South Indian Bank Mini Statement Number

Last Updated : June 11, 2024, 3:41 p.m.

South Indian Bank simplifies banking with its mini statement service, enabling customers to efficiently monitor their financial transactions. With this service, you can quickly check details of recent transactions including deposits, withdrawals, and balance inquiries.

The mini statement feature from South Indian Bank is available through several convenient methods. You can access it at ATMs, on mobile and internet banking platforms, or by sending a simple SMS. This service is designed to meet the evolving needs of today’s banking customers. It makes managing your accounts easy and secure.

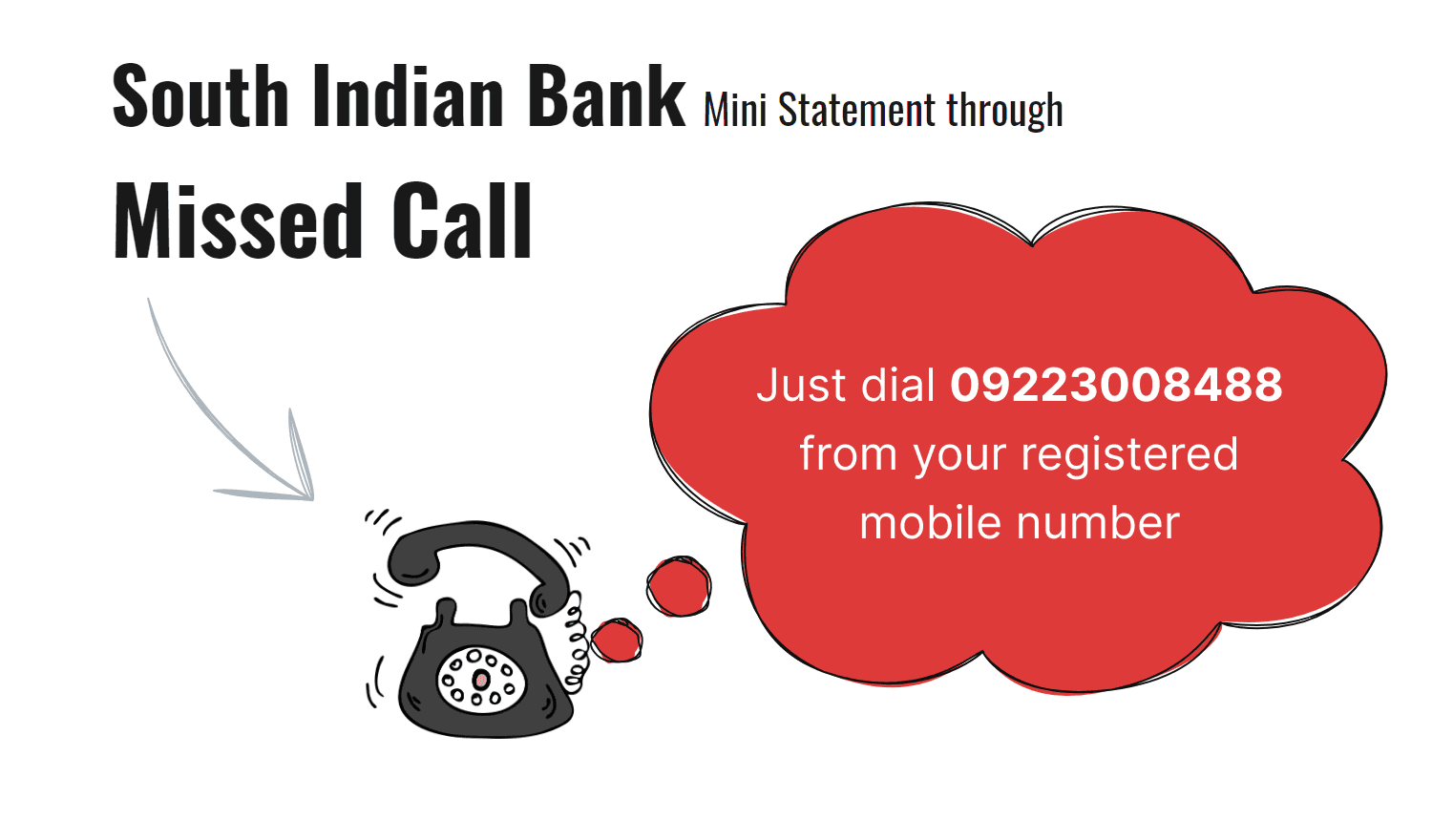

South Indian Bank Mini Statement Via Missed Call

You can easily view your South Indian Bank mini statement through missed call services. Just dial 09223008488 from your registered mobile number. The call will get disconnected after a few rings. You will receive the mini statement over SMS soon after.

