RBL Bank Mini Statement Number

Last Updated : June 6, 2024, 4:09 p.m.

Account holders can easily check their RBL Bank Mini Statement and account balance without needing to visit a bank branch. RBL Bank offers several convenient ways to access this information. By simply making a missed call from their registered mobile number, customers can receive instant updates.

Additionally, they can access their mini statement through various methods such as a toll-free number, SMS banking, online banking, the RBL MoBank 2.0 app, or by visiting a bank branch in person.

We will discuss all these steps in detail in the following article. So, let’s get started!

How to Register Mobile Number to Avail RBL Bank Mini Statement?

The best approach is to register your mobile number when you open your account. You can also add your mobile number later by following these steps:

- Go to your home branch of RBL Bank.

- Fill out an application form with your account number and the mobile number you want to register.

- Provide a self-attested copy of your Aadhaar card and any other required documents to the bank.

- Once your application is processed, the bank will send you an SMS to confirm the registration.

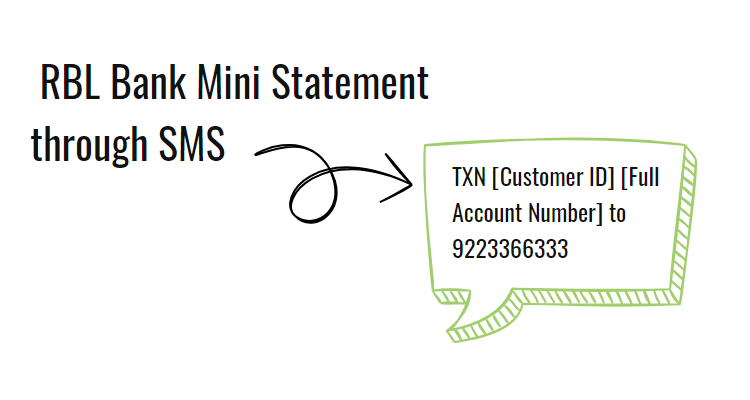

RBL Bank Mini Statement Through SMS Banking

To get the mini statement number via RBL Bank SMS banking, text the message:

TXN [Customer ID] [Full Account Number]

to

9223366333

You will receive an SMS from RBL Bank containing the mini statement of your primary account. The mini statement will include the last five transactions.

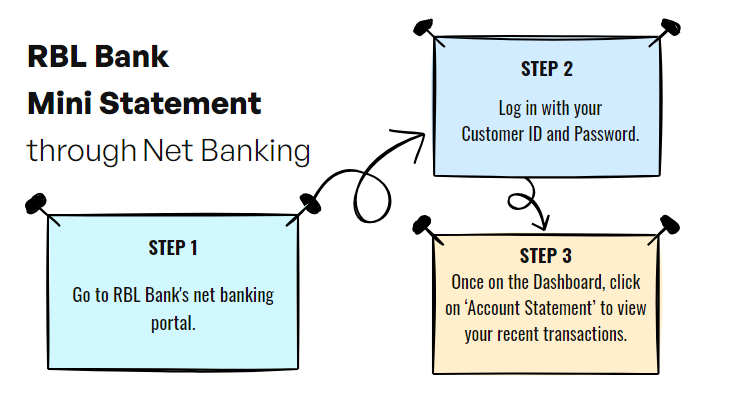

RBL Bank Mini Statement Through Netbanking

Customers can easily access their mini statements through RBL Bank's e-banking portal, which offers round-the-clock access and the latest technology. To use internet banking, customers can sign up on the RBL website using their credit card , debit card, customer ID, or loan account number.

Here’s how to get your RBL Mini Statement online:

- Go to RBL Bank's net banking portal.

- Log in with your Customer ID and Password.

- Once on the Dashboard, click on ‘Account Statement’ to view your recent transactions.

RBL Bank Mini Statement Via RBL MoBank 2.0

RBL Bank also provides access to mini statements through its mobile banking app. Here are the steps you need to follow:

- Download the app from Google Play Store or Apple App Store.

- Login using the user ID and password.

- Once on the homepage, click on ‘Transaction History’.

- You will get the details of your last few transactions.

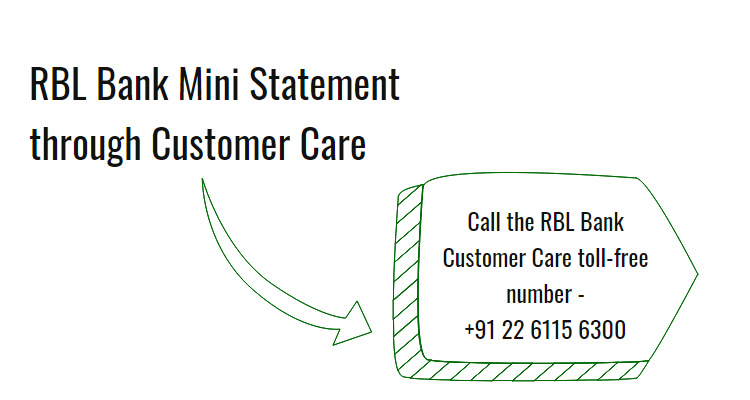

RBL Bank Mini Statement Through Customer Care

This service is available for free to all RBL Bank account holders and does not require internet access. Simply call the RBL Bank Customer Care toll-free number below:

+91 22 6115 6300

After your call, an SMS with the latest transactions will be sent to your registered phone number. This service works for both current and savings accounts and is accessible 24/7, giving you continuous access to your account information.

RBL Bank Mini Statement Through WhatsApp Number

To receive your RBL statement through WhatsApp, simply save RBL Bank’s official WhatsApp number, ‘84335 98888’, to your contacts and send a message saying ‘Hi RBL’ from your registered mobile number.

