Axis Bank Mini Statement Number

Last Updated : May 29, 2024, 6:14 p.m.

Mini statements are a quick and convenient way for Axis Bank customers to keep track of their recent banking transactions. Providing a snapshot of the latest activities in your account, mini statements help you manage your finances efficiently without the need for detailed bank statements.

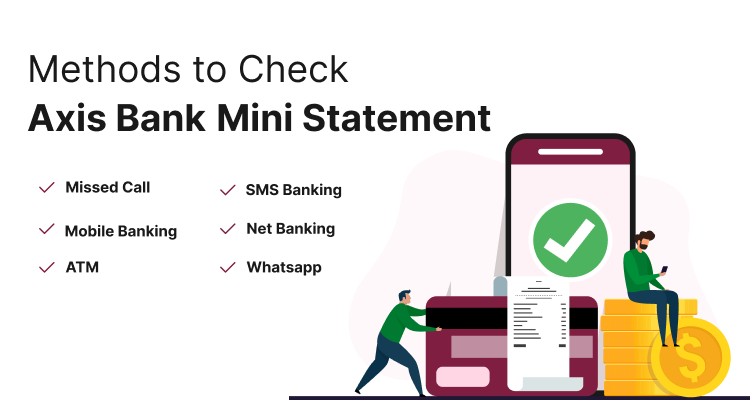

In this guide, we'll dive into the methods to access mini statements, potential fees, and advantages of using this service.

Register Mobile Number for Axis Bank Mini Statement

In order to get a mini statement online, account holders need to have their mobile number registered with the bank to use this service. If your number isn't registered or needs updating, here's what you can do:

- Visit your nearest Axis Bank branch and fill out a form to register or update your mobile number.

- Alternatively, you can update your number at an Axis Bank ATM

- Insert your ATM or debit card and enter your PIN.

- Choose the 'Registrations' option.

- Select 'Mobile number update'.

- Follow the prompts to 'update' your mobile number.

- Enter and re-enter your mobile number to finish setting up for the mini statement service.

Axis Bank Mini Statement Through Missed Call

Axis Bank offers mini statements in both Hindi and English for its account holders. If you have a savings account with Axis Bank, you can quickly receive a mini statement by making a missed call to a designated number from your registered mobile phone. Here’s how to do it:

- For an English mini statement, call 1800 419 6969.

- For a Hindi mini statement, call 1800 419 6868.

After you call, the phone will ring twice and then disconnect automatically. Shortly after, you'll receive an SMS with your mini statement, showing your most recent transactions.

Axis Bank Mini Statement Using SMS Banking

Axis Bank charges a small fee of Rs. 5 per month for its SMS banking service, which includes getting mini statements. To sign up for SMS banking, you can either visit an Axis Bank branch or contact their customer care.

If you want details about your last three transactions, here’s what to do:

- Type MINI, add a space, and then your account number.

- Send this message to Axis Bank’s mini statement number: either 9717000002 or 5676782.

Axis Bank Mini Statement Via Mobile Banking

Axis Bank offers two mobile apps for various banking services, including accessing mini statements instantly:

Axis Mobile

- Download the Axis Mobile app from the Google Play Store or Apple App Store.

- Open the app and click on 'login' to register. A verification SMS will be sent from your registered mobile number.

- Create an mPIN to start using the app. You can check your balance, view mini statements, transfer funds, and more.

Axis OK

Axis OK is available only for Android users. One of its key features is that it works offline without needing an internet connection. You don't need to register beforehand; just use your registered mobile number to request services.

With Axis OK, you can check your balance, transfer funds, and get mini statements among other services.

Axis Bank Mini Statement Using Netbanking

Account holders can log in to the Axis Bank net banking portal to access their mini statement. You'll need to enter your customer ID and password. If you don't have a password, you can set one using your 4-digit ATM PIN and registered mobile number. If you don't have a debit card, you can also request to have the password sent to you by courier.

Get Axis Bank Mini Statement By Visiting ATM

Here are the steps you can follow to get access to a mini statement by visiting Axis Bank ATM:

- Locate and visit an Axis Bank ATM.

- Insert your Axis Bank debit card into the ATM machine.

- Select your preferred language.

- Type in your 4-digit ATM pin.

- Once you have successfully entered the PIN, go to the banking services menu.

- Look for an option labeled ‘Mini Statement’ and select it.

- The ATM will print a mini statement that shows your recent transactions.

Get Axis Bank Mini Statement By Visiting Bank Branch

To get an Axis Bank mini statement by visiting a bank branch, you can follow the given steps:

- Visit your nearest Axis bank branch.

- Inquire at the bank branch about obtaining a mini statement.

- Request that the most recent transactions be printed in your passbook or ask for a printed mini statement.

- The bank staff will assist you in printing your passbook or provide you with a printed mini statement that contains all the information you need about your recent transactions.

