Banks that Provide the Best Savings Account to Individuals

Last Updated : Feb. 4, 2025, 2:48 p.m.

A savings account is a well-known banking option used by many people. It's one of the most popular banking products across the country. A large number of people have one or more savings accounts. This basic banking service lets you deposit your money safely in a bank. This means you don't have to carry cash all the time. You can also withdraw your money anytime, anywhere without any hassle, and you will earn interest on the amount you deposit.

Open a Savings Bank Account Online Now!

However, there are so many banks offering savings accounts for individuals that choosing the best one can be difficult. Several factors determine a bank's suitability for opening a savings account. These include the interest rates banks offer, the services and facilities they provide, and a few other factors. In this article, we will explain what a savings account is, identify the banks with the best savings accounts for individuals, and discuss their interest rates and features. This could be an informative read for you if you are considering opening a savings account in a bank.

What is a Savings Account?

Before exploring the best savings accounts in India, it's essential to understand what a savings account is. As mentioned, individuals can deposit their money safely in a savings account at a bank, which in return provides interest on that amount. The interest rates for savings accounts can vary from one bank to another. A savings account is considered one of the most liquid investments because it allows you the freedom to withdraw your money anytime and anywhere you need it.

With the advancements in technology, you can now open a savings account from your mobile phone. Additionally, some banks offer the convenience of opening a savings account over the phone. You no longer need to visit a bank branch with all your documents to open an account. Simply fill out the online application form, upload the required KYC documents, and your savings account will be ready.

Anyone who is an Indian citizen can open a savings account , either individually or jointly. If you're wondering why you need a savings account, there are many reasons. A savings account allows you to save your money safely, make bill payments, mobile recharges, send and receive money, and pay your credit card bills, among other things. The benefits are numerous. All you need to do is choose the bank that offers the best savings account, and we will guide you in this process.

Top Banks that have the Best Savings Account for Individuals

We are showing details of those banks that have the best savings accounts for individuals in India. This will help you in choosing the best savings account for you. Have a look.

State Bank of India (SBI) Savings Account

State Bank of India (SBI) is the largest bank in India and offers a wide range of banking products to its customers. The SBI Savings Account is one of its most popular products that allows individuals to deposit their money safely. When it comes to interest rates, the SBI Savings Account offers 2.70% per annum. You can view many more features in the table below:

Features | Details |

|---|---|

Interest Rates | 2.70% - 3.00% per annum |

Monthly Average Balance | Nil |

Maximum Balance | No Limit on Maximum Balance |

Cheque Book | The first 10 cheque leaves are free in a financial year Thereafter, 10-leaf chequebook at INR 40 plus GST 25-leaf chequebook at INR 75 plus GST |

Account Operation | Single or Jointly |

Nomination Facility | Available |

Eligibility | All individuals/Central/State Govt Departments |

Other Features | Mobile Banking SMS Alerts Internet Banking YONO App facility State App Anywhere SBI Quick Missed Call Facility |

HDFC Bank Savings Account

HDFC Bank, a leading private sector bank in India, offers a wide range of financial products to its customers. One such product is the Savings Account, which you can open instantly without any hassle, all from the comfort of your home. HDFC offers savings accounts with interest rates ranging from 3.00% to 3.50% per annum, calculated every quarter.

HDFC Bank has a savings account to meet all your needs, from zero deposit to feature-rich and customized accounts. Yes, you can choose the type of account you want to open with HDFC Bank.

Here, we have curated a list of different savings accounts based on your needs, along with their interest rates and average monthly balances. Have a look at the table below to learn more about HDFC Savings Accounts:"

Type of Account | Interest Rate | Average Monthly Balance |

|---|---|---|

Savings Max Account | 3.00%-3.50% | Rs 25,000/- |

Women’s Saving Account | 3.00%-3.50% | - Rs. 10,000 (Metro/Urban Branches) - Rs 5,000 (Semi Urban/ Rural Branches) |

Regular Savings Account | 3.00%-3.50% | - Rs. 10,000 (Metro/Urban Branches) - Rs 5,000 (Semi Urban/ Rural Branches) |

DigiSave Youth Account | 3.00%-3.50% | - Rs. 5,000 (Metro/Urban Branches) - Rs 2500 (Semi Urban/ Rural Branches) |

Senior Citizen’s Account | 3.00%-3.50% | Rs 5,000 (Urban / Semi Urban) |

Kid’s Advantage Account | 3.00%-3.50% | Rs 5,000 |

Institutional Savings Account | 3.00%-3.50% | NIL |

Basic savings Bank Deposit account | 3.00%-3.50% | NIL |

Government Scheme Beneficiary Savings Account | 3.00%-3.50% | NIL |

BSBDA Small Account | 3.00%-3.50% | NIL |

Saving Farmers Account | 3.00%-3.50% | Rs 2,500 Average Half Yearly Balance |

Other key features and benefits of opening best savings account for individuals with HDFC Bank:

- The minimum amount required for opening a Savings Account in HDFC is Rs. 10,000 for metro-urban branches. Rs. 5,000 For semi-urban branches and Rs. 2,500 for Rural branches is required to open a Savings Regular Account.

