IDBI Bank Mini Statement Number

Last Updated : May 31, 2024, 12:40 p.m.

IDBI Bank mini statement offers a convenient way for customers to stay updated on their account transactions quickly and easily. By sending a simple SMS or making a quick phone call, customers can receive a summary of their latest transactions directly on their mobile phones.

It's an efficient solution for keeping an eye on your finances, ensuring you're always informed about your account activity. In this article, we will learn various ways to access mini statements of IDBI Bank.

IDBI Bank Mini Statement Through Missed Call

Customers can quickly get their mini statement by giving a missed call to this toll-free number: 18008431133

After the call, IDBI Bank will send an SMS with the last 5 transactions from your account.

IDBI Bank Mini Statement Using SMS

Make sure your mobile number is registered with IDBI Bank for SMS banking services. If not, you can register by visiting your nearest IDBI Bank branch.

Once done, send the following message:

TXN < space > Customer ID < space > PIN < space > A/c No.to 9820346920 or 9821043718

After sending the SMS, you will receive your mini statement (last 3 transactions) on your registered mobile number within a few seconds.

IDBI Bank Mini Statement Via WhatsApp Number

IDBI Bank customers can easily check their mini statement through WhatsApp Banking. Simply send "Hi" to 88600 45678 from your registered mobile number to get started.

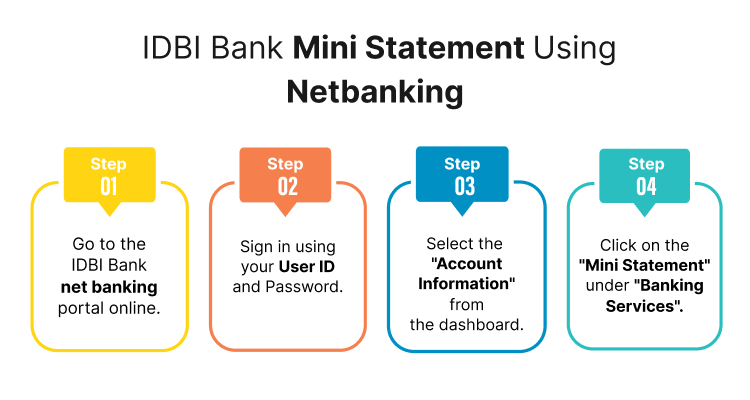

IDBI Bank Mini Statement Using Netbanking

For customers who already use net banking, accessing a mini statement is straightforward. Those without net banking can activate the service by visiting their nearest IDBI Bank branch. After registering for net banking, follow these steps to obtain an IDBI Bank mini statement:

- Go to the IDBI Bank net banking portal online.

- Sign in using your User ID and Password.

- Select the "Account Information" from the dashboard.

- Click on the "Mini Statement" under "Banking Services".

IDBI Mini Statement Using Mobile Banking

Customers can also use mobile banking to get their mini statement. IDBI Bank offers various mobile apps that allow customers to check their account balance and transaction history easily. By logging in with their User ID and password on the following apps, account holders can quickly access their mini statement anywhere:

IDBI Bank GO Mobile+ App

Available for both Android and iOS devices, the IDBI GO Mobile+ app can be downloaded on any smartphone. This app lets you manage various banking activities like checking your IDBI Bank balance, viewing mini statements, requesting cheque books, and transferring funds, all on your mobile device.

IDBI Bank mPassbook App

This app acts as a digital passbook for IDBI Bank account holders. It updates you on all transactions and shows your current account balance. You can view your mini statement directly on the app and even request a detailed account summary to see all past transactions.

IDBI Bank Mini Statement Through ATM

To check your IDBI Bank mini statement through an ATM , follow these steps:

- Find a nearby ATM that supports IDBI Bank transactions.

- Place your IDBI Bank ATM or debit card into the card slot.

- Carefully type in your Personal Identification Number (PIN).

- Look for the option labeled 'Mini Statement' or similar on the ATM screen.

- The ATM will print a mini statement for you, detailing recent transactions in your account.

IDBI Bank Mini Statement By Visiting Bank

Customers also have the option to visit the closest IDBI Bank branch to obtain a copy of their mini statement. This statement will include details of the most recent five transactions, covering both debits and credits.

