UCO Bank Balance Check Number

Last Updated : Dec. 6, 2024, 2:46 p.m.

Many people across the country have savings accounts with UCO Bank, enjoying various services while keeping their money safe. To keep track of your UCO Bank balance, you can easily use the bank's SMS and calling services. These methods allow you to check your account balance even without an internet connection or smartphone. Simply call or send an SMS to the UCO Bank Balance Check Number to know your available balance. Alternatively, you can also use your UCO Bank debit card at any ATM to check your balance.

Let’s explore all possible methods to do the UCO Bank balance enquiry.

Methods to Know UCO Bank Balance Enquiry Number

There are various ways to know the balance of the UCO Bank Savings account. You can use any method to check the bank balance of your UCO account.

UCO Bank Toll-Free Number For Balance Check

Here is the UCO Bank Balance enquiry number -

- You can dial 1800-274-0123 and follow the instructions to know the available balance in your UCO Bank account.

- Make sure that you dial the toll-free number from your registered mobile number with the UCO Bank. Once you follow all the instructions carefully, then you can easily make the UCO Bank balance enquiry.

UCO Bank Missed Call Balance Check Number

There isn't a separate balance inquiry number for missed calls at UCO Bank.However, UCO Bank customers can give a missed call to the toll-free number mentioned above to check their account balance.

UCO Bank SMS Service for Balance Check

To check your UCO Bank balance, simply send an SMS with the text "UCOBAL" to 56161. You will receive an SMS within seconds with your UCO Bank balance details.

Please ensure that the SMS is sent from your registered mobile number, as the balance details will be sent to the same number.

UCO Bank NetBanking Account Statement

Steps for how to check UCO Bank Account Balance -

- Visit the official website of UCO Bank on any of your device.

- Then click on the Green Login button present at the top-right corner of the page.

- Enter your User ID and Password and click on the Personal Login option.

- Now you will be able to view the UCO bank balance.