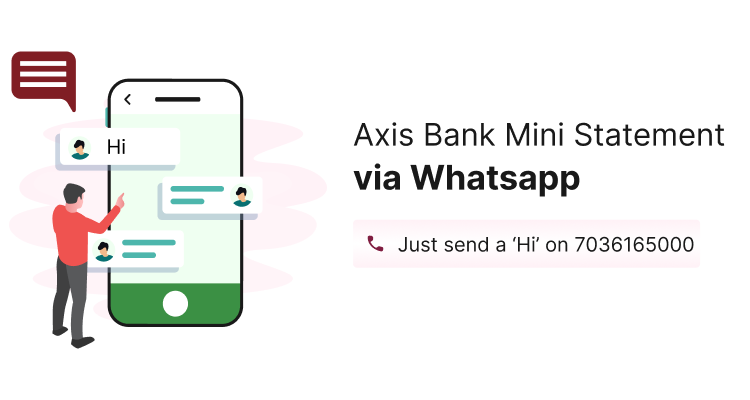

Axis Bank Mini Statement Via WhatsApp

Axis Bank WhatsApp services is available 24*7 (even on holidays). Just send a ‘Hi’ on 7036165000 and you can access a wide range of services, including mini statements.

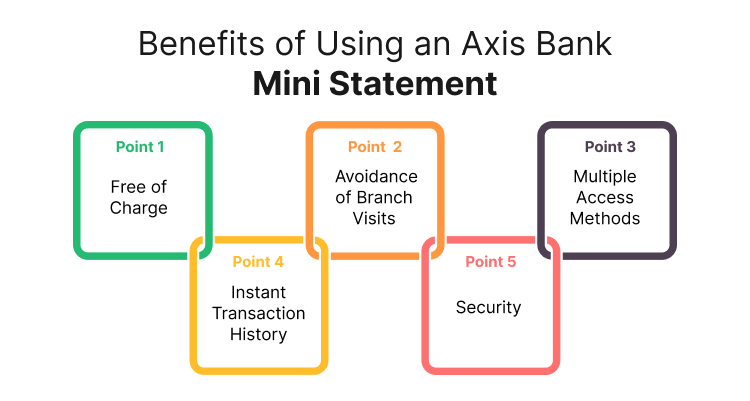

Benefits of Using an Axis Bank Mini Statement

The Axis Bank mini statement and account balance check service offers several benefits to its customers, making it a convenient tool for managing and monitoring their financial transactions. Here are the key advantages of using the Axis Bank mini statement:

- Free of Charge: The service is provided at no cost to the customers. This makes it an economical option for obtaining quick updates on recent transactions without incurring any additional fees.

- Avoidance of Branch Visits: By using the mini statement service, customers can avoid the need to visit the bank branch for transaction information. This saves time and spares them from having to wait in queues.

- Multiple Access Methods: Axis Bank provides various methods for accessing the Mini Statement, including missed calls, SMS banking, mobile banking, internet banking, ATM visits, and visiting a bank branch. This flexibility allows customers to choose the most convenient option based on their preferences and circumstances.

- Instant Transaction History: The mini statement service enables customers to review their last 5 transactions, helping them keep track of their transaction history and manage their finances more effectively

- Security: The service provides a secure way to monitor account activity, helping customers to quickly detect any unauthorized transactions or discrepancies in their account.

Frequently Asked Questions (FAQs)

How can I check my last 5 transactions in Axis Bank?

How can I get an Axis Bank mini statement by SMS?

What is the WhatsApp number for Axis mini statement?

How do I get a mini statement of AXIS?

How can I get an Axis Bank mini statement through an ATM?

Best Offers For You!

Account Balance Check by Bank

- SBI Balance Check

- PNB Balance Check

- Bank of Baroda Balance Check

- Canara Bank Balance Check

- YES BANK Balance Enquiry

- RBL Bank Balance Check

- Kotak Bank Balance Check

- ICICI Bank Balance Enquiry

- HDFC Bank Balance Check

- Federal Bank Balance Check

- Bandhan Bank Balance Check

- Axis Bank Balance Check

- AU Bank Balance Check

- Bank of Maharashtra Balance Check

- Indusind Bank Balance Check

- UCO Bank Balance Check

- Union Bank of India Balance Check

- Punjab & Sind Bank Balance Check

- Indian Overseas Bank Balance Check

- Central Bank of India Balance Check

- Indian Bank Balance Check

- IDFC First Bank Balance Check

- DCB Bank Balance Check

- Karur Vysya Bank Balance Check

- South Indian Bank Balance Check

Account Mini Statement by Bank

- SBI Mini Statement

- ICICI Bank Mini Statement

- Axis Bank Mini Statement

- PNB Mini Statement

- IDFC First Bank Mini Statement

- Indusind Bank Mini Statement

- Kotak Bank Mini Statement

- YES BANK Mini Statement

- Indian Bank Mini Statement

- Union Bank of India Mini Statement

- Bank of Maharashtra Mini Statement

- Central Bank of India Mini Statement

- Canara Bank Mini Statement

- Bank of Baroda Mini Statement

- RBL Bank Mini Statement

- Punjab & Sind Bank Mini Statement

- Indian Overseas Bank Mini Statement

- Federal Bank Mini Statement

- Bandhan Bank Mini Statement

- Karur Vysya Bank Mini Statement

- South Indian Bank Mini Statement

- DCB Bank Mini Statement

- IDBI Bank Mini Statement

- Bank of India Mini Statement