Bank of India Mini Statement Number

Last Updated : May 13, 2024, 11:09 a.m.

Get CIBIL Score Instantly for Free and Save around INR 4,800 a Year (Only for Wishfin Customers)

Instant Personal Loan Quotes from 17 Banks and Get the Best Deal

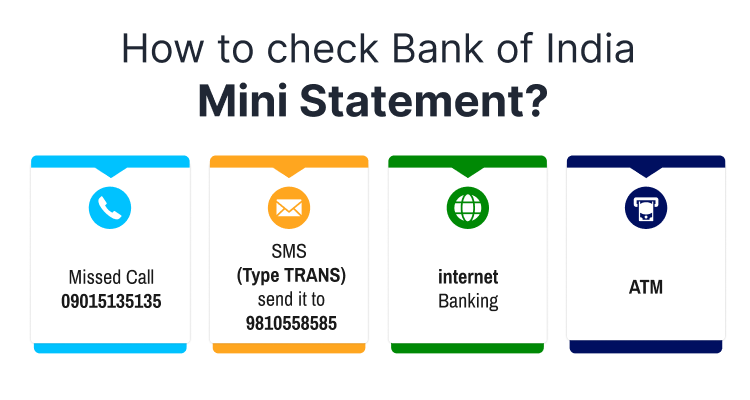

It is critical for everyone to keep track of their bank account’s monthly statement in order to forecast future spending. However, it is not always possible to visit a bank branch and update the statement passbook. Therefore, banks offer mini-statements that include information for the previous ten transactions. Also, there are numerous techniques for obtaining a Bank of India mini statement and keeping a track of the previous transactions. You can use the Bank of India mini statement number to get the information of your previous transactions. You can also get the BOI mini statement via SMS or BOI internet banking facility. Below are all of the options for obtaining a Bank of India savings account mini statement.

Techniques to Obtain Your Bank of India Mini Statement

Below are some of the techniques that you can use to obtain your BOI mini statement:

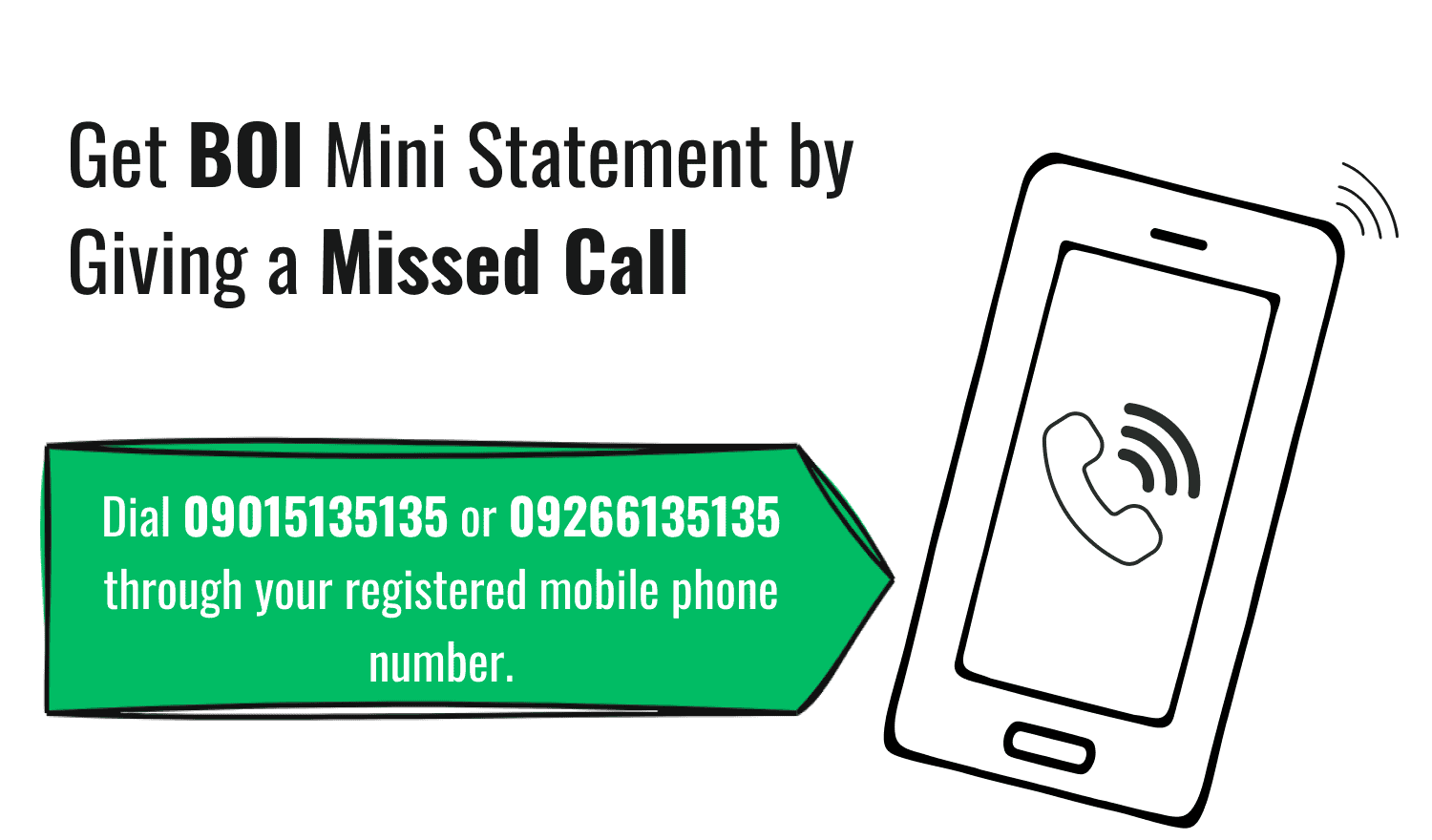

Get Mini Statement by Giving a Missed Call

Dial 09015135135 or 09266135135 through your registered mobile phone number and your call will get disconnected automatically after a few rings. Once your call is disconnected, you will receive a text message with your account number and mini statement. Moreover, the customers can use this facility throughout the day and they do not need to pay a charge for this service. However, always note that you will not receive a message with your BOI mini statement. If you do not link your mobile number with your bank account.

