How to Get Aadhaar e-KYC or e-KYC Verification Online & Offline?

Last Updated : Dec. 28, 2024, 3:14 p.m.

In today’s digital-first world, understanding how to do Aadhaar e-KYC Verification Online and Offline has become essential for hassle-free identity verification. Aadhaar e-KYC (Electronic Know Your Customer) simplifies the process of validating personal details for a variety of purposes, including financial services, telecom connections, and government benefit schemes.

With the convenience of both online and offline verification methods, Aadhaar e-KYC caters to diverse needs, ensuring accessibility for all. This guide provides detailed insights on how to do Aadhaar e-KYC Verification Online and Offline, enabling you to complete the process effortlessly while enjoying the benefits of Aadhaar-based services.

Do You Know What is Aadhaar e-KYC?

Aadhaar e-KYC (Electronic Know Your Customer) is a secure and paperless method of verifying an individual's identity using their Aadhaar details. It leverages the biometric and demographic information stored in the Aadhaar database to authenticate a person’s identity quickly and efficiently. This system eliminates the need for traditional, cumbersome KYC processes that involve physical documents and manual verification.

Process of Aadhaar E-KYC

You must be aware of the fact that Aadhaar Card details have to be submitted to banks or other service providers when you take a loan or their services. So, to verify your Name and Address, the service provider makes an E-KYC. It doesn’t visit any center to verify your documents because your details are sent directly to UIDAI for verification. UIDAI has all your Aadhaar Details so it doesn’t take much time to verify it. This whole process is known as Aadhaar E-KYC.

The whole process is digital and the verification is made online. It saves time for both the Aadhaar Cardholder and the Service Process. The process is quick and easy and has modernized the process of verification. Now, it will be convenient for banks, companies, and customers to complete the KYC and verify their Aadhaar Details.

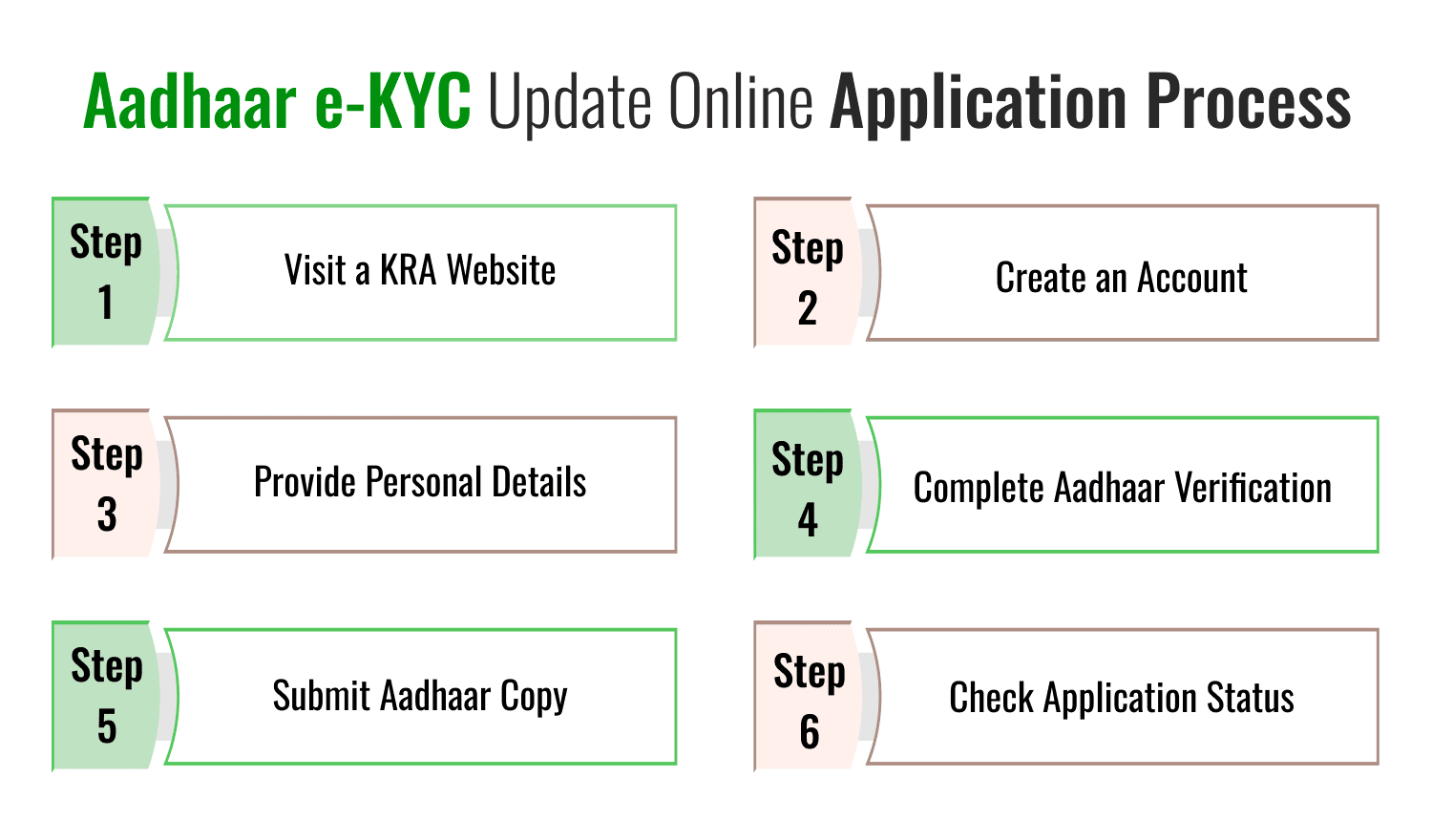

Aadhaar e-KYC Online Application Process

You can complete the Aadhaar e-KYC online by following these steps:

Visit a KRA Website: Apply for e-KYC through the website of any SEBI-licensed KYC Registration Agency (KRA), such as CDSL Ventures Ltd or DotEx International Limited.

Create an Account: Register yourself by creating an account on the chosen KRA’s portal.

Provide Personal Details: Enter your Aadhaar number and registered mobile number to receive an OTP for verification.

Complete Aadhaar Verification: Use the OTP sent to your mobile number to verify your Aadhaar details.

Submit Aadhaar Copy: Upload a self-attested copy of your Aadhaar card to complete the process.

Check Application Status: To track the status of your e-KYC, visit the KRA’s web portal and enter your PAN number.

Aadhaar e-KYC Offline Application Process

Follow these steps to complete the Aadhaar e-KYC process offline:

Visit the UIDAI Portal: Go to the official UIDAI website for the offline Aadhaar e-KYC application process.

Enter Aadhaar Details: Provide your Aadhaar Number or VID (Virtual ID) along with the security code displayed on the page.

Choose Verification Method: Select either ‘Send OTP’ to receive a One-Time Password on your registered mobile number or ‘Enter TOTP’ to use a Time-based One-Time Password from the mAadhaar app.

Verify Your Identity: Enter the OTP or TOTP received on your registered mobile number.

Generate a Share Code: Create a 4-character Share Code, which will be used to encrypt a ZIP file containing your Paperless Offline e-KYC data. This Share Code will act as the password for the ZIP file and must be shared with the agency requesting your KYC data.

Download the e-KYC File: After entering the Share Code, click the ‘Download’ button. A digitally signed XML file will be provided as a password-protected ZIP file.

Share the ZIP File: Provide the downloaded ZIP file and the Share Code to the agency requiring your KYC data. The agency will use the Share Code to access and verify your e-KYC details.

This method ensures a secure and privacy-conscious way of completing Aadhaar e-KYC without the need for direct internet-based submission.

Different Types of e-KYC for Aadhaar

Aadhaar-based e-KYC offers various methods of identity verification, catering to diverse user needs and technological capabilities. Whether you’re completing a KYC process for financial services or exploring how to execute a KYC Aadhaar card link, here are the primary types of e-KYC processes:

- Online Aadhaar e-KYC - In this method, the service provider directly accesses an individual's Aadhaar details from the UIDAI database in real time.

- Authentication : Verified using OTP (One-Time Password) sent to the registered mobile number or biometric authentication.

- Use Cases : Commonly used for opening bank accounts, getting SIM cards, or applying for financial services.

- Offline Aadhaar e-KYC - Users download a password-protected ZIP file containing their Aadhaar details in XML format from the UIDAI portal. This file is shared with the service provider for verification.

- Authentication : OTP or TOTP-based verification during the XML file download process.

- Use Cases : Preferred for privacy-conscious individuals or when internet connectivity is limited.

- Biometric e-KYC - This method involves biometric verification (fingerprint or iris scan) against the Aadhaar database for authentication.

- Authentication : Biometric details provided by the individual are matched with the data stored in UIDAI’s records.

- Use Cases : Ideal for scenarios where mobile OTP access is unavailable, such as for elderly or rural populations.

- OTP-based e-KYC - This is the simplest and most widely used method where you can verify via aadhaar e-KYC OTP which is sent to the Aadhaar-registered mobile number for identity verification

- Authentication : OTP entered by the user is validated against the UIDAI database.

- Use Cases : Frequently used for online verification processes like mutual fund investments, loans, or credit card applications.

- Paperless Aadhaar e-KYC - This process allows users to provide Aadhaar data in a digital, paperless format, either through the online method or by sharing the XML file in offline mode.

- Authentication : Depends on OTP or biometric validation.

- Use Cases : Reduces paperwork and enhances efficiency for government or private service applications.

- XML-based e-KYC - Similar to offline e-KYC, this method involves downloading Aadhaar details in XML format from UIDAI. The XML file contains digitally signed data, ensuring authenticity.

- Authentication : A shared Code provided by the user is required to unlock the ZIP file containing the XML.

- Use Cases : Used when privacy and control over shared data are a priority.

- Aadhaar QR Code-based e-KYC - The QR code printed on an Aadhaar card or e-Aadhaar contains encoded demographic details that can be scanned for KYC purposes.

- Authentication : Scanned data is matched with UIDAI records.

- Use Cases : Often used in offline environments for quick and secure verification.