- Cheque Book – Free- 25 cheque leaves per financial year & Additional cheque book of 25 leaves will be charged @Rs 75/-per cheque book.

- HDFC Bank's personalized account number and cheque book enhance security and ensure that your money is safe.

- You can get SMS alerts and e-statement facilities with HDFC Savings Account.

- You can easily transfer your amount to another bank account through RTGS , IMPS , NEFT & UPI facilities.

- With the HDFC Auto Sweep facility, your account can be linked to a Multi Option Deposit (MOD) Account.

Axis Bank Savings Account

Axis Bank provides a variety of savings account options tailored to meet the diverse needs of its customers. These accounts are designed for flexibility, making them perfect for creating an emergency fund while also providing a decent interest rate on deposited amounts. Axis Bank offers interest rates ranging from 3.00% to 3.50% on these savings accounts.

The minimum balance requirement for an Axis Bank Savings Account varies by location: Rs. 12,000 for metro and urban areas, Rs. 5,000 for semi-urban areas, and Rs. 2,500 for rural locations. We have listed the main features below.

Features | Details |

|---|---|

Interest Rate | 3.00% - 3.50% per annum |

Monthly Average Balance | Varies as per location and type of savings account |

Maximum Balance | No Limit |

Debit Card | Instant Virtual Debit Card |

Nomination Facility | Available |

Features | Branchless, Signatureless, Paperless Get access to free airport lounges Cashback of up to 10% on Flipkart and Amazon deals Free 24x7 fund transfers via UPI, NEFT, IMPS, RTGS |

Kotak Mahindra Bank Savings Account

If you are someone who is looking to choose the best savings account from the options available, Kotak Mahindra Bank Savings Account could be one of them. With an extended range of savings accounts provided by Kotak Mahindra Bank, you can manage your money efficiently. Kotak Mahindra Bank Savings Account interest rates are fixed at 3.50% - 4.00% per annum on balances above INR 1 lakh.

There are no transaction or monthly account fees that you need to pay on this best bank for a savings account. You can choose an account according to your needs from a range of savings accounts such as 811 Digital Bank Account, Edge Savings Account, Sanman Savings Account, Classic Savings Account, etc.

We are showing you some of the details related to the Kotak Mahindra Bank Classic Savings Account in the below table. Have a look!

Features | Details |

|---|---|

Interest Rates | 3.00% - 4.00% per annum |

Monthly Average Balance | Nil/INR 10,000 |

Maximum Balance | No limit on maximum balance |

Debit Card | Virtual Debit Card Free Platinum International Chip Debit Card |

Account Operation | Single or Jointly |

Nomination Facility | Available |

Eligibility | Resident Indian Hindu Undivided Families (HUFs) Foreign Nationals living in India |

Other Features | Free NEFT through Internet Banking Free Cash Withdrawals at Domestic ATMs Scan and Pay to make payments for shopping, groceries, and much more |

DBS Bank Savings Account

A savings account from DBS Bank could be a great option for you if you're looking for the best savings account. Did you know that you don't even need to leave your home to open a DBS Digi Savings Account? Simply download the Digibank mobile app onto your smartphone and fill in the required details. With interest rates ranging from 3.25% to 7.0% per annum, you also receive welcome benefits when opening a savings account. For instance, you will get INR 150 cashback if you add INR 10,000 to your Savings Account or spend INR 3,000 with your debit card within the first 10 days of account opening. Have a look at some of the features of this best savings account for individuals in the table below.

Features | Details |

|---|---|

Interest Rate | 3.25% - 7.0% per annum |

Monthly Average Balance | Nil |

Maximum Balance | No Limit |

Debit Card | DBS Digibank Debit Card |

Nomination Facility | Available |

Features | Branchless, Signatureless, Paperless Tap-to-pay facility Cashback up to 10% on shopping Free 24x7 fund transfers via UPI, NEFT, IMPS, RTGS |

RBL Bank Savings Account

RBL Bank is one of the leading private banks of India that provides a wide range of banking products among which its Savings Account is one of the popular ones. With the basic savings account, you can get higher interest rates ranging from 3.50% - 7.0% and you can put this account even with zero balance.