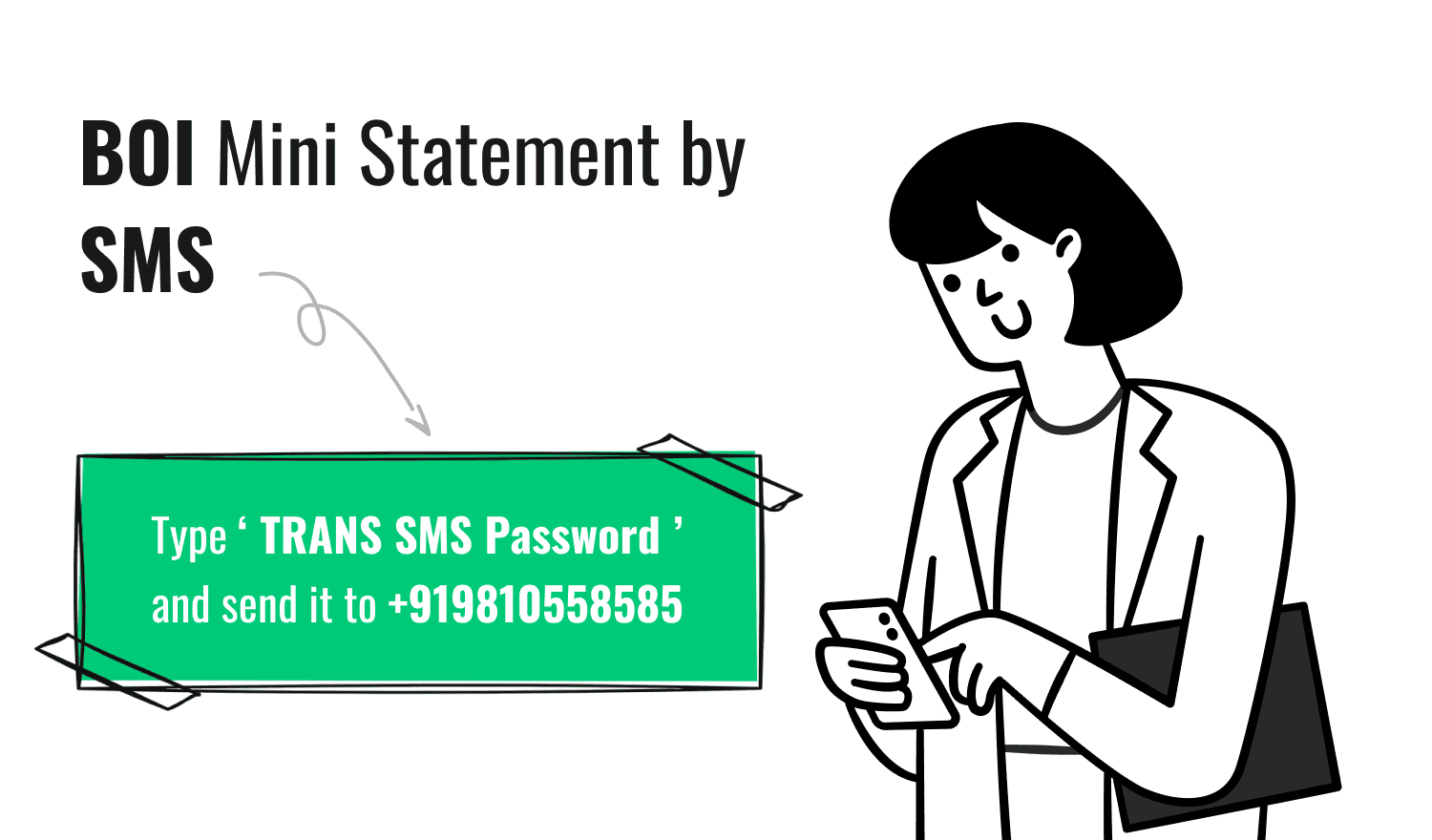

BOI Mini Statement by SMS

In order to get a BOI mini statement by SMS, you need to register your mobile number for mobile banking. After activation, you will receive a 4 digits SMS password. This password can be used to get the mini statement on your registered mobile number. All you need to do is type ‘ TRANS SMS Password ’ and send it to +919810558585 from the registered mobile banking number. You will then receive the last 5 transaction details through SMS immediately.

Benefits of Generating Mini Statement via SMS

- Convenience: The BOI mini statement by SMS service provides a convenient way for customers to access their account information anytime, anywhere, through their registered mobile number.

- Time-Saving: With this service, customers can save time by getting their last five transaction details quickly on their mobile phones, without having to visit a bank branch or ATM.

- Free of cost: The service is provided free of cost to BOI customers who have registered their mobile number for mobile banking.

- Secure: The 4-digit SMS password ensures that only the registered mobile number holder can access the mini statement, providing an additional layer of security.

- Accessible: This service is accessible to all BOI customers who have a mobile phone with SMS capabilities, making it an inclusive service for all.

- Transparency: By providing the last five transactions, customers can keep track of their account activity and monitor any unauthorized transactions.

- Easy to Use: The process of getting the mini statement via SMS is simple and easy to follow, making it a user-friendly service for all customers.

BOI Internet Banking Facility

You can use the BOI internet banking facility to get your mini statement Bank of India. Head over to the official Bank of India website and login to download your Bank of India mini statement. You can make a successful login using your credentials and check your account balance. Along with the account balance you can also check your previous transactions.