RBL Bank Mini Statement through ATM

To obtain a mini statement number of RBL Bank, you can also visit a nearby ATM and follow the below-given steps:

- Insert your RBL Bank ATM or debit card into the ATM machine.

- Choose your preferred language from the options provided on the ATM screen.

- Enter your 4-digit ATM PIN to access your account.

- From the menu options displayed, select the 'Mini Statement' option. This option is usually found under 'Banking' or 'Account Information'.

- The ATM will display the last few transactions (typically the last 5 transactions) on the screen.

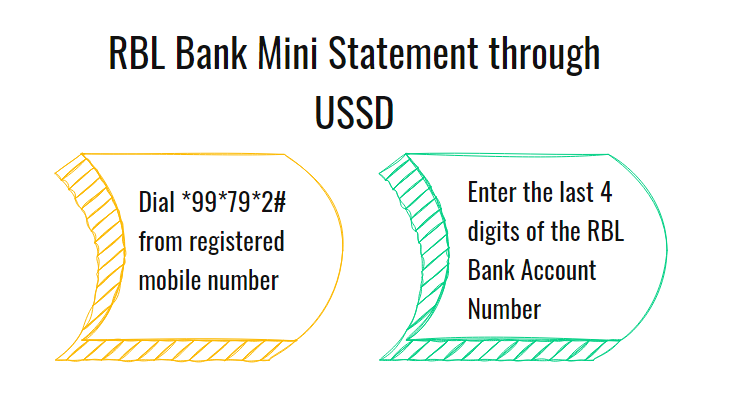

RBL Bank Mini Statement Through USSD

You can also get access to your mini statement using Unstructured Supplementary Service Data (USSD) based mobile banking. Customers can use the USSD payment service and avail RBL Mini Statement by USSD without connecting to the Internet.

- Dial *99*79*2# from registered mobile number.

- Enter the last 4 digits of the RBL Bank Account Number.

The user will be able to see the mini statement with the last 3 transactions on the screen of the device.

RBL Bank Mini Statement By Visiting Bank

If you prefer to obtain your RBL Bank mini statement by visiting a bank branch, follow these steps:

- Find the nearest RBL Bank branch. You can do so by visiting the RBL Bank website or downloading a mobile app to locate a branch near you.

- Visit the bank branch and approach the customer service desk.

- Take your RBL Bank passbook and a valid photo ID (such as Aadhaar card, PAN card, or passport) for verification purposes.

- Inform the bank representative that you would like to obtain a mini statement for your account.

- You may be asked to provide your account number or show your passbook for verification.

- Once done, the representative will print out the mini statement for you with the last few transactions.

Advantages of Using RBL Bank Mini Statement

RBL Bank offers several convenient methods for customers to access their mini statements, which provide a summary of the last few transactions in their account. Here are the key advantages of using RBL Bank's mini statement services:

Multiple access methods: Customers can access their mini statements through various channels including missed call, SMS, USSD, internet banking, and mobile banking apps. This flexibility ensures that customers can choose the most convenient method for them.

Instant updates: By using services like SMS banking or missed call, customers can get real-time updates on their recent transactions, helping them stay informed about their account activity.

Secure access: Accessing mini statements through registered mobile numbers and secure internet banking platforms ensures that the information is protected and only accessible to the account holder.

No internet required: Services like USSD and SMS banking do not require an internet connection, making them accessible even in areas with poor internet connectivity.

Frequently Asked Questions (FAQs)

How can I check my last 5 transactions in RBL Bank?

How can I get an RBL Bank mini statement by SMS?

What is the WhatsApp number for RBL Bank mini statement?

How do I get a mini statement from RBL Bank?

How can I get a RBL Bank mini statement through an ATM?

What is the toll-free number of RBL Bank for a mini statement?

Best Offers For You!

Account Balance Check by Bank

- SBI Balance Check

- PNB Balance Check

- Bank of Baroda Balance Check

- Canara Bank Balance Check

- YES BANK Balance Enquiry

- RBL Bank Balance Check

- Kotak Bank Balance Check

- ICICI Bank Balance Enquiry

- HDFC Bank Balance Check

- Federal Bank Balance Check

- Bandhan Bank Balance Check

- Axis Bank Balance Check

- AU Bank Balance Check

- Bank of Maharashtra Balance Check

- Indusind Bank Balance Check

- UCO Bank Balance Check

- Union Bank of India Balance Check

- Punjab & Sind Bank Balance Check

- Indian Overseas Bank Balance Check

- Central Bank of India Balance Check

- Indian Bank Balance Check

- IDFC First Bank Balance Check

- DCB Bank Balance Check

- Karur Vysya Bank Balance Check

- South Indian Bank Balance Check

Account Mini Statement by Bank

- SBI Mini Statement

- ICICI Bank Mini Statement

- Axis Bank Mini Statement

- PNB Mini Statement

- IDFC First Bank Mini Statement

- Indusind Bank Mini Statement

- Kotak Bank Mini Statement

- YES BANK Mini Statement

- Indian Bank Mini Statement

- Union Bank of India Mini Statement

- Bank of Maharashtra Mini Statement

- Central Bank of India Mini Statement

- Canara Bank Mini Statement

- Bank of Baroda Mini Statement

- RBL Bank Mini Statement

- Punjab & Sind Bank Mini Statement

- Indian Overseas Bank Mini Statement

- Federal Bank Mini Statement

- Bandhan Bank Mini Statement

- Karur Vysya Bank Mini Statement

- South Indian Bank Mini Statement

- DCB Bank Mini Statement

- IDBI Bank Mini Statement

- Bank of India Mini Statement