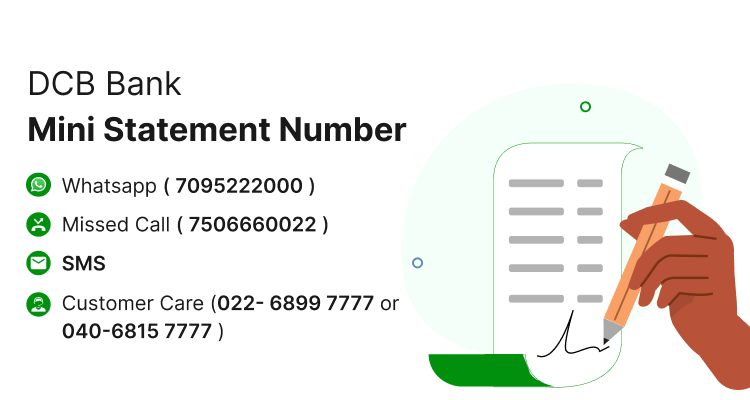

DCB Bank Mini Statement Number

Last Updated : May 30, 2024, 4:53 p.m.

Managing your finances has become really important in today’s fast-paced world, and staying updated on your bank account transactions can save you both time and trouble.

For DCB Bank customers, keeping a close eye on their finances is made simple with the convenience of obtaining a mini statement quickly through various quick ways. This includes making a phone call, sending an SMS, and more.

In this article, we will explore these methods in detail to help you make the most of DCB Bank's services. Let’s dive in!

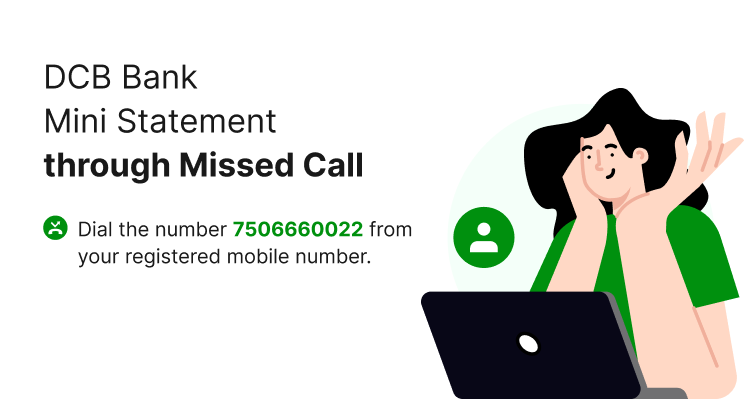

DCB Bank Mini Statement through Missed Call

To check your DCB Bank Mini Statement through a missed call, you should dial the number 7506660022 from your registered mobile number. After giving a missed call to this number, you will receive an SMS containing the mini statement of your account, which includes details of your recent transactions.

This service is convenient and allows you to quickly access your transaction history without the need for internet access or visiting a bank branch.

DCB Mini Statement Via WhatsApp

To check your DCB Bank Mini Statement through WhatsApp, you need to follow these steps:

- Ensure that your mobile number is registered with DCB Bank for WhatsApp banking services.

- Give a missed call to 7095222000 from your registered mobile number to activate WhatsApp banking services if you haven't done so already.

- After activation, you can use various banking services through WhatsApp, including account balance check, getting a mini statement of the last 5 transactions, and more.

- To get your mini statement, simply send a message requesting a mini statement through WhatsApp to DCB Bank's official WhatsApp number, which is 8657697777 .

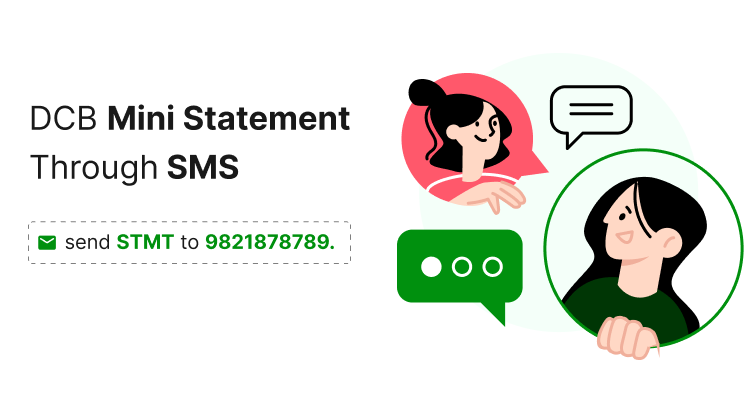

DCB Bank Mini Statement Through SMS

If your number is already registered with the bank, all you need to do is send STMT to 9821878789 . You will get the details of your last 5 transactions.

DCB Mini Statement Via Visiting Bank Branch

Here are the steps to follow to check your DCB mini statement by visiting a bank branch:

- Go to the nearest DCB bank branch. You can use the DCB website or mobile app to find the branch closest to you.

- Once at the bank branch, approach the customer service desk or bank representative and request a mini statement for your account.

- The bank staff might ask for your account number and a valid ID proof to verify your identity. Ensure you carry an official identification document such as your Aadhaar card, PAN card, or passport.

- Once verified, the bank representative will process your request and provide you with a printed mini statement.

DCB Bank Mini Statement Through Mobile Banking

To check your DCB Bank mini statement through mobile banking, you can use the DCB Mobile Banking application. Here are the steps to follow:

- Download the DCB Mobile Banking app from the Google Play Store or Apple App Store.

- If you are a first-time user, you will need to register on the app. You can register using your DCB debit card details, DCB internet banking login details, or a temporary PIN provided by the bank.

- Once registered, login to the app using your credentials.

- After logging in, look for the option to view your mini statement.

DCB Mini Statement Using Netbanking

In order to use the netbanking to get your mini statement, you need to follow the below-mentioned steps:

- Log in to your DCB Netbanking account. You can do this by visiting the DCB Bank website and entering your user ID and password.

- After logging in, look for the option to view your account summary or mini statement. This option is usually found in the main menu or dashboard under the accounts section.

- Click on the mini statement option to view the last few transactions in your account.

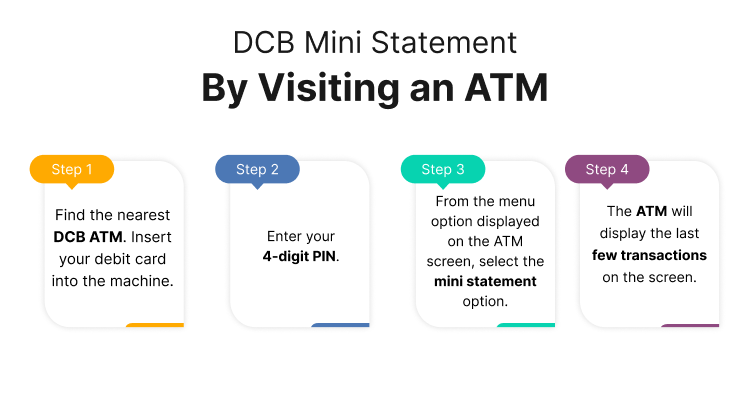

DCB Mini Statement By Visiting an ATM

If you want to access a mini statement through an ATM, follow the steps below:

- Find the nearest DCB ATM. Insert your debit card into the machine.

- Enter your 4-digit PIN.

- From the menu option displayed on the ATM screen, select the mini statement option.

- The ATM will display the last few transactions on the screen.

DCB Mini Statement Through Customer Care

Customer care representatives of DCB could also help you in generating mini statements for your recent transactions.

- Dial the DCB Bank Customer Care number, which is 022-6899 7777 or 040-6815 7777. These numbers are available for customer support and can be used to inquire about your mini statement.

- Once connected, follow the Interactive Voice Response (IVR) instructions. Typically, you will need to:

- Press 1 if you are an existing customer.

- Go through the menu options to select the service you need, such as account information or mini statement.

- When prompted, request the mini statement for your account. The customer care representative or the automated system will provide you with the details of your last few transactions (usually the last 5 transactions).

- The mini statement details will be provided to you over the phone. In some cases, the bank may also send the mini statement to your registered email or mobile number as an SMS.

Advantages of DCB Mini Statements

Here are the main advantages of getting access to mini statements:

- Convenience: The mini statement service allows customers to quickly access their recent transaction history without needing to visit a bank branch or ATM. This can be done through various channels such as missed calls, mobile banking, internet banking, and customer care, making it highly convenient.

- Real-time updates: Customers can get real-time updates on their account transactions, helping them stay informed about their financial activities and manage their finances more effectively.

- Accessibility: The service is accessible through multiple platforms, including mobile banking apps, internet banking, and even via a simple missed call. This ensures that customers can access their mini statements anytime and anywhere, even without an internet connection.

- Security: By regularly checking their mini statements, customers can quickly identify any unauthorized transactions or discrepancies in their accounts, enhancing the security of their financial information.

- Ease of use: The process of obtaining a mini statement is straightforward and user-friendly. For instance, customers can simply give a missed call to a designated number to receive their mini statement via SMS.

Frequently Asked Questions (FAQs)

How can I check my last 5 transactions in DCB Bank?

How can I get a DCB Bank mini statement by SMS?

What is the WhatsApp number for the DCB Bank mini statement?

How do I get a mini statement from DCB Bank?

How can I get a DCB Bank mini statement through an ATM?

Best Offers For You!

Account Balance Check by Bank

- SBI Balance Check

- PNB Balance Check

- Bank of Baroda Balance Check

- Canara Bank Balance Check

- YES BANK Balance Enquiry

- RBL Bank Balance Check

- Kotak Bank Balance Check

- ICICI Bank Balance Enquiry

- HDFC Bank Balance Check

- Federal Bank Balance Check

- Bandhan Bank Balance Check

- Axis Bank Balance Check

- AU Bank Balance Check

- Bank of Maharashtra Balance Check

- Indusind Bank Balance Check

- UCO Bank Balance Check

- Union Bank of India Balance Check

- Punjab & Sind Bank Balance Check

- Indian Overseas Bank Balance Check

- Central Bank of India Balance Check

- Indian Bank Balance Check

- IDFC First Bank Balance Check

- DCB Bank Balance Check

- Karur Vysya Bank Balance Check

- South Indian Bank Balance Check

Account Mini Statement by Bank

- SBI Mini Statement

- ICICI Bank Mini Statement

- Axis Bank Mini Statement

- PNB Mini Statement

- IDFC First Bank Mini Statement

- Indusind Bank Mini Statement

- Kotak Bank Mini Statement

- YES BANK Mini Statement

- Indian Bank Mini Statement

- Union Bank of India Mini Statement

- Bank of Maharashtra Mini Statement

- Central Bank of India Mini Statement

- Canara Bank Mini Statement

- Bank of Baroda Mini Statement

- RBL Bank Mini Statement

- Punjab & Sind Bank Mini Statement

- Indian Overseas Bank Mini Statement

- Federal Bank Mini Statement

- Bandhan Bank Mini Statement

- Karur Vysya Bank Mini Statement

- South Indian Bank Mini Statement

- DCB Bank Mini Statement

- IDBI Bank Mini Statement

- Bank of India Mini Statement