Indian Overseas Bank Mini Statement Number

Last Updated : June 6, 2024, 6:06 p.m.

Staying on top of your finances is crucial, and Indian Overseas Bank (IOB) makes it easier with their mini statement feature.

Whether you’re out shopping, planning your budget, or just curious about your recent transactions, a quick glance at your IOB mini statement can give you all the updates you need.

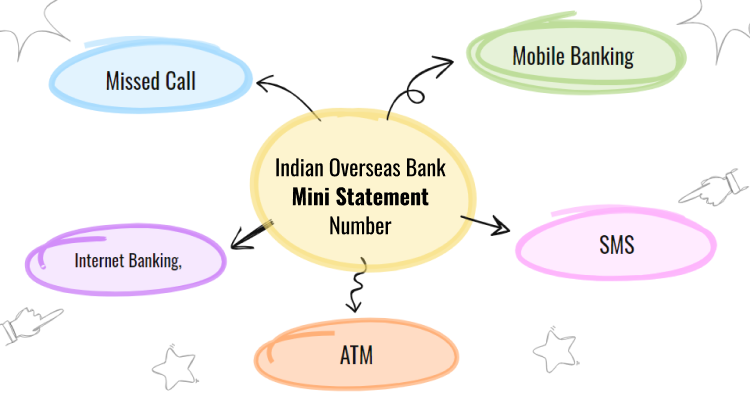

IOB provides several convenient methods to access your mini statement, so you can choose the one that fits your lifestyle.

In this article, we will explore all these options so you can start managing your transactions effortlessly.

How to Get Indian Overseas Bank Mini Statement Online & Offline?

Furthermore, we will discuss the steps that will help you get access to IOB mini statements and account balance check through online as well as offline modes:

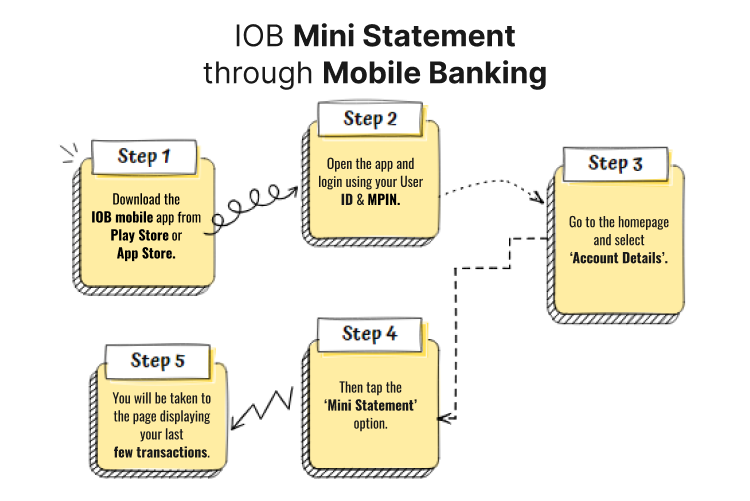

IOB Mini Statement Through Mobile Banking

Indian Overseas Bank (IOB) offers a convenient way to access your mini statement through its mobile banking app. Here are the steps to get your mini statement using the IOB Mobile Banking app:

- Download the IOB mobile app from Play Store or App Store.

- Open the app and login using your User ID and MPIN.

- Go to the homepage and select ‘Account Details’.

- Then tap the ‘Mini Statement’ option.

- You will be taken to the page displaying your last few transactions.

IOB Mini Statement Through Internet Banking

To check your IOB mini statement number online, just follow these easy steps:

- Go to the official Indian Overseas Bank internet banking website.

- Once you're on the homepage, click on the Internet Banking option.

- Log in by entering your User ID and Password.

- Click on ‘Enquiry’ from the Account Statement menu.

- Then select ‘mini statement’ to see your last five transactions.

IOB Mini Statement Through Missed Call

In order to get access to IOB mini statementnumber, you have the option to send a missed call to +91-84240-22122 from your registered mobile number. The call will get automatically disconnected after a few rings. Soon after, you will receive the SMS containing your mini statement.