Other than that, with BOI Internet Banking, you can perform a variety of tasks, including:

- Account Information: You can view your account balance, account statement, and transaction history.

- Fund Transfer: You can transfer funds between your BOI accounts as well as to other bank accounts in India.

- Bill Payment: You can pay your utility bills, credit card bills, and other bills quickly and easily.

- Online Shopping: You can use the BOI Internet Banking facility to shop online and pay using your BOI debit card.

- Request Services: You can request services such as a new chequebook, stop payment of a cheque, and more.

- Mobile Recharge: You can recharge your mobile phone or DTH account through BOI Internet Banking.

- Fixed Deposit: You can open a fixed deposit account online and manage it through BOI Internet Banking.

- Investment Services: You can invest in mutual funds and other investment products through BOI Internet Banking.

- Update KYC Details: You can update your KYC details online through BOI Internet Banking.

- Online Tax Payment: You can pay your taxes online through BOI Internet Banking.

These are just a few of the many features and services offered by BOI Internet Banking.

Visit Your Nearest ATM

Another way of obtaining your BOI mini statement is by visiting your nearest ATM . You can use your BOI debit card to access the ATM and then select the mini statement option. The ATM will then print a mini statement of your account. This receipt will contain information about the last 10 transactions of your account. By using this method you will be able to get a hard copy of your BOI mini statement.

BOI Mobile Application

Just like the BOI internet banking facility, you can also use the BOI mobile banking platform to avail your Bank of India mini statement. Simply download the BOI mobile phone application through the Google Play Store or App Store and login using your credentials. After logging in you can either generate a BOI mini statement pdf or email it to your registered email ID.

Frequently Asked Questions (FAQs)

How can I check my Bank of India mini statement?

How can I get a Bank of India mini statement on mobile?

How can I get a mini statement of Bank of India Online?

Do you have to pay any charges for availing Bank of India mini statement service?

How can I check my last 5 transactions in the Bank of India?

How can I check my last 10 transactions in BOI?

Can I download my 3 month bank statement from BOI?

How can I check my mini statement in BOI ATM?

Best Offers For You!

Account Balance Check by Bank

- SBI Balance Check

- PNB Balance Check

- Bank of Baroda Balance Check

- Canara Bank Balance Check

- YES BANK Balance Enquiry

- RBL Bank Balance Check

- Kotak Bank Balance Check

- ICICI Bank Balance Enquiry

- HDFC Bank Balance Check

- Federal Bank Balance Check

- Bandhan Bank Balance Check

- Axis Bank Balance Check

- AU Bank Balance Check

- Bank of Maharashtra Balance Check

- Indusind Bank Balance Check

- UCO Bank Balance Check

- Union Bank of India Balance Check

- Punjab & Sind Bank Balance Check

- Indian Overseas Bank Balance Check

- Central Bank of India Balance Check

- Indian Bank Balance Check

- IDFC First Bank Balance Check

- DCB Bank Balance Check

- Karur Vysya Bank Balance Check

- South Indian Bank Balance Check

Account Mini Statement by Bank

- SBI Mini Statement

- ICICI Bank Mini Statement

- Axis Bank Mini Statement

- PNB Mini Statement

- IDFC First Bank Mini Statement

- Indusind Bank Mini Statement

- Kotak Bank Mini Statement

- YES BANK Mini Statement

- Indian Bank Mini Statement

- Union Bank of India Mini Statement

- Bank of Maharashtra Mini Statement

- Central Bank of India Mini Statement

- Canara Bank Mini Statement

- Bank of Baroda Mini Statement

- RBL Bank Mini Statement

- Punjab & Sind Bank Mini Statement

- Indian Overseas Bank Mini Statement

- Federal Bank Mini Statement

- Bandhan Bank Mini Statement

- Karur Vysya Bank Mini Statement

- South Indian Bank Mini Statement

- DCB Bank Mini Statement

- IDBI Bank Mini Statement

- Bank of India Mini Statement