Karnataka Bank Mini Statement Number

Last Updated : June 8, 2024, 3:28 p.m.

Karnataka Bank provides multiple hassle-free methods to access your mini statement, allowing you to keep a close eye on your banking transactions. From digital platforms to traditional banking methods, you can choose the most convenient way to stay updated with your account. Let's explore these options and find out how you can access your mini statement with ease.

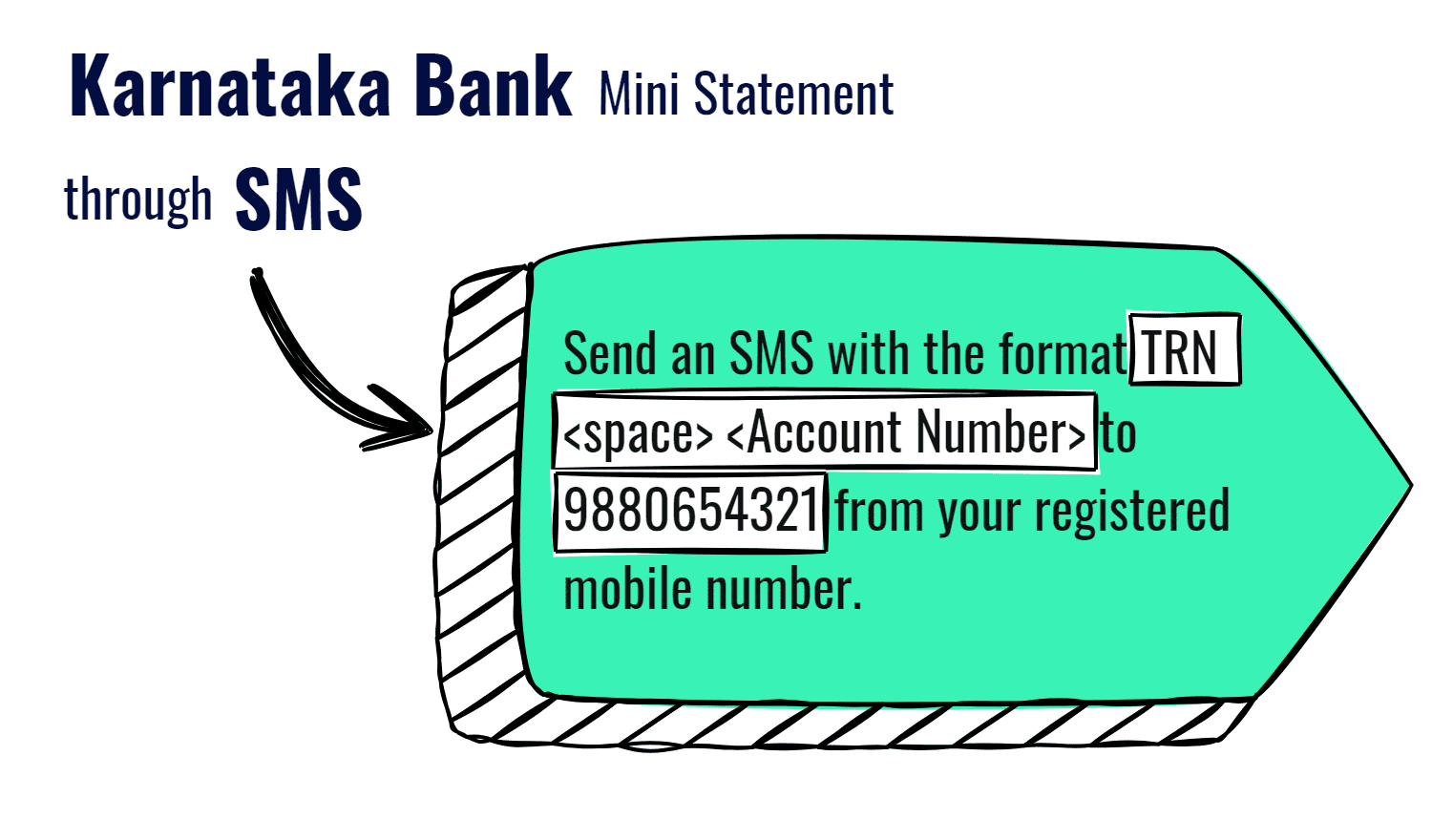

Karnataka Bank Mini Statement through SMS

To get your Karnataka Bank mini statement number through SMS banking, send an SMS with the format TRN <space> <Account Number> to 9880654321 from your registered mobile number. This service provides the last five transactions of your account, offering a quick and convenient way to monitor your recent account activity.

