ICICI Bank Balance Check Number

Last Updated : Dec. 3, 2024, 3:13 p.m.

Everyone knows that the ICICI Bank is one of the most famous banks in India. The ICICI Bank balance check number is 9594612612. Simply give a missed call from your registered mobile number, and you will receive an SMS with your account balance details. This service is quick, free of charge, and available 24/7 for registered customers. It becomes necessary to check the available balance in your account because it helps to speculate on future financial plans.

Let’s explore all the available techniques to make an ICICI Balance Enquiry.

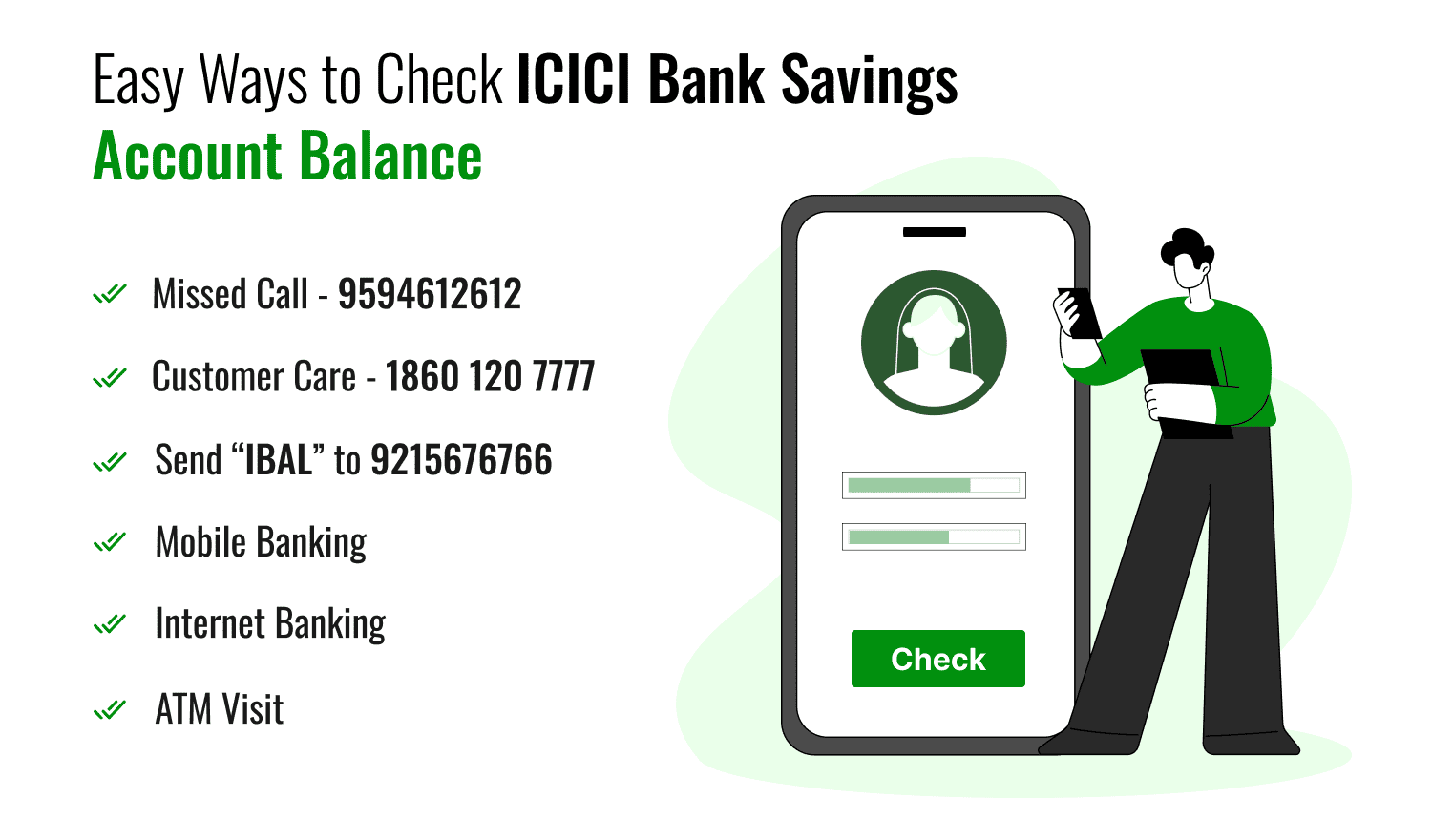

ICICI Bank Balance Check Number: Enquire Your Savings Account Balance Easily

Here are the various methods and ICICI Bank balance check numbers to ease you in finding out the balance in your savings account -

ICICI Bank Balance Check Customer Care or Toll-Free Number

ICICI Bank account holders can quickly check their account balance by calling the Toll- Free or ICICI Bank Balance Customer Care Number:

- 1860 120 7777

Here’s how you can check your balance through this service:

- Call the ICICI Bank Balance check number or say customer care number provided above. You can find additional ICICI customer care numbers on their official website.

- Select your preferred language from the available options.

- Choose the option for ‘Banking Account’ from the menu.

- Enter your 16-digit debit card number or 12-digit account number when prompted.

- Authenticate by entering your ATM PIN.

- Once authenticated, you can instantly check your account balance.

