Link Aadhaar with EPF/UAN - How to Link Online/Offline?

Last Updated : Dec. 19, 2024, 2:51 p.m.

The Employees' Provident Fund Organisation (EPFO) allows employees to link their Aadhaar card to their Universal Account Number (UAN). The EPFO has made it mandatory for employees to link their UAN with Aadhaar to continue receiving benefits and accessing their EPF. This allows all employees in India to manage their PF accounts online. They can complete the Aadhaar Card Link to EPF Account by visiting the EPFO website, visiting the nearest EPFO office, or using the UMANG app. Read on further to learn more about both online and offline modes in detail.

Different Ways to Check the Status of Aadhaar Link to EPF Account

Below, are the various ways through which you can check if your Aadhaar card is linked to your EPF account or not:

Link Aadhaar with EPF Account Online

Follow the steps below to link your Aadhaar card with your EPF account online:

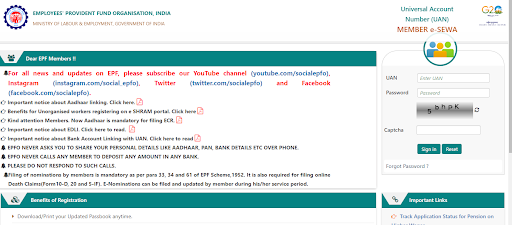

- Visit the EPFO Member home page or the e-SEWA portal.

- Input your UAN along with the password to access your account.

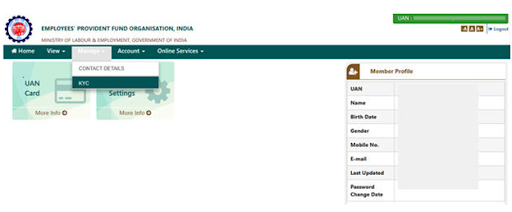

- Then select the KYC option in the "Manage" section.

- You will be taken to a new page where you need to input your Aadhaar and PAN numbers in the 'Add KYC' tab and click on 'Submit'.

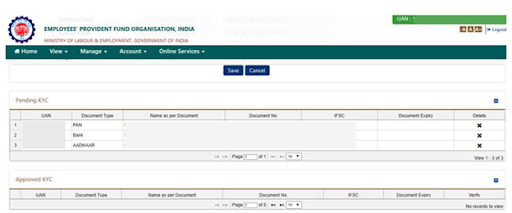

- The information will then be displayed under the 'Pending KYC tab'.

- Your Aadhaar will be verified using UIDAI data after you save your Aadhaar details.

- After your KYC document is approved, you will be able to successfully link Aadhaar with your EPF account, and you will see "Approved" written against your Aadhaar details.

Link Aadhaar with EPF Account Offline

EPFO has also made offline provisions for linking Aadhaar with an EPF account to accommodate those who find it difficult to link their Aadhaar online. Such employees can link their EPF account to Aadhaar by going to an EPFO office and submitting the application in person. It is a simple process. Here are the simple steps you need to follow:

- Request a form titled "Aadhaar Seeding Application."

- Enter your UAN, Aadhaar number, and any other necessary details.

- Enclose the form with self-attested copies of your UAN, PAN, and Aadhaar.

- Hand it over to an executive at any EPFO field office or Common Service Centre (CSC) outlet.

- Following proper verification, your Aadhaar will be linked to your EPF account, and you will receive a notification on your registered mobile number.

Link Aadhaar with UAN using the UMANG App

You can also use the UMANG mobile application to link your Aadhaar card with your EPF account. To improve mobile governance in India, the Ministry of Electronics and Information Technology, along with the National e-Governance Division, introduced the UMANG (Unified Mobile Application for New-age Governance) app. To claim your EPF online, you must link your Aadhaar with your UAN (Universal Account Number). Linking your UAN with Aadhaar will also connect your EPF account. Here are the steps to link your Aadhaar with your EPF account using the UMANG App:

- Log in to the UMANG App with your "MPIN" or the OTP sent to your registered mobile number.

- After logging in, select “EPFO” from the "All Services” tab.

- In the EPFO section, select "e-KYC services."

- Select the Aadhaar Seeding option under "e-KYC services."

- Now enter your UAN and press the "Get OTP" button.

- An OTP will be sent to your registered mobile number linked with the EPF Account.

- Enter your Aadhaar information.

- You will now receive another OTP to your registered mobile number and email address.

- Once the OTP is verified, your Aadhaar will be linked to your UAN.