Though, the interest rates will change according to the balance in your account. To know why this could be the best savings account for you, have a look at the below table where we have shown important details related to it.

Features | Details |

|---|---|

Interest Rates | 3.50% - 7.50% per annum |

Monthly Average Balance | Nil |

Maximum Balance | No Limit on Maximum Balance |

Debit Card | Free Rupay Debit Card with a withdrawal limit of INR 50,000 |

Chequebook Facility | 2 cheque books per annum(40 Leaves) for free |

Eligibility | Resident Indian |

Other Features | Free NEFT through Internet Banking Unlimited Free transaction at RBL ATMs Free Replacement of Damaged Card Higher FD rates |

IndusInd Bank Savings Account

One of the leading private sector banks in India, IndusInd Bank provides the facility for opening a savings account instantly without any hassle. There are so many savings accounts from the IndusInd Bank from which you can easily choose the best savings account for you according to your needs. Some of them are Indus Online, Indus Select, Indus Senior, Indus Privilege Max, and Indus Classic. With the interest rates ranging from 3.00% - 6.75% per annum, it could be a suitable choice for you to keep your money safe. Other details related to the IndusInd Bank Savings Account are shown in the table below. Please check!

Features | Details |

|---|---|

Interest Rates | 3.00% - 7.00% per annum |

Monthly Average Balance | Nil/INR 1,500/INR 2,500/INR 10,000 (depends on the location) |

Maximum Balance | No Limit on Maximum Balance |

Debit Card | IndusInd Titanium Debit Card with INR 50,000 withdrawal limit Platinum Plus Debit Card @ INR 1000 plus GST charges |

Eligibility | Valid for 1 year only; after which customer has to do face-to-face KYC |

Other Features | Cashback on all your spends with your Debit Card Upto 15% off on best restaurants across India Free Movie Tickets worth INR 3,000 6x Rewards on Shopping as cashback Offers on Travel, Fashion and Shopping IndusMobile Application |