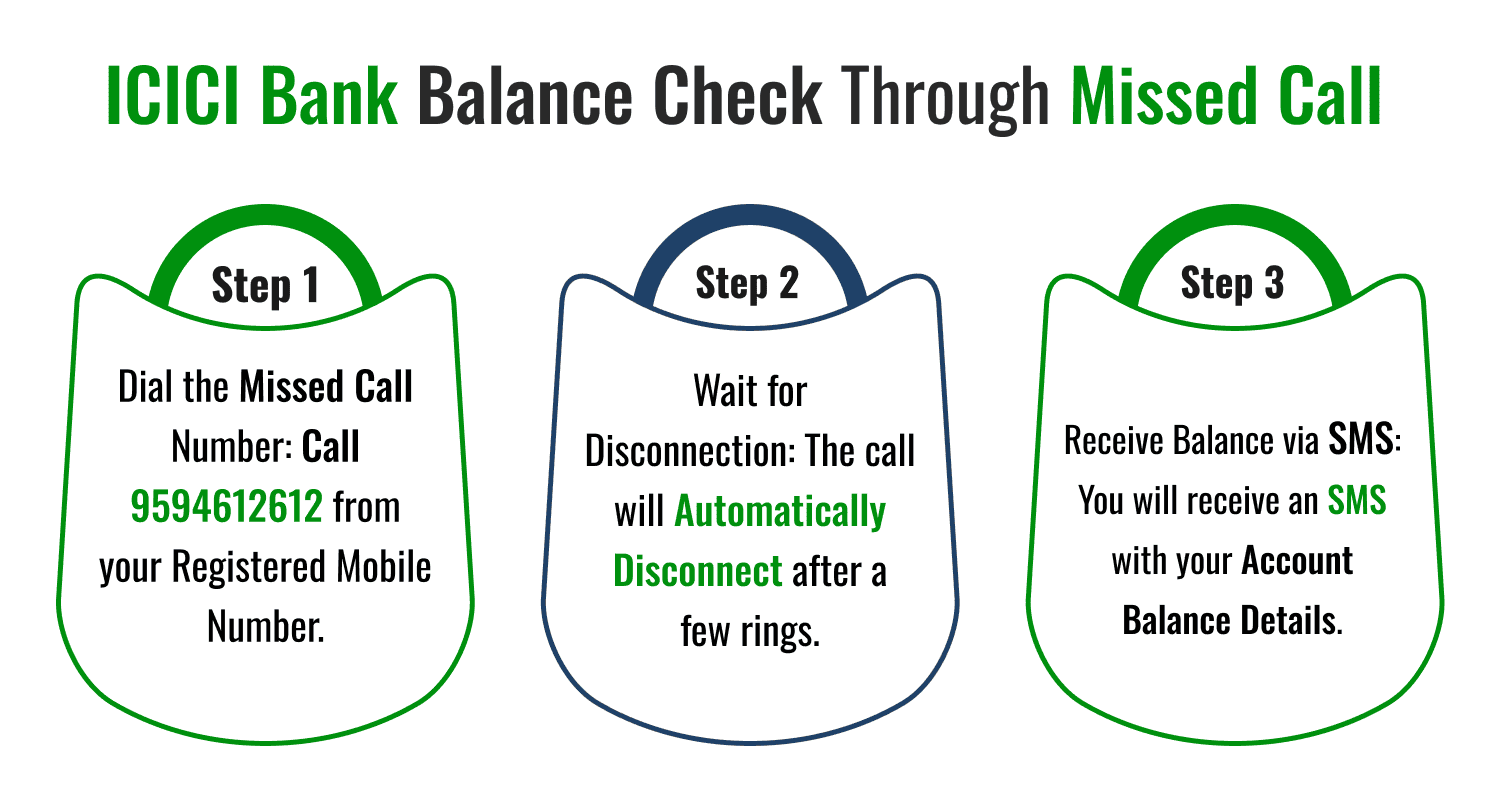

ICICI Bank Balance Check Through Missed Call

To check your ICICI Bank account balance through a missed call:

- Dial the Missed Call Number: Call 9594612612 from your registered mobile number.

- Wait for Disconnection: The call will automatically disconnect after a few rings.

- Receive Balance via SMS: You will receive an SMS with your account balance details.

Notes: Ensure your mobile number is registered with ICICI Bank to use this service. This service is free and available 24/7.