How to Check if Your Aadhaar is Linked to Your PF Account?

To check if your UAN is linked to Aadhaar, follow the steps below:

- Head over to the official EPFO portal.

- Log in by entering your UAN and password.

- Locate Aadhaar using the information provided on the member homepage.

- If "Verified (DEMOGRAPHIC)" appears next to your Aadhaar number, it means UIDAI has successfully linked and verified your Aadhaar with your EPF account.

What are the Benefits of Linking Your Aadhaar with an EPF Account?

Before linking to the UAN, the PF must be seeded with an Aadhaar card. The EPFO mandates that employees link their UAN with Aadhaar to continue benefiting from and accessing their EPF. This enables all Indian employees to manage their PF accounts online efficiently.

Here are several advantages of linking your Aadhaar number with your EPF account:

- You can withdraw your PF online without needing your employer's signature. The entire process is online and straightforward.

- When you link Aadhaar to EPF account and UAN, it reduces the likelihood of data discrepancies and errors, ensuring your information aligns with what's on your Aadhaar card.

- It minimizes the risk of duplicate accounts.

- Once the linking is confirmed, your Aadhaar details will appear under the 'Approved KYC' section.

Frequently Asked Questions (FAQs)

Will I get an alert if I link my EPF to Aadhaar?

Can I add more than one mobile number to my EPF/UAN account?

Is it possible to link my EPF with Aadhaar without using the internet?

Do I need to link my Aadhaar with UAN to file an EPF e-nomination?

Is there a fee to link my EPF/UAN account with Aadhaar?

Is it required to link Aadhaar with UAN?

Aadhaar

- Check Aadhaar Update History

- Aadhaar Card Services

- Aadhaar Services on SMS

- Documents Required for Aadhaar Card

- Aadhaar Card Status

- E-Aadhaar Card Digital Signature

- Aadhaar Card Authentication

- Aadhaar Card Online Verification

- Lost Aadhaar Card

- Aadhaar Card Not Received Yet

- Aadhaar Virtual ID

- Retrieve Forgotten & Lost Aadhaar Card UID/EID

- Aadhaar Card Address Validation Letter

- Get Aadhaar Card for Non-Resident Indians

- Get Aadhaar e-KYC Verification

- Aadhaar Card Seva Kendra

- Aadhaar Card Features

- Aadhaar Card Online Corrections

- Change Photo in Aadhaar Card

Link Aadhaar Card

- Link Aadhaar Card to Bank Account

- Link Aadhaar Card to IRCTC Account

- Link Aadhaar Card to Income Tax Return

- Link Aadhaar Card with EPF

- Link Aadhaar Card with Driving Licence

- LInk Aadhaar to Caste Certificate

- Link Aadhaar with BPCL

- Link Aadhaar Card with LPG Gas

- Link Aadhaar Card with Ration Card

- Link Aadhaar Card with HP Gas

- Link Aadhaar Card with NPS Account

- Link Aadhaar Card with Mutual Funds

- Link Aadhaar Card with Demat Account

- Link Aadhaar Card with HDFC Life Insurance

- Link Aadhaar Card with SBI Life Insurance

Link Aadhaar to Mobile Number

Aadhaar Enrollment Centers

- Aadhaar Card Enrollment Centres

- Aadhaar Card Enrolment Centers in Delhi

- Aadhaar Card Enrolment Centers in Bangalore

- Aadhaar Card Enrolment Centers in Mumbai

- Aadhaar Card Enrolment Centers in Ahmedabad

- Aadhaar Card Enrolment Centers in Hyderabad

- Aadhaar Card Enrolment Centers in Ranchi

- Aadhaar Card Enrolment Centers in Indore

- Aadhaar Card Enrolment Centers in Kanpur

- Aadhaar Card Enrolment Centers in Patna

- Aadhaar Card Enrolment Centers in Surat

- Aadhaar Card Enrolment Centers in Lucknow

- Aadhaar Card Enrolment Centers in Bhopal

- Aadhaar Card Enrolment Centers in Jaipur

- Aadhaar Card Enrolment Centers in Ghaziabad

- Aadhaar Card Enrolment Centers in Faridabad

- Aadhaar Card Enrolment Centers in Noida

- Aadhaar Card Enrolment Centers in Gurgaon

- Aadhaar Card Enrolment Centers in Kolkata

- Aadhaar Card Enrolment Centers in Pune

- Aadhaar Card Enrolment Centers in Chennai

- Aadhaar Card Enrolment Centers in Chandigarh