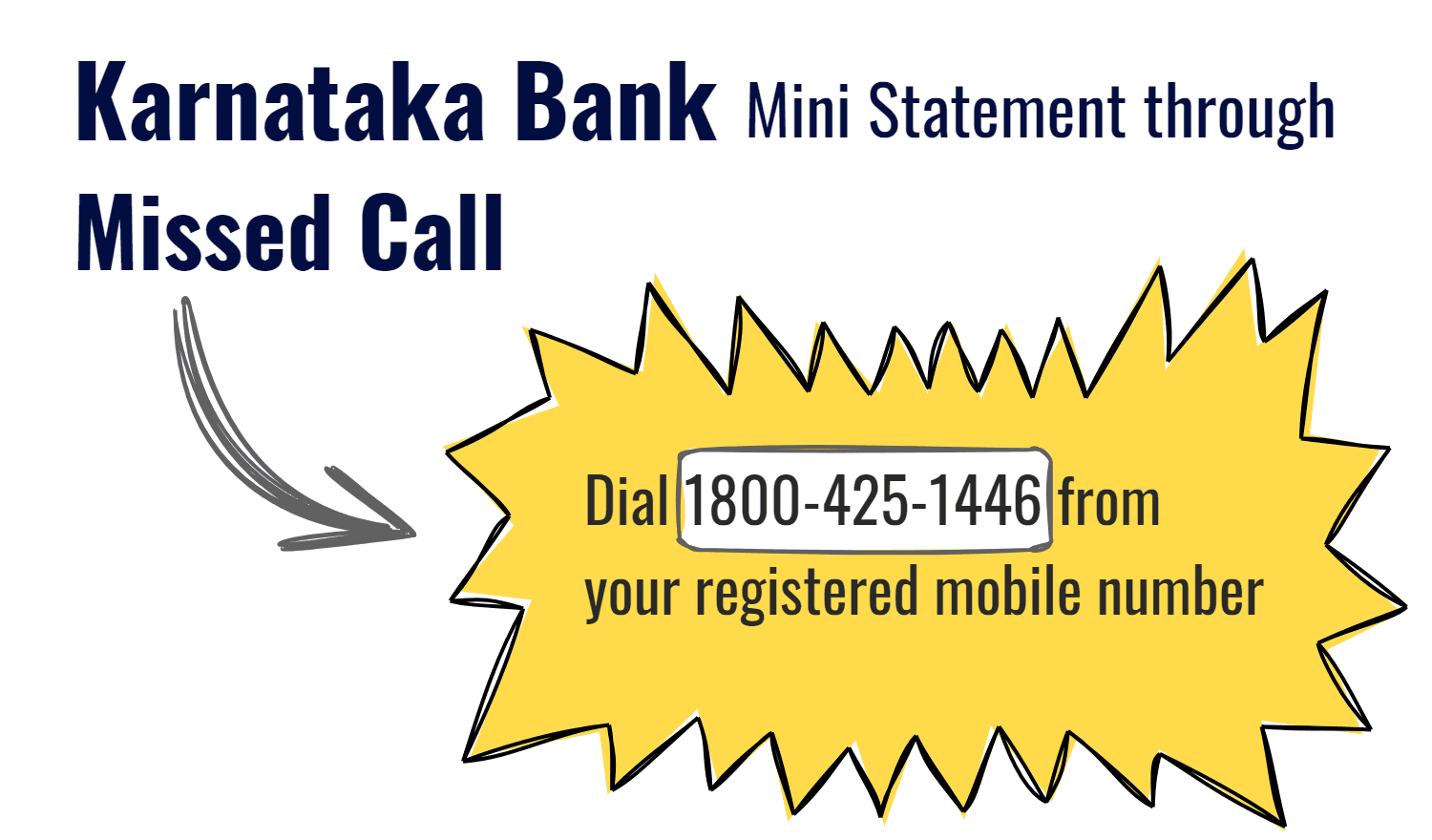

Karnataka Bank Mini Statement Through Missed Call

Follow the below steps to obtain your Karnataka Bank mini statement through a missed call:

- Dial 1800-425-1446 from your registered mobile number.

- The call will be automatically disconnected, and you will receive an SMS with the last five transactions of your account.

Karnataka Bank Mini Statement through Mobile Banking

To get your Karnataka Bank mini statement number through the mobile banking app, download and install the KBL Mobile Plus app, log in with your User ID and MPIN, go to the 'Accounts' section, select 'Mini Statement' or 'Recent Transactions', and view the last few transactions of your account.