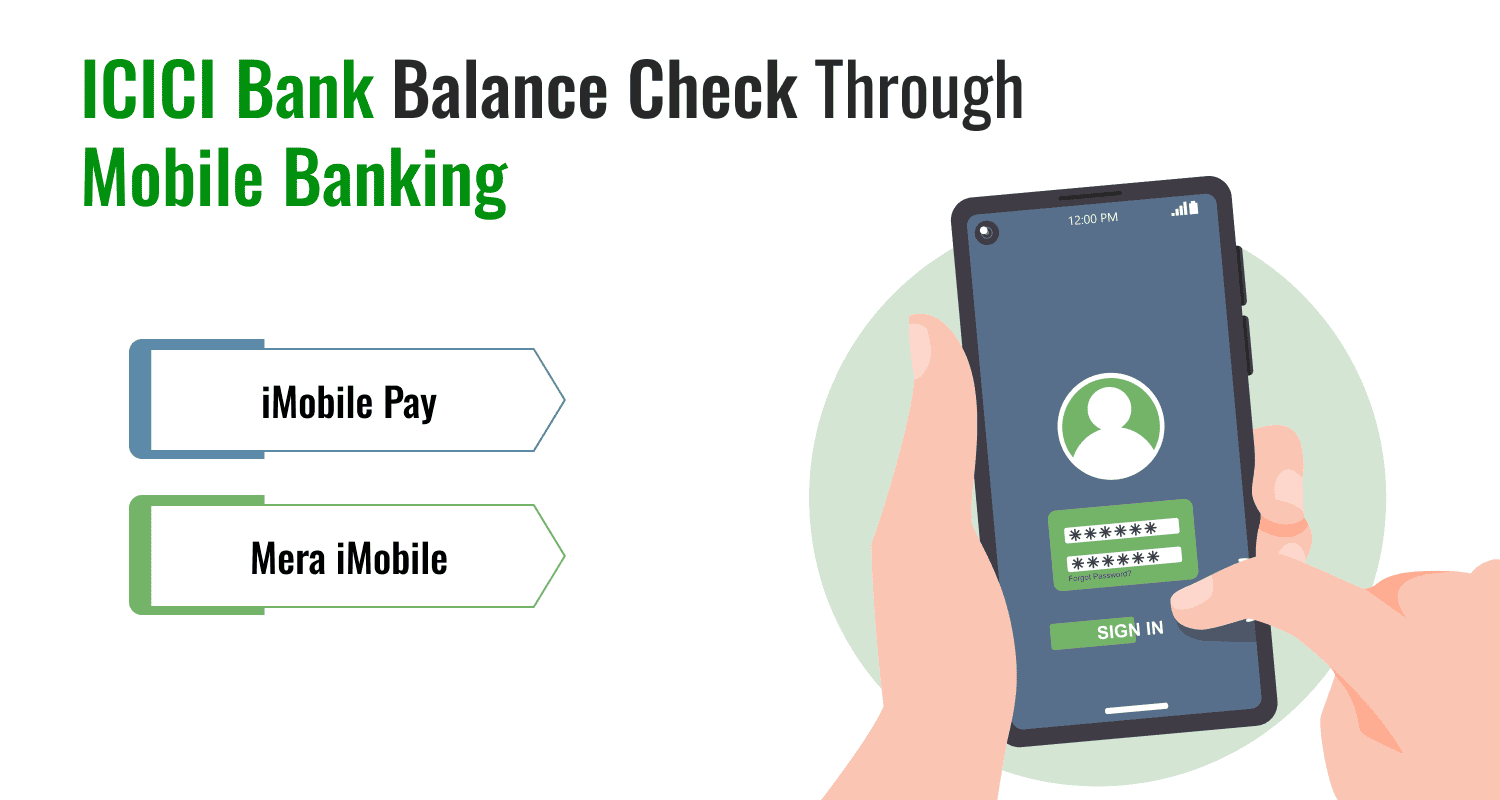

ICICI Bank Balance Check Through Mobile Banking

ICICI Bank provides an easy way to check account balances, including through the ICICI Bank Balance Check Number and its mobile banking applications. These services offer account holders the convenience of accessing banking services anytime, anywhere.

Here are the steps that can be used for ICICI Bank Balance Check Through Mobile Banking :

- iMobile Pay:

Available on both Google Play Store and Apple App Store, iMobile Pay offers a comprehensive mobile banking experience. With this app, you can:- Check account balances and view mini-statements.

- Manage and transact across multiple accounts (savings, loans, PPF, insurance, and more).

- Make fund transfers and utility payments.

- Access detailed account statements via email.

- Mera iMobile:

Tailored for regional users, this app supports 12 different languages. Key features include:- Checking account balances and viewing account summaries.

- Accessing detailed statements.

- Performing fund transfers and paying utility bills.

These apps ensure seamless and secure access to ICICI Bank services from your smartphone, making banking more convenient than ever.