IDBI Bank Mini Statement Through Customer Care

To check your IDBI Bank Mini Statement through Customer Care, follow these steps:

- Dial the IDBI Bank Customer Care number. The toll-free numbers are: 1800-209-4324, 1800-22-1070.

- Once connected, follow the Interactive Voice Response (IVR) instructions. Typically, you will need to: Select the language of your choice.

- Press the appropriate number to access account-related services.

- When prompted, request the mini statement for your account. You may need to provide your account number or customer ID for verification purposes.

- The customer care representative or the automated system will provide you with the details of your last few transactions.

Benefits of Using IDBI Mini Statements

Accessing IDBI Bank mini statements offers several benefits to account holders, providing a convenient and efficient way to monitor recent transactions and manage finances. Here are the key benefits:

Real-Time Transaction Monitoring: Mini statements provide a quick snapshot of the most recent transactions, typically the last 5 transactions. This allows account holders to stay updated on their account activity in real-time, helping them to monitor their spending and detect any unauthorized transactions promptly.

Time-Saving: Accessing a mini statement is quick and easy, saving customers the time and effort of visiting a bank branch or ATM. This is particularly beneficial for busy individuals who need to keep track of their transactions without disrupting their daily routines.

Enhanced Security: Regularly checking mini statements helps account holders quickly identify any suspicious or unauthorized transactions. This proactive monitoring can enhance the security of their accounts and reduce the risk of fraud.

Accessibility: The service is accessible 24/7 through various channels, including mobile banking apps like IDBI Bank GO Mobile+ and mPassbook, as well as internet banking. This ensures that customers can access their mini statements at any time, even outside of regular banking hours.

Eco-Friendly: Accessing mini statements electronically through SMS, mobile apps, or internet banking reduces the need for paper statements, contributing to environmental sustainability by minimizing paper usage.

Frequently Asked Questions (FAQs)

How can I check my last 5 transactions in IDBI Bank?

How can I get an IDBI Bank mini statement by SMS?

What is the Whatsapp number for IDBI Bank mini statement?

How do I get a mini statement from IDBI Bank?

How can I get an IDBI Bank mini statement through an ATM?

Best Offers For You!

Account Balance Check by Bank

- SBI Balance Check

- PNB Balance Check

- Bank of Baroda Balance Check

- Canara Bank Balance Check

- YES BANK Balance Enquiry

- RBL Bank Balance Check

- Kotak Bank Balance Check

- ICICI Bank Balance Enquiry

- HDFC Bank Balance Check

- Federal Bank Balance Check

- Bandhan Bank Balance Check

- Axis Bank Balance Check

- AU Bank Balance Check

- Bank of Maharashtra Balance Check

- Indusind Bank Balance Check

- UCO Bank Balance Check

- Union Bank of India Balance Check

- Punjab & Sind Bank Balance Check

- Indian Overseas Bank Balance Check

- Central Bank of India Balance Check

- Indian Bank Balance Check

- IDFC First Bank Balance Check

- DCB Bank Balance Check

- Karur Vysya Bank Balance Check

- South Indian Bank Balance Check

Account Mini Statement by Bank

- SBI Mini Statement

- ICICI Bank Mini Statement

- Axis Bank Mini Statement

- PNB Mini Statement

- IDFC First Bank Mini Statement

- Indusind Bank Mini Statement

- Kotak Bank Mini Statement

- YES BANK Mini Statement

- Indian Bank Mini Statement

- Union Bank of India Mini Statement

- Bank of Maharashtra Mini Statement

- Central Bank of India Mini Statement

- Canara Bank Mini Statement

- Bank of Baroda Mini Statement

- RBL Bank Mini Statement

- Punjab & Sind Bank Mini Statement

- Indian Overseas Bank Mini Statement

- Federal Bank Mini Statement

- Bandhan Bank Mini Statement

- Karur Vysya Bank Mini Statement

- South Indian Bank Mini Statement

- DCB Bank Mini Statement

- IDBI Bank Mini Statement

- Bank of India Mini Statement