IOB Mini Statement through SMS Banking

Indian Overseas Bank (IOB) provides SMS Banking services that allows customers to access their mini statements conveniently from the comfort of their homes. Here’s how you can use this service:

- Open the SMS application on your registered mobile number.

- Send the following formatted message to 84240 22122: MINI<space><Last four digits of your account number>.

- Once sent, you will receive the details of your mini statement.

IOB Mini Statement From an ATM

To print your IOB mini statement at an ATM , just follow these steps:

- Insert your Indian Overseas Bank debit card and type in your PIN.

- Select “Other Services” from the menu.

- Choose “Debit Card for Mobile Banking Registration” and enter the required details to register.

- After registration, your IOB mini statement will print out from the ATM.

IOB Mini Statement By Visiting the Bank

Go to the nearest Indian Overseas Bank. It’s advisable to visit during non-peak hours to avoid long wait times. Take a valid identity proof and IOB passbook with you. Approach the customer service desk and ask the representative for the mini statement. Show the identity card for verification along with your passbook. Upon verification, the bank representative will print out the mini statement for you.

Advantages of Using IOB Mini Statement

Using the IOB (Indian Overseas Bank) mini statement offers several advantages:

Quick access: You can quickly check the latest transactions without needing a full bank statement, which is especially handy for everyday banking.

Convenience: It's available 24/7 through ATMs, online banking, and mobile apps, so you can view your transactions anytime and anywhere.

Track spending: Regularly checking your mini statement helps you keep an eye on your spending and manage your budget better.

Fraud detection: By frequently reviewing your mini statement, you can spot and report any unauthorized transactions faster, enhancing your financial security.

Ease of use: The mini statement is simple to understand and shows the most important information, making it easy for anyone to use.

Frequently Asked Questions (FAQs)

How can I check my last 5 transactions in Indian Overseas Bank?

How to open an IOB bank statement PDF?

How do I view my Indian Overseas Bank mini bank statement?

How can I get a mini statement of IOB by SMS?

What is the number of Indian Overseas Bank statements?

How can I download my IOB bank statement?

How can I get an IOB mini statement through an ATM?

Best Offers For You!

Account Balance Check by Bank

- SBI Balance Check

- PNB Balance Check

- Bank of Baroda Balance Check

- Canara Bank Balance Check

- YES BANK Balance Enquiry

- RBL Bank Balance Check

- Kotak Bank Balance Check

- ICICI Bank Balance Enquiry

- HDFC Bank Balance Check

- Federal Bank Balance Check

- Bandhan Bank Balance Check

- Axis Bank Balance Check

- AU Bank Balance Check

- Bank of Maharashtra Balance Check

- Indusind Bank Balance Check

- UCO Bank Balance Check

- Union Bank of India Balance Check

- Punjab & Sind Bank Balance Check

- Indian Overseas Bank Balance Check

- Central Bank of India Balance Check

- Indian Bank Balance Check

- IDFC First Bank Balance Check

- DCB Bank Balance Check

- Karur Vysya Bank Balance Check

- South Indian Bank Balance Check

Account Mini Statement by Bank

- SBI Mini Statement

- ICICI Bank Mini Statement

- Axis Bank Mini Statement

- PNB Mini Statement

- IDFC First Bank Mini Statement

- Indusind Bank Mini Statement

- Kotak Bank Mini Statement

- YES BANK Mini Statement

- Indian Bank Mini Statement

- Union Bank of India Mini Statement

- Bank of Maharashtra Mini Statement

- Central Bank of India Mini Statement

- Canara Bank Mini Statement

- Bank of Baroda Mini Statement

- RBL Bank Mini Statement

- Punjab & Sind Bank Mini Statement

- Indian Overseas Bank Mini Statement

- Federal Bank Mini Statement

- Bandhan Bank Mini Statement

- Karur Vysya Bank Mini Statement

- South Indian Bank Mini Statement

- DCB Bank Mini Statement

- IDBI Bank Mini Statement

- Bank of India Mini Statement