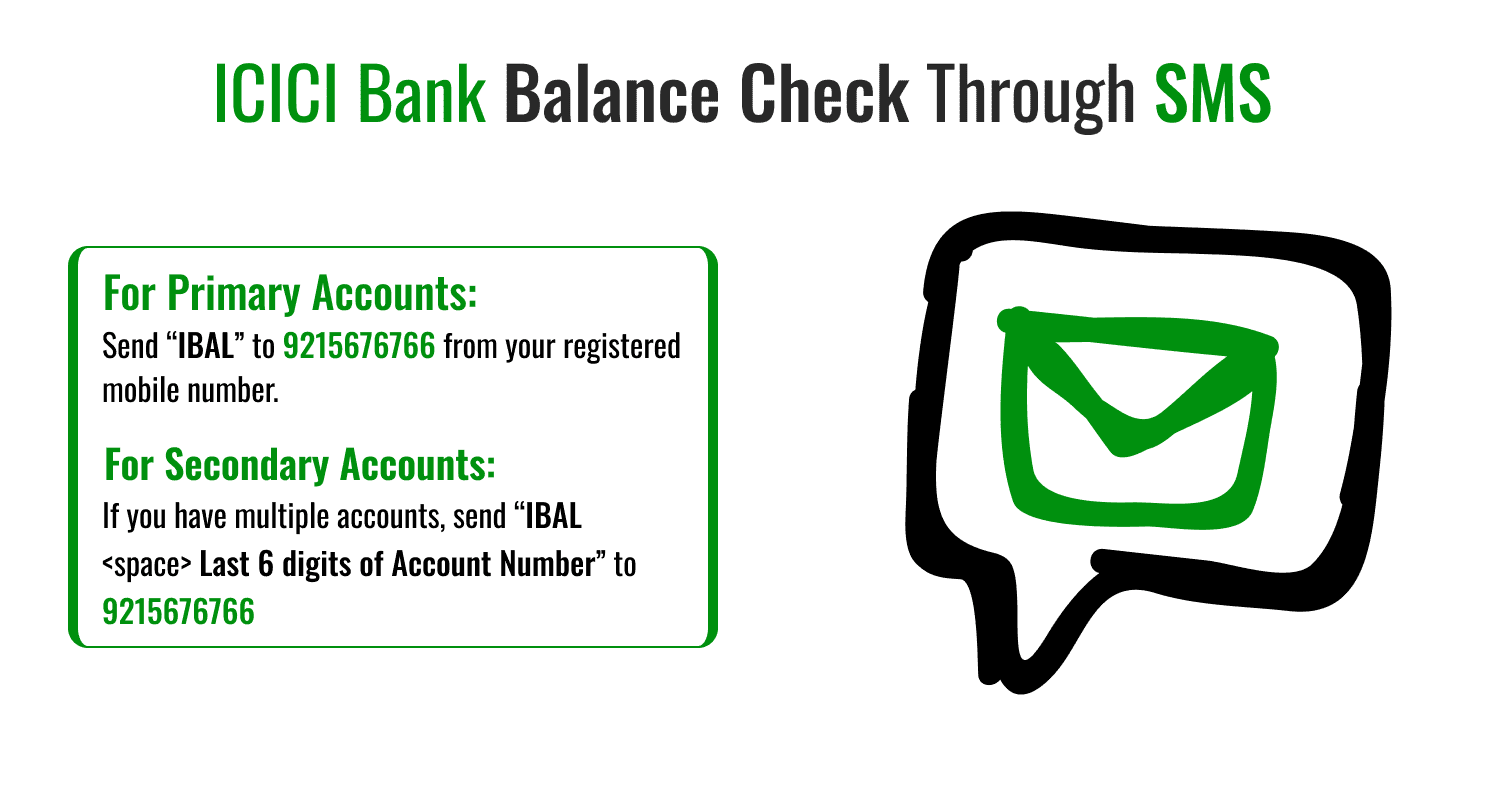

ICICI Bank Balance Check Through SMS

To check your ICICI Bank account balance Through SMS, read the content below -

- For Primary Accounts:

Send “IBAL” to 9215676766 from your registered mobile number.

- For Secondary Accounts:

If you have multiple accounts, send “IBALLast 6 digits of Account Number” to 9215676766 to check the balance of a specific account.

Notes: Ensure your mobile number is registered with the bank. Standard SMS charges may apply.

You will receive the balance details of that account.

Services | SMS format | Description |

|---|---|---|

Check the Current Account Balance | CIBAL(space) | Send an SMS to 5676766 or 9215676766 from your registered mobile number linked to your Corporate Internet Banking account to access services. Ensure the mobile number is updated in the bank's records for seamless use. |

Check details of the last 5 Transactions | CITRAN(space) |

ICICI Bank Balance Check Number Through Internet Banking

ICICI Bank account holders registered for Internet banking can easily check their account balance through the ICICI Net Banking portal anytime.

- Log In to Net Banking:

Visit the ICICI Net Banking portal.

Enter your User ID and Password to log in.

- Check Account Balance:

After logging in, the account balance is displayed on the dashboard .