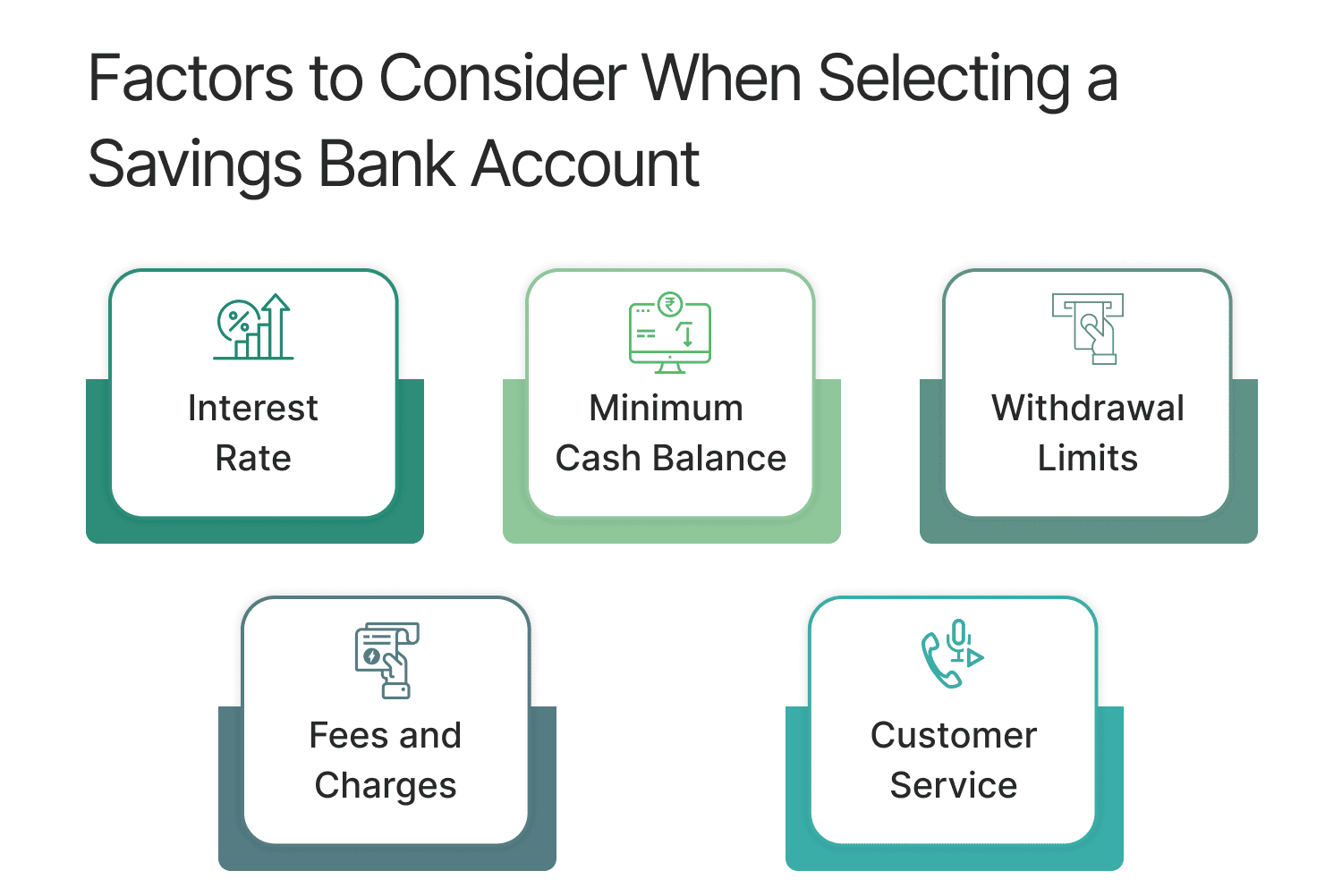

Factors to Consider When Selecting a Savings Bank Account

When choosing a savings account, consider these essential factors:

Interest Rate:

The interest rate is crucial as it determines how much you will earn on your savings. Even small differences in rates can significantly impact your earnings over time, so choose carefully.

Minimum Cash Balance:

Many banks require a minimum deposit to open a savings account and may also require you to maintain a minimum balance. This could influence your choice depending on how you prefer to manage your funds. While some appreciate the flexibility of no minimum balance, others might prefer having a set balance to help with budgeting.

Withdrawal Limits:

Consider how often you'll require to withdraw and use your money. Some accounts have limits on monthly withdrawals, while others allow more frequent access without fees.

Fees and Charges:

Be aware of any potential fees associated with your savings account. These can include monthly fees, transaction fees, and annual maintenance charges. Reviewing these details beforehand can help you avoid unwanted costs.

Customer Service:

Good customer service is vital. You’ll want quick and effective support for any issues, whether it’s a lost debit card or a transaction query. Choosing a bank known for excellent customer service can save you a lot of hassle.

Conclusion

In our blog about the best savings accounts in India, we emphasize that focusing only on the interest rate is not enough when selecting the best bank account.

Before making a decision, it's crucial to weigh the pros and cons of different options and compare their features. While there isn’t one perfect bank for everyone opening a savings account, we have identified some of the top choices currently available in India.

Frequently Asked Questions (FAQs)

What are the best interest rates offered by savings accounts in India?

What should I look for in a savings account apart from interest rates?

Can I open a savings account online in India?

Are there any savings accounts in India that do not require a minimum balance?

Best Offers For You!

Account Balance Check by Bank

- SBI Balance Check

- PNB Balance Check

- Bank of Baroda Balance Check

- Canara Bank Balance Check

- YES BANK Balance Enquiry

- RBL Bank Balance Check

- Kotak Bank Balance Check

- ICICI Bank Balance Enquiry

- HDFC Bank Balance Check

- Federal Bank Balance Check

- Bandhan Bank Balance Check

- Axis Bank Balance Check

- AU Bank Balance Check

- Bank of Maharashtra Balance Check

- Indusind Bank Balance Check

- UCO Bank Balance Check

- Union Bank of India Balance Check

- Punjab & Sind Bank Balance Check

- Indian Overseas Bank Balance Check

- Central Bank of India Balance Check

- Indian Bank Balance Check

- IDFC First Bank Balance Check

- DCB Bank Balance Check

- Karur Vysya Bank Balance Check

- South Indian Bank Balance Check

Account Mini Statement by Bank

- SBI Mini Statement

- ICICI Bank Mini Statement

- Axis Bank Mini Statement

- PNB Mini Statement

- IDFC First Bank Mini Statement

- Indusind Bank Mini Statement

- Kotak Bank Mini Statement

- YES BANK Mini Statement

- Indian Bank Mini Statement

- Union Bank of India Mini Statement

- Bank of Maharashtra Mini Statement

- Central Bank of India Mini Statement

- Canara Bank Mini Statement

- Bank of Baroda Mini Statement

- RBL Bank Mini Statement

- Punjab & Sind Bank Mini Statement

- Indian Overseas Bank Mini Statement

- Federal Bank Mini Statement

- Bandhan Bank Mini Statement

- Karur Vysya Bank Mini Statement

- South Indian Bank Mini Statement

- DCB Bank Mini Statement

- IDBI Bank Mini Statement

- Bank of India Mini Statement