Karnataka Bank Mini Statement Through Netbanking

Here are the steps you need to follow to check your mini statement or account balance using the netbanking portal of Karnataka Bank:

- Go to the Karnataka Bank netbanking portal.

- Use your User ID and password to log in or register if you are a new user.

- Search for the ‘Accounts’ section.

- Choose your account and select 'Mini Statement' or 'Recent Transactions'.

- The portal will display the last few transactions, and you can download or print the mini statement if needed.

Karnataka Bank Mini Statement through ATM

Visit a nearby ATM and insert your card. Then select your language, enter your PIN, and choose the 'Mini Statement' option. View or print the last few transactions.

Karnataka Bank Mini Statement By Visiting the Bank

Go to your nearest Karnataka Bank branch. It's a good idea to check the bank's working hours beforehand to make sure it's open. Take along a valid ID like your driver’s license, passport, or Aadhar card, and your bank passbook if you have one.

At the bank, approach the customer service desk and request a mini statement for your account. Show your ID to the bank official to verify your identity. They might also ask for your account number, so having your passbook handy can be helpful.

Once your identity is confirmed, the bank official will provide you with a printed mini statement that lists your recent transactions.

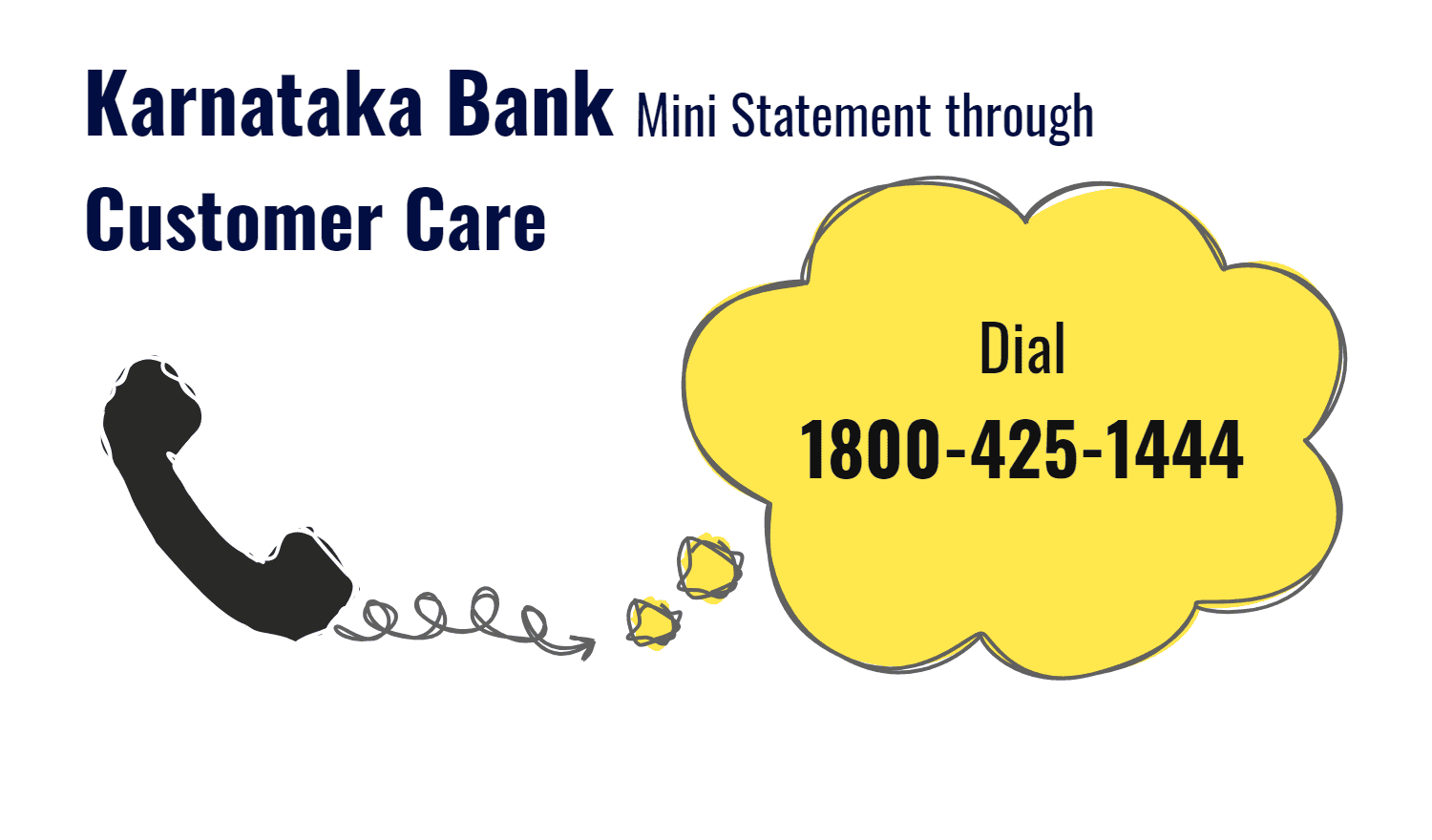

Karnataka Bank Mini Statement Through Customer Care

You can also get your mini statement by directly calling the customer care. Here are the steps:

- Confirm that your mobile number is registered with Karnataka Bank.

- Dial 1800-425-1444.

- Follow the IVR prompts to authenticate your identity.

- Navigate the IVR menu to select 'Mini Statement' or 'Account Information'.

- The mini statement details will be provided over the phone or sent via SMS.

Karnataka Bank Mini Statement Using WhatsApp Number

Save +91 9632188999 as ‘Karnataka Bank’ in your contacts. Open WhatsApp and start a chat. Type and send Hi to initiate the conversation. Follow the menu options to select ‘Mini Statement’. Provide any required authentication details. View the mini statement in the WhatsApp chat.

Key Benefits of Getting Access to Karnataka Bank Mini Statement

Getting a mini statement from Karnataka Bank has several advantages that help streamline your financial management:

Immediate information: Mini statements give you a quick snapshot of your recent transactions. This immediate access helps you stay updated about deposits, withdrawals, and other account activities as they happen.