Users can view the balance of all linked ICICI Bank accounts.

- Access Additional Features:

Check previous transactions and ICICI mini statements.

Transfer funds or manage accounts using the net banking facility.

- Not Registered?

If you’re not registered for net banking, visit the nearest ICICI Bank branch to activate this service.

ICICI Bank Balance Check Through ATM

ICICI Bank account holders can check their account balance conveniently at the nearest ATM by following these steps:

- Visit the closest ICICI Bank or any other bank's ATM.

- Insert or swipe your ICICI Bank ATM card into the machine.

- Enter your 4-digit ATM PIN securely when prompted.

- Select the ‘Balance Check’ or ‘Balance Enquiry’ option from the menu.

- The ATM will display your account balance on the screen and may also provide a printed receipt with the account balance details.

This process ensures quick access to your account balance anytime.

ICICI Bank Balance Check Through Mini Statement

Account holders can easily access the ICICI mini statement number by giving a missed call to 9594 613 613 from their registered mobile number. This service is free of charge and provides a quick way to stay updated on recent transactions.

How It Works:

- Dial 9594 613 613 from your mobile number registered with ICICI Bank.

- The call will automatically disconnect after a ring—waiting or speaking to an operator is unnecessary.

- Shortly after, you will receive an SMS from ICICI Bank containing the details of your last 3 transactions.

Conclusion

The ICICI Bank Balance Enquiry Number (1860 120 7777) provides a quick and hassle-free way for customers to check their account balance. This service eliminates the need to visit a branch or ATM, offering convenience through a simple phone call. By following a secure verification process involving the account or debit card number and ATM PIN, customers can instantly access their balance information anytime, anywhere. This facility is especially beneficial for those seeking on-the-go access to their financial details.

Frequently Asked Questions (FAQs)

What is the ICICI Balance Check Enquiry Number?

Is there any charge for using the ICICI Balance Check Number?

Can I use the ICICI Bank balance enquiry service from any phone number?

Is the ICICI Balance Enquiry service available 24/7?

Can I use a missed call service to check my ICICI bank balance?

Best Offers For You!

Account Balance Check by Bank

- SBI Balance Check

- PNB Balance Check

- Bank of Baroda Balance Check

- Canara Bank Balance Check

- YES BANK Balance Enquiry

- RBL Bank Balance Check

- Kotak Bank Balance Check

- ICICI Bank Balance Enquiry

- HDFC Bank Balance Check

- Federal Bank Balance Check

- Bandhan Bank Balance Check

- Axis Bank Balance Check

- AU Bank Balance Check

- Bank of Maharashtra Balance Check

- Indusind Bank Balance Check

- UCO Bank Balance Check

- Union Bank of India Balance Check

- Punjab & Sind Bank Balance Check

- Indian Overseas Bank Balance Check

- Central Bank of India Balance Check

- Indian Bank Balance Check

- IDFC First Bank Balance Check

- DCB Bank Balance Check

- Karur Vysya Bank Balance Check

- South Indian Bank Balance Check

Account Mini Statement by Bank

- SBI Mini Statement

- ICICI Bank Mini Statement

- Axis Bank Mini Statement

- PNB Mini Statement

- IDFC First Bank Mini Statement

- Indusind Bank Mini Statement

- Kotak Bank Mini Statement

- YES BANK Mini Statement

- Indian Bank Mini Statement

- Union Bank of India Mini Statement

- Bank of Maharashtra Mini Statement

- Central Bank of India Mini Statement

- Canara Bank Mini Statement

- Bank of Baroda Mini Statement

- RBL Bank Mini Statement

- Punjab & Sind Bank Mini Statement

- Indian Overseas Bank Mini Statement

- Federal Bank Mini Statement

- Bandhan Bank Mini Statement

- Karur Vysya Bank Mini Statement

- South Indian Bank Mini Statement

- DCB Bank Mini Statement

- IDBI Bank Mini Statement

- Bank of India Mini Statement