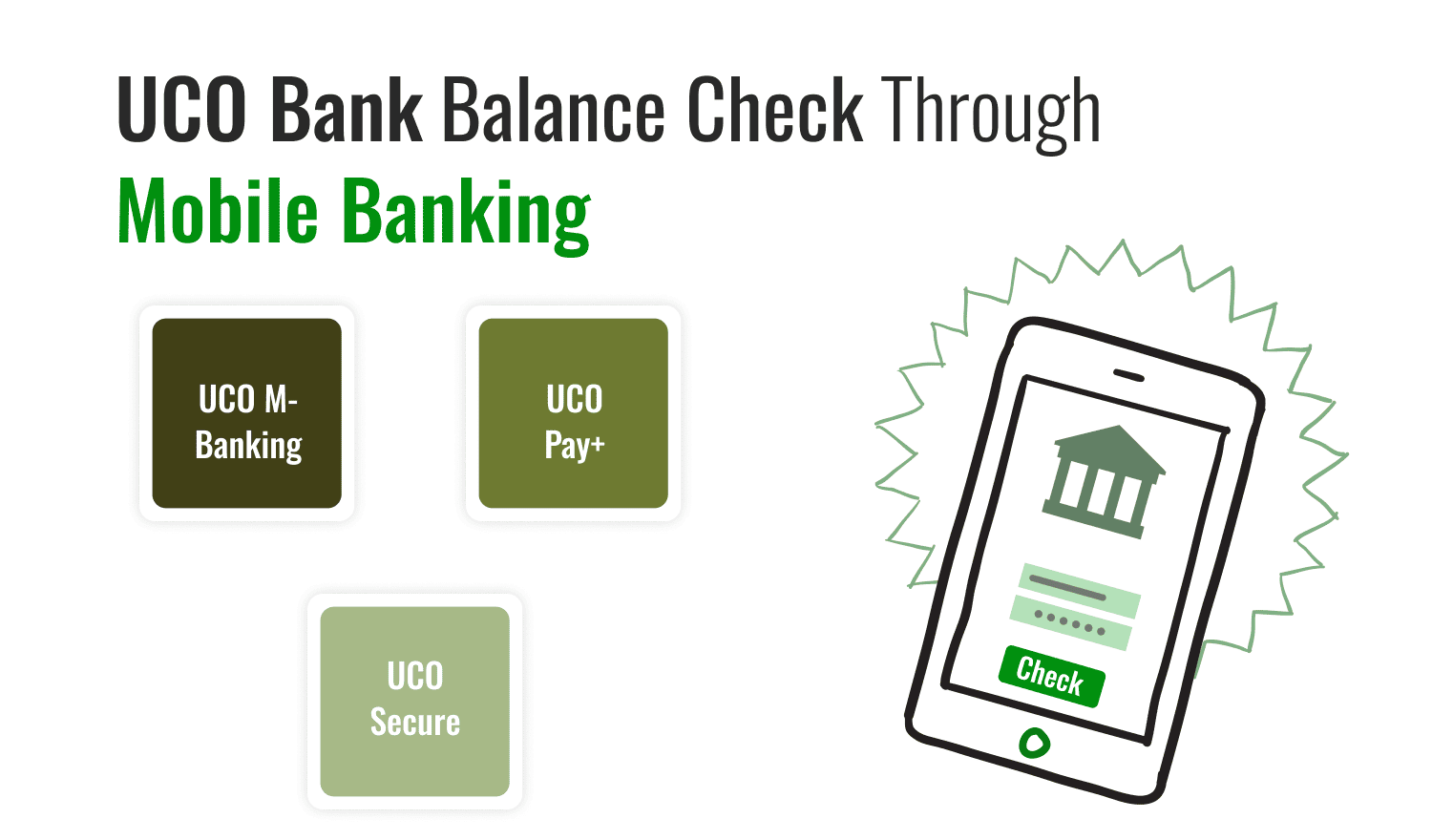

UCO Bank Balance Check Through Mobile Banking

In addition to the UCO Bank balance check number and net banking facilities, UCO Bank offers multiple apps for easy balance inquiry. Account holders can conveniently check their UCO Bank account balance on the go using the following UCO Bank mobile banking apps:

- UCO M-Banking: This app is available for UCO Bank account holders on both Android and iOS devices. It provides quick and simple access to a range of banking services, such as fund transfers, mini statements, chequebook requests, and account balance checks for UCO Bank.

STEPS :-

- Log in using your registered mobile number or account number.

- Enter your UCO Bank MPIN or security PIN.

- Navigate to the ‘My Accounts’ section.

- Select ‘View Account Balance’ to check your account balance.

- UCO Pay+: This wallet app from UCO Bank is exclusively available for Android devices. In addition to balance inquiry, users can load money into their UCO Pay+ wallet and use it for recharges and bill payments. You can also send or receive money from friends using net banking, debit cards, or credit cards.

- UCOSecure: The UCOSecure mobile app enhances the security of all of UCO Bank's digital products. It allows you to block and unblock services such as m-banking, e-banking, debit cards, UCO Pay (e-wallet), and BHIM UCO UPI. This app also provides the option to check your account balance.

STEPS:-

- Log in using your registered mobile number or account number.

- Enter your UCO Bank MPIN or security PIN.

- Navigate to the ‘My Accounts’ section.

- Select ‘View Account Balan ce’ to check your account balance.

- UCO mPassbook: The UCO mPassbook app lets you view your electronic passbook transactions on the go. You can check your UCO Bank balance anywhere, online and offline, by creating an account and using this app in offline mode.

STEPS:-

- Log in using your UCO Bank MPIN.

- Go to ‘Account Details’.

- On the Screen , you can find the balance which is available in your account.

- BHIM UCO UPI: UCO Bank’s BHIM UCO UPI app enables users to send and receive money using a Virtual Private Address (VPA). Additionally, users can check their account balance through this app.

STEPS:-

- Open the UCO UPI app and enter your MPIN.

- Tap on ‘View Account Balance’ and select your preferred bank account.

- Enter your UPI PIN.

- Your account balance will be displayed.

UCO Bank Balance Enquiry through UCO Bank Passbook

UCO Bank account holders receive a passbook to track their banking transactions. The passbook records all debit and credit transactions, providing a clear overview of account activity.

To check the latest balance, customers can:

- Visit the nearest UCO Bank branch to update their passbook.

- Download the UCO Bank m-Passbook app and log in using your registered mobile number and account number for an easy and instant balance inquiry.

Visit UCO Bank ATM For Balance Check

You can visit the nearest ATM to have a UCO Bank balance check using your UCO Bank debit card. While using the ATM from your debit card, you will just have to go to the balance enquiry option in the banking option. Then the ATM will display the available balance in your UCO Bank savings account on the screen first and then it will give a print of the receipt that will have the details of the available balance.

STEPS:-

- In the ATM, insert your UCO bank ATM card.