Each type of e-KYC is tailored for specific situations, offering flexibility and security for various services and user needs.

Difference Between Aadhaar e-KYC and Aadhaar Offline KYC

Aadhaar e-KYC and Aadhaar Offline KYC are two distinct methods for identity verification based on Aadhaar details. While both aim to simplify the KYC process, they differ in terms of execution, data sharing, and privacy. Here's a comparison:

Aspect | Aadhaar e-KYC | Aadhaar Offline KYC |

|---|---|---|

Process | Conducted online, where the service provider directly accesses Aadhaar details from UIDAI. | Done offline by downloading and sharing a password-protected file containing KYC data. |

Data Source | Real-time access to the Aadhaar database. | XML file downloaded by the user from UIDAI's portal. |

Verification Method | OTP-based or biometric authentication. | OTP or TOTP verification to generate the offline XML file. |

Data Privacy | Involves sharing full demographic and biometric details with the service provider. | Only limited details are shared, ensuring higher privacy. |

Internet Requirement | Requires an internet connection for verification. | Can be completed offline after downloading the XML file. |

Agency Dependency | The service provider relies on UIDAI for accessing Aadhaar data. | The user has full control over data sharing with the agency. |

Use Case | Suitable for quick and automated processes like opening a bank account or getting a SIM card. | Preferred for privacy-conscious users or when internet access is limited. |

Encryption | Data is directly shared from UIDAI’s database to the agency. | Data is shared as a password-protected ZIP file with a 4-character code. |

Both methods provide secure and efficient KYC options, but the choice depends on the user’s preference for privacy and convenience.

Conclusion

After reading the above information, you will easily understand the Aadhaar KYC process. This process has made the verification procedure quick and convenient. The entire KYC process is digital and can be completed online. However, if you are opting for offline KYC, your physical presence will be required. Whether you are applying for a loan from a bank or purchasing an insurance policy, you will need to go through the Aadhaar e-KYC. To get Aadhaar e-KYC or e-KYC verification online & offline, you can choose the method that best suits your needs.

Frequently Asked Questions (FAQs)

What is Aadhaar e-KYC?

How is Aadhaar Offline e-KYC Available?

How can I update my Aadhaar card offline?

How to do eKYC on mobile?

Can we update Aadhaar from home?

Aadhaar

- Check Aadhaar Update History

- Aadhaar Card Services

- Aadhaar Services on SMS

- Documents Required for Aadhaar Card

- Aadhaar Card Status

- E-Aadhaar Card Digital Signature

- Aadhaar Card Authentication

- Aadhaar Card Online Verification

- Lost Aadhaar Card

- Aadhaar Card Not Received Yet

- Aadhaar Virtual ID

- Retrieve Forgotten & Lost Aadhaar Card UID/EID

- Aadhaar Card Address Validation Letter

- Get Aadhaar Card for Non-Resident Indians

- Get Aadhaar e-KYC Verification

- Aadhaar Card Seva Kendra

- Aadhaar Card Features

- Aadhaar Card Online Corrections

- Change Photo in Aadhaar Card

Link Aadhaar Card

- Link Aadhaar Card to Bank Account

- Link Aadhaar Card to IRCTC Account

- Link Aadhaar Card to Income Tax Return

- Link Aadhaar Card with EPF

- Link Aadhaar Card with Driving Licence

- LInk Aadhaar to Caste Certificate

- Link Aadhaar with BPCL

- Link Aadhaar Card with LPG Gas

- Link Aadhaar Card with Ration Card

- Link Aadhaar Card with HP Gas

- Link Aadhaar Card with NPS Account

- Link Aadhaar Card with Mutual Funds

- Link Aadhaar Card with Demat Account

- Link Aadhaar Card with HDFC Life Insurance

- Link Aadhaar Card with SBI Life Insurance

Link Aadhaar to Mobile Number

Aadhaar Enrollment Centers

- Aadhaar Card Enrollment Centres

- Aadhaar Card Enrolment Centers in Delhi

- Aadhaar Card Enrolment Centers in Bangalore

- Aadhaar Card Enrolment Centers in Mumbai

- Aadhaar Card Enrolment Centers in Ahmedabad

- Aadhaar Card Enrolment Centers in Hyderabad

- Aadhaar Card Enrolment Centers in Ranchi

- Aadhaar Card Enrolment Centers in Indore

- Aadhaar Card Enrolment Centers in Kanpur

- Aadhaar Card Enrolment Centers in Patna

- Aadhaar Card Enrolment Centers in Surat

- Aadhaar Card Enrolment Centers in Lucknow

- Aadhaar Card Enrolment Centers in Bhopal

- Aadhaar Card Enrolment Centers in Jaipur

- Aadhaar Card Enrolment Centers in Ghaziabad

- Aadhaar Card Enrolment Centers in Faridabad

- Aadhaar Card Enrolment Centers in Noida

- Aadhaar Card Enrolment Centers in Gurgaon

- Aadhaar Card Enrolment Centers in Kolkata

- Aadhaar Card Enrolment Centers in Pune

- Aadhaar Card Enrolment Centers in Chennai

- Aadhaar Card Enrolment Centers in Chandigarh