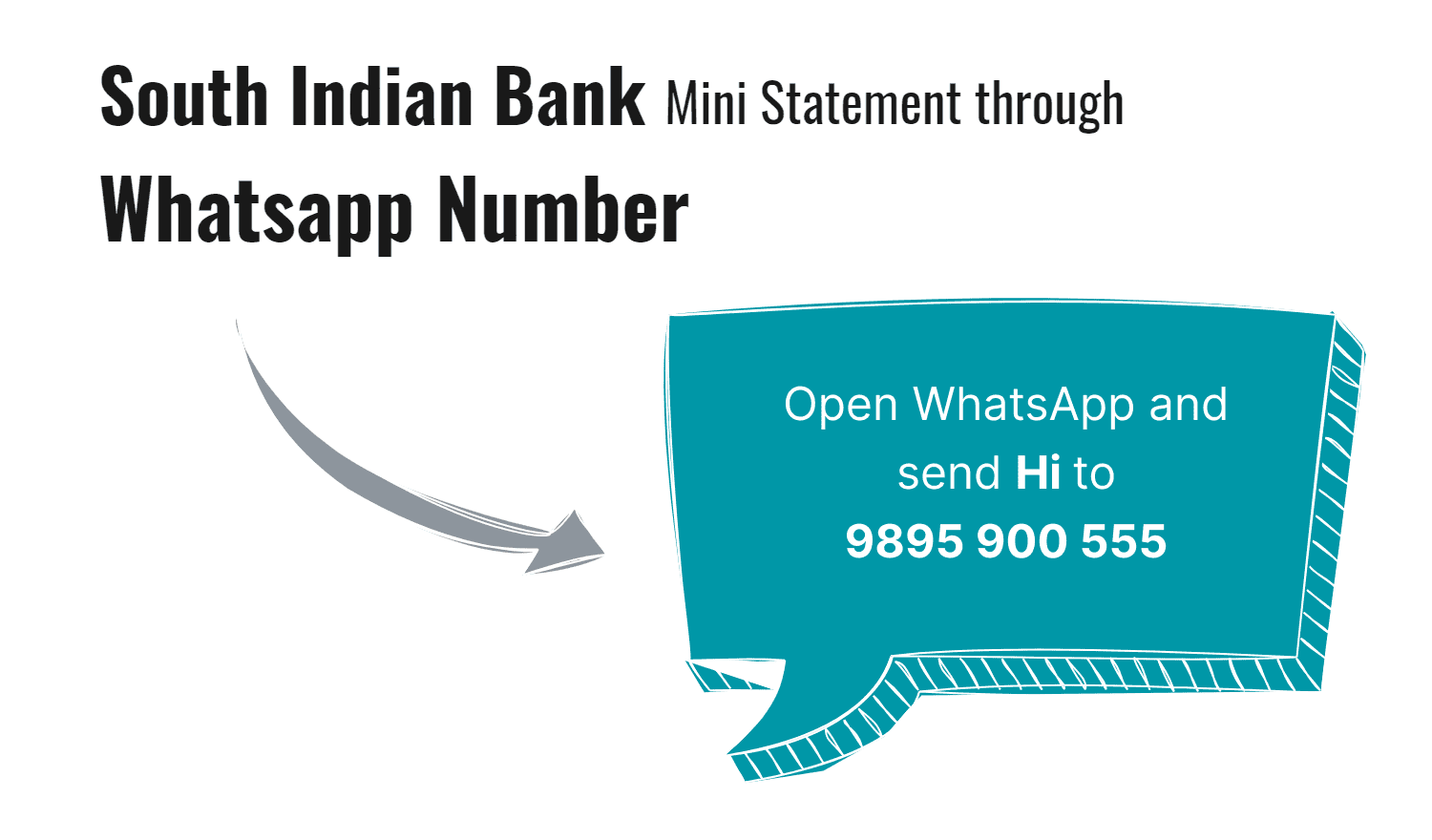

South Indian Bank Mini Statement Through WhatsApp Number

South Indian Bank mini statement can also be availed through WhatsApp services. Open WhatsApp and send Hi to 9895 900 555. You will get a list of options. Choose the ‘Mini Statement’ option, and you will receive the details of your last few transactions.

South Indian Bank Mini Statement Using Mobile App

To check your mini statement using the South Indian Bank mobile app, follow these steps:

- First, ensure that the South Indian Bank mobile app is downloaded and installed on your smartphone. The app is available on both the Google Play Store and Apple App Store.

- Open the app and log in using your credentials. If you haven't registered for mobile banking, you'll need to do so first.

- Once logged in, go to the 'Accounts' section of the app.

- Look for an option labeled 'Mini Statement', 'Recent Transactions', or something similar. Select this to view your recent banking transactions.

- Your mini statement will display a list of recent transactions. This typically includes details like the date, transaction description, and the amount debited or credited.