- Enter your four-digit ATM PIN.

- Select ‘Account Balance Enquiry’ from the options on the ATM screen.

- Your UCO Bank account balance will be displayed on the screen.

Why Should You Regularly Check Your UCO Bank Balance?

Here are some of the reasons for the regular checking of your UCO Bank Balance. Read the content carefully -

- Stay Updated on Automated Payments:

If you have automated payments like EMIs, utility bills, or SIP investments, it’s essential to know your balance before the deduction date to avoid failed transactions.

- Manage Your Budget:

Regular balance checks help you track your spending and monitor where your money is going, making it easier to manage your monthly budget.

- Control Expenses:

By keeping an eye on your account, you can identify unnecessary expenses and take control of your financial habits.

- Avoid Penalties:

Failing to maintain the minimum balance in your account can lead to penalties. Regular checks ensure you maintain sufficient funds to avoid such charges. - Prevent Fraud:

With the rise in cyber fraud, frequent balance checks allow you to detect unauthorized or fraudulent transactions promptly and take action.

Why is the UCO Bank Balance Check Useful?

Here are some of the points that can tell you about the importance of UCO Bank Balance Check -

- Track Financial Status:

Knowing your account balance helps you stay informed about your financial health and plan expenditures accordingly.

- Manage Payments:

Ensures you have sufficient funds for automated payments like EMIs, utility bills, and subscriptions, avoiding failed transactions.

- Avoid Penalties:

Regular balance checks help you maintain the required minimum balance and avoid penalties for non-compliance.

- Monitor Spending:

Provides insights into your spending patterns, helping you control unnecessary expenses and stick to your budget.

- Fraud Detection:

Frequent balance checks allow you to identify unauthorized or fraudulent transactions quickly and take necessary action.

- Convenience:

UCO Bank offers multiple ways to check your balance, such as mobile apps, SMS, missed calls, and ATMs, making it accessible anytime, anywhere.

Conclusion

So, you can choose any method mentioned above to have the UCO Bank Balance Check Number. You can plan your future costs by using any of the aforementioned methods to find out the precise amount that is available in your UCO Bank account. The best thing is that all the methods are free of cost and you can take advantage of them around the clock.

Frequently Asked Questions (FAQs)

What is the UCO Bank Balance Number for the Balance check?

How to Check Your UCO Bank Account Balance via Missed Call?

How to Check UCO Bank Account Balance Online?

How to Use UCO Bank SMS Banking to Check Your Balance?

How to Check UCO Bank Balance Without a Registered Mobile Number?

How to Register for UCO Bank Mobile Banking?

Best Offers For You!

Account Balance Check by Bank

- SBI Balance Check

- PNB Balance Check

- Bank of Baroda Balance Check

- Canara Bank Balance Check

- YES BANK Balance Enquiry

- RBL Bank Balance Check

- Kotak Bank Balance Check

- ICICI Bank Balance Enquiry

- HDFC Bank Balance Check

- Federal Bank Balance Check

- Bandhan Bank Balance Check

- Axis Bank Balance Check

- AU Bank Balance Check

- Bank of Maharashtra Balance Check

- Indusind Bank Balance Check

- UCO Bank Balance Check

- Union Bank of India Balance Check

- Punjab & Sind Bank Balance Check

- Indian Overseas Bank Balance Check

- Central Bank of India Balance Check

- Indian Bank Balance Check

- IDFC First Bank Balance Check

- DCB Bank Balance Check

- Karur Vysya Bank Balance Check

- South Indian Bank Balance Check

Account Mini Statement by Bank

- SBI Mini Statement

- ICICI Bank Mini Statement

- Axis Bank Mini Statement

- PNB Mini Statement

- IDFC First Bank Mini Statement

- Indusind Bank Mini Statement

- Kotak Bank Mini Statement

- YES BANK Mini Statement

- Indian Bank Mini Statement

- Union Bank of India Mini Statement

- Bank of Maharashtra Mini Statement

- Central Bank of India Mini Statement

- Canara Bank Mini Statement

- Bank of Baroda Mini Statement

- RBL Bank Mini Statement

- Punjab & Sind Bank Mini Statement

- Indian Overseas Bank Mini Statement

- Federal Bank Mini Statement

- Bandhan Bank Mini Statement

- Karur Vysya Bank Mini Statement

- South Indian Bank Mini Statement

- DCB Bank Mini Statement

- IDBI Bank Mini Statement

- Bank of India Mini Statement