the Car Loan -

- Look for a Down Payment - The amount you pay upfront towards the car purchase is the down payment. A higher down payment reduces the loan amount, which can lower your monthly payments and the overall interest you pay over time.

- Rate of Interest - The interest rate on your car loan directly affects your monthly payments and the total cost of the loan. Shop around and compare rates from different lenders to get the best deal.

- Understand Loan Terms and Conditions - Before signing the agreement, make sure you fully understand the terms and conditions, including interest rates, repayment tenure, and any hidden charges. Clarifying these can prevent surprises later on.

- Choose and Decide which car you want to own - It’s important to finalize the car you wish to buy before applying for a loan. Lenders may offer different rates for different types of cars, so knowing the exact car model will help you get an accurate loan offer.

- Decide the Right Loan Tenure - Loan tenure refers to the period over which you’ll repay the loan. A longer tenure means smaller monthly payments but more interest over time, while a shorter tenure results in higher payments but lower total interest.

- Charges Applicable on or with the Loan - Be aware of all additional fees associated with the loan, such as processing fees, late payment charges, foreclosure charges, and other hidden costs. These can significantly affect the overall cost of the loan.

- Loan Processing Time - Different lenders have varying processing times. If you need the loan quickly, look for lenders offering fast disbursal times. Some can process and disburse funds within hours.

- Read the Fine Print of the Agreement - Always read the fine print carefully to understand the full terms of your loan. Look out for any clauses that could impact you financially, such as prepayment penalties or hidden fees.

- Look for the Best Car Loan Interest Rates - Compare interest rates from different lenders available in the market before finalizing your loan. Even a small difference in rates can lead to substantial savings over the loan’s term.

- Know all the Documents Required - Ensure you have all the necessary documents ready before applying for the loan. These typically include identity proof, income proof, address proof, and car-related documents. Having them in order speeds up the approval process.

Frequently Asked Questions (FAQs)