Convenient access: With options to obtain a mini statement through ATMs, mobile banking, and visiting branches, Karnataka Bank makes it easy for you to check your account status on the go or from the comfort of your home.

Enhanced security: Regularly checking your mini statement can alert you to any fraudulent or unexpected transactions quickly, allowing you to take immediate action to secure your account.

Better budgeting: By regularly reviewing your mini statement, you can track your spending patterns more effectively. This helps in maintaining a budget and can guide you in making smarter financial decisions.

Saves time: Instead of waiting for a detailed monthly statement or having to log in to online banking, a quick trip to the ATM or a few taps on your smartphone can give you the essential information you need about your finances.

Frequently Asked Questions (FAQs)

How can I check my last 5 transactions in Karnataka Bank?

How can I get Karnataka Bank mini statement by SMS?

What is the WhatsApp number for Karnataka Bank mini statement?

How do I get a mini statement of Karnataka Bank?

How can I get Karnataka Bank mini statement through ATM?

What is the toll-free number of Karnataka Bank for mini statements?

Best Offers For You!

Account Balance Check by Bank

- SBI Balance Check

- PNB Balance Check

- Bank of Baroda Balance Check

- Canara Bank Balance Check

- YES BANK Balance Enquiry

- RBL Bank Balance Check

- Kotak Bank Balance Check

- ICICI Bank Balance Enquiry

- HDFC Bank Balance Check

- Federal Bank Balance Check

- Bandhan Bank Balance Check

- Axis Bank Balance Check

- AU Bank Balance Check

- Bank of Maharashtra Balance Check

- Indusind Bank Balance Check

- UCO Bank Balance Check

- Union Bank of India Balance Check

- Punjab & Sind Bank Balance Check

- Indian Overseas Bank Balance Check

- Central Bank of India Balance Check

- Indian Bank Balance Check

- IDFC First Bank Balance Check

- DCB Bank Balance Check

- Karur Vysya Bank Balance Check

- South Indian Bank Balance Check

Account Mini Statement by Bank

- SBI Mini Statement

- ICICI Bank Mini Statement

- Axis Bank Mini Statement

- PNB Mini Statement

- IDFC First Bank Mini Statement

- Indusind Bank Mini Statement

- Kotak Bank Mini Statement

- YES BANK Mini Statement

- Indian Bank Mini Statement

- Union Bank of India Mini Statement

- Bank of Maharashtra Mini Statement

- Central Bank of India Mini Statement

- Canara Bank Mini Statement

- Bank of Baroda Mini Statement

- RBL Bank Mini Statement

- Punjab & Sind Bank Mini Statement

- Indian Overseas Bank Mini Statement

- Federal Bank Mini Statement

- Bandhan Bank Mini Statement

- Karur Vysya Bank Mini Statement

- South Indian Bank Mini Statement

- DCB Bank Mini Statement

- IDBI Bank Mini Statement

- Bank of India Mini Statement