South Indian Bank Mini Statement Through Netbanking Portal

For getting your mini statement through the South Indian Bank net banking portal, follow these steps:

- Open your web browser and go to the South Indian Bank net banking portal. You can find this by searching for ‘South Indian Bank netbanking’ or directly navigating to the official South Indian Bank website.

- Enter your user ID and password to log into your netbanking account. If you have not set up netbanking yet, you'll need to register first, which you can usually do online or by visiting a branch.

- Once logged in, look for the 'Accounts' tab or section on the main menu. Click on it to open the dropdown or expand the options.

- Within the Accounts section, find and select the option labeled 'Mini Statement' or 'Transaction History'.

- Upon selecting the mini statement option, you will be able to view a list of recent transactions made with your account. This typically includes details such as the transaction date, description, and the amount debited or credited.

South Indian Bank Mini Statement From an ATM

South Indian Bank mini statements can be easily accessed using a nearby ATM . Find a South Indian Bank ATM and place your card into the machine slot. Carefully enter your PIN when prompted to ensure security.

From the menu options, select the option for a mini statement. This may be directly available on the main screen or under a 'Banking Services' or 'Account Information' submenu.

After selecting the mini statement option, the ATM will process your request and print a receipt with your recent transactions. This typically includes details such as the date, transaction type, amount, and balance.

Remember to safely end your session by following the ATM's instructions, and don't forget to take your card and the mini statement receipt.

South Indian Bank Mini Statement By Visiting a Bank Branch

Start by locating the nearest branch, which can be done using the bank’s website or a map application. Once you arrive, approach a bank officer or teller and request a mini statement for your account. You'll need to verify your identity, so bring along your bank passbook, ATM card, or a valid government-issued ID such as a driver’s license or passport.

The bank staff will then print out a summary of your recent transactions, which typically includes deposits, withdrawals, and any fees incurred. Before leaving, take a moment to review the transactions listed to ensure all activity is accurate.

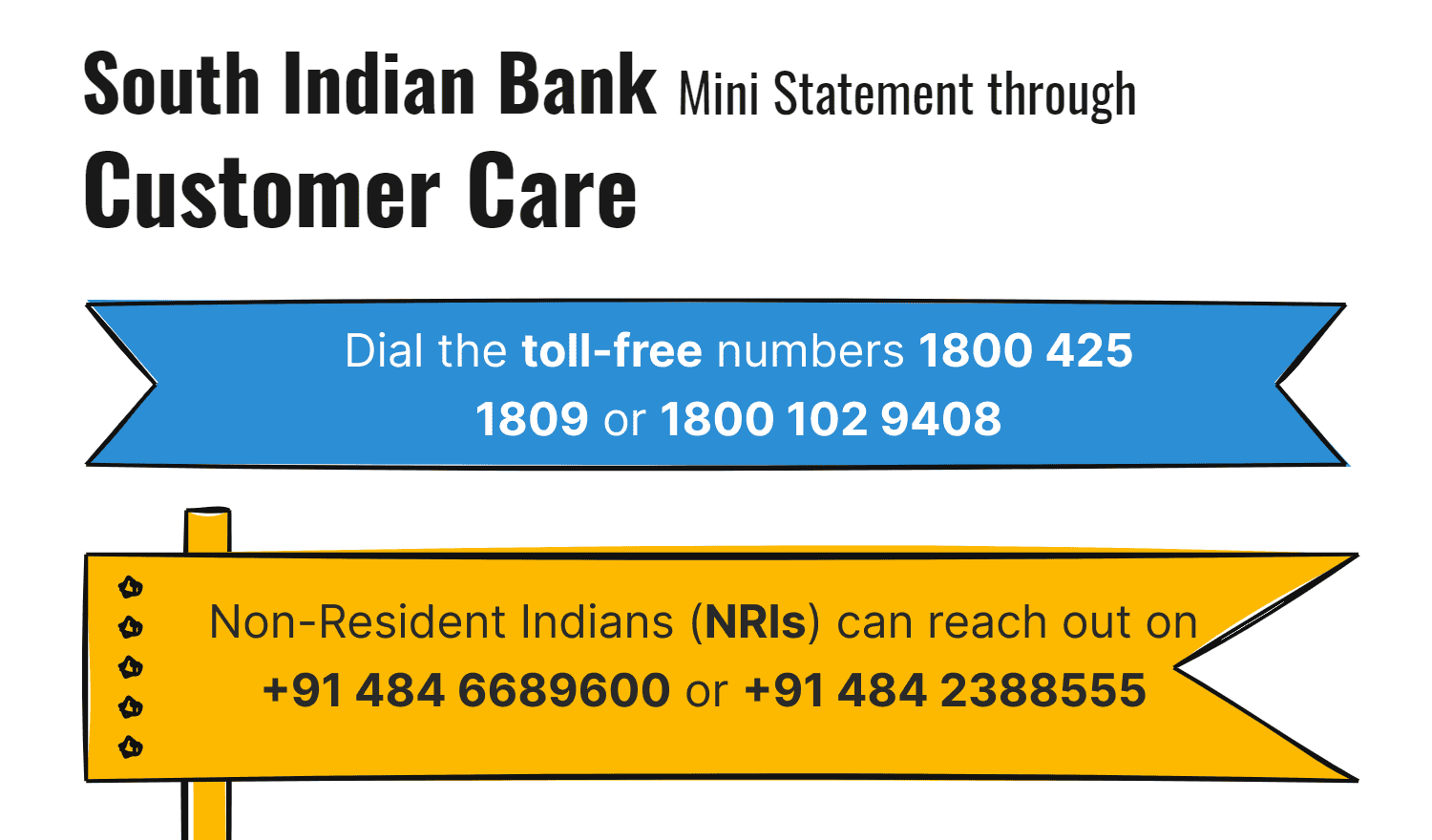

South Indian Bank Mini Statement Through Customer Care

Account holders can also get access to mini statements by contacting customer care representatives. For residents in India, dial the toll-free numbers 1800 425 1809 or 1800 102 9408. Non-Resident Indians (NRIs) can reach out on +91 484 6689600 or +91 484 2388555.

Once connected, you’ll be guided by an Interactive Voice Response (IVR) system. Listen to the options and select ‘banking services’ or a similar category that includes mini statements. You may need to enter your account number or other identification details.

Follow the prompts to request a mini statement. The system might provide your recent transaction details verbally through the IVR, or you might have an option to get the mini statement sent to your registered email or through an SMS to your registered mobile number.

Main Benefits of Utilizing South Indian Bank Mini Statements

Immediate access to transaction history: Mini statements provide a quick overview of recent transactions. This allows customers to immediately check their latest deposits, withdrawals, and balance updates. It helps in keeping track of financial activities without waiting for monthly statements.

Effective budget management: By regularly reviewing mini statements, customers can better manage their budgets. Monitoring spending patterns helps in adjusting budgets and financial plans according to recent expenses and income.

Fraud detection: Regular checks of mini statements can help in early detection of unauthorized transactions. Spotting and reporting suspicious activity promptly can prevent potential financial loss and help in resolving issues faster.

Reduced environmental impact: Electronic mini statements reduce the need for paper-based bank statements. This contributes to environmental conservation by lowering paper use and waste.

Frequently Asked Questions (FAQs)

How can I check my last 5 transactions in South Indian Bank?

What is the Whatsapp number for the South Indian Bank mini statement?

How do I get a mini statement from South Indian Bank?

How can I get a South Indian Bank mini statement through an ATM?

What is the toll-free number of the South Indian Bank mini statement?

Best Offers For You!

Account Balance Check by Bank

- SBI Balance Check

- PNB Balance Check

- Bank of Baroda Balance Check

- Canara Bank Balance Check

- YES BANK Balance Enquiry

- RBL Bank Balance Check

- Kotak Bank Balance Check

- ICICI Bank Balance Enquiry

- HDFC Bank Balance Check

- Federal Bank Balance Check

- Bandhan Bank Balance Check

- Axis Bank Balance Check

- AU Bank Balance Check

- Bank of Maharashtra Balance Check

- Indusind Bank Balance Check

- UCO Bank Balance Check

- Union Bank of India Balance Check

- Punjab & Sind Bank Balance Check

- Indian Overseas Bank Balance Check

- Central Bank of India Balance Check

- Indian Bank Balance Check

- IDFC First Bank Balance Check

- DCB Bank Balance Check

- Karur Vysya Bank Balance Check

- South Indian Bank Balance Check

Account Mini Statement by Bank

- SBI Mini Statement

- ICICI Bank Mini Statement

- Axis Bank Mini Statement

- PNB Mini Statement

- IDFC First Bank Mini Statement

- Indusind Bank Mini Statement

- Kotak Bank Mini Statement

- YES BANK Mini Statement

- Indian Bank Mini Statement

- Union Bank of India Mini Statement

- Bank of Maharashtra Mini Statement

- Central Bank of India Mini Statement

- Canara Bank Mini Statement

- Bank of Baroda Mini Statement

- RBL Bank Mini Statement

- Punjab & Sind Bank Mini Statement

- Indian Overseas Bank Mini Statement

- Federal Bank Mini Statement

- Bandhan Bank Mini Statement

- Karur Vysya Bank Mini Statement

- South Indian Bank Mini Statement

- DCB Bank Mini Statement

- IDBI Bank Mini Statement

- Bank of India Mini Statement