Central Bank of India Mini Statement Number

Last Updated : May 28, 2024, 4 p.m.

Do you have an account with the Central Bank of India? As one of the oldest government-owned banks, it boasts a widespread network of branches across the country and stands as one of the largest commercial banks.

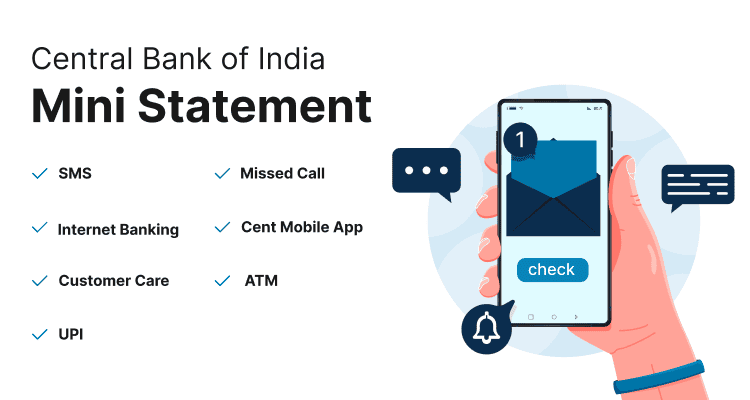

The Central Bank of India is dedicated to providing excellent banking services, including easy access to mini-statements to meet the diverse needs of its customers. If you hold an account here, being familiar with how to quickly retrieve your mini-statements can significantly enhance your banking experience.

This service allows you to keep track of your recent transactions conveniently, helping you manage your finances more effectively. In this article, we will cover the different ways to access mini statements. Let’s begin.

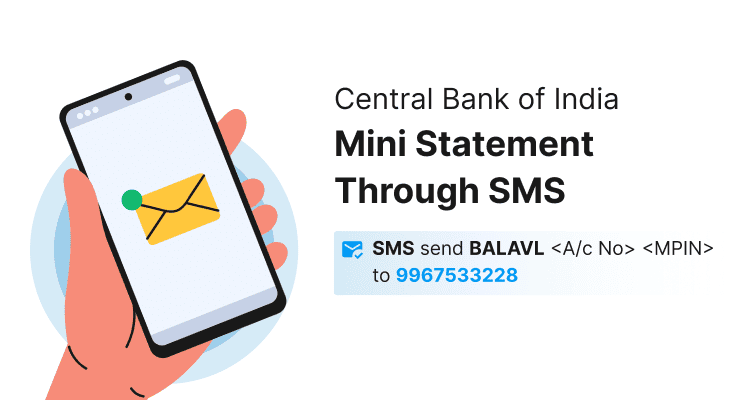

Check Central Bank of India Mini Statement Through SMS

In order to avail the mini statement of Central Bank of India through SMS, follow the below-mentioned steps:

- The customer first needs to register his/her mobile number with the Central Bank of India.

- Once the customer's mobile registration application is approved, the bank will send the MPIN via SMS to the registered mobile number.

- Customers need to send BALAVL <A/c No> <MPIN> to 9967533228 from their registered mobile number to get a mini statement or enquire about their balance.

NOTE: Customers must keep their MPIN confidential and, for security reasons, should delete both the MPIN SMS from the Central Bank of India and any service request SMS from their mobile phones.

Central Bank of India Mini Statement Through Missed Call

Customers need to use their registered mobile number to make a call to 9555144441 to request for a mini statement.

Here are the steps to follow:

- Dial 9555144441 from your registered mobile number.

- The call will disconnect automatically after the first ring.

- You will receive an SMS containing the requisite information i.e. mini account statement on your registered mobile number by the Central Bank of India through SMS.

This allows for quick and easy access to basic account information without the need for internet access or complex interactions. But in order to access the missed call services of the Central Bank of India, it is essential to have your mobile number registered with the bank.

Central Bank of India Mini Statement Through Internet Banking

The following are the steps to check mini statement of Central Bank of India through their net banking services:

- Visit the Central Bank of India's official Internet Banking website at https://www.centralbank.net.in. Enter your user ID and password to log in.

- Look for the option that says ‘Account Summary’ or a similar term.

- Choose the account for which you want to view the mini statement. This could be your savings account , current account, or any other account type you have with the bank.

- After selecting the account, look for an option labeled ‘Mini Statement’, ‘Recent Transactions’, or something similar. Click on this to view the recent transactions in your account.

Check Central Bank of India Mini Statement Using Cent Mobile App

Central Bank of India customers can download the Cent Mobile app on their Android or iOS devices for a comprehensive mobile banking experience. Users can access a variety of services including checking account balances, viewing mini-statements, initiating fund transfers, managing term deposits, using UPI , and checking NEFT status among others.

Here’s how to access your mini-statement:

- Log in using your MPIN, username, or biometric authentication.

- Your current savings account balance will be displayed at the top of the dashboard. You have the option to conceal or reveal your balance.

- Select 'Recent Transactions' to review the latest activities in your account.

Central Bank of India Mini Statement Using the Cent-M Passbook App

To check your Central Bank of India (CBI) mini statement using the Cent m-Passbook app, follow these steps:

- Download the Cent m-Passbook app from the Google Play Store or Apple App Store.

- Open the app and log in using your Customer Information File (CIF) number and the mobile number registered with the bank.

- An OTP (One-Time Password) will be sent to your registered mobile number for verification. Enter the OTP to proceed.

- Once logged in, go to the section where you can view your recent transactions.

- The Cent m-Passbook app also offers an offline view feature, allowing you to check your mini statement even without an internet connection.

Check Central Bank of India Mini Statement By Visiting an ATM

You can get a mini statement of your Central Bank of India account via an ATM . To do so, follow these steps:

- Swipe your Central Bank of India ATM card at any bank's ATM machine.

- Enter your four-digit ATM PIN.

- Select ‘Balance Enquiry’ from the options.

- Check your account balance.

- Select the option to generate ‘Mini Statement’ on a receipt.

Central Bank of India Mini Statement By Visiting Bank Branch

To check your Central Bank of India mini-statement by visiting a bank branch, follow these steps:

- Locate the nearest Central Bank of India branch. You can find this information on the bank's official website or by using a map application on your smartphone.

- If you have a passbook, you can request the bank staff to update it. The updated passbook will include all recent transactions, effectively serving as a mini statement.

- If you prefer not to update your passbook or if you do not have it with you, you can request a printed mini statement from the bank staff.

Central Bank of India Mini Statement Through Customer Care

Account holders of the Central Bank of India can enquire about their account balance and other services or speak to the customer care executive by calling the toll-free number - 1800 22 1911.

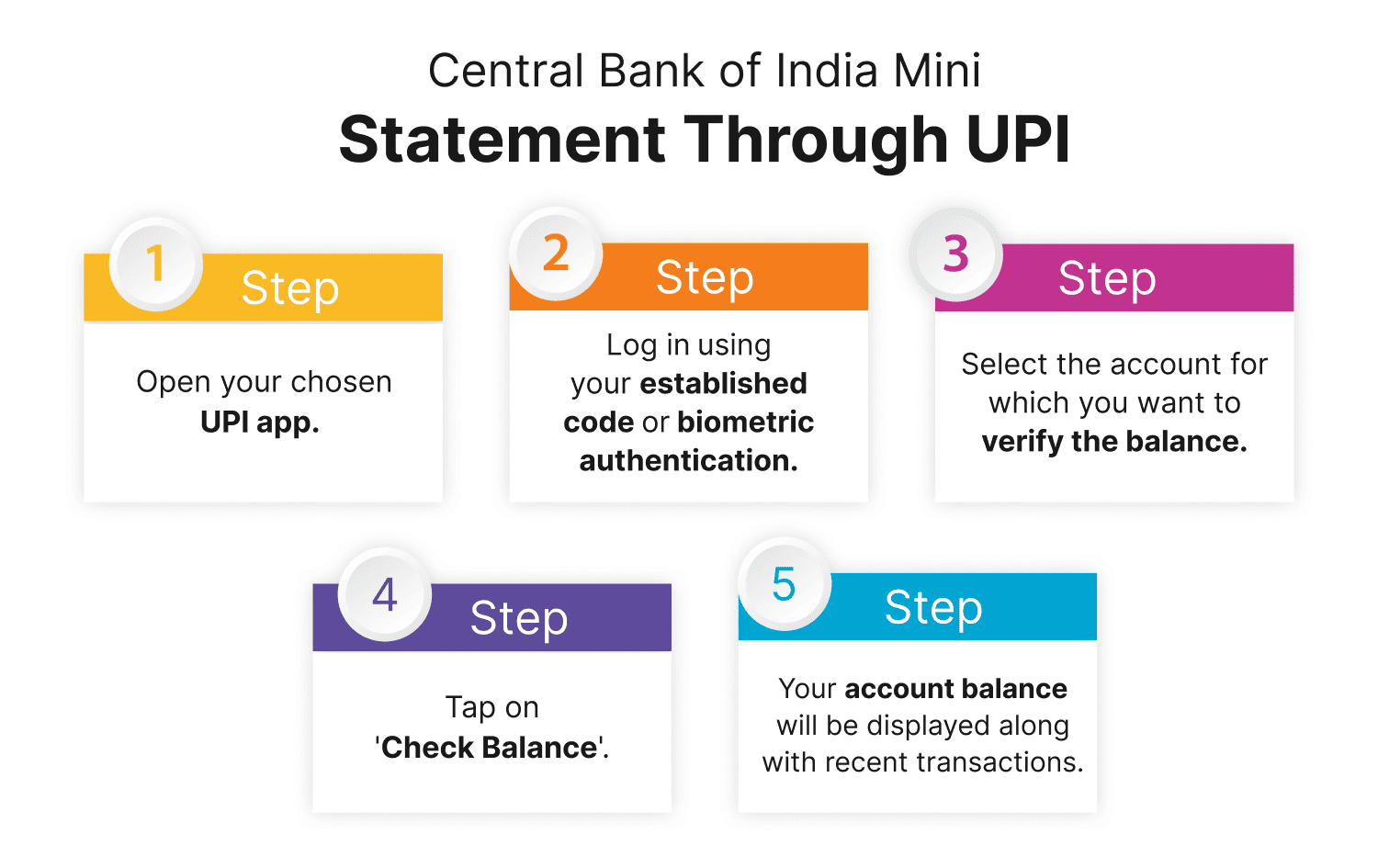

Central Bank of India Mini Statement Through UPI

To check your account balance using a UPI app on your smartphone, follow these streamlined steps:

- Open your chosen UPI app.

- Log in using your established code or biometric authentication.

- Select the account for which you want to verify the balance.

- Tap on 'Check Balance'.

- Your account balance will be displayed along with recent transactions.

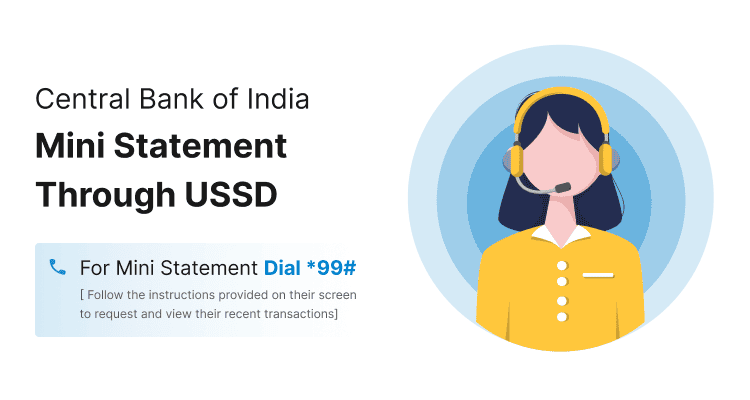

Central Bank of India Mini Statement Through USSD

Customers who have registered their mobile number with the bank can access banking services via USSD. For a mini-statement, users should dial *99# and follow the instructions provided on their screen to request and view their recent transactions.

Advantages of Using Central Bank of India Mini Statement

The Central Bank of India Mini Statement offers several advantages to account holders, making it a convenient tool for managing finances. Here are the key benefits:

Quick Access to Recent Transactions: The mini statement provides a quick overview of the last few transactions, usually the last 3 to 10, depending on the service used. This allows account holders to stay updated on their recent account activities without needing a full statement.

Convenience: Obtaining a mini statement is highly convenient as it can be accessed through various methods such as missed calls, SMS, mobile banking apps, ATMs, and internet banking. This means account holders can check their recent transactions and account balance anytime and anywhere without visiting a bank branch.

Monitor Account Activity: Regularly checking the mini statement helps in monitoring account activity, which is crucial for detecting any unauthorized transactions or discrepancies early. This vigilance helps in preventing potential fraud and financial loss.

Supports Financial Planning: By regularly reviewing their mini statement, account holders can make informed decisions about their spending, savings, and budgeting. This ongoing review supports better financial planning and management.

Frequently Asked Questions (FAQs)

How can I check my last 5 transactions in the Central Bank?

How do I view my Central Bank mini bank statement?

What is the number of Central Bank of India statements?

How can I download my CBI bank statement?

How can I get a CBI mini statement through an ATM?

Account Balance Check by Bank

- SBI Balance Check

- PNB Balance Check

- Bank of Baroda Balance Check

- Canara Bank Balance Check

- YES BANK Balance Enquiry

- RBL Bank Balance Check

- Kotak Bank Balance Check

- ICICI Bank Balance Enquiry

- HDFC Bank Balance Check

- Federal Bank Balance Check

- Bandhan Bank Balance Check

- Axis Bank Balance Check

- AU Bank Balance Check

- Bank of Maharashtra Balance Check

- Indusind Bank Balance Check

- UCO Bank Balance Check

- Union Bank of India Balance Check

- Punjab & Sind Bank Balance Check

- Indian Overseas Bank Balance Check

- Central Bank of India Balance Check

- Indian Bank Balance Check

- IDFC First Bank Balance Check

- DCB Bank Balance Check

- Karur Vysya Bank Balance Check

- South Indian Bank Balance Check

Account Mini Statement by Bank

- SBI Mini Statement

- ICICI Bank Mini Statement

- Axis Bank Mini Statement

- PNB Mini Statement

- IDFC First Bank Mini Statement

- Indusind Bank Mini Statement

- Kotak Bank Mini Statement

- YES BANK Mini Statement

- Indian Bank Mini Statement

- Union Bank of India Mini Statement

- Bank of Maharashtra Mini Statement

- Central Bank of India Mini Statement

- Canara Bank Mini Statement

- Bank of Baroda Mini Statement

- RBL Bank Mini Statement

- Punjab & Sind Bank Mini Statement

- Indian Overseas Bank Mini Statement

- Federal Bank Mini Statement

- Bandhan Bank Mini Statement

- Karur Vysya Bank Mini Statement

- South Indian Bank Mini Statement

- DCB Bank Mini Statement

- IDBI Bank Mini Statement

- Bank